Financial planning:For everything your money touches.

Get expert financial advice that goes beyond your investments. Facet’s CERTIFIED FINANCIAL PLANNER® professionals help you define the life you want to live today while also helping to ensure you are planning for a secure tomorrow.

Featured in

Experience a modern take on financial planning.

Financial planning should be dynamic, constantly evolving as your life changes. For everything your money touches, we’ve got you covered.

Go beyond investment planning.

More than basic 401(k)s and investment strategies. Our valuable financial solutions help our members thrive in every facet of their lives.

Expert financial advice from human + tech.

Each member gets access to a team of CFP Professionals®—the highest certification in our industry—to develop a personalized financial plan made to evolve with you. Powered by industry-leading technology to manage and organize your entire financial life in one place.

No hidden fees or commissions.

We charge a flat membership fee—that’s it. With our model, when you make more, you keep more*.

*This statement is based on an analysis by Facet comparing a flat planning fee, like the one Facet charges, to a fee based on a percentage of the assets invested (AUM fee) over a ten year time frame. The analysis compared the total fees paid over that time and the impact to investment balances. It was found that the flat fee approach was more beneficial in generating a greater investment balance while paying lower overall fees. The analysis used the same set of variables (starting balance, rate of return, underlying investment expenses, etc.) in the comparison and used a 1% AUM fee and $3,000 flat fee.

No hidden fees.

Our membership-based fees are tied only to your needs, not your assets. Facet’s straightforward membership fee covers financial advice for your entire life, not just your investments.

- No product sales and no commissions mean our advice is always centered on what's right for you.

- A flat membership fee tailored to your needs, not your money.

- Always a CFP® Professional. Always a fiduciary.

Objective financial advice

+ industry-leading technology.

You deserve honest advice and personalized guidance for your entire financial life. That’s why all Facet Planners are CFP® Professionals—the highest certification in the industry—to ensure you are getting absolutely objective recommendations.

Our industry-leading technology makes it easy for you to understand your options and make the right financial decisions with the help of your team of experts.

How Facet memberships work.

Our flat-fee membership model means no commissions

Support from a team of CFP® professionals and experts.

Secure, industry-leading technology to manage and organize your entire financial life in one place.

Exclusive partner offers that complement your financial outcomes.

“We felt more comfortable with the Facet approach, which was a fixed fee that works within your budget.”

Brad and Cat

Oregon

Alyssa G.

California

“I’ve always just sort of felt really uncomfortable with like opening bills, looking at my bank account, and I end up just kind of ignoring the problem until it gets problematic. With Facet it has been such a relief for me”

Jonathan U.

California

“The fee structure is probably the other biggest thing that sent me to Facet and it’s made me very happy with Facet. It puts us at an equal footing with anybody else. It’s not about how much money I have managed by Facet. It’s about us as a client…and as we grow our finances, the attention we get is not gonna change. We’re still a client paying for our Facet services with a fee structure that supports us as just a couple, not as a set of assets.”

Sarah & Michael D.

North Carolina

Frequently asked questions.

What is financial planning?

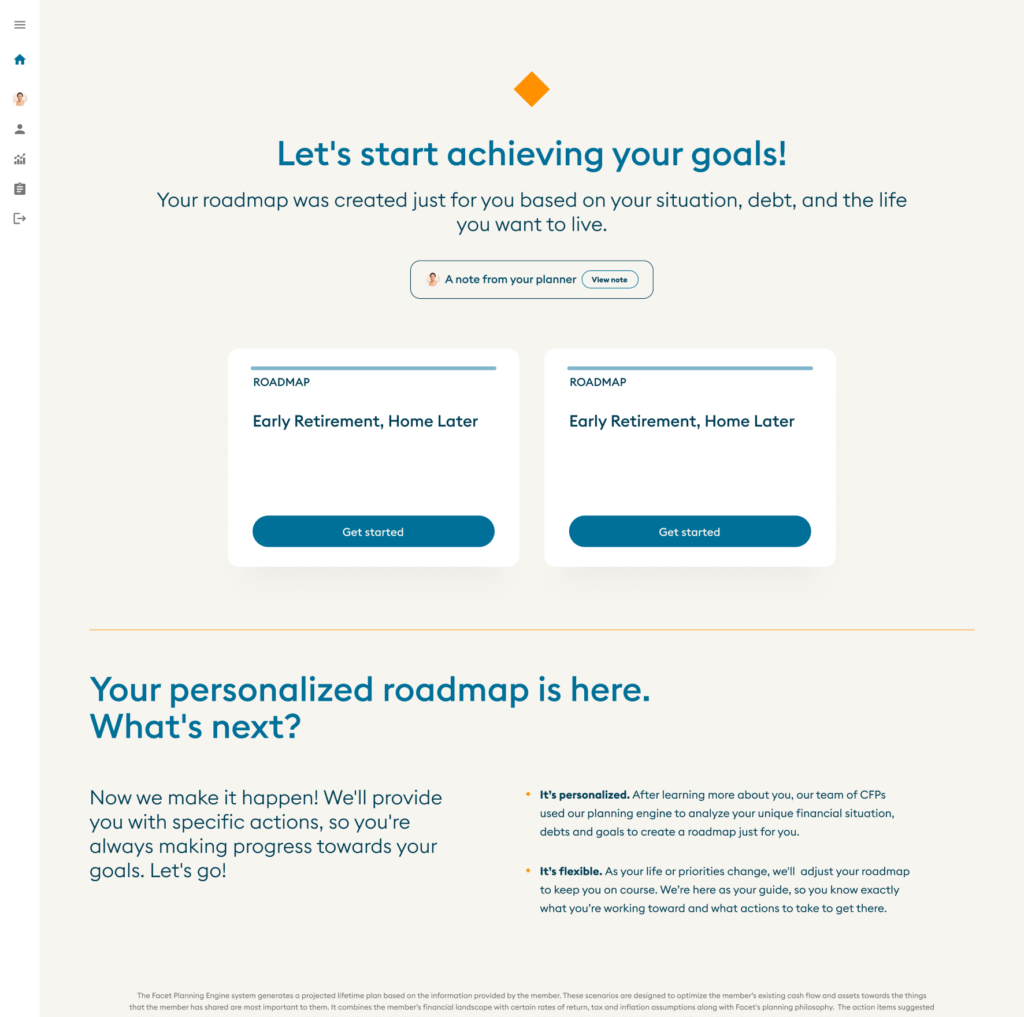

Financial planning is an approach to managing your money that helps you build and protect wealth while working toward your goals. With a professional financial planner, you can create a personalized roadmap that covers all aspects of your financial life — from managing day-to-day expenses to investing for the long run.

While financial planning guidance might sound expensive, getting started won’t cost you an arm and a leg. We believe in flat-fee financial planning that gives you access to expert guidance without any hidden costs or commission-based sales pitches.

With Facet, you’ll work with experienced CFP® professionals who’ll guide you through everything from budgeting and investing to tax planning. Ready to take control of your finances?

Get started today with a plan tailored just for you.

Who needs financial planning?

Here’s the truth: financial planning isn’t just for the wealthy — it’s for anyone and everyone who wants to make smart decisions with their money. Whether you’re just starting your career, thinking about buying your first home, or exploring investing in real estate, having a financial advisor in your corner can help you understand and manage important money decisions with confidence.

Take our quick financial wellness quiz to see how a personalized financial roadmap could benefit you.

When should I start financial planning?

The best time to start financial planning is now! Life moves quickly, and a solid financial roadmap helps you prepare for expected milestones and unexpected changes. The earlier you start, the more time your money has to grow and work for you.

Whether you’re in your first job or established in your career, each stage of life brings unique opportunities to grow and protect what matters to you. Starting early gives you more flexibility to adjust your strategy as life evolves, whether that means saving for a down payment, planning for a growing family, or working toward financial peace of mind.

Plus, getting started sooner means you’ll have a trusted advisor by your side during major life decisions — like negotiating a job offer, understanding your equity, or figuring out the smartest way to pay for a wedding. Our financial planning services help you stay on track through all of life’s twists and turns, not just the ones you can see coming.

Check out our investment philosophy to learn how we approach long-term wealth building.

Can a financial advisor help me prepare for retirement?

What's the difference between a traditional financial advisor and an online financial advisor?

Traditional financial advisors often require in-person meetings during limited office hours and typically charge a percentage of your investments. An online financial advisor, on the other hand, offers modern convenience with the same expert guidance.

At Facet, you’ll work with CFP® professionals — the highest certification in the industry — who are available when and where you need them through unlimited messaging and virtual meetings.

Plus, our transparent pricing means you’ll never wonder if your advisor recommends investments based on commissions rather than your best interests.