The information provided is based on the published date.

Key takeaways

- Stocks fell this week, as worries about rising interest rates, the middle east conflict and earnings put pressure on stocks.

- The odds of multiple Fed rate cuts in 2024 are fading, and this is causing longer-term interest rates to rise.

- Stocks will be focused on major earnings releases from companies like Microsoft, Meta and Alphabet coming up this week.

- How you manage taxes in relation to your investments can make a big difference in your ultimate returns.

Welcome to our latest edition of the Facet investor newsletter. I’m Tom Graff, Chief Investment Officer here at Facet. This week we’re going to break down what was a tough week for investors, between some suspect bank earnings and tough talk from the Federal Reserve. We’ll also talk about how to approach taxes in your portfolio.

As always, we really want your feedback! If you have questions about the content, suggestions for how to make this newsletter better, or ideas for future newsletters, please let us know! This newsletter is a new experiment for Facet. Your feedback will help us make this as valuable as it can be for individual investors. Please e-mail us at [email protected] with any thoughts you have!

Market recap

Stocks were lower this week, with the S&P 500 finishing down more than 3%. Several things weighed on the market: hawkish Fed talk, some weaker earnings, and escalation in the middle east. Growth stocks led the way down, as some weaker earnings from Netflix and mixed results from Dutch semiconductor company ASML and Taiwan Semiconductor stoked concerns about U.S. tech earnings this quarter. The U.S. dollar and the 10-year Treasury surged to new 2024 highs, both rising as the potential for Fed rate cuts is fading.

This week's chatter

With so many different things going on, I’d say there was no single theme to the chatter among professional investors this week. Clearly the strike by Israel on Iran on Friday morning was a topic of conversation, but the market reaction was very muted. With anything related to the middle east, watch oil prices to see what the “smart money” thinks of the event. In this case, crude oil spiked about $4 right after the event, but within an hour was back to about unchanged on the day, and overall oil ended the week down almost 3%.

The Fed and interest rates were the bigger focus. Right now futures markets are pricing in one rate cut around September and then about a 40% chance of another cut in November or December. I’d say equally important to the pros (but less reported in the media) is the question of what the “neutral” rate is for the Fed. This is basically the Fed target rate that the economy can handle over the long run without either causing inflation or an economic slowdown. The higher this neutral rate is, the higher the 10-year Treasury will go.

Stocks absolutely can rise in the face of higher interest rates. In fact, that’s historically been the normal pattern. It really comes down to earnings. My best guess would be that if this upcoming earnings season is strong, we’ll forget all about what the Fed is doing and stocks will be materially higher.

Speaking of earnings, we’re starting to get some more impactful reports. Early in the week several large banks reported. As a group, everything was pretty good about these reports: solid loan growth, good credit performance, even commercial real estate losses were lower than expected. The one problem was that higher deposit rates were eating into bank earnings. Traders didn’t like that and sent bank stocks down. So far in April the banking sector within the S&P 500 is down 5%.

The other big earnings report this week was from Netflix. This one really shows how tough picking individual stocks is. The company beat profit expectations by nearly 17%, but forecasted that future growth might slow, and also said that they would stop reporting subscriber counts going forward. That rattled Wall Street and sent the stock down more than 9%.

The themes I’m focused on this earnings season are: consumer spending/inflation, online advertising, construction spending, and AI/tech investment spending. While Netflix is a big company, it doesn’t really fit in any of those categories. However, over the next couple weeks, we’ll get a number of companies that do, including Alphabet, Amazon, Microsoft, United Rentals, Visa, Caterpillar, Procter & Gamble, American Express, Meta, and some others. So in my view, the real meat of earnings season gets started next week.

Pro corner

In honor of tax day last week, I thought we’d discuss how the pros think about taxes in portfolios. There are several kinds of tax mistakes one can make, and we’ll try to show you how to avoid each of them. Let’s start out with a simple overarching idea: the goal to maximize your after-tax return over time. I.e., the goal isn’t to minimize tax, nor is it to maximize nominal return. If you make money on your investments, you eventually are going to have to pay some taxes. The goal is to just be smart about it.

With that being said, here’s a few major tax mistakes we often see individual investors make.

Owning tax-inefficient investments: There are a number of types of investments where most of the gains are going to be taxable each year. The most obvious are funds that produce a lot of current income: high-yield bonds, REITs, certain dividend stocks, etc. It isn’t that these are always bad investments, but you can’t ignore the tax consequences.

Take the SPDR S&P 500 High Dividend ETF. In the 5-years ending April 18, the ETF’s price has basically not changed. All of its 4.8% annualized return has come from dividend payments. But note you need to haircut that by 20% because you are paying tax every year on those dividends. Another fund with the same return would be compounding at the full 4.8% rate.

This advice also applies to actively managed mutual funds that distribute large capital gains each year. Look through all the funds you own and check how tax efficient they really are. You might still want to keep the fund, but at least understand how it is impacting your tax bill.

Hanging on to something simply to avoid paying tax: Remember you eventually will owe taxes on any investment that makes money. All else being equal, you want to defer that tax as long as possible. But if all else isn’t equal, then err on the side of building the best portfolio you can first, and worry about taxes second.

For example, say you own a fund or an individual stock that you don’t want to hold anymore. Maybe performance has been poor or it has been especially volatile, or maybe it has just grown too large relative to the rest of your holdings. If you hang on to it to avoid paying taxes, only one of two things can happen: either it keeps going up and therefore you owe more tax, or it drops and you erase your gains. Neither is great news, especially if it keeps going up but keeps underperforming what else you might have bought. We detail some math behind this idea in a longer article here.

Generally when you want to trim and/or eliminate something, you are better off just doing it and paying the taxes. Focus on the quality of your portfolio first.

Not tax-loss harvesting: Tax-loss harvesting is where you sell one asset that is at a loss and buy a very similar asset with the proceeds. If you do it right, you get a tax loss to help offset other gains in the current year, and you haven’t changed your investment portfolio. Therefore if the market rebounds, you’ll participate fully.

Facet has a proprietary way of approaching tax-loss harvesting based on a series of quantitative studies, and it would be hard to exactly replicate our process as an individual investor. However, you can come close if you make a list of alternative funds for each fund you currently own, and then wait for the general market to drop by about 4% from its recent highs. Once that happens, check your portfolio for material losses. If there are any, replace your current fund with the alternative you have pre-selected. Also be sure to watch out for wash sales: you cannot claim a tax loss if you have bought the same fund 30 days before or after the loss sale.

In fact, Facet did one of these tax-loss harvestings this week for members that use our investment service. So if you haven’t done this analysis recently, now might be a good time to do so.

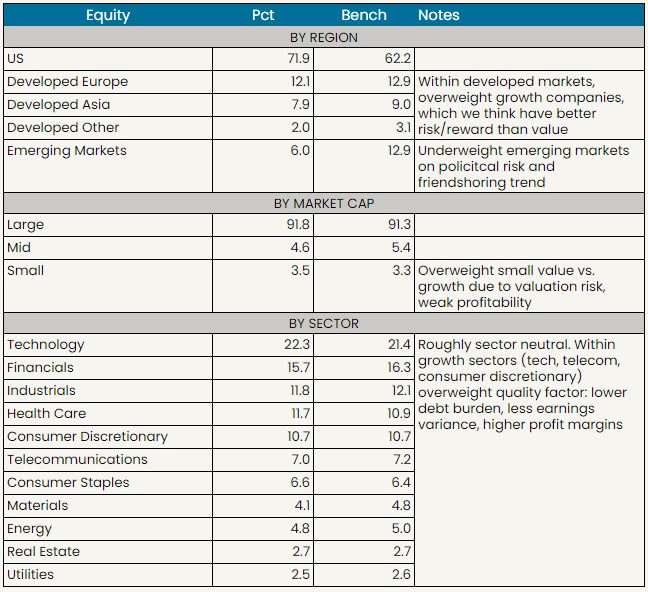

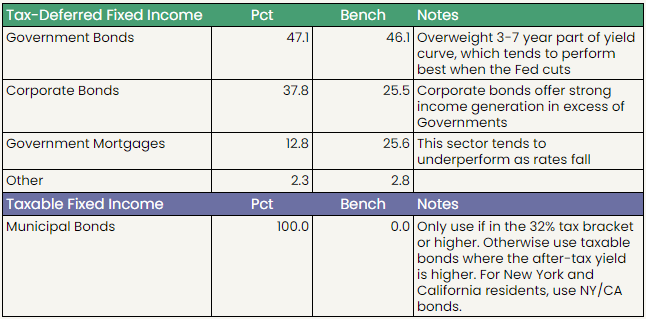

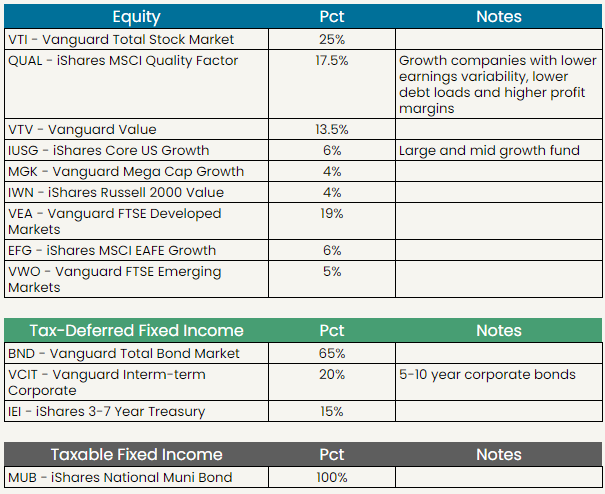

Following one size fits all advice: Lastly, be aware that everyone’s tax situation is different. For example, Facet actively looks at the relative value of tax-free municipal bonds vs. taxable bonds. You’ll notice in the tables below detailing our current ETF model portfolios, we only recommend owning municipals if you are in the 32% marginal tax bracket or higher. If market conditions change, we might change that recommendation.

This is just one example of how you can’t just follow generalized tax advice that you find on Google. You have to insert your own situation into the calculus.

Taxes are definitely tricky to get right in your investments. If you are going it alone, you should consider the above suggestions in your decision making. It will give you a better shot at success.

Facet portfolio positioning

Facet's current ETF models

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser. This is intended as educational information and is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. This is not a solicitation for the sale or purchase of any specific securities, investments, investment strategies, or products. Past performance is not a guarantee of future performance and all investments come with risks. Individuals should consider their personal risk tolerance, time horizon and goals when make a decision about investing. There are no guarantees on returns; implied or otherwise; investment results may vary.

Tom Graff, Chief Investment Officer

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser headquartered in Baltimore, Maryland. This is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. Past performance is not a guarantee of future performance.