Once, financial planning was for the few.

For starters, it cost too much. Most people simply couldn’t afford it. On top of that, many firms wanted to see an account of $100k or more before they’d even deal with you – as if planning was only for the rich.

But now with Facet...

Finally, financial planning is all about you.

We’ve made financial planning the way it should be. All about you. And that’s much more than retirement planning, it’s planning for the life you want to live – from big things to everyday things – and how your finances can get you there.

Our five fundamentals.

Did you know traditional advisor fees can come with hidden costs...

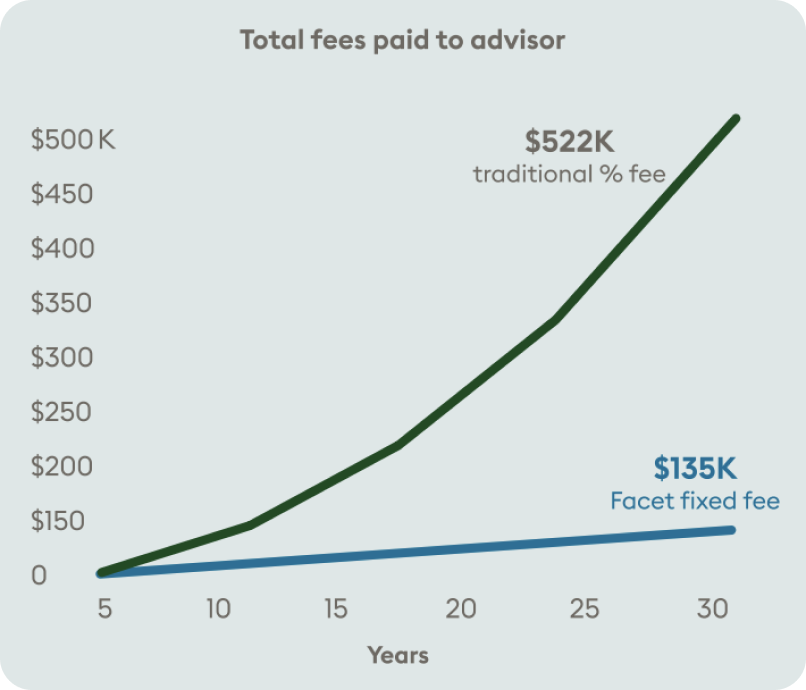

Many traditional advisors charge based on total assets under management (how much you invest); if your investments grow the fee you pay will grow as well. Facet charges a flat fee that does not change if your assets grow and does not earn commissions on products.

01

Planning should be a flat fee.

It starts with an affordable flat fee (which won’t change even as your money grows) that sets us apart from traditional firms that charge you by the hour or take a cut out of your returns.

02

Planning should include a CFP® professional who offers objective advice.

You’ll work with a CERTIFIED FINANCIAL PLANNER® professional who puts you first. They’ll always guide you toward moves that are in your best interest.

Did you know a CERTIFIED FINANCIAL PLANNER® (CFP®) professional is considered...

the gold standard in financial planning? CFP® professionals are fiduciaries, meaning they are legally and ethically required to act in your best interest. This ensures that the guidance you receive is tailored to your financial well-being. A CFP®

professional can provide you with comprehensive financial planning services, including investment management, retirement planning, and estate planning, all aligned with your personal goals.

Real Facet member

“Before Facet it almost felt like I worked for my money and now my money works for me."

Colby

Facet member since 2023

03

Planning should cover every facet of life.

Our planning covers every financial decision – far more than just retirement. And it evolves as your life evolves. After all, needs arise and opportunities unfold. Together, they help you make all the right moves for you and your money.

04

Planning should be simple and guided.

Our guidance gives you a clear path forward with a personalized financial roadmap. Along the way, we help you keep on track with guided steps, regular check-ins with a CFP® professional, and user-friendly tech, so you can make smart money moves again and again.

Nice job staying on track!

Complete three actions by the end of the month to meet your goals.

- Increase 401k to 10%

- Contribute $7k to Roth IRA

- Save $500/month to vacation account

05

Planning should pay for itself.*

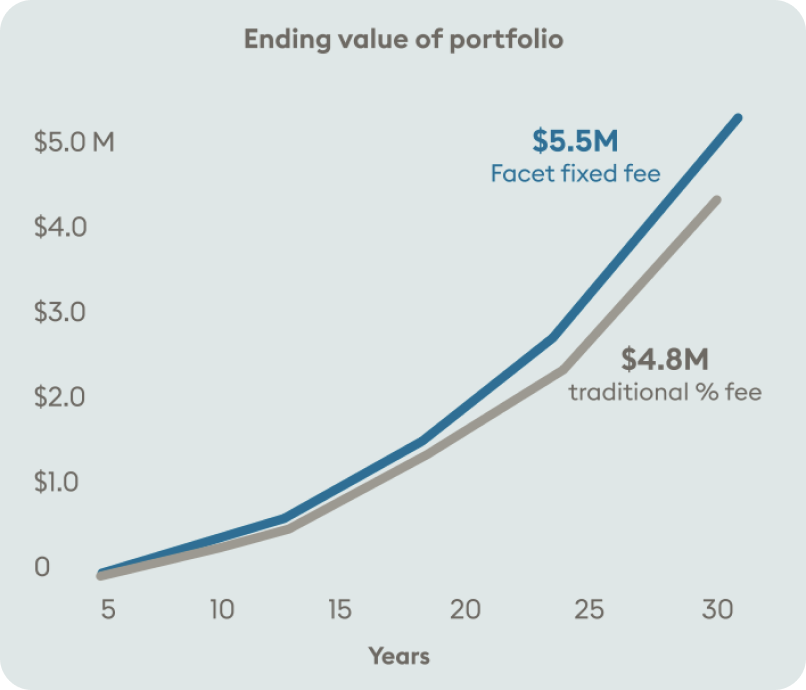

Our low flat fee helps you keep more.*

The money you save on planning can go right back into other things, like investments that may gain value.

The charts and claims are based on an analysis of a starting investment balance of $500,000, annual contributions and an annual return of 8%. It then compared a portfolio that was charged a 1% asset based fee versus a flat fee of $3,000 annually and charted the post fee investment growth for both for comparative purposes. An annual investment expense fee of .08% was used in both cases. This is intended strictly for illustrative purposes. Investing includes risks and there is no guarantee of future performance.

*Based on a study conducted by Facet in May of 2024. A complete data set was reviewed for core recommendations made for each of Facet’s service levels. That data showed that the majority of Members achieved value greater than their planning fee. This value was shown to reoccur on an annual basis. Assumptions included average expenses and fees, using retirement tax savings, portfolio expenses, debt refinance, tax loss harvesting, and potential insurance premium savings as value drivers using Facet’s investment services, and discounting value to align with the acceptance of Facet recommendations. Facet has tiered pricing packages based on the individual service needs of the member. There is no separate or additional fee for investment management. This is not a guarantee or prediction of actual results for any member and results may vary by member. Some value like tax loss harvesting may vary year to year.

Navigate your finances confidently with a team of experts guiding you every step of the way.

Frequently asked questions.

Why should I choose Facet?

In an industry saturated with fees, confusing jargon, and cookie-cutter solutions, Facet exists to make financial planning affordable, accessible, and personalized.

Affordable: With our flat-fee membership options and commission-free approach to investing, we’re helping you keep money in your pocket so you can spend it on the things that matter most to you.

Accessible: Financial planning can be complicated enough as it is, without all the fancy jargon and hard-to-understand processes. With knowledgeable, objective CFP® professionals, intuitive technology and ongoing support, we’re making financial planning simple. (As it should be.)

Personalized: There is no one-size-fits-all approach to planning because there is no such thing as a “standard member.” We take the time to understand our members’ individual needs, dreams and priorities to develop plans that help them achieve success by their unique definition of the word.

I can do this myself, why do I need a financial planner?

What’s a fiduciary?

A fiduciary holds a legal and ethical relationship of trust with the person whom they’re serving. Therefore, a fiduciary is legally obligated to only make recommendations in the best interest of each person they are giving advice to. Like all SEC-registered firms, all of the CFP® professionals at Facet are fiduciaries on behalf of our members.

What happens if I want to cancel my membership?

All of Facet’s memberships are annual and non-refundable. If you choose to cancel your membership, you will be responsible for any outstanding balance, and will retain access to your planner and services for the remainder of the term.

Can my spouse or partner join under my membership or do they need their own?

You and your spouse or partner can use the same membership.

What fees does Facet charge for investment management?

Facet offers flat-fee planning memberships that don’t change based on how much you invest and earn, however, our custodians or third party service providers may charge fees that will be deducted from your account.

You can view a full list of potential custodial costs under the “Investment management” section of our legal page and for more information about Facet’s approach to investing, watch this video.

Facet’s specific investment management services vary depending upon the chosen service level.

How can Facet manage my investments as part of my membership when others charge a fee?

We’re able to include investment management as part of your Core, Plus, or Complete membership because we believe in a transparent and member-centric approach to financial planning. To us, managing a $100,000 portfolio isn’t much different than managing a $1,000,000 portfolio—so why would we make our members pay more? By structuring our services this way, we prioritize your financial well-being over transaction-based fees.

Watch this video to learn about how Facet could bring value to your investing strategy.