Key takeaways

- The Consumer Price Index (CPI) release on April 10th is a key data point for investors, as it can influence the Fed's decision on rate cuts.

- Investors should track their portfolio performance compared to a benchmark to gauge their returns.

- A strong economy with high interest rates is preferable for stocks over a weak economy.

- The stock market can be influenced by rumors and upcoming economic data releases. Investors should be aware of this when making decisions.

Hello from your Chief Investment Officer and welcome to our inaugural edition of the individual investor newsletter. In this newsletter, we’ll cover all the things I’m watching right now, what the chatter is among the pros, and give some details on how Facet portfolios are currently positioned. All aimed at helping individual investors make the most out of their portfolios.

With that, here’s what you need to know this week.

Got a question about any of the topics in this week’s letter? Feedback on the newsletter itself? Email the Facet investment team at [email protected].

Market recap

It was a volatile week last week, highlighted by a big intra-day selloff on Thursday afternoon. Around 1:30pm ET, some rumors began to circulate that Israel was preparing for a retaliatory Iranian strike. At the same time, Minneapolis Fed President Neel Kashkari floated the idea that the Fed might not cut rates at all in 2024. The S&P 500 went from up about 0.8% to down 1.2% on the day after those two events.

One should be careful overinterpreting these day by day moves to be sure. In particular, the fact that these events happened in the afternoon just before the US jobs report was due to come out the next day matters. Wall Street trading desks don’t want to wind up holding a bunch of stock ahead of such a big event. So if clients tried to sell stocks Thursday, there weren’t going to be a lot of aggressive buyers. That kind of thing can exacerbate sell-offs.

I’ll also point out that Neel Kashkari might be the least influential member of the Fed’s policy committee. Close Fed watchers know certain Fed officials’ words carry more weight than others. Kashkari is probably dead last on that list for me.

The actual jobs report came in pretty strong, with total jobs gained at +303,000, a bit better than the +214,000 expected according to Bloomberg’s economist survey. Stocks rose significantly on the news, but not enough to finish the week positive, with the S&P finishing down about 1% for the week.

This week's chatter

Broadly speaking, traders are focused on two big themes right now. First, can company earnings meet elevated expectations? And second, how much will the Fed cut rates in 2024? We’re going to get a lot of data on both in the next few weeks.

As I said above, the jobs report came in a bit better than expected. However, I don’t think this changes how the Fed is thinking about potential rate cuts. The Fed is considering cutting rates a couple times as a preemptive measure, i.e., so that policy goes from very restrictive to merely restrictive. They just need inflation to be improving enough before starting such a process.

As stock investors, we should be cheering good employment reports and be worried about weaker ones. A strong economy with relatively high interest rates is perfectly fine for stocks. A weak economy is a problem.

The most critical number of the month for Fed watchers is the Consumer Price Index (CPI), which will be released on Wednesday the 10th. There have been two surprisingly high CPI reports in a row the last couple months. Most traders think these were more about seasonal effects than a real change in the inflation trend. But we’re all anxiously awaiting this next CPI report. If the result comes in even mildly lower than February, there will be a big sigh of relief among investors.

First quarter earnings season starts Friday the 12th with several big banks reporting that morning. For stock market investors, I believe earnings will be far more impactful than the macro data or the Fed over the course of this quarter as well as the remainder of 2024. However investors are going to be more focused on tech and consumer companies than banks this earnings season, so don’t expect too many fireworks until those companies start to report later in April and into May.

In terms of the middle east conflict, traders are definitely talking about what the various possibilities are. I don’t think anyone truly knows what will come next. But speaking strictly about Thursday’s rumors, I think the smart money noticed that stocks were reacting much more aggressively than oil prices were. If the market were sure the conflict was about to widen substantially, oil prices would have spiked by a greater degree.

Pro corner

Perhaps the single most important suggestion I can give to anyone investing on their own is to properly measure your performance. I don’t see any way one can succeed without doing this. Here’s my advice on how to think about this.

First let’s talk about why this is so important. You need a way of knowing if you are getting adequately paid for the risks you are taking in your portfolio. You also need a way of knowing whether your decision-making process is working or not. There’s no way to do these two things without measuring your results versus some alternative.

A lot of people only bother to look to see if they are making money or not from their investments. However, over the long-run, stocks and bonds generally go up in value. If you keep your money invested for any decent amount of time, odds are you are going to make money. According to Bloomberg data, 97% of large-cap U.S. focused stock funds made money over the three years ending in March. However only 19% did better than the S&P 500. Merely having a profit on your investments doesn’t tell you if you are making good investment decisions. This would be like concluding that a basketball team is good because they have scored any points. Every team scores some points!

To tell if a team is good, you at least have to compare your score to the opponent. In investing, that means comparing your results vs. some benchmark. At Facet we use the Morningstar Global benchmark for equities, and anyone can get basic return data on that benchmark for free. You want to pick a benchmark that basically reflects the universe of investments you will be making. That’s why we pick a broad global benchmark. If it is more convenient, you can also use some broad global ETF like Vanguard Total World Stock (ticker VG) or iShares All Country World (ticker ACWI). If you invest in both stocks and bonds, you want to also pick a bond benchmark and their weight the two benchmarks approximately equal to your base asset allocation.

If you haven’t been comparing your performance to a benchmark until now, that’s OK. You can start now. But if your broker supplies performance information on your statement or the website, go ahead and compare your past results to this benchmark and see what you think.

Going forward though, you’ll want to not only compare your periodic results to the benchmark, but analyze how each of your investments are contributing. You never expect every investment to outperform or underperform, but how each is performing should make sense vis a vis the risk inherent in each. One good place to start is to ask yourself why you are holding each investment you own, and does the performance of that investment make sense given what has been happening in the economy? Only by doing this exercise will you know if your decision making is working or not.

If you are looking at your investments and feel a bit unsure of why you are holding every line item, don’t worry. We’ll cover the professional way to approach this also in an upcoming newsletter.

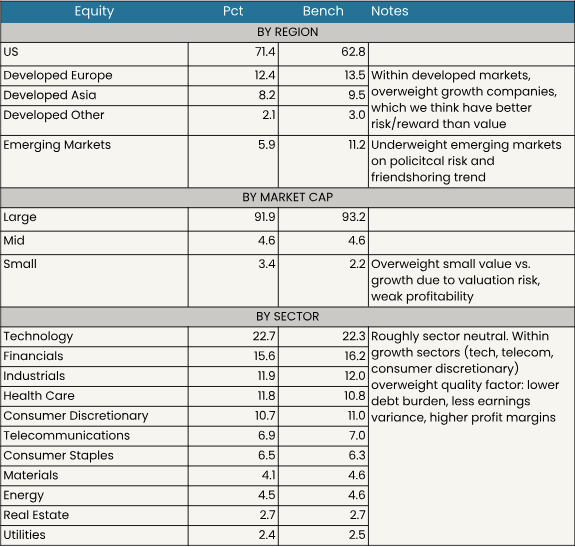

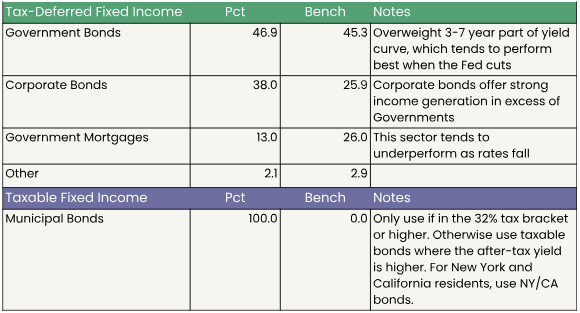

Facet portfolio positioning

Each week we’ll be showing some detail on how Facet’s base ETF portfolio is currently positioned. Bear in mind that our allocation can change at any time, although if we do make changes, we’ll include our reasons why in the sections above. The allocation detail below is based on the underlying stocks and bonds within Facet’s ETF allocation.

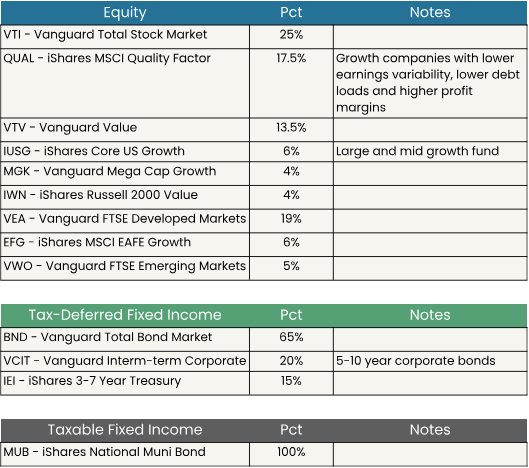

Facet's Current ETF Models

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser. This is intended as educational information and is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. This is not a solicitation for the sale or purchase of any specific securities, investments, investment strategies, or products. Past performance is not a guarantee of future performance and all investments come with risks. Individuals should consider their personal risk tolerance, time horizon and goals when make a decision about investing. There are no guarantees on returns; implied or otherwise; investment results may vary.