Financial planning for the life you want.

Featured in

Feel confident you’re making the right money decisions.

With Facet’s flat-fee membership, you’ll get objective advice you can trust. We’ll create a personalized financial roadmap tailored to all aspects of your life, not just retirement.

Finally, financial planning that’s

-

objective.

-

personalized.

-

for every facet of life.

Objective advice you can trust

Guidance from a CFP® professional at a simple flat membership fee.

- Financial planning from experts.

- We don't take commissions, so no surprises.

- Your flat membership fee won’t change even as your money grows.

Personalized for you

A financial roadmap designed just for you.

- It guides your way and adapts as your life changes.

- Guided steps, regular check-ins, and messaging keep you on track.

- Your own secure dashboard to track your money and see your progress.

Planning for all facets of your life

Big-picture planning that gets you and your goals.

- More than retirement, your membership covers a full range of planning.

- Big goals, like investments, saving for a home, a car, and school.

- Smaller goals too, like trips, regular nights out, and tax planning.

Let’s update your roadmap and see how soon we can get you into a new home!

I would like to sell my condo and move into a house, what is my best path forward?

Facet was ranked #1 Best Financial Advisory Firm 2025 by USA TODAY!

In April of 2025, USA TODAY partnered with Statista to rank the top 500 RIAs. Recommendations were collected via an independent survey among over 30,000 individuals and an AUM development analysis over the short and long term. Self-recommendations were prohibited, and no compensation was provided for the ranking.

Meet some of the people we’ve helped along the way.

See how Facet helps 20,000+ members turn their goals into reality.

Real Facet member

Colby

“Before Facet it almost felt like I worked for my money and now my money works for me.”

Greater financial security allows her to pursue her passions for philanthropy and charity.

Real Facet member

Jonathan

“With Facet, its been such a relief for me that I want to tell everyone and get everyone on board.”

Has less anxiety around money and was able to travel for the first time.

We’re here for all of life’s moments — big and small.

(It’s more than just retirement. Much more.)

New baby on the way

Susan & Vi, mid 30’s

- Have the right amount saved in an emergency fund so they’re prepared for life’s surprises.

- Have a solid handle on their cashflow and debt to balance life’s multiple financial priorities.

Save for college fund

Shante, late 30’s

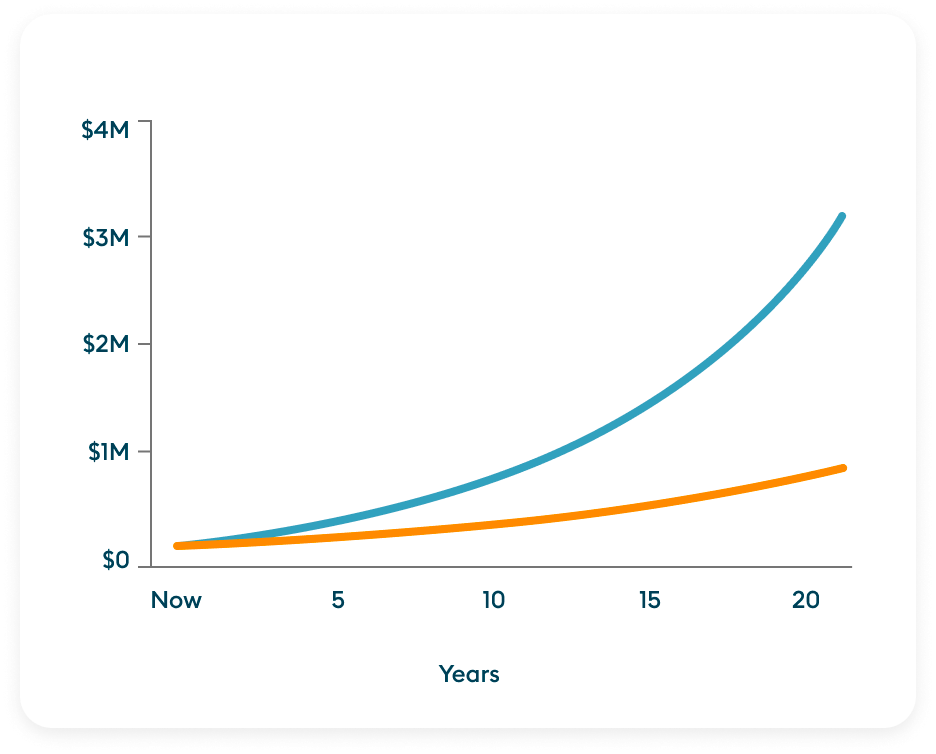

- Started their education savings plan early so their money has more time to grow through investing and compound interest.

- Received guidance on 529 plans and exactly how much to save every month.

Buy the dream home

Bianca & Manuel, early 40’s

- Kicked off a down payment savings plan for their forever home.

- Worked with their planner to determine the right homeowners insurance.

Finally take a vacation

Jill, late 40’s

- Paid down debts to finally take the guilt-free vacation she’s been waiting for.

- Her personalized financial roadmap includes at least one vacation a year.

Early retirement

Vanessa & Tom, early 50’s

- Started planning their ideal retirement scenario with their CFP® professional early to minimize taxes and have the spending money they wanted.

- When their life, needs, or goals change, their roadmap gets an update.

Not current members, for illustrative purposes only.

Hear from industry experts.

Ramit Sethi

Host of Netflix’s “How To Get Rich” & Host of the I Will Teach You To Be Rich Podcast

“Facet recognized what was wrong with the AUM Model and did something about it. They’re making financial advice accessible to everybody.”

Tyler Gardner

Former Portfolio Manager, 20+ Years in Professional Education

Ramit Sethi is not a member of Facet, and has an incentive to endorse Facet as he has an ongoing fee based contract for cash compensation based on this endorsement. All opinions are his own and not a guarantee of a similar outcome.

Tyler Gardner is not a member of Facet, and has an incentive to endorse Facet as he has an ongoing fee based contract for cash compensation, as well as a percentage of equity in Facet, based on this endorsement. All opinions are his own and not a guarantee of a similar outcome.

Services

Helping you with all your life goals, and everything your money touches.

Tax filing*

- Expert tax prep and filing

- Personalized tax-saving opportunities

- Single dashboard for finances and taxes

- Guaranteed accuracy and maximum refund†

Tax planning*

- Tax reduction strategy

- Tax-efficient education savings

- Last year’s tax return missed opportunity analysis

- Personalized Roth conversion & more

Investing*

- Goal-aligned investment strategy

- Risk assessment

- Tax loss harvesting

- Employer plan portfolio guidance (401k, HSA, etc.)

Retirement & life

- Goal and income assessment

- Savings and investment planning

- Tax-advantaged contributions & withdrawals

- Ongoing planning pre and post-retirement

Estate planning**

- Estate planning education and guidance

- Full suite of state-optimized documents

- Last will & testament

Equity compensation*

- Equity award planning (optimal exercise & tax plan)

- Company stock plan guidance (RSUs, ISOs, etc.)

- Annual access to equity comp specialist

Family planning

- Having a baby

- Marriage

- Divorce

- Caring for aging parents

- Making a big purchase

Insurance planning

- Identify coverage gaps

- Annual review with recommendations

- Employer-sponsored insurance support (health, life, etc.)

Education planning

- Savings and funding strategies

- Financial aid guidance

- Loan payoff strategies

Employee Benefits*

- Grow with your career

- 401(k)s, IRAs, profit-sharing, ESOPs, and more

- Health, disability, life insurance and more

*Facet’s services vary depending upon the chosen service level.

**Estate Planning services provided by wealth.com, the fee is non-refundable and covers their services. Facet is not an attorney and does not provide tax or legal advice or directly prepare legal documents. Tax laws and regulations are complex and subject to change. Consult with an attorney or tax professional regarding your specific situation. Wealth.com is a separate membership service that automatically renews for Complete members as part of your Facet membership renewal. For Core and Plus members, Wealth.com automatically renews for a $150 annual fee unless this service is canceled prior to renewal.

The life you want starts now. See how good it can get with Facet as your financial guide.