Financial wellness: Find your financial fulfillment.

Financial wellness is an ongoing, dynamic, and evolving process. It’s essential for leading a happier and more fulfilling life. Facet provides the tools, support, and advice to help you make informed decisions and take control of everything your money touches.

Featured in

Be free to be more you.

Financial decisions are an expression of your identity, the person you are or want to be. Financial wellness is about more than just having enough money; it’s about having the financial security to live the life you want with confidence.

Less Stress

Higher Productivity

Enjoy life more

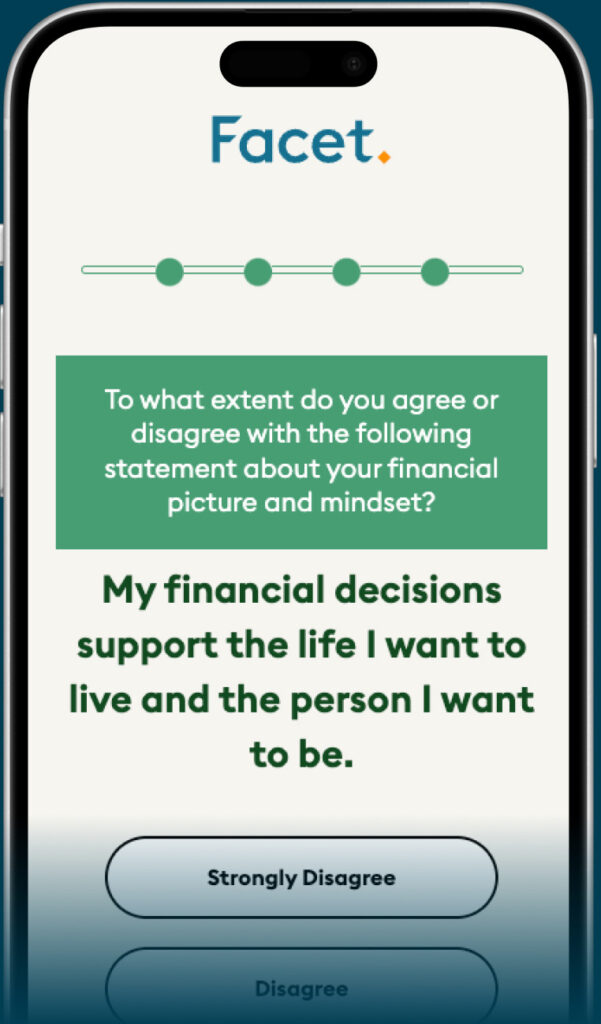

Do you have questions about how money fits into the life you want? Take our free quiz to better understand what’s helping and hurting you reach that goal when it comes to your money. We’ll also provide you with some next steps to take as you start focusing more on your financial wellness.

Find your financial calm.

Financial calm is achieved when you find freedom from worry and stress and gain clarity over your entire financial picture. It gives you the confidence to make the right decisions and control not just your money, but the life you want to live.

Through Facet’s dynamic financial planning process, you will learn to be intentional with your money, unlock its ultimate potential, and achieve greater fulfillment.

Our process starts in a rather unexpected place – your mind.

Your financial mindset is how you think and feel about money and how those thoughts and feelings influence your actions and behaviors. Financial planning creates mindset awareness, allowing you to gain control of your financial decisions. Mastering your mindset is critical to mastering your money.

Delivering dynamic strategies for all of your financial decisions.

Whether it’s prioritizing your objectives, optimizing your cash flow, debt, and short-term savings, or getting the most out of your work benefits, Facet is here for you. We help protect your health and wealth.

As your life changes, your plan changes.

Financial planning, as it should be, is an ongoing process. Facet helps you navigate every event in your financial life — career changes, getting married or divorced, starting or raising a family, saving for retirement or education, caring for an aging parent, and everything in between.

How Facet memberships work.

Our flat-fee membership model means no commissions

Support from a team of CFP® professionals and experts.

Secure, industry-leading technology to manage and organize your entire financial life in one place.

Exclusive partner offers that complement your financial outcomes.

“We feel more empowered navigating our finances, more than we ever have. Facet’s dashboard keeps us organized and gives us a clear understanding of where we’re tracking with our goals, budget, and more. Very user friendly.”

Hanna P.

New York

Alyssa G.

California

“I’ve always just sort of felt really uncomfortable with like opening bills, looking at my bank account, and I end up just kind of ignoring the problem until it gets problematic. With Facet it has been such a relief for me”

Jonathan U.

California

“The fee structure is probably the other biggest thing that sent me to Facet and it’s made me very happy with Facet. It puts us at an equal footing with anybody else. It’s not about how much money I have managed by Facet. It’s about us as a client…and as we grow our finances, the attention we get is not gonna change. We’re still a client paying for our Facet services with a fee structure that supports us as just a couple, not as a set of assets.”

Sarah & Michael D.

North Carolina

Facet was ranked #1 Best Financial Advisory Firm 2025 by USA TODAY!

In April of 2025, USA TODAY partnered with Statista to rank the top 500 RIAs. Recommendations were collected via an independent survey among over 30,000 individuals and an AUM development analysis over the short and long term. Self-recommendations were prohibited, and no compensation was provided for the ranking.

Frequently asked questions.

What is financial wellness?

Financial wellness is more than just having money in the bank — it’s about feeling confident and in control of your money. It’s the sweet spot where your daily money management, long-term goals, and peace of mind all come together. A solid financial wellness plan helps you handle everything from everyday expenses to those big life dreams while keeping stress levels in check.

Just like physical wellness isn’t just about the number on your scale, financial wellness isn’t just about your bank balance. It’s about creating a healthy relationship with money that lets you sleep better at night and wake up excited about your possibilities.

When you’re financially well, you’re not constantly checking your account balance or stress-shopping at 2 AM — you’re confidently making money moves that align with your values and goals.

Why is financial wellness important?

Money impacts pretty much every part of our lives. When you have your finances in order, you’re better prepared for unexpected expenses, and you’re setting yourself up for less stress and more options in life.

Financial wellness helps you make smarter financial decisions, whether diversifying your investments or saving for a home. It’s about creating a lifestyle where money works for you, not against you.

Think about how many daily decisions involve money: your morning coffee, where you live, what you eat, how you get around, and what you do for fun. When you’re financially well, these choices become opportunities rather than sources of stress.

How can I improve my financial wellness?

Improving your financial wellness is possible for everyone. You can begin by taking our quick financial wellness quiz to see where you stand. Then, focus on building healthy money habits that actually stick (no extreme budgeting necessary).

The most important thing you can do is get clear on your spending and saving patterns. Track where your money goes and set up a budget that fits your lifestyle. If debt is weighing you down, look into consolidating your debt to make it more manageable.

Next, think of the bigger picture. Create emergency savings, learn about our investment philosophy, and start planning for major life goals.

Here’s what real financial wellness progress looks like: Maybe you start by automating your savings (even if it’s just $50 a month). Then, you might tackle high-interest debt while building an emergency fund. Soon, you’re learning about investing and thinking about long-term goals like starting a business or buying a house.

How can a financial planner help me achieve financial wellness?

A financial wellness service can help you reach your goals. At Facet, we’re here to help you create a personalized financial roadmap that actually makes sense for your life. Work with CFP® professionals who have your best interests in mind to tackle everything from budgeting and investing to retirement strategies.

Think of us as your personal money coach and biggest cheerleader. We keep things real, skip the stuffy financial jargon, and focus on what actually matters to you. We’re not here to judge your spending habits or make you feel bad about your purchases — we’re here to help you create a plan that works for your life.

Ready to take the next step? Get started with a plan that fits your unique situation and goals.

Are financial wellness services only for people with a high income?

Absolutely not! Everyone deserves access to financial wellness support, regardless of their income level or where they’re starting from. Whether you’re just beginning your career, dealing with student loans, or already have some investments under your belt, there’s value in getting expert guidance.

We believe in making professional financial guidance accessible to everyone who wants to level up their money game.