Key takeaways

- The basic business conditions for most real estate sectors are poor, with vacancies high and rent growth weak.

- Interest rates aren’t necessarily going to fall just because the Fed cuts rates, and real estate stocks tend to follow interest rates.

- Despite all the challenges, real estate remains expensive due to a lack of selling and continued optimism from real estate buyers.

- All of these factors combine to make real estate a tough investment right now.

We often get asked by Facet members about investing in real estate, including everything from real estate stocks to private funds to individual properties. I get the appeal. Real estate investments usually promise a steady stream of income. Plus it can feel much more tangible than other kinds of investments. However, we aren't big fans of real estate right now, and certainly would not want it to be an outsized part of your portfolio.

Here’s our thoughts on the state of the real estate market.

Fundamentals are poor

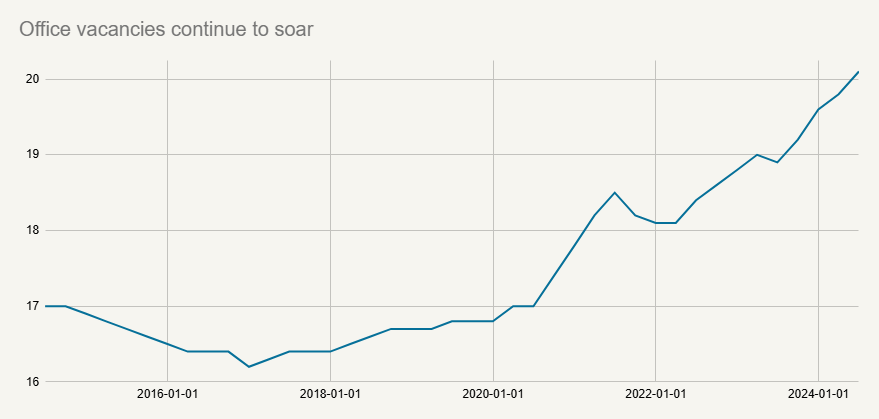

The basic business conditions for real estate, what investors call the “fundamentals,” are pretty poor right now. Office buildings have been struggling ever since the COVID outbreak in 2020, but the problems don’t seem to be abating. According to Moody’s, office vacancies continue to climb, and are currently at an all-time high.

Source: Moody’s

However it isn’t only offices that are challenged right now. Apartment vacancies are much lower than office at 5.7%, also according to Moody’s, but that is the highest level since 2011. The relatively high vacancy level is weighing on rent growth. After rising rapidly during 2020 and 2021, the average apartment rent rate has been flat the last two years.

A big part of the issue with apartment vacancies has been the huge increase in construction that occurred during the low interest rate environment of 2019-2021. Large apartment buildings take years to complete and begin renting, so many of these projects are just now coming online. There is an overall shortage of housing in the U.S., so from that perspective the construction boom was a good thing. But speaking strictly from the perspective of investors, rising vacancy rates and low rent growth are clearly negative.

Other real estate sectors, like warehouses and retail space are also struggling with closures.

There’s no obvious improvement on the horizon. Many office buildings will need to be converted into something else. Many regions are considering government funding for apartment conversions, which again, might be good for the housing crisis, but won’t be good for apartment investors.

Interest rates aren't helping

The real estate sector has been hoping for rate cuts from the Federal Reserve for years now, and is finally now getting them. The bad news is that it isn’t helping much. Real estate projects are generally financed with longer-term debt. Therefore the interest rates that are relevant for real estate investors are not the Fed’s short-term target rate, but things like the 10-year Treasury yield.

We discussed this issue in more detail in a recent video talking about home mortgage rates. The same concepts apply to commercial real estate loans. If longer-term rates keep rising, that will keep putting pressure on real estate investments.

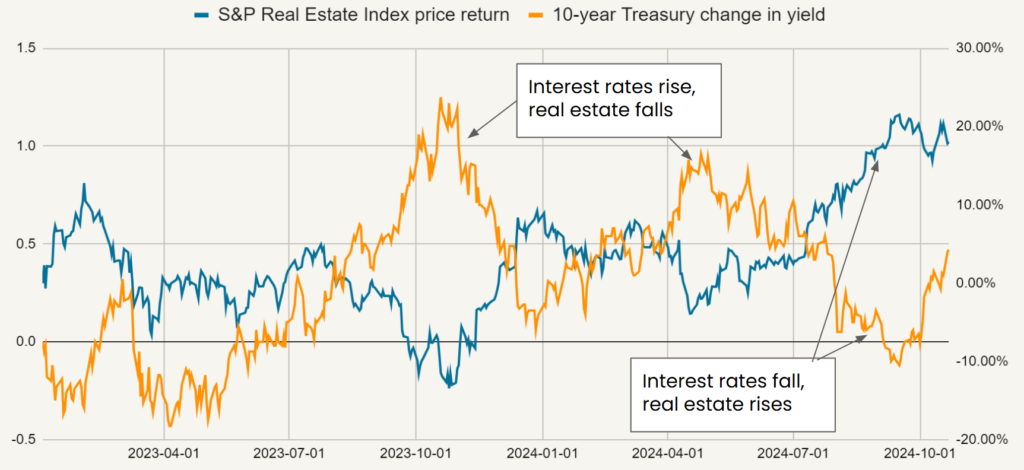

We can see this by looking at a chart of real estate stocks (also called Real Estate Investment Trusts or REITs) vs. the 10-year Treasury rate.

Source: S&P Dow Jones Indices, Bloomberg

In this chart, you can see that every time the orange line (the Treasury yield) rises significantly, the blue line (real estate stock prices) decline. The opposite is also true, when Treasury yields decline, real estate prices rise.

Remember that real estate is almost always a highly leveraged asset. In other words, there’s usually debt on a piece of property. If interest rates remain high, that means the cost of borrowing will keep eating into the profits for real estate projects, which means less money left for investors.

Given all this, we can think of real estate as just a bet on interest rates dropping, and that isn’t a bet we’re terribly excited to make.

Real estate stocks remain too expensive

All that being said, even when conditions are bad for a sector, there still can be a great investment opportunity if the stocks are cheap enough. There’s a famous Wall Street saying that you should “buy when there’s blood in the streets.” It means that when everyone thinks a sector is a bad investment, and prices have fallen enough to reflect that sentiment, it can often be a great time to buy.

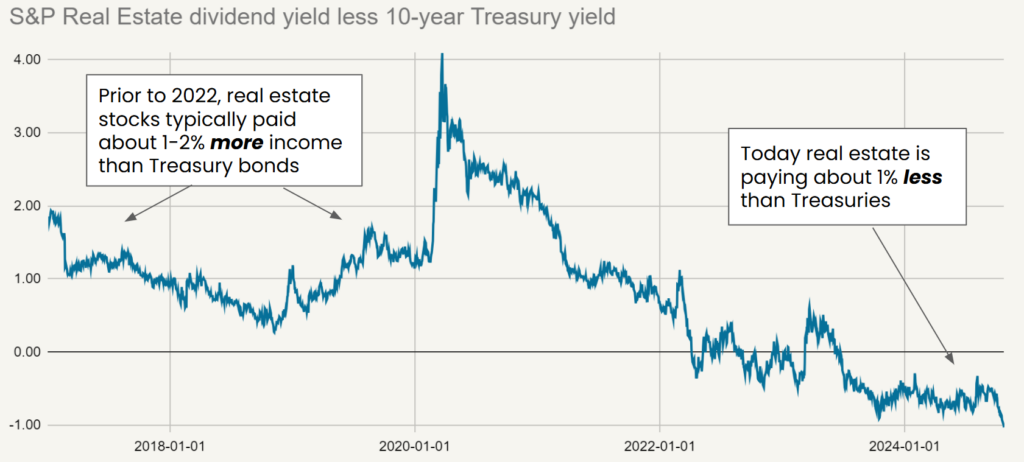

Unfortunately, this doesn’t describe real estate today. In fact, on some metrics real estate stocks are more expensive today than they have been in many years. One simple way to value real estate stocks is to look at their dividend yield. This is just the amount of dividends being paid by the companies divided by the price of the stock. You’d think that if all these REIT stocks are “cheap” then this dividend yield would be relatively high. Unfortunately, it is actually relatively low.

Source: S&P Dow Jones Indices, Bloomberg

This chart shows the dividend yield of the S&P Real Estate sector minus the yield on the 10-year Treasury. This is how pros tend to look at any income-producing investment. Comparing the income from the asset to a risk-free asset like Treasuries helps us normalize for different environments.

Here we see that in the pre-COVID era, real estate stocks tended to yield about 1% more than Treasury bonds. Today they yield about 1% less. In other words, REIT stocks are priced like things are unusually good in the real estate market.

Now to be fair, real life investment valuation is much more nuanced than we can show on one chart. However, given how ugly the fundamentals are in real estate, we’d want the sector to be obviously cheap. That does not at all appear to be the case.

Private real estate has its own problems

So far we’ve talked mostly about real estate stocks, but what about private investments in real estate? Generally speaking, we think all the same problems exist whether you are looking at a private real estate fund, a private REIT, or even buying a rental property yourself.

Most private real estate funds, including private REITs, allow investors to buy at the “net asset value” or NAV. This is just an estimation of the value of all the properties within the fund. Unlike stocks and bonds though, these commercial buildings don’t trade regularly. Hence these funds use appraisals to estimate the value of each of their properties.

To be clear, these funds are doing nothing untoward by using appraisals. There’s no other good way to value private properties. However, if you’ve ever gotten your own home appraised, you’ll know there’s two big problems.

The first is that the appraisals have to be based in part on the price of similar properties that have recently sold. Right now there are very few sales happening in commercial properties. Funds are being careful to only sell properties they can sell close to the appraised value. Hence funds are only selling the the most desirable buildings. It’s like if only the biggest houses in your neighborhood sell. That probably inflates the appraised value for the rest of the houses.

The second problem is timing. Private funds don’t revalue every property monthly or even quarterly. The exact valuation process varies from fund to fund, but a common cadence is something like having ¼ of the fund’s properties get a new appraisal each quarter, thus resulting in each building being revalued once a year.

This means that at any given time, some portion of the fund hasn’t been valued in close to a year. If the actual value of these properties has generally been declining, then it may be that those properties are currently overvalued.

What about owning rental properties directly? Buying a house and renting it out can certainly be profitable, but I’m not sure the timing is great. Home prices have been kept high by a lack of sellers, so you aren’t buying houses on the cheap right now. In addition, the pressure on rent rates we mentioned above is going to impact all kinds of rental properties, not just big apartment complexes. I think there are easier places to invest your money than rental properties.

Real estate likely to remain challenging

If you buy any kind of real estate investment now, you are probably banking on rates continuing to fall in order to make a strong return. The dividend yield on most investments, especially lower risk ones, isn’t especially high, and the bad fundamentals don't look likely to reverse anytime soon. There may come a time when real estate is an interesting buy, but prices probably need to fall further before we are ready to add a dedicated real estate allocation.