Key takeaways

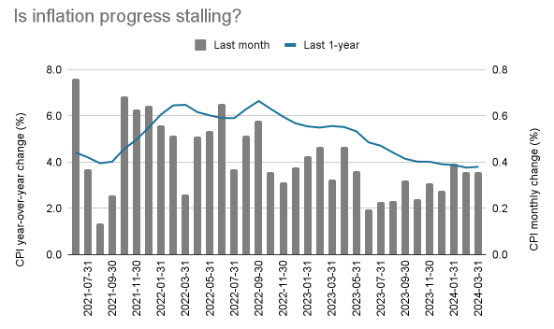

- Inflation remains high with the Consumer Price Index (CPI) showing above the Federal Reserve's target of 2%.

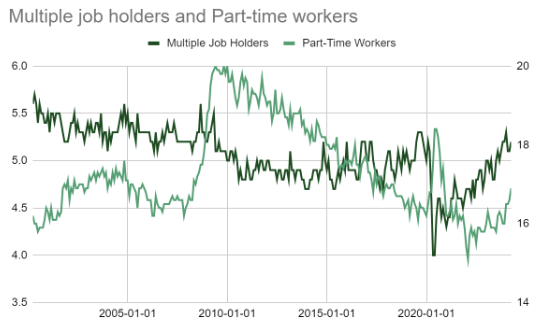

- Job growth is strong, the economy added more jobs than expected in March. However, some of the growth is in part-time jobs.

- The Fed is likely to delay rate cuts until they see a significant decrease in inflation.

- A healthy job market is a positive sign for corporate profits and economic growth, even with higher interest rates.

Over the last several days, we have gotten key economic reports on U.S. employment and inflation. For investors, they painted a mixed picture. Inflation remains too high, with the March report coming in higher than most economists expected. Meanwhile job gains were very strong, indicating that companies are still feeling optimistic about growth.

So what does this mean for investment markets or for the potential for Federal Reserve rate cuts? Here is our take.

Inflation still running high

The Consumer Price Index (CPI) advanced 0.4% in March, marking the third month in a row coming in at that level. That’s way too high for the Fed’s taste. If we extrapolate out this CPI figure for a full year, it implies an annual rate of 4.4%, far above the Fed’s 2% target.

Source: Bureau of Labor Statistics

Source: Bureau of Labor Statistics

We had noted previously that we thought the recent jump in inflation was probably temporary. We haven’t seen the kind of jump higher in consumer spending or household incomes that typically coincide with a lasting inflation acceleration. Fed Chair Jerome Powell seemed to agree when he said there was “reason to think that there could be seasonal effects there” at the Fed’s most recent meeting.

That might still prove to be the case. Looking at the individual items driving CPI higher this month, a lot of them are so-called “non-market” prices. I.e., prices that the Bureau of Labor Statistics derives statistically as opposed to prices we actually observe. This includes things like medical insurance and implied rents on owned homes.

Regardless, we’re going to need to see material improvement in these inflation numbers before the Federal Reserve can seriously contemplate cutting rates.

Job growth strong on the surface

The economy added 303,000 jobs in March, solidly above Bloomberg's estimate of +214,000. That is definitely good news. Companies continue to hire at a solid clip, which not only means more households have income to spend, but also tells us that companies remain optimistic about their own future prospects.

There is some question about whether the labor market is actually as strong as the headline job gains number makes it seem. For example, we’ve talked in prior reports about the fact that the number of job openings has been declining, and the pace of employees quitting one firm to join another has fallen below pre-COVID rates. Both of those trends have continued, suggesting a labor market that could be softening.

This month there was another odd incongruity in the jobs data. The total number of people working full time jobs actually declined slightly, while a surge in part-time work made up the difference. Notably all of the increase in part-time work came from the category called “Part-time for non-economic reasons” which translates to “people who only want to work part-time.” There was also an unusually large jump in people working multiple jobs.

I don’t want to overstate the meaning of the increase in both of these figures. They’ve both increased a lot recently, but were previously coming off historically low levels. Now they are more in-line with pre-COVID normal levels.

Source: Bureau of Labor Statistics

Source: Bureau of Labor Statistics

That being said, if part-time work is making up a disproportionate amount of new jobs, it suggests that perhaps the job market isn’t as red hot as the headlines suggest. In particular, it suggests that the increase in household income from new employment isn’t as large as it would be had all those job gains come from full-time work.

Overall, we think the state of the labor market is good, but not great. Which is fine actually: solid job growth is probably the path to a strong economy without undue inflation. We’ll be on the lookout for employment softening further.

For the Fed, inflation now more important than jobs

Recently, Powell has been saying that strong jobs reports aren't going to dissuade them from cutting the target rate. He's no longer of the mind that there needs to be labor market "pain" in order to bring inflation down. As long as inflation appears to be “moving sustainably down toward 2%” the Fed will be considering a rate cut.

We think it likely that the March CPI report has pushed back the timing of Fed rate cuts. Even if inflation data improves from here, the Fed is going to want to see 3-4 months worth of improvement before cutting. That probably puts the first cut no sooner than September, with July remaining an outside possibility.

That being said, with each strong jobs report, hopes for an elongated rate cutting cycle are fading. The Fed has said that they believe policy is currently “restrictive.” By this they mean that rates are high enough that they are “restricting” economic activity. At some point the Fed will no longer want to be “restrictive” and will cut rates toward a more “neutral” stance.

However no one actually knows what the neutral rate is. What we can say is that if job growth remains strong, then it suggests that today’s policy rate is only mildly restrictive. If that’s right, then neutral is probably close to today’s rate. That might mean that rates could stay near 5% for an extended period.

Now there’s a lot of “ifs” in that paragraph. Not to mention what we said above: perhaps the labor market isn’t as strong as it seems. But this has major implications for bond yields, mortgage rates, and any other longer-term rate.

For stocks, jobs more important than inflation

The stock market cheered the March jobs report, with the S&P 500 rising over 1% that day despite rising bond yields. To be sure, stock traders would prefer the Fed to cut rates, which is why stocks sold off a bit after the CPI report.

But we maintain that jobs are much more important than interest rates right now. The stock market will be better served in a world with a strong economy, good profit growth, and high interest rates than middling earnings and low rates. So seeing that companies remain optimistic enough about their prospects to keep hiring is bullish, with any concerns about higher interest rates being secondary at best.