Key takeaways

- Despite a booming jobs market, the economy is showing signs of slowing down

- Inflation is still high, but there are signs that it may start to fall

- Used car prices, a one-off factor, are expected to fall and may contribute to falling inflation

- Job growth is slowing down, but still remains above historical averages

- Business confidence, indicated by bank loan demand, is waning, which could lead to less business spending and eventually a slower economy

- An economic slowdown is likely, but whether it becomes a recession is uncertain

The US jobs market continues to boom while inflation continues to run above 5%.

So why are we talking about a recession? Or, for that matter, why is the Federal Reserve talking about stopping rate hikes?

The devil, as they say, lies in the details.

A holistic analysis of the economy indicates that it is probably slowing, and if that happens, inflation should continue falling.

Inflation is sticky but heading in the right direction

Last week, the Consumer Price Index report indicated that overall inflation rose by 4.9% over the last year, 5.5% if you exclude food and energy. There is no doubt that this level of inflation is way too high for the Fed.

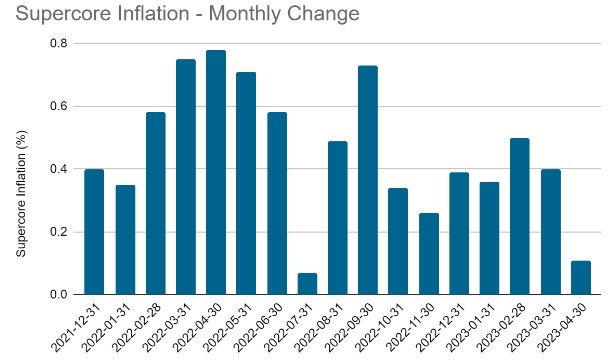

However, there are a number of silver linings in this report. Fed Chair Jerome Powell has mentioned a few times that he is focused on a measure he calls “Core Services excluding Shelter,” which analysts sometimes call the “supercore” inflation.

These are a set of service prices where labor costs tend to be one of the largest input costs: everything from haircuts to medical care to personal transportation. The idea is that if labor shortages and (or) wages drive inflation higher, we should see it more clearly in this subset of prices. This month supercore inflation came in at 0.11%, the lowest monthly read since July 2022.

Source: Bureau of Labor Statistics

In addition, analysts knew some one-off items were going to make the April CPI report a little on the higher side.

For example, this month, used car prices rose a whopping 4.4%. Of course, everyone knew that was coming, but we also know those prices aren’t going to keep climbing at that pace.

The Manheim Used Car Wholesale price index indicated that prices fell in April. It may take a couple of months for this to appear in the CPI report, but it is coming.

Used cars contributed 0.14% to the Core CPI figure for April, while another well-known lagging sector, Shelter, contributed another 0.17%. That means that everything else contributed just 0.09%.

The Manheim index tells us that used car prices aren’t continuously rising, while the generally weak housing market also tells us shelter costs aren’t continuously increasing.

If other prices aren’t proliferating, then we can have some confidence that the Fed is actually getting inflation under control.

Employment is still strong, but a lagging indicator

On its face, the April jobs report looked solid, but when you zoomed in, it was more of a mixed bag.

The headline was that the economy added a solid 253,000 new jobs. However, the Bureau of Labor Statistics “revised down” its estimate of employment growth in the prior two months by 149,000. That actually leaves the 3-month average a bit below expectations.

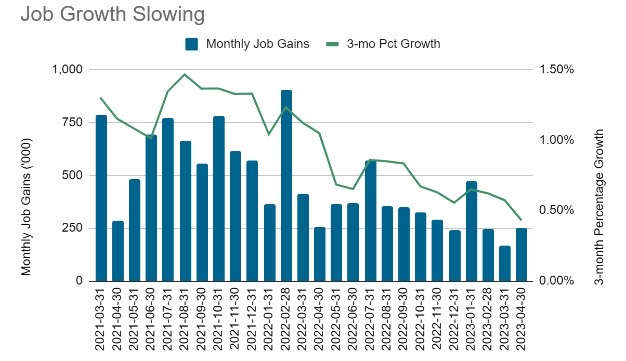

It also continues a pattern of slowing job growth. The chart below shows the monthly payroll gains in the blue bars and a three-month percentage gain in the green line.

We can see that the pace of job gains has slowed by more than half, from over 1% a year ago to about 0.43% now.

Source: Bureau of Labor Statistics

It could be that employment growth continues at this pace.

In reality, job growth of around +1% over a 3-month period probably wasn’t sustainable and perhaps was part of why inflation got so high.

Growth of around 0.43% is pretty normal for non-recessionary periods. For example, from 2010 to 2019, payrolls averaged a 0.42% 3-month gain. This suggests it is probably a growth rate that wouldn’t necessarily be inflationary.

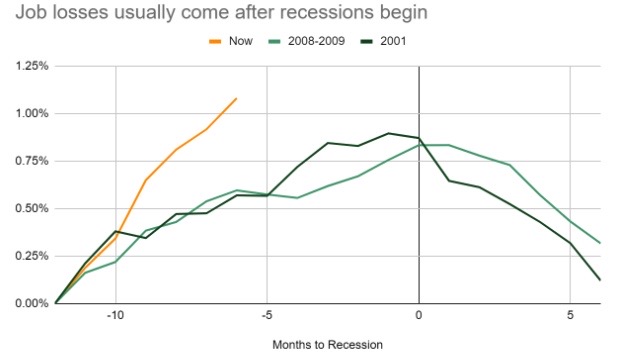

The bad news is that historically a sustained period of job slowing like this tends to keep slowing. The fact that job gains remain healthy right now doesn’t tell us much about how far off a recession might be.

Ahead of the last two recessions, job growth remained positive until well after the recession began.

The chart below shows cumulative job growth starting 12 months before each recession (green lines) and starting six months ago today (orange line).

Source: Bureau of Labor Statistics

Business confidence is waning

There is a reason why job growth is usually still positive when a recession begins: companies don’t lay people off out of the blue.

The cycle typically starts with companies seeing weaker product demand than expected. It usually takes a few months (or even quarters) of this before the company gets to actually laying people off. This is why economists call job growth a lagging indicator. It doesn’t tell us much about where the economy is headed.

For that, we want to look at signs of business confidence. Are companies looking to expand production or contract?

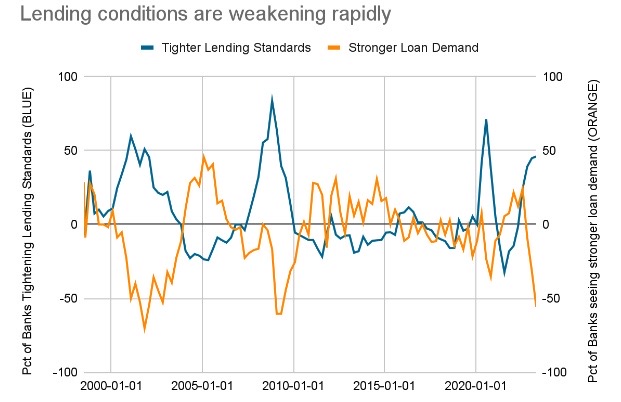

There’s no simple measure for business confidence, but one reasonably reliable indicator is bank loan demand. If firms are looking to expand, they’ll need money to do so, and for many firms, that comes in the form of loans.

Here the news isn’t so good. The Fed recently released its quarterly Senior Loan Officer survey. We expected that banks would be tightening lending standards in the wake of recent bank stress. However, the survey also suggested that loan demand has fallen substantially. In other words, banks don’t want to lend, and businesses don’t want to borrow.

Source: Federal Reserve

While this is an imperfect measure, the lack of loan demand tells us that firms generally aren’t seeking fresh funds for expansion.

Those firms that do want to borrow will find banks much more hesitant to lend. Naturally, that will lead to less business spending, less hiring, and ultimately a slower economy.

Notice that during each of the past three recessions (2001, 2008, and 2020), we saw this kind of spike in tighter lending and a drop in loan demand.

So are we definitely having a recession?

We think all of these indicators mean some kind of economic slowdown is very likely. Whether that will result in a recession is a much tougher call.

One could argue that the economy has never been as strong as it was in 2021-2022. Unemployment is currently at an all-time low. There is much room for the economy to slow without it actually contracting.

Moreover, as the inflation spike we’ve experienced tells us, this level of growth was probably never sustainable. Some amount of slowing will be healthy. The fact that stocks have risen mildly so far in 2023 reinforces this point. Unsustainable growth isn’t good for investors. Healthy growth is.

That being said, there are several things we are doing to try to protect Facet portfolios from a potentially slower economy. We are underweight emerging markets stocks. Most of these economies are heavily reliant on exports to developed countries, especially in raw materials. That has typically resulted in underperformance during global slowdowns, even those that didn’t turn into recessions.

Through the ETFs we own, we are also overweight companies with lower debt burdens, higher profit margins, and lower revenue volatility. Lower debt and higher profit margins should indicate more financial flexibility. I.e., companies that can more easily withstand a period of weaker profits. In addition, companies with lower revenue variance should naturally see less of a profit decline than other firms.

We are also overweight bonds with 3-7 year maturities within bond portfolios for retirement accounts. This part of the market tends to outperform when the Fed starts cutting rates.

As we said, the economy may well avoid a recession entirely. Additionally, given that a recession is so widely anticipated, it could easily be the case that these protective measures aren’t necessary. However, we think this provides members with a good middle ground.

If the stock market continues to rise, this mix of stocks and bonds will rise too. But if there is volatility due to the economy slowing, we think this mix can help provide some protection.