Key takeaways

- The Federal Reserve held its target interest rate steady, marking the first time it hasn't hiked rates since January 2022

- Inflation remains significantly high and has not yet fully flowed into the economy, so the Fed wants to see the impact of previous hikes before deciding on further ones

- There is a lot of debate within the Fed about how quickly inflation needs to subside, with some advocating for more hikes and others seeing a pause or slow approach as appropriate

- If the Fed is done hiking, this could mean longer-term rates such as mortgage rates won't rise from here

- The stock market has shown resilience to the prospect of higher rates, and traders are now more focused on economic growth and earnings resiliency

On Wednesday, the Federal Reserve kept its target interest rate steady, marking the first time the Fed has chosen not to hike interest rates since January 2022.

Could this be the end of the Fed’s rate hikes, or will the Fed return to hiking in July?

Here are our thoughts on what comes next and how it will impact you.

Inflation is still much too high

To be sure, inflation remains far too high for the Fed’s liking. As Fed Chair Jerome Powell said in his post-meeting remarks, inflation “has a long way to go” before reaching its 2% target.

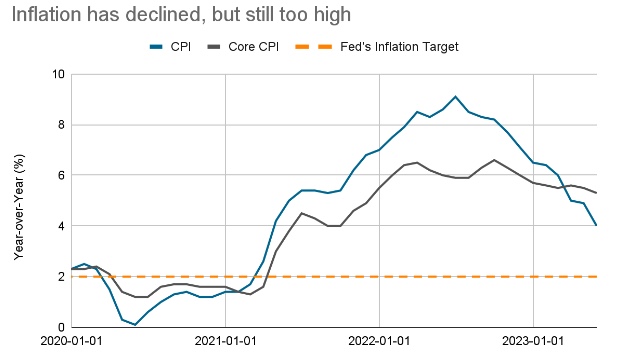

The day before the Fed’s meeting, the Labor Department released the Consumer Price Index (CPI) report, showing that inflation was 4.0% over the last year. The good news is that it is down from over 9% in the middle of 2022.

Source: Bureau of Labor Statistics

The bad news is that even at 4.0%, inflation is still double the Fed’s 2% target. Additionally, the Fed focuses more on “Core” inflation, which excludes volatile food and energy prices.

Over the last year consumer energy prices (primarily gasoline and heating oil) have fallen over 20%. The chart above shows that Core CPI (gray line) has only declined modestly in recent months.

Will inflation continue to decline even if the Fed stops hiking?

We can’t know for sure if inflation will continue to slow. What we do know is that the impact of the Fed’s previous rate hikes has not yet fully flowed into the economy.

As Powell said after the June meeting, “We’ve covered a lot of ground and the full effects of our tightening are yet to be felt.” In other words, a rate hike today isn’t fully felt within the economy for several months.

This is a big reason why the Fed decided not to hike at this meeting. They know that it takes time for their actions to flow into the economy, and they want to give it a little time to see the impact of these lagged effects.

Is this an end to hikes or merely a pause?

The answer relies heavily on the strength of economic growth going forward. During the press conference, Powell said that “nearly all committee participants expect it will be appropriate to raise interest rates somewhat further by the end of the year.”

However, he also said that “if the economy does not evolve as projected, the path for policy will adjust as appropriate.” In other words, while one or two rate hikes are the base case, it really depends on the economy.

Remember, consumer demand outpacing the economy’s ability to supply goods and services fundamentally causes inflation. As long as demand is too strong, inflation will continue to be too high. As soon as supply and demand are in balance, inflation will normalize.

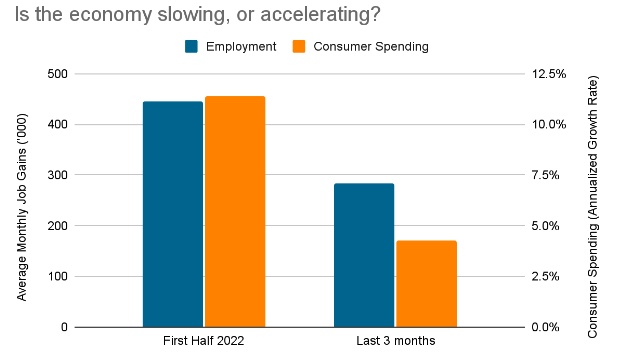

So is the economy slowing? It depends on how you look at it. The chart below shows two simple measures: average job growth from the monthly payroll report and total consumer spending.

Source: Bureau of Labor Statistics, Bureau of Economic Analysis

Here we see that job growth and spending have declined greatly from the pace set during the first half of 2022. Looking at this chart, we’d think that the economy is slowing, consumer demand is waning, and inflation should be on a downward trajectory. However, the economy never moves in a straight line.

The most recent employment report showed a gain of 339,000 jobs, the highest in four months. The most recent consumer spending figure showed an increase of 0.8% in just one month, which would be almost 11% if repeated over a full year.

So which do we believe? The slower indicators over the last few months or the apparent acceleration in May?

The reality is that economic movement is never linear, and the shorter-term data is more likely to be noise than an actual change in direction. Still, it muddies the waters for the Fed trying to ascertain the degree to which the economy is slowing.

How quickly does the Fed need inflation to subside?

We don’t know the degree to which the economy is currently decelerating. However, we do know that inflation is still too high and, based on Core measures, is only improving slowly.

But is that good enough? Will the Fed be satisfied letting inflation return slowly to its target, perhaps over a period of years?

The answer is not totally clear from anything Powell said during the post-meeting press conference. He did say that it will “take time” for inflation to subside, and he has said in the past that the Fed is likely to stop hiking well before inflation makes it to 2%. But precisely how quickly does he want to see that happen? We would argue this will become the central question for the Fed going forward.

During the post-meeting press conference, Powell did not provide a definitive answer. He did, however, suggest that it will take a considerable amount of time for inflation to subside. Additionally, in previous statements, Powell has communicated that the Fed may discontinue its hike well before the inflation rate rises to 2%.

There is a general consensus among economists that keeping inflation relatively low is important for the health of the economy. When inflation was high and accelerating through most of 2022, there was no debate within the Fed that hiking rates was the right course of action.

Now that inflation is declining, there is likely to be less agreement. While almost all economists agree that high inflation is problematic, there is considerable debate about how low it needs to be or how quickly it needs to get there.

We are already seeing this debate within the Fed.

In recent weeks regional Fed Presidents James Bullard and Neel Kashkari have advocated for more rate hikes. In contrast, Chicago Fed President Austan Goolsbee recently said he wasn’t sure May’s hike was necessary.

Look for this divide to be more evident as various Fed officials voice their own opinions about the inflation debate. However, we would remind readers that the Fed is not a democracy. It operates more like a board of directors at a company: ultimately, the company’s CEO makes the big decisions. In this case, that’s Chair Powell.

While Powell likes to build consensus for the Fed’s decisions, discerning where he stands in this debate will be the key to telling where the Fed heads next.

What does this mean for interest rates?

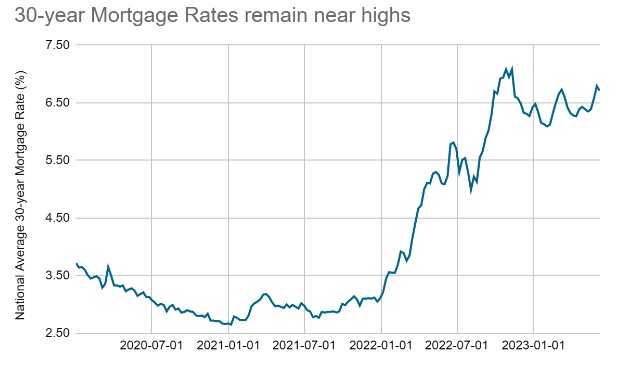

If the Fed does pause, could this mean that interest rates might finally decline? Let's consider home mortgages as an example.

According to Freddie Mac, the nationwide mortgage rate is 6.7%, close to the post-COVID highs.

Source: Freddie Mac

If the Fed is indeed done with rate hikes, there’s a good chance that we won’t see longer-term rates, such as mortgage rates, rise from here. But it doesn’t necessarily mean those rates fall.

A major decline in interest rates probably requires the economy to weaken or at least inflation to decelerate enough to allow the Fed to cut interest rates.

What about the stock market?

Stocks have shown considerable resilience to the threat of higher rates so far this quarter. For example, after the very strong May payroll report, stocks surged even as traders priced in higher odds of future Fed hikes.

In 2022, a strong payroll report like this one would have sent stocks tumbling. We believe this is a good example of how the market’s attitude has shifted.

In 2022 stock traders were entirely focused on inflation, rates, and valuation. Now traders are much more focused on economic growth and earnings resiliency. We think that is a trend that will continue in the coming months.

The Fed could hike once or twice more this year, or they could already be done. But either way, markets feel they have a handle on the range of outcomes. Now that stock investors have this confidence, they can refocus on core fundamentals like profits and growth.

Facet is positioned to be overweight companies with strong profit margins, low debt burdens, and solid earnings growth. We think these kinds of companies are well-positioned to perform in the coming months.