Investing as it should be.

OUR APPROACH TO INVESTING

01

We use Nobel-prize winning research with a modern twist*

Long-term investment success is all about the right mix of diversified investments, taking smart risks, and staying invested over time.

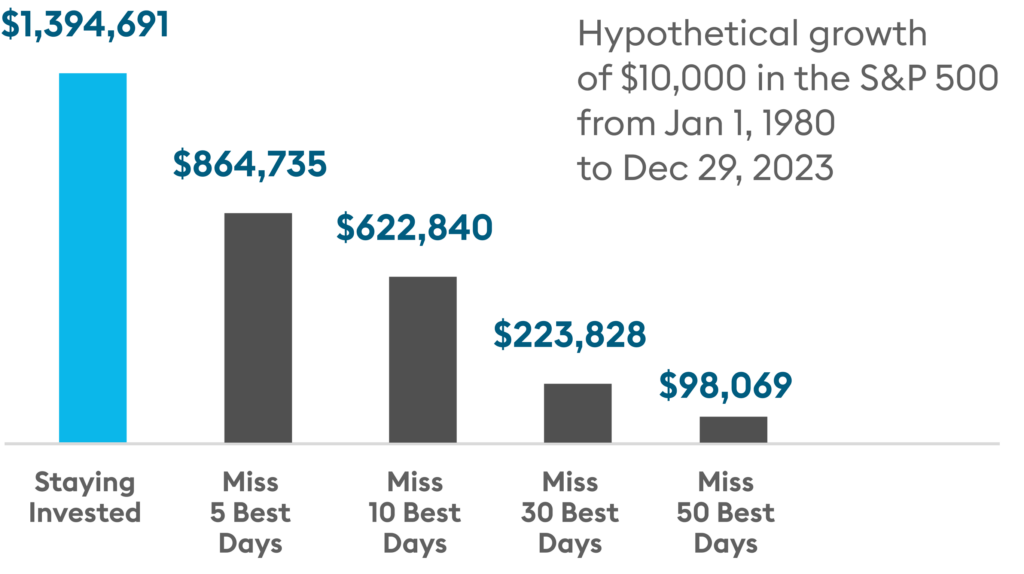

TIMING THE MARKET CAN MEAN MISSING OUT ON RETURNS1

02

A tailored portfolio that helps you live your today and plan for tomorrow

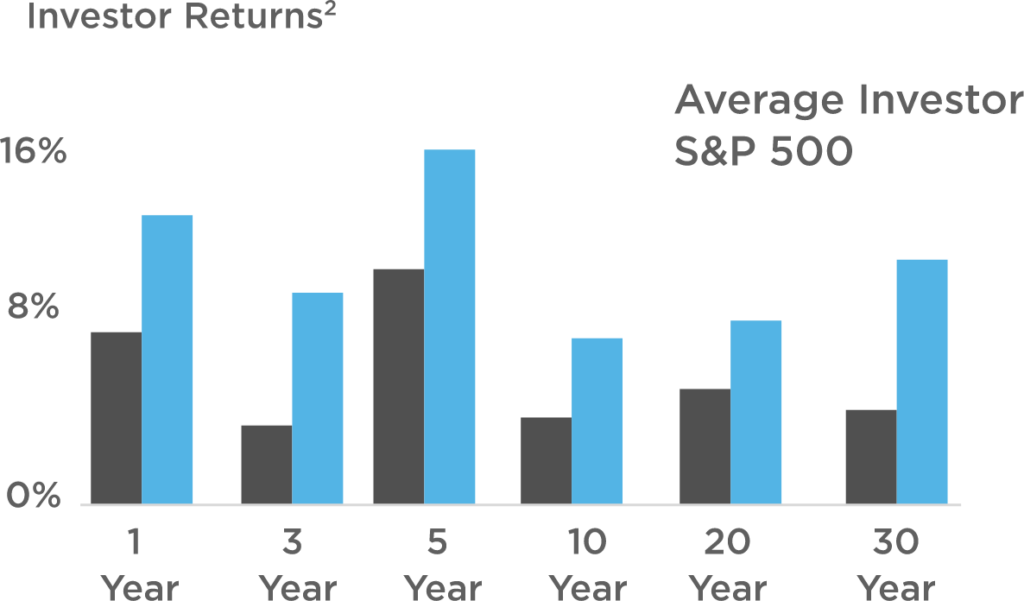

With your plan as your foundation, and low cost, tax-efficient ETFs at the core of your portfolio, you’ll be positioned to participate in market returns and avoid the mistakes that most investors make.

03

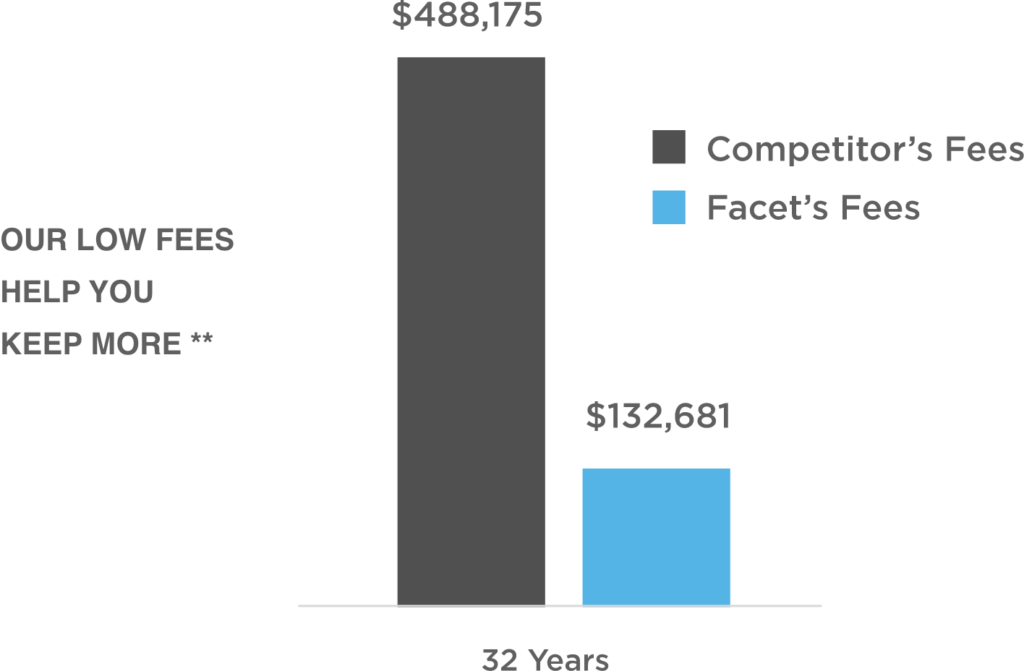

A dedicated CFP® professional who offers purely objective investing advice

We don’t charge you commissions or fees based on a percentage of your investments. Most advisors do. Our transparent, flat fee means you keep more of your money.

04

All this, plus some of the lowest fees in the industry, with tax-efficient planning included

In addition to low-cost investments like ETFs, we’ll recommend accounts to minimize taxes today and create tax-efficient income for tomorrow. All for one low flat fee - which makes a big difference over time.

1 Based on a study conducted by Facet in January 2024. The study used daily total returns for the S&P 500, the compounded return of $10,000 invested from January 1, 1980 to December 31, 2023 and excluded market days with the highest returns for the period to determine the impact of missing those days.

2 Source: Dalbar | Capital Spector.com

3 https://www.kitces.com/blog/financial-advisor-average-fee-2020-aum-hourly-comprehensive-financial-plan-cost

* Our investment approach includes research from Nobel prize winners Harry Markowitz, Eugene Fama and Richard Thaler.

** Based on a traditional advisor charging 1% of your total account vs. a Facet annual flat fee of $2,400 plus .08% fund fees. Assumes a starting account balance of $100,000 adjusted for annual contributions and investment growth.

Dive deep into Facet’s approach to investing

Explore our methodology for building and managing client portfolios