Key takeaways

- Stocks rose last week, closing near all-time highs. Non-U.S. and small cap stocks were the best performers.

- In a speech on Friday, Federal Reserve Chair Jerome Powell confirmed that the Fed was about to begin a series of interest rate cuts.

- With a rate cutting cycle confirmed, this may influence your investment decisions in various ways.

- However the Fed’s impact on markets can sometimes be misunderstood. We discuss how it does and doesn't matter for your investments.

Welcome to another edition of the Facet Investor Newsletter. I’m Facet’s Chief Investment Officer, Tom Graff. Last week’s biggest highlight was Federal Reserve Chair Jerome Powell formally announcing that the Fed was ready to cut rates. So with the cutting cycle about to begin, we’ll cover all the ways this can impact your investments and your trading decisions. I suspect this is going to be a very different cutting cycle than any other in history, and I’m going to try to help you be prepared.

Got questions on anything you’ve read here? Or feedback on the newsletter? Please send us a note at [email protected]. We’d love to hear from you.

Market recap

Stocks rose this week, with the S&P 500 adding 1.5%. The Morningstar Global index hit an all-time high on Friday, recovering all its losses from the July/August sell-of. Small caps outperformed materially, especially on Friday after Powell’s Jackson Hole speech. More on that below. Non-U.S. stocks also outperformed, boosted by a mildly weaker dollar.

Shorter-term interest rates fell modestly on the Fed announcement. The 2-year Treasury declined by 0.13% to end the week at 3.91%. The 10-year Treasury fell more modestly, declining 0.08% to 3.80%.

This week’s chatter

All eyes were on Jackson Hole, Wyoming this week. Starting on Friday and continuing over the weekend, the annual Kansas City Federal Reserve Economic Symposium will be held, better known as the Jackson Hole Conference. The conference has traditionally kicked off with a speech from the Fed Chair, and has featured some of the most famous Fed speeches in history, including Ben Bernanke’s argument for quantitative easing (or QE) and Powell’s introduction of flexible inflation targeting.

Last week’s speech wasn’t quite that momentous, but Powell did officially confirm that the Fed was ready to begin cutting interest rates. His clear implication was that several rate cuts were likely, with the speed and total number of cuts depending on the “evolving outlook.”

Among traders, the chatter wasn’t about Powell announcing a cut was coming in September. Everyone knew that. Rather, everyone was trying to parse what his speech told us about the Fed’s reaction function. In other words, how sensitive will the Fed be to either a slower labor market or fluctuations in inflation.

My take is that Powell seems to be satisfied that inflation is heading back to 2%. He didn’t mention inflation rebounding as one of the risks the Fed faces. This implies that the Fed will move relatively rapidly toward a “neutral” policy rate. I.e., a level of rates where policy is no longer restricting the economy.

No one knows exactly what “neutral” is. In fact, a few years ago Powell gave another Jackson Hole speech that was all about how difficult estimating neutral is. But I’d say the Fed can feel pretty comfortable that the neutral rate is at least 4% if not lower. This implies the Fed has at least 1.5% worth of cuts they’ll make relatively quickly (say, within the next six months) and almost no matter what happens with economic data.

Powell did seem at least somewhat concerned about the labor market. He said that “we do not seek or welcome further cooling in labor market conditions” and then later said that the Fed had “ample room to respond” if there were “unwelcome further weakening in labor market conditions.” Translation: the Fed will get more aggressive with cuts if the jobs market gets worse.

Speaking of the jobs market, the media put a lot of focus on the Bureau of Labor Statistics employment revision for the year ending March 2024. This is a routine annual true up of figures collected by both the BLS and the Census Bureau. The result this year was an unusually large downward revision of 818,000. Traders put no real weight on this. Everyone knew a downward revision was coming, as the BLS already gave a preliminary read on the revision a couple months ago. Plus this revision covers a period that was five months ago. It doesn’t say anything about the current trend. This is a great example of the kind of thing that seems like a big deal, but pros know better.

Pro corner

Now that we officially know the Fed is about to start a cutting cycle, let’s go through a few ways in which a falling rate environment may change your investment thinking.

First on cash-like investments, such as money markets, high-yield accounts, etc. There’s a place for these investments in your portfolio, especially for holding your emergency fund. However, there have been a lot of investors that were enticed by the unusually high yields available in cash lately, and therefore may be holding too much in cash. We recently published a longer-form article on this subject here. If you do nothing else, at least read that article and talk to your planning team about any changes you might want to make.

Next on your bond allocation. There is no guarantee that just because the Fed cuts short-term rates that long-term rates will also fall. One simple way to think about long-term Treasury bond yields is that they are approximately the market’s estimate of the future average Fed target rate over the life of that bond. E.g., the 10-year Treasury yield is equal to the forecasted average Fed target rate over the next 10 years.

As of Friday’s close, the 10-year Treasury yielded 3.8%. That’s already way lower than the Fed’s target of 5.5%. At 3.8%, the market is saying that the Fed will cut rates to 3-3.5% over the next year or so and hold there. So unless the Fed cuts more than that, the 10-year yield won’t fall. Similar logic applies to mortgage rates.

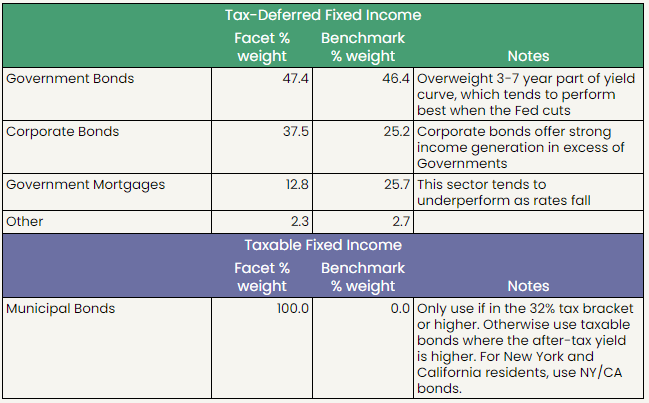

This is why we are still positioned defensively on interest rates and are overweight 3-7 year bonds. There is a risk that longer-term rates actually rise if the Fed winds up only cutting to 4% or such. Whereas the 3-7 year maturity range has historically performed best as the yield curve uninverts. We think that’s the best mix of risk and reward in the bond market.

Lastly on stocks. The Fed cutting does matter for stock prices, but it can be overrated. Remember that profit growth is the basic driver of stock prices over time. So the real impact the Fed has is through their management of the economy. If Fed hikes make a recession more likely, that’s bad for stocks. If Fed cuts help to lower recession risk, stocks should rise.

Beware of people pedaling other reasons why the Fed matters for stocks. At best, these are secondary factors that can distract you from the primary ones. This includes stuff like the “discount rate” effect. Other things you might read are flat out not true (or maybe barely true). For example, if you read “injecting liquidity” in someone’s argument, best to stop reading.

This is a long way of saying that if the Fed manages to cut enough to prevent the economy from slowing, stocks will probably do well. But it won’t be the actual level of rates that matters so much as how that rate impacts the economy overall.

One thing to look at in your portfolio is your non-U.S. exposure. If the Fed winds up cutting more aggressively than other world central banks, it could cause the dollar to decline in value. That is an environment where non-U.S. stocks may outperform, as has happened so far this quarter. We haven’t overweighted non-U.S., but we do believe diversifying globally is important, especially now.

Facet portfolio positioning

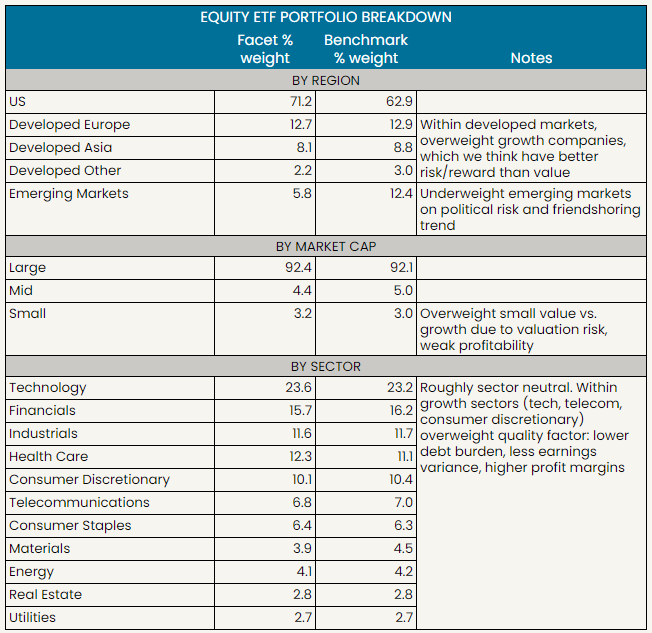

Here is a brief summary of how Facet’s exchange-traded fund portfolio breaks down in terms of regions, sectors and market capitalization. The benchmark is the Morningstar Global Index. This essentially allows for a comparison between Facet’s portfolio and the broad world stock market.

This is the same view but for Facet’s fixed income allocation. The benchmark here is the Morningstar U.S. Core Bond index.

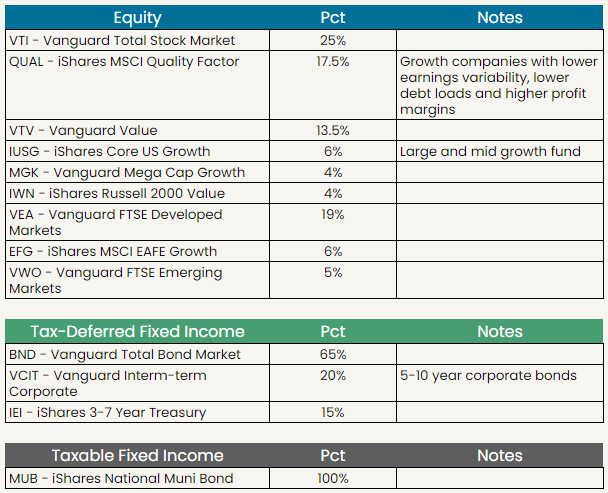

Facet’s current ETF models

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser. This is intended as educational information and is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. This is not a solicitation for the sale or purchase of any specific securities, investments, investment strategies, or products. Past performance is not a guarantee of future performance and all investments come with risks. Individuals should consider their personal risk tolerance, time horizon and goals when making a decision about investing. There are no guarantees on returns; implied or otherwise; investment results may vary.