Key takeaways

- The Federal Reserve is likely to start cutting its interest rate target soon, and this may start a period of declining rates.

- This means the yield on cash-like investments, including money markets, high yield accounts, CDs, etc., will also probably decline.

- If so, you may want to consider changing your investment strategy when it comes to short-term savings. Options like short-term bond funds might allow you to realize a more attractive yield.

- Your ultimate decision depends on your personal circumstances

For the last couple years, investors have enjoyed relatively high interest rates on things like savings accounts, money market funds, and similar accounts. This has resulted in a surge in money flowing into these kinds of accounts. In the last two years, investors have added $1.7 trillion to money market funds alone.

However, this could all be about to change. The Fed looks likely to start cutting its interest rate target as soon as this September. Those high interest rates you’ve been getting in cash-like accounts may soon be a thing of the past. How will this play out? And what should you be doing differently in a falling rate environment? Here are our thoughts.

How quickly will the Fed cut rates?

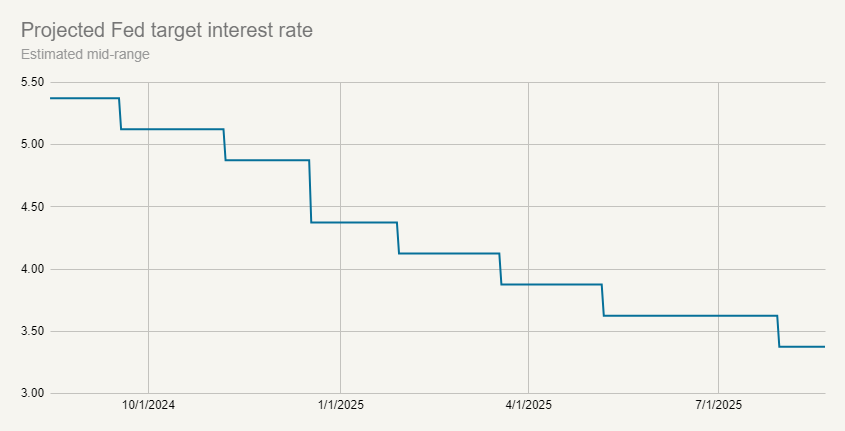

No one knows how many times the Fed might cut in the next year or so. The answer depends a lot on how quickly inflation subsides as well as the health of the labor market. If the economy seems to weaken in the coming months, then the Fed could cut aggressively. If inflation rebounds, the Fed could stop cutting altogether.

However, looking at the futures market for the Fed’s target rate, we can at least tell what the market’s consensus is. As of August 19, the market is estimating that the Fed will cut by 0.25% in September, and another 0.75% for the remainder of 2024. The market is also projecting about 1% worth of additional cuts through August of next year.

Source: CME group

In other words, the market is projecting that the Fed will have cut its rate target by 2% over the next 12-months.

If this occurs, it roughly means that all very short-term investment vehicles will also decline in yield by about the same amount and at about the same time. This includes things like Treasury bills, money market funds, high-yield accounts, etc. The yields on all of these investments will move almost exactly in line with Fed rate policy.

Why your stated yield isn’t your real yield

When you are quoted the yield on a money market or high-yield account, that yield is stated on an annual basis. E.g., if that yield is 4.9%, you are only going to actually earn 4.9% if nothing changes about interest rates over the course of the next year.

In reality, the yield being quoted is only promised for that one day. After that, the yield can (and will) change. The better way to think about your actual realized return on these investments is it will be approximately the average rate offered over the next year.

To use the example above, if we assume the Fed cuts interest rates by 2% over the next year, we would also assume that the rate on these kinds of accounts will also move 2% lower. So if the stated yield is 4.9% today, it will probably be 2.9% a year from now. The average over the whole period will be something like 3.9% depending on the exact timing of rate cuts.

What are the alternatives?

With interest rates declining, does this mean you should do something different with your money? The answer is, maybe. It all depends on what your purpose is for the money that is currently in a cash-like account.

One option is a short-term bond fund. There are a few reasons to think that these funds could perform better than cash funds during a period of falling rates.

First, shorter-term bonds do give you some degree of locked in yield. For example, the 2-year Treasury bond currently has a yield of 4.07%. If you simply held that security for its two year term, you would make 4.07% per year. So while that yield is lower than some cash account yields today, it has the advantage of being locked in, at least for a short period.

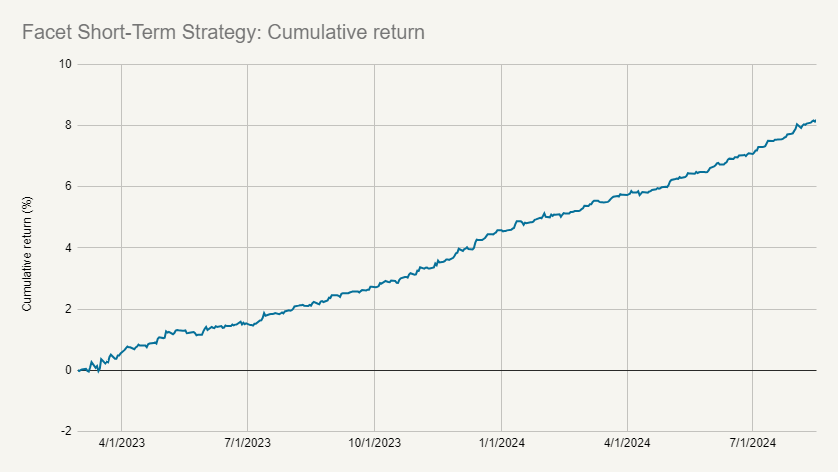

The same idea applies to bond funds that hold these kinds of short-term bonds. For example, Facet’s Short-Term Strategy (STS) has about ⅓ held in a bond fund that holds 1-3 year bonds. A fund like this will hold on to more of its yield as interest rates decline.

The rest of STS is in floating-rate securities that don’t fluctuate meaningfully as interest rate change. Together, this results in a portfolio that does have some fluctuation in value, as you can see from the chart below, but those fluctuations are small.

We think this could offer the best of both worlds: a very stable strategy but also one that should hold up better in a falling rate environment.

Below is the return of STS since its inception.

Source: Bloomberg

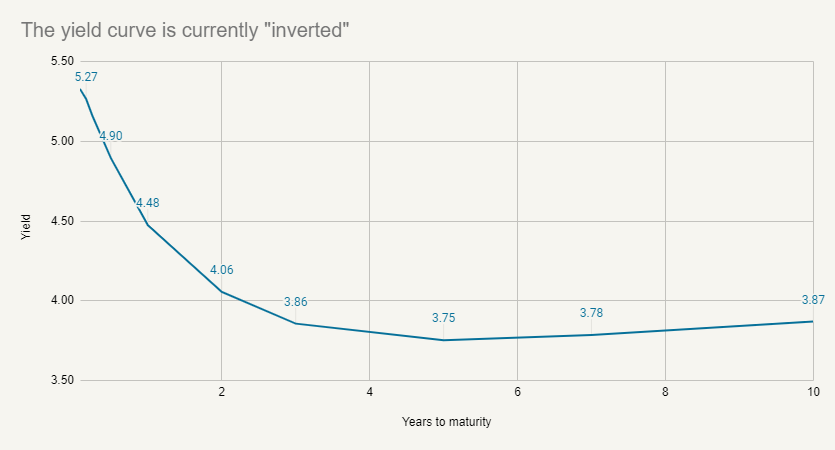

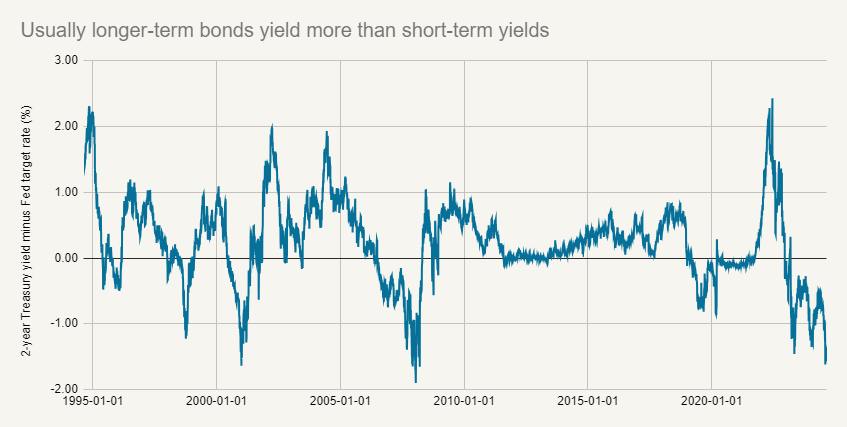

Yield curve won't stay inverted

Another important item that will change as the Fed starts cutting rates is the so-called “yield curve inversion.” Usually it is the case that the shorter-term an instrument is, the lower the yield. However during an inversion, the opposite is true. Below is today’s yield curve, where you can see that the shortest maturities offer the highest yields.

Source: Bloomberg

Typically the yield curve inverts while the Fed is hiking rates and starts to uninvert as the Fed begins cutting. For example, right now the 2-year Treasury bond yield is about 1.4% lower than Fed’s target rate. However, historically the 2-year has typically been between 0-1% higher.

Source: Bloomberg

If history repeats and the yield curve normalizes, it would mean that cash yields will fall much faster than the yield on longer-term bonds. If that’s the case, then short-term bond funds will hold onto more of that income generation than a cash-like account.

What about CDs? Or T-Bills?

A few things to bear in mind about CDs and T-Bills. First the good news. Like typical bank accounts, CDs are FDIC insured. Similarly, T-Bills are backed by the U.S. government. So in both cases, these are very safe investments.

That being said, bear in mind that the yield quoted in these cases is also annualized. So if your bank offers you a 6-month CD at 5%, you aren’t going to actually make 5%. That is an annualized rate. So for rough math, your actual return will be about half of that quoted rate if it is a 6-month term. It is the same for T-Bill that is less than a year to maturity.

This means that at the end of the initial term, you’ll have to reinvest that money. Under today’s circumstances, it is likely you will be reinvesting at a lower rate. This is a problem for both T-Bills and CDs if you need to invest for longer than the stated term. With CDs, if you need the money earlier than the term, you generally have to pay penalties.

These options are also not easy to add amounts to over time. If you are slowly saving for a large purchase, such as a new home, you want to be able to easily make new deposits. CDs and T-Bills make that difficult due to minimum new investments, filing new paperwork, etc.

Therefore these options only make sense in a very narrow situation:

- You know the exact amount and timing of some future payment.

- You already have all the money saved for this payment.

- There’s no chance you’ll need the money sooner than expected.

- You can find a yield on a CD/T-Bill that is better than other options.

Should I make a change?

All this being said, you may not want to make any change. Short-term bond funds do fluctuate modestly in value. It is possible that if you invested in something like the Facet Short-Term Strategy and needed to withdraw those funds suddenly that the funds are at a slight loss. Perhaps even a small loss isn’t a risk you are willing to take with some of your funds.

This is why Facet often recommends having some cash in something like a high-yield account and some cash in something like Short-Term Strategy depending on the member’s personal situation. This can allow you to earn a bit more income on your cash holdings, but also know you have some money that won’t fluctuate in value at all.

If you have questions about what is right for you, message your planning team for more information.