Key takeaways

- Short-term investments have been yielding higher due to the Fed increasing interest rates

- Deposit accounts are a good option for very short-term goals, but offer lower rates

- Short-term bond strategies offer higher yields but may experience small price fluctuations

- If you can handle a little risk, there’s potential to earn a little more yield and boost your compounding interest

For most of the last 15 years, investors looking for safe, shorter-term investments have been out of luck: interest rates have been stuck at or near zero for most of this time.

But with the Federal Reserve having hiked interest rates at a record pace over the last year and a half, that has all changed.

The good news is that yields on various short-term investments are now as high as when Lehman Brothers was still in business.

The bad news is that now there are a lot of choices, and picking the right one can be challenging.

Here are some thoughts on Facet’s approach to investing for a short-term goal.

Your best option depends on your situation

As is always the case, there is no one best option for short-term investing. What is best for you depends on your circumstances.

Is this money for emergency savings or some specific goal? How certain is the amount or timing of the money you will need? What other resources do you have?

All of these questions are crucial in determining the amount and type of investment you may want to choose. We won’t cover every possible option in this article. We advise discussing your situation with your planner to determine your best choice.

Deposit accounts

One option is a deposit account. These take several forms, including a high-yield savings account or a multi-bank deposit service like Flourish.

At their core, they work similarly: your money sits in a bank account, which, as long as you are under the legal limit, is FDIC-insured. The value of your investment doesn’t change unless you add or withdraw money, except for periodic interest payments.

The bank determines your rate. It’s based on how much they need deposits, but generally, the rate will move up and down with the Federal Reserve’s rate moves. The rate can change anytime and is only locked in once daily.

A deposit account can be a good choice if you have a very short-term goal, say under a year, and may need to withdraw all your money at once.

Because these accounts don’t fluctuate in value, there’s no timing risk. However, they generally have lower rates than other options.

Short-term bond strategies

Another option is to own short-term bonds or funds that own short-term bonds. This includes bonds with maturity dates of less than three years or bonds with a floating rate coupon (variable interest rate).

Both of these elements protect the bond’s price from unnecessary volatility. With a floating rate bond, payments are tied to a short-term interest rate index, effectively moving with the Fed’s rates.

A bond with a short-term maturity pays off quickly, so as long as you own high-quality bonds, the chance for large price fluctuations is low.

Facet’s Short-Term Strategy uses a mix of these types of bonds. About two-thirds of the current holdings in this strategy are high-quality floating-rate bonds, and the other third are Treasury bonds that mature between one and three years.

As we said above, both the floating rates and the short maturity help to protect these funds from large price movements, but there still are fluctuations.

If you put money into a strategy like this and withdraw it quickly, it would be possible for the market value of your investment to decline.

To compensate for this risk, the yield on these bonds is generally higher than on deposit accounts. For example, Facet’s Short-Term Strategy yield is 5.36% as of June 19, 2023, versus 4.65% for a deposit account at Flourish.

How risky are short-term bonds?

We already mentioned that these bonds’ short-term, floating rate nature generally keeps price fluctuations small. You can see this by looking at the actual returns for Facet’s Short-Term Strategy since it was launched at the start of 2023.

Below is a daily chart showing $10,000 deposited in Facet’s Short-Term Strategy, including price fluctuations and interest received.

Source: Bloomberg

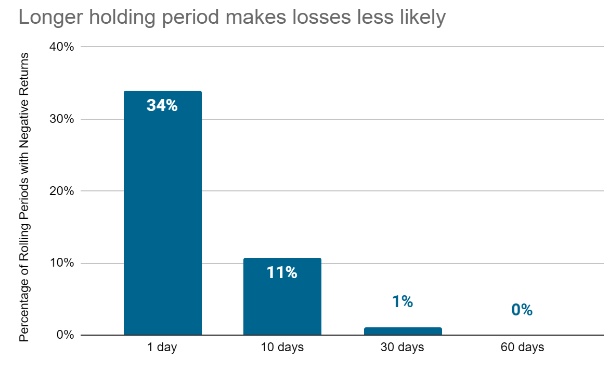

The interest payments received are another protection investors in these bonds have against loss. The longer you stay in the strategy, the more interest you collect and, therefore, the less likely you will have suffered losses. To illustrate this, the chart below shows the percentage of rolling periods where an investor would have suffered a loss for one day through 60 days.

Source: Bloomberg

This shows that if you put money into this strategy and withdrew it the next day, you would have taken some amount of loss about a third of the time. However, holding just 10 days drops that probability down to 11% of the time. At 60 days, there were no loss periods at all.

That is not to say this strategy could not lose money over a 60-day period or even longer. However, given that the strategy generates approximately 5.3% in income per year, the decline in price would have to exceed 5.3% to produce a negative return, all else being equal.

Even in 2022, the worst year for bond returns since at least the 1970s, the price decline on Short-Term Strategy was only -1.8%.

What about the inverted yield curve?

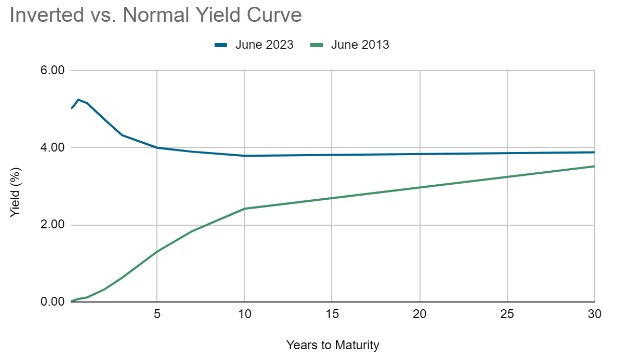

Normally longer-term Treasury bonds yield more than their shorter-term counterparts. However, right now, the opposite is true due to a phenomenon called an inverted yield curve.

The chart below is a plot of Treasury bond yields by maturity, with today’s yields in blue and a “normal” curve (in this case, from June 2013) in green.

Source: U.S. Treasury

When the curve is “normal,” like it was in 2013, investors get paid more for the longer-term bond they buy. However, today the yield gets lower and lower as maturities get longer. This might tempt one to ask why bother owning longer-term bonds at all.

For example, why not buy the highest-yielding part of this curve in Facet’s Short-Term Strategy? Why own the 1-3 year maturities?

The answer lies in the advantage of locking in your rates. Typically the yield curve inverts when the Federal Reserve is near the end of a rate hiking period. That could mean the Fed’s next move is a rate cut at some point down the road. If that occurs, you will want to have locked in some of today’s relatively high rates.

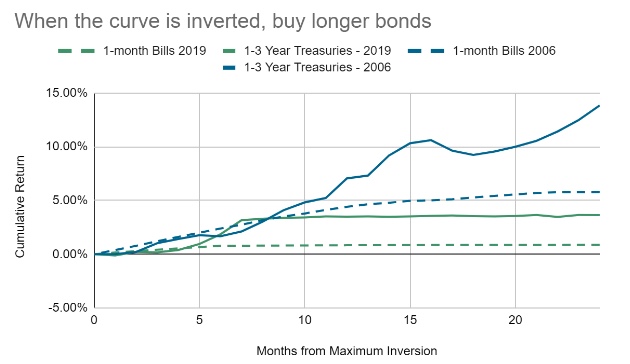

We can see how big of an advantage this can be by looking at the last two periods where the yield curve was inverted: 2019 and 2006.

The chart below shows the cumulative return of a 1-month T-Bill (dotted lines) and a mix of 1-3 year Treasury bonds (solid lines). The chart starts at the point when the yield curve was the most inverted and then measures monthly returns from there.

Source: Bloomberg

The chart shows that in 2019, sticking with T-Bills netted you less than 1% over the following 24 months, whereas the 1-3 year bond mix returned 3.6%. In 2006 the gap was even more stark: T-Bills returned 5.8% vs. 13.8% for 1-3 year bonds.

A similar phenomenon would have existed for deposit accounts. Since the rate on these accounts can reset any day, if rates fall, so will the yield on your account.

This is exactly what happened in the chart above and why locking in some of today’s higher yields with some of your short-term money can be so important.

So which should I choose?

As we said above, there’s no one answer. If you are in a situation where having absolute daily stability of your principal balance is critical, then a deposit account is best.

If small fluctuations aren’t a problem, it might be better to earn a little more yield. Even small differences in your earning rate can compound to make a big difference over time.

Either way, this is a perfect example of what we mean by planning-focused investment management. The right decision for you depends on your personal circumstances.

Facet Investment Disclosure

Investment returns shown here are intended for illustrative purposes only. All investments involve risk, including the potential for the loss of principal. The model portfolio performance of Facet Short-Term Strategy began in 2023. At times when Facet changed a recommended ETF, the average transaction price of both buys and sells were used to update the portfolio. Otherwise the portfolio was rebalanced monthly. Calculations were performed using the Bloomberg Portfolio Analytics tool. This illustration is meant to most closely resemble what a common Facet client in this strategy may have returned. It does not represent any actual client or group of clients. We believe the sources for this data to be reliable but cannot guarantee the accuracy or completeness of the information. No consideration was given to tax loss harvesting or other activities that occur during the ongoing management of investments nor does Facet assert an opinion on the impact of these actions on these returns. These returns were calculated net of the fees associated with the underlying investments. Facet charges an annual planning fee based on the complexity of a client’s financial situation but does not charge a separate fee for investment management. The planning fee was not considered in the calculation of returns. Past performance is not indicative of future returns.