Education planning:It starts now, and it may be easier than you think.

Whether you're helping your child reach their academic goals or pursuing your own educational dreams, college is a valuable investment. Facet can guide you through the process with our savings and funding plans, financial aid guidance, and student loan payoff strategies. Together we’ll help you approach your educational journey with confidence.

Featured in

An education savings plan is one piece of a bigger picture.

At Facet, we believe in building a customized education savings plan for your unique circumstances. Our planners collaborate with you to leverage time, investments, and the proper accounts to help you achieve your goals.

We go beyond generic strategies.

Our team will assess your available resources, education aspirations, and funding preferences. This comprehensive approach allows us to craft a tax-efficient strategy for accumulating and distributing funds. Whether you consider 529 Plans, Roth IRAs, or custodial accounts, we’ll identify the ideal solution for your situation.

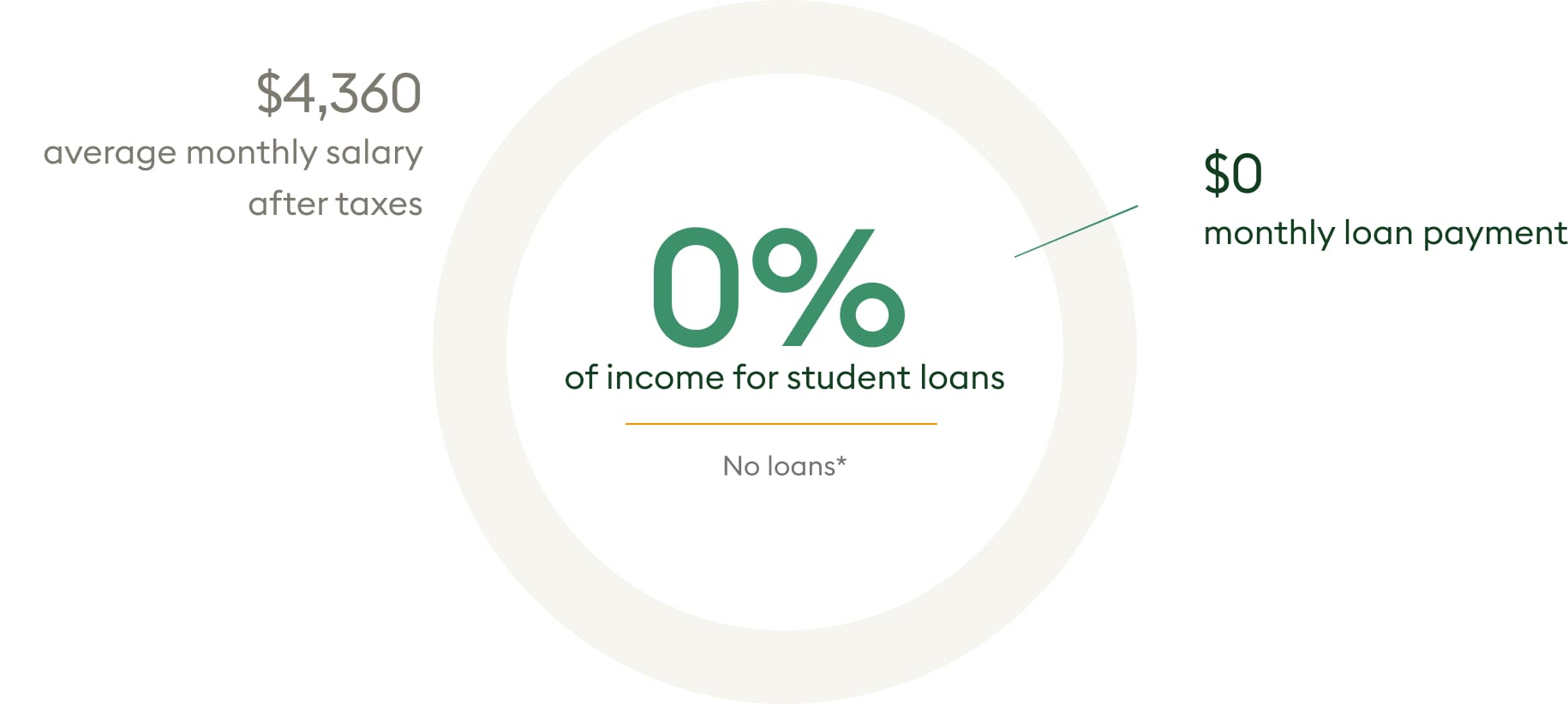

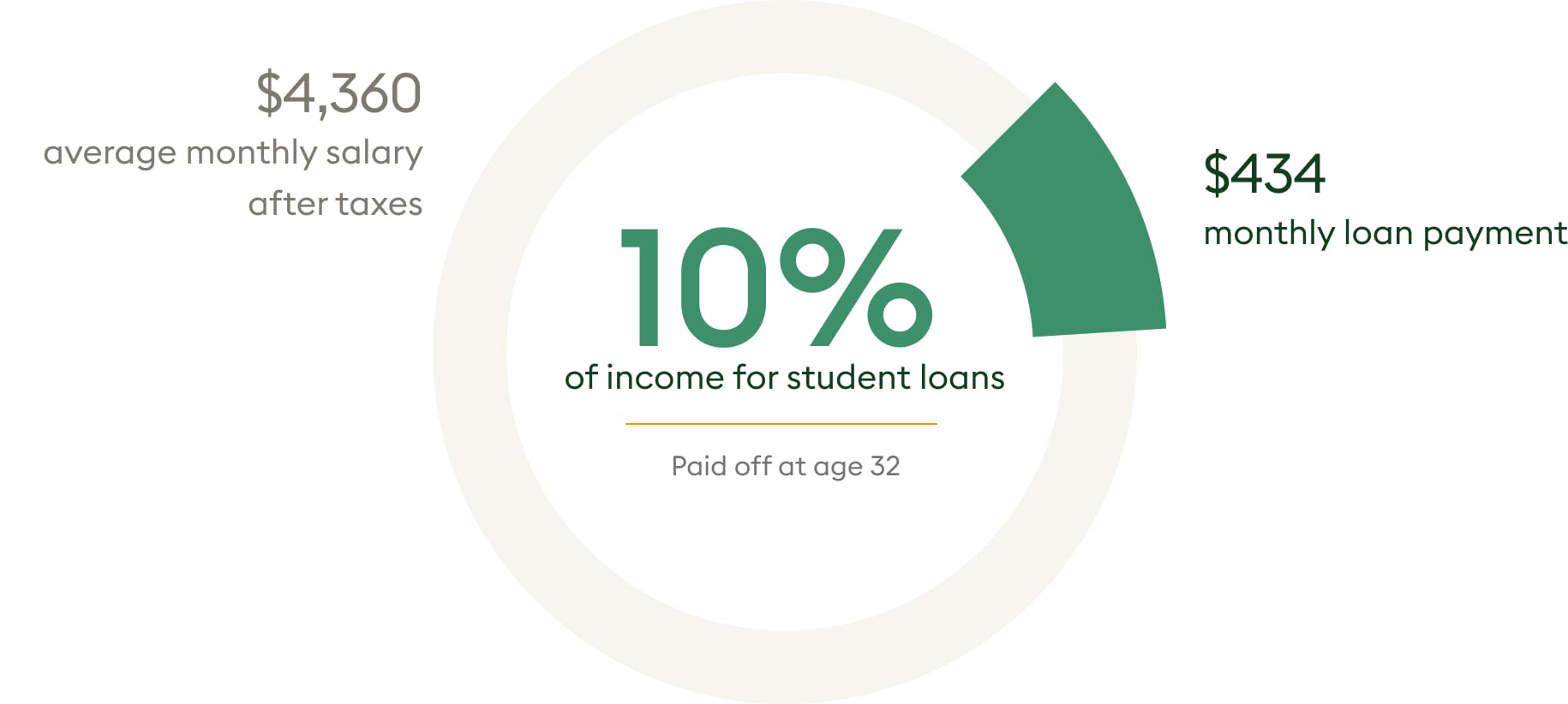

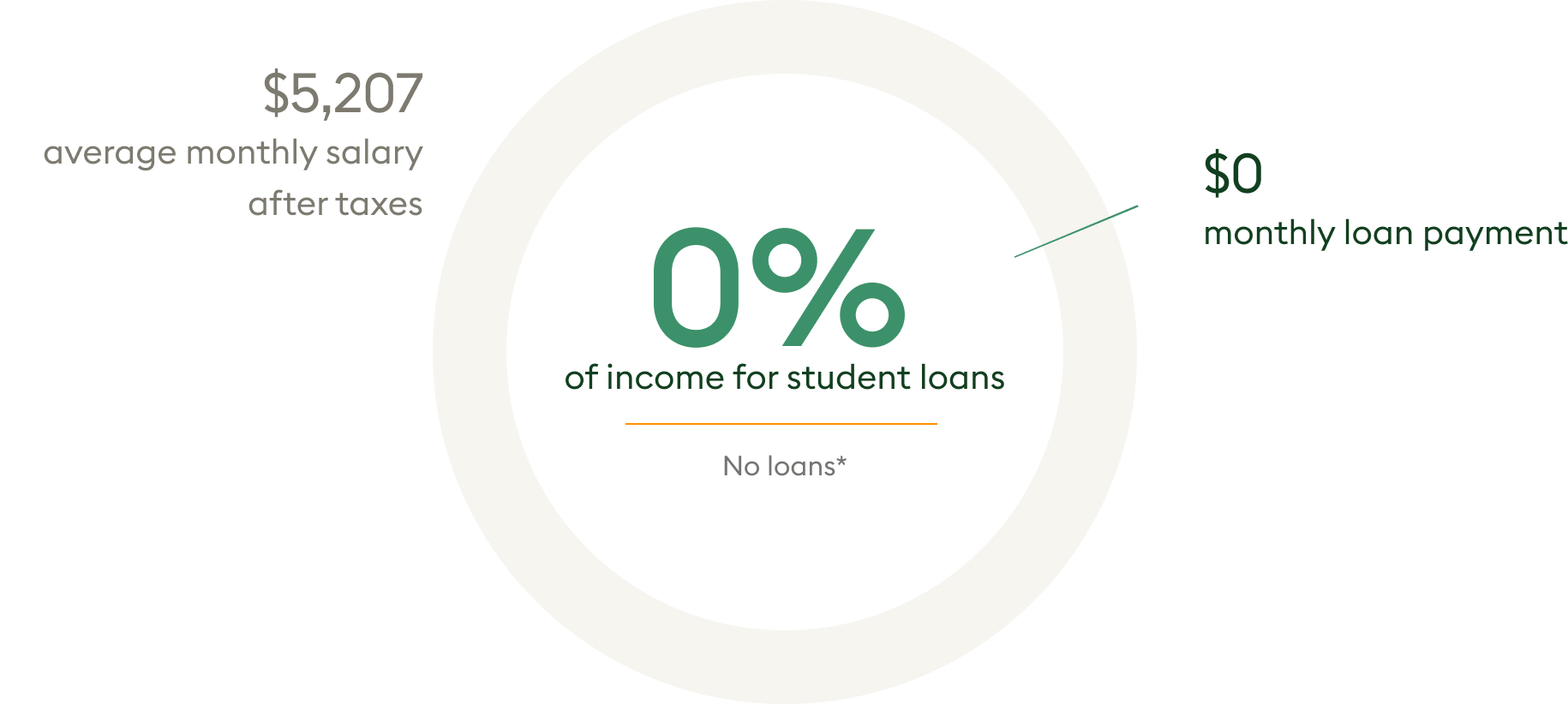

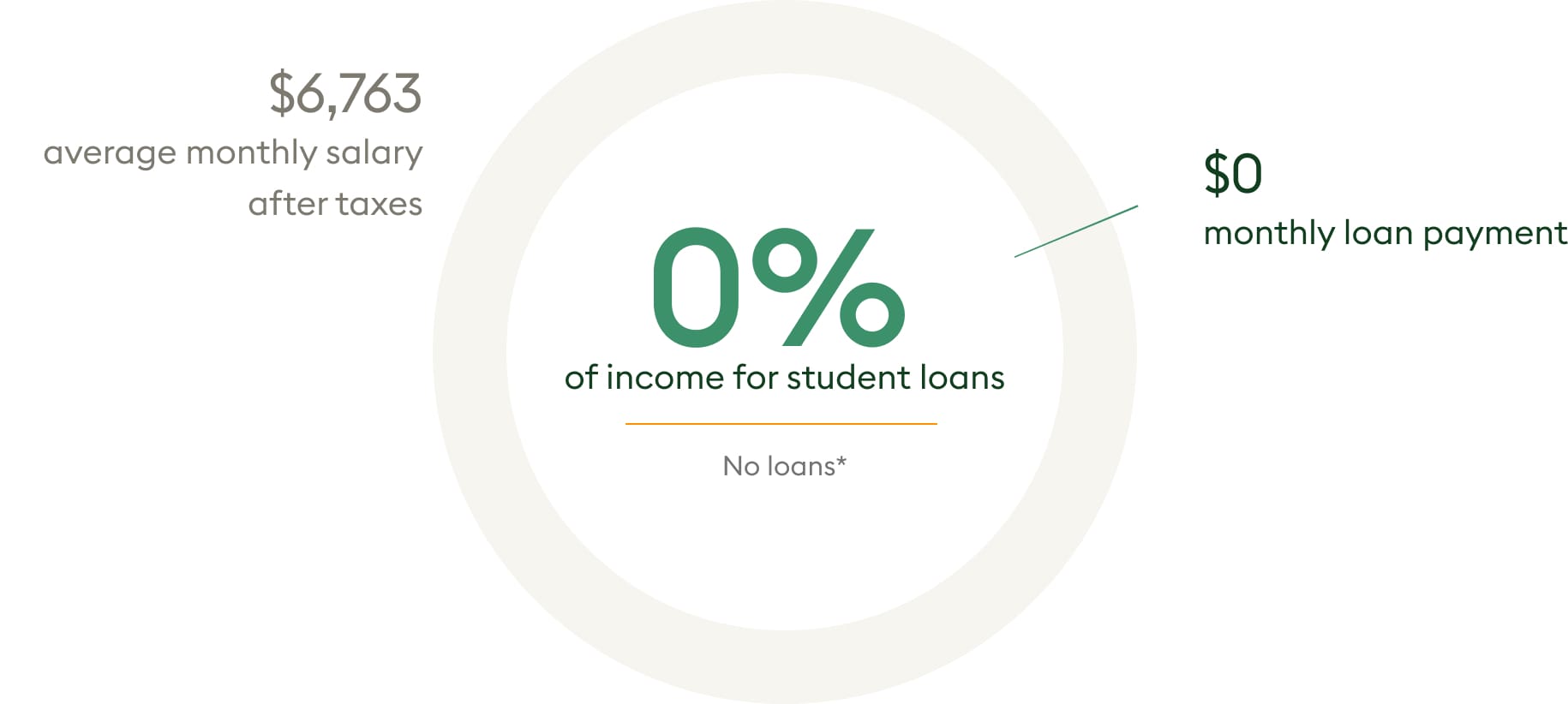

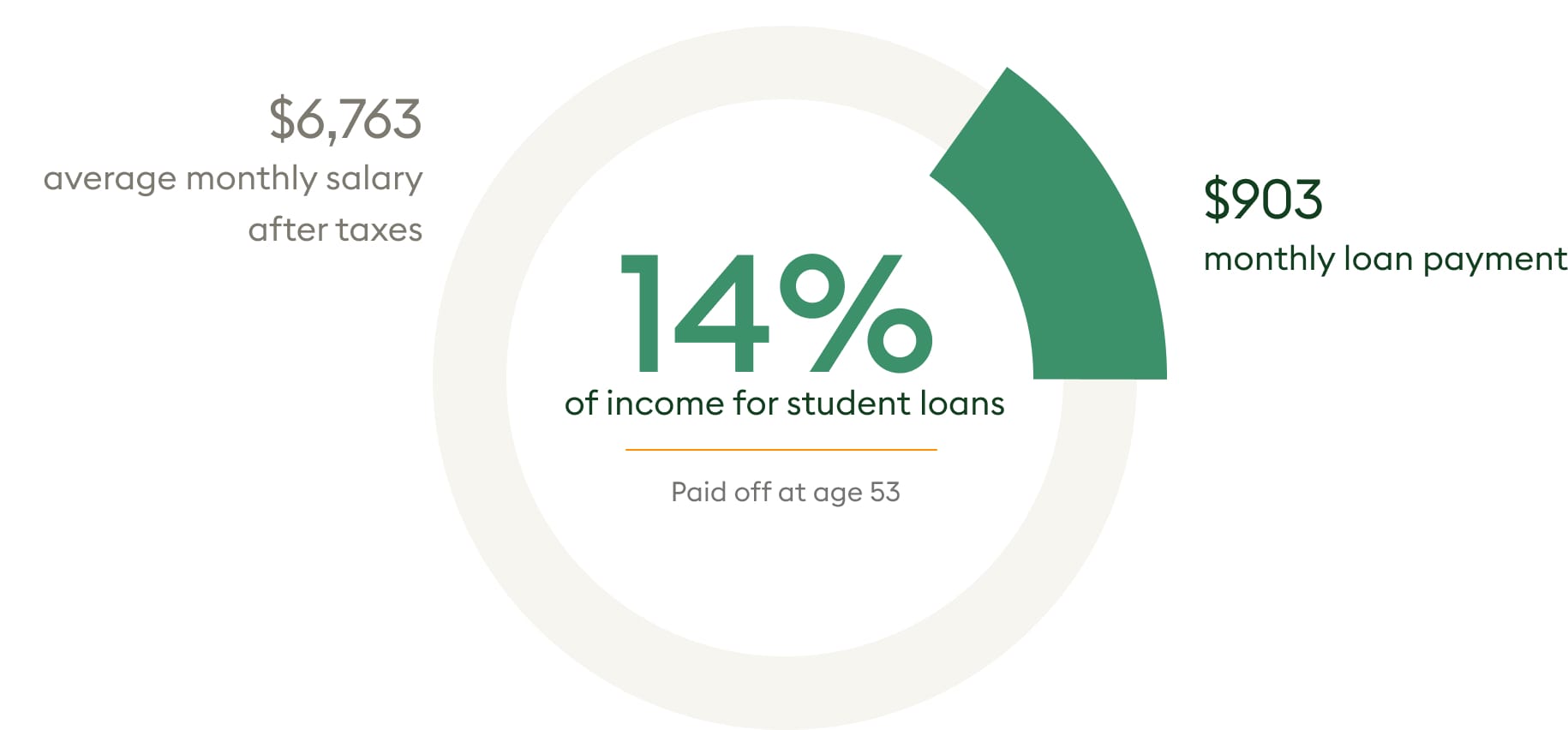

Plan ahead: The true cost of student loan payments.

Dependent on education savings strategy.

Data source: Education Data Initiative

Prioritize your savings goals with confidence.

We’ll help you answer your most important education planning questions.

- How do I save for an education and still meet my retirement goals?

- What happens to education savings if my child doesn’t use it?

- What investment options are available in my state?

- How do you even set up an education savings plan?

- How do these plans affect financial aid?

- How much is enough?

- How am I supposed to know what my kid will do in 5, 10, or 15 years?

Facet’s in-depth planning process helps you understand trade-offs and choose the best savings strategy for your unique priorities. Whether it’s education, retirement, travel, or all three, our team helps make achieving your dreams easier.

How Facet memberships work.

Our flat-fee membership model means no commissions

Support from a team of CFP® professionals and experts.

Secure, industry-leading technology to manage and organize your entire financial life in one place.

Exclusive partner offers that complement your financial outcomes.

“We feel more empowered navigating our finances, more than we ever have. Facet’s dashboard keeps us organized and gives us a clear understanding of where we’re tracking with our goals, budget, and more. Very user friendly.”

Hanna P.

New York

Alyssa G.

California

“I’ve always just sort of felt really uncomfortable with like opening bills, looking at my bank account, and I end up just kind of ignoring the problem until it gets problematic. With Facet it has been such a relief for me”

Jonathan U.

California

“The fee structure is probably the other biggest thing that sent me to Facet and it’s made me very happy with Facet. It puts us at an equal footing with anybody else. It’s not about how much money I have managed by Facet. It’s about us as a client…and as we grow our finances, the attention we get is not gonna change. We’re still a client paying for our Facet services with a fee structure that supports us as just a couple, not as a set of assets.”

Sarah & Michael D.

North Carolina

Frequently asked questions.

What is education planning, and why is it important?

Education planning is how you handle one of the biggest investments you’ll make for your kids or yourself. Having a solid education savings plan doesn’t just mean stashing money away for college; it’s about creating real opportunities for your children while keeping your finances healthy.

Here’s the thing about planning for education: costs are always going up, but when you plan ahead, you give yourself options. Instead of that sinking feeling when the first tuition bill hits, you can face it with confidence.

When should I start saving for my child's education?

Don’t wait! Education planning gets so much easier when you give yourself plenty of leeway. Starting early means your money has more time to grow through investing, and you can contribute smaller amounts each month instead of trying to scramble later.

Some parents start saving even before their little one arrives. But if you’re reading this and thinking, “Yikes, I should’ve started already,” don’t worry. It’s never too late to begin, and we can help you create a roadmap that fits your timeline.

Want to know where you stand? Take our financial wellness quiz for personalized insights.

What are the best savings options for education?

Let’s break down your main options for education savings plans. Each has its perks, and the right choice depends on your specific situation:

- 529 college savings plans: These are education-specific investment accounts with tax perks. When used for qualified education expenses, your money grows tax-free, and many states throw in extra tax benefits.

- Coverdell education savings accounts (ESAs): These work similarly to 529s but can also be used for K-12 expenses. They have lower contribution limits, but more flexibility isn’t a bad thing.

- Custodial accounts (UGMA/UTMA): This is the choose-your-own-adventure of education savings. These funds can be used for anything, not just education, but they don’t come with the same tax benefits as 529s or ESAs.

- Savings bonds: These are the slow-and-steady options. Series EE and I bonds can be tax-free when used for education, making them a great low-risk choice.

At Facet, we look at your whole financial picture. Check out our guide to managing your finances through all of life’s stages to see how education savings fits into the bigger picture.

What is a 529 plan, and how does it work?

A 529 plan is a tax-smart investment account with education benefits. Your money grows tax-free, and when you use it for qualified education expenses, you won’t pay taxes on the withdrawals either. These expenses can include:

- College tuition and fees

- Books and supplies

- Room and board

- Computer tech for school

- Up to $10,000 yearly for K-12 tuition

You can open one of these accounts in any state, regardless of where you live or where your child might go to school. Each state offers different investment options and potential tax benefits for residents.

Why work with Facet for education planning?

We do things differently at Facet. Our approach to education and family planning isn’t about pushing generic solutions — it’s about understanding what matters to your family and creating a roadmap that fits your life.

Unlike traditional advisors who might focus solely on education savings, we look at how everything fits together. Our investment philosophy is built on smart, evidence-based strategies that help you save for education while keeping your other financial goals on track.

Ready to create an education savings plan that actually makes sense for your family? Get started with Facet today. Let’s build something that works for you. No cookie-cutter solutions, just real planning for real life.