Key takeaways

- Compounding accelerates savings growth

- Compound interest is interest calculated on what you start with (principal) and all interest you accumulated previously

- The power of compound interest is commonly referred to as "interest on interest"

- Interest compounding frequencies vary: daily, monthly, semimonthly, annually, or even continuously

- Compounding does not start until interest is credited to your account

What is compound interest?

Compound interest is when your initial savings and any interest it accumulates grows more interest.

This means that each time you earn interest, it automatically gets added to your account and becomes part of the initial principal.

Think of your savings as a snowball rolling down a hill. The farther it travels, the more snow it accumulates, and the bigger it grows — that’s how compound interest works.

How does compound interest work?

If we boil down the concept to its absolute core, compound interest is “interest on interest.” This is how the power of compound interest is often described. However, calculating compound interest involves some math.

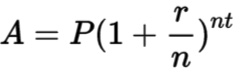

For the do-it-yourselfers, here’s the formula:

- A = final amount

- P = principal sum (the amount you start with)

- r = annual interest rate (how much the bank pays you on your savings)

- n = number of times interest was applied per compounding period

- t = number of compounding periods

For those who wish to skip the lengthy formula and get a rapid response, Investor.gov has a free compound interest calculator you can use.

Example of the power of compound interest

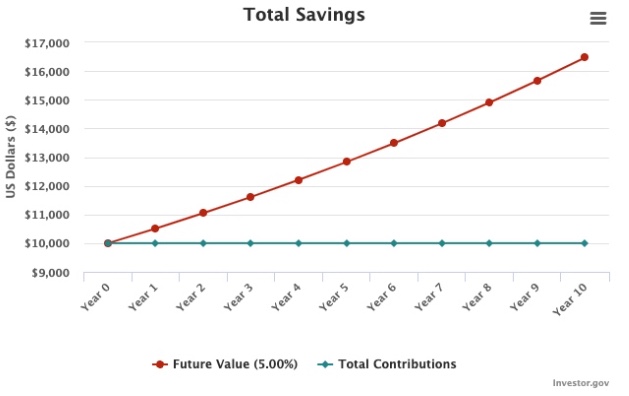

Say you open an account with $10,000 at an annual interest rate of 5%, compounded monthly, and hold it for ten years. At the end of the ten years, you will have $16,470.09.

As you can see in the table above, you made $511.62 in the first year. As time went on, your interest continued to generate more interest.

Discover Facet’s Short-term Investment Strategy

Compound interest vs. simple interest

If you’re wondering how compound interest differs from simple interest, here’s a brief explanation.

Simple interest generates new interest each year but doesn’t get added back to your principal.

Compound interest, on the other hand, generates new interest and adds it back to your initial principal amount. This is what allows for exponential growth over time.

Using the same scenario above, if your account received simple interest, $500 would be added to your account every year, and your final value would be $15,000. You would have made $1,470.09 more with monthly compounding interest, or $16,470.09.

How to use the Rule of 72 to calculate compound interest

The Rule of 72 is a quick calculation to estimate how long it would take for your money to double. Simply divide 72 by your interest rate to see how long it will take to grow your savings twofold.

For example, if you have $1,000 with a 5% interest rate, it would take 14.4 years to turn into $2,000.

(72 / 5 = 14.4 years)

How often is compound interest credited to an account?

Compounding periods designate how often interest is added to an account. The intervals vary: Interest can be compounded annually, semiannually, quarterly, monthly, daily, continuously, or on various other bases.

It can get even more complex, too. For example, interest may grow daily but only added monthly to the account. This is important because your interest can't earn more until it is credited to your account.

At what frequency is compound interest added to common financial instruments?

- Certificate of deposit (CD): Standard CD compounding frequency schedules are monthly or daily.

- Series I bonds: Interest is compounded every six months or semiannually.

- Savings and money market accounts: The frequently used compounding period for bank accounts is daily.

What are the most common ways to start earning compound interest?

Conventional compound interest accounts include traditional savings accounts, certificates of deposit (CDs), high-yield savings, money market accounts, and bonds (fixed-income investments).

Traditional savings accounts offer the lowest interest rates, followed by CDs. Both typically carry zero risk and are FDIC insured if purchased through most banks.

Money markets are another option for those seeking to take advantage of the power of compound interest. They're similar to savings accounts, but they often offer better yields that will vary by institution.

High-yield savings accounts typically offer more competitive interest rates than traditional savings accounts, CDs, and money markets. As the compounding period of these accounts is shorter, you'll be able to grow your money faster.

Lastly, bonds (fixed-income) can also be used to generate compound interest. To receive compounded interest with bonds, you will need to reinvest your interest. Bond funds (mutual funds) can also be a substitute for individual bonds.

Final word

Compound interest is a powerful tool you can use to supercharge your savings over time.

By understanding how it works and what investment vehicles you can use to take advantage of it, you can maximize your money’s growth and save more towards achieving your financial goals.

To find out how our short-term savings strategy works, or to get a progress report of how you’re doing, set up a call today.