Download now

Finding the time to talk to someone about your finances is overwhelming. Get answers to the financial questions you’ve been having when it’s most convenient.

We’re one of the fastest-growing financial services companies, as seen in:

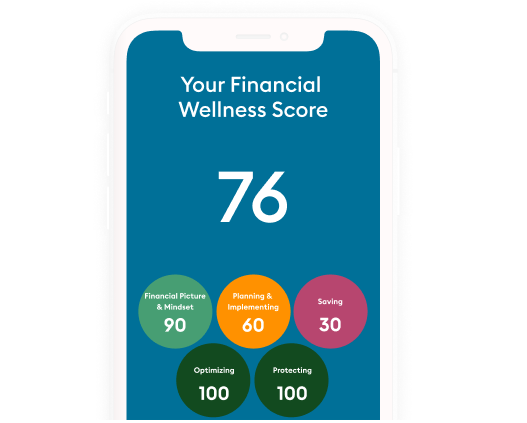

Check your Financial Wellness Score today

Takes less than 5 minutes.

Unlock insights about your financial health.

Facet’s unbiased financial planning covers everything that has to do with money so you’ll know you’re making the right decisions for every facet of life.

Why choose Facet?

For your entire life (not just your investments)

Because every life decision has financial impacts, we advise on everything your money touches, like major purchases, benefit selections, your investments and more--plus, we go even further to help you execute your plan.

The highest level of financial planning

Our virtual service is accessible from anywhere and around your schedule. You'll meet with your own CFPⓇ Professional (the highest certification possible) and they’ll never sell you products or earn commissions.

Affordable, fixed fees with no surprises

Our fixed fees are based on your needs--whether you invest money with us or not--and won’t increase as your money grows, which makes a big difference over time.

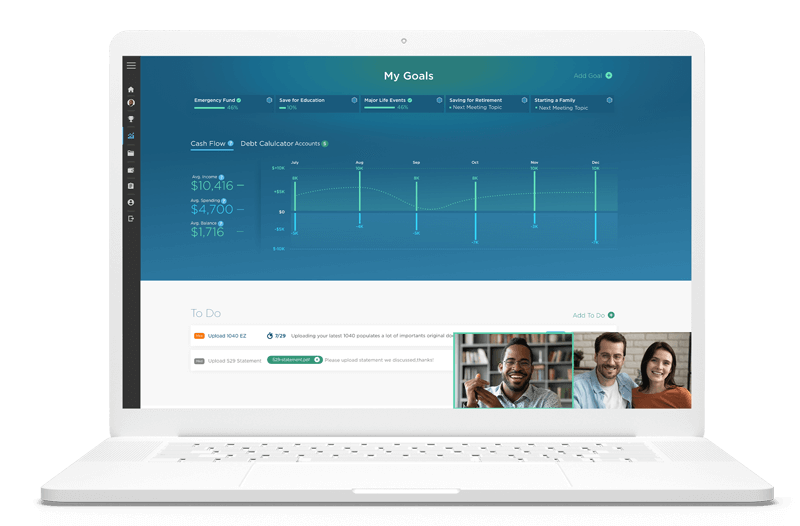

How we work with you.

Take a look at what it’s like to work with Facet.

Meet your CFPⓇ Professional at Facet.

You’ll work virtually one-on-one with your CERTIFIED FINANCIAL PLANNERTM Professional--the highest possible certification--and go into detail about your full financial life story to surface what matters most to you.

Build a plan and put it into action.

You’ll work with your CFPⓇ Professional to establish a strong foundation, reveal choices you didn’t know you had, and ensure you’re making the right ones. We’ll also work with you to execute your plan.

Nurture your plan.

Since your financial plan needs to keep evolving based on what’s changing in the world and in your life, we meet with you quarterly (on average). Your CFPⓇ Professional is also available to you when questions arise.

Learn more about how we build a personalized, high-impact plan to create your best financial outcomes.

How we can help.

Your financial life is impacted by much more than the market. Unplanned and planned changes are a part of life, so your CFPⓇ Professional at Facet will work with you on an ongoing basis to create the best possible outcomes.

Life milestones

- Getting married or having children

- Separation or divorce

- Healthcare or medical expenses

- Inheritance or a death in the family

- Buying or renting a home

- Elder care planning

Career changes

- A new job, raise or career change

- Employee stock plan questions

- Starting a business

- Benefit selection

Investments & Taxes

- Investment management and optimization

- Retirement account management

- Market and tax law changes

- Tax planning questions

Retirement planning

- Distribution strategies

- Generational transfers and charitable giving

- Navigating Social Security

- Healthcare planning

We’re one of the fastest-growing financial services companies.

Members in all 50 states

How we’re different.

What Facet clients are saying.

These testimonials were provided by current clients of Facet Wealth, Inc. The clients were not compensated, nor are there material conflicts of interest that would affect the given testimonials. These testimonials may not be representative of the experiences of other clients, and do not provide a guarantee of future performance success or similar services.

Grow your knowledge.

We think financial planning information should answer more of the questions we all have and be less complicated. Learn about how we approach personal finance through our library of free articles that will help you deepen your financial literacy.

Give your 401(k) a boost in 2025

With this news, it seemed like a good time to do a deep dive on 401(k) accounts. With the right plan, contributions, and investment strategies in place, a 401(k) gives you an excellent way to save and invest for the future. And like any kind of investment, you have plenty of options and points to ... Read more

The Mega Backdoor Roth 401(k): A supercharged retirement strategy

A Mega Backdoor Roth 401(k) is a strategy that can boost your retirement contribution up to $69,000 a year—all through a “backdoor” approach that works around the restrictions of Roth accounts. Instead of contributing directly to a Roth, you can contribute to your 401(k) and then convert it to a Roth 401(k), regardless of your ... Read more

Could Trump’s proposed tariffs increase inflation?

How will tariffs impact the economy, inflation, interest rates, and financial markets? We dive into what tariffs are, and how it is impacting your investments.