The information provided is based on the published date.

Key takeaways

- Stocks rose this week in a broad rally, fueled in part by calmer bond and currency markets.

- Utility stocks have been a surprise outperformer this earnings season on increased electricity demand from AI projected.

- Next week will be a big one, with major reports on inflation and earnings from big consumer companies.

- It is critical to know why you own each item in your portfolio. We give some examples of how pros document and track the why behind what they own.

Hello and welcome to another edition of the Investor Newsletter. I’m Tom Graff, Chief Investment Officer here at Facet. This week we’ll cover what the Japanese yen has to do with stocks rising this week, preview some big events happening next week, and go over how pros think about monitoring what’s in their portfolios over time.

Got questions about this newsletter? Ideas for topics we should cover? Email us at [email protected]. We’d love your feedback.

Market recap

Stocks rose this week in a very broad rally. The S&P 500 was up about 1.9% with all 11 major sectors were higher. Utilities led the way, which is unusual. Typically utilities are a defensive sector and tend to underperform in up markets. But some strong earnings reports in that sector have revealed that electricity demand from AI might result in the utility sector seeing real demand growth for the first time in decades.

Bond yields fell mildly, with the 10-year Treasury falling 0.02% to 4.49%. But it wasn’t so much the move itself as the stability that mattered this week. As we discussed in the prior edition of this newsletter, volatility itself is a common reason why stocks decline. Here we saw the opposite: a little stability in bonds helped to buoy stocks.

The other area of volatility that investors have been watching is the Japanese yen. Pros have been keenly watching this currency all year, but it has become especially important lately. The yen is about 30% weaker vs. the dollar this year, and over the last couple weeks has been especially volatile.

I know this might seem like an odd thing to have a big influence on US stocks, but it does. One reason is that currencies are a big playground for hedge funds, so volatility in one segment of their portfolio might change how they invest elsewhere. The other reason is that Japanese banks and insurance companies are big players in global markets. The cost of hedging their investments back to yen matters a lot for the decisions these investors make.

This week the yen seemed to stabilize, with the Bank of Japan supposedly standing by to support the currency. That definitely contributed to better investor sentiment around the globe.

This week’s chatter

Next week is set to be a big one. We will get two huge inflation reports for April: the Producer Price Index (PPI) on the 14th and the Consumer Price Index (CPI) on the 15th. Officially the Bloomberg Economist surveys have both improved slightly compared to March. I’d say the sentiment in the macro community is guardedly optimistic as well. The fact that the April jobs report was a bit soft has some figuring that inflation might also be a bit soft in April as well.

We will cover this inflation report in its own article on our Discover page as well as dive into the market’s reaction in this newsletter next week.

In addition we’ll get some key indicators on consumer spending next week as well. Walmart and Home Depot will report earnings, and these will give us some good clues on the state of the consumer. We will also get the Retail Sales report from the Census Bureau on the 15th, which will allow us to compare the macro numbers with the micro data from Walmart and Home Depot.

One thing to bear in mind is that consumer spending on goods has been pretty weak lately, while consumer spending on services has been strong. So far this year, spending on goods has only risen by 0.6% vs. 2.4% for services. This continues a trend that has persisted for most of the year two years.

A big debate among analysts is whether this trend will reverse, and if it does what does that mean for inflation? Lately goods inflation has been very close to zero. In other words, just about all the inflation is coming from services. If consumers start spreading out their spending in a more normal pattern, will that ease inflation pressures on services? Or will it cause inflation pressure to build in goods? I’ll be looking for any clues on this in the data coming next week.

Pro corner

When you look at all of your investments, do you know why you own everything that you own? This might seem obvious at first, but I bet if you really scrutinized every line item in your portfolio, your reason to own at least a few items is a little vague. Not to worry, here’s the pro's approach to this exercise.

Every professional investor, whether it is a long-term investor like Facet or a day trader at a hedge fund, has an investment thesis behind everything they own. This is their answer to why. Some of the details vary, but the basics of a good investment thesis are pretty consistent:

- What do I expect to go right in order for this investment to work out?

- What could go wrong?

- What indicators can I monitor to know if it is going right or wrong?

- What is the time horizon for this investment?

- How does this investment fit with everything else I own?

When Facet makes changes to member portfolios, we will write the answers to all these questions into a thesis paper. These are typically 10-20 pages long, which should give you some idea of how much detail we put behind each question.

Maybe that’s too much for you, but I would encourage you to write down your thoughts when you buy something new. Try to answer each of these questions with as much detail as you can.

I’ll give two quick examples. Say you own an individual stock. What do you expect to go right? Be as specific as you can. Is it a new product roll out? Cost cutting measures? Whatever it is, check each earnings report as it comes out and ask yourself whether that thing is happening. If it is, is the stock going up? This helps you know if the world agrees with you about what should be driving this company’s value.

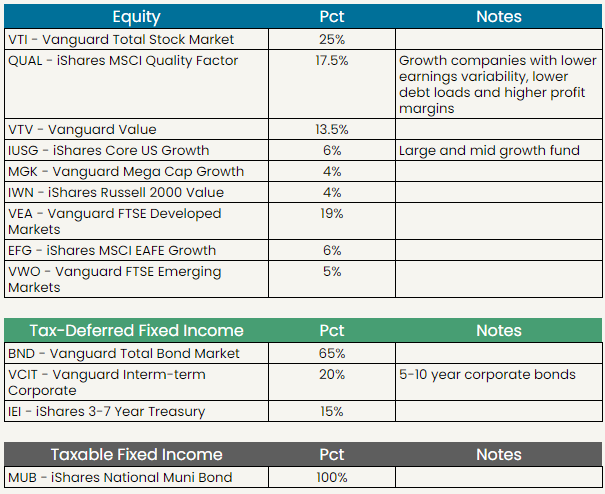

Now say you just own some broad market ETF, such as the Vanguard Total Stock ETF (VTI) that Facet owns or an S&P 500 fund. One way to think about something like this is just that you expect stocks to generally rise over time as corporate profits broadly grow. Nothing wrong with that thesis.

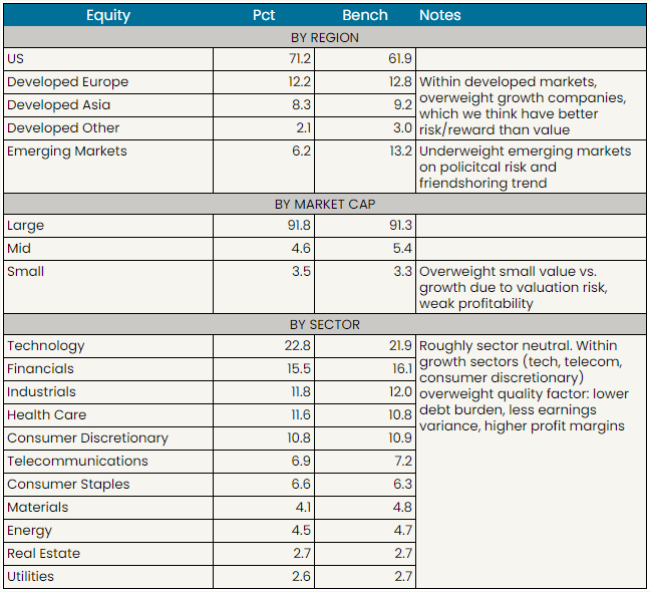

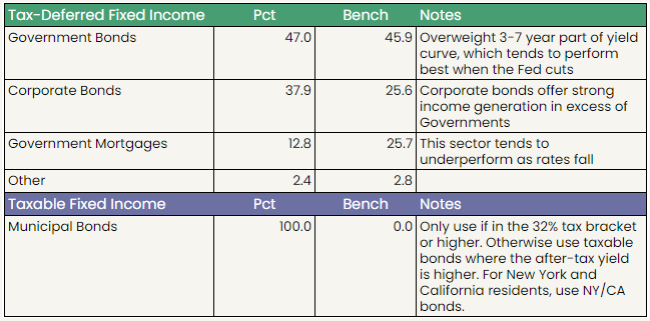

However the way institutional investors like Facet handle these investments goes a step further. We start with the “stocks generally rise over time” as our broad thesis for why we own stock funds at all. From there our investment thesis center around what we own more or less of any given thing vs. the broad market weight. You can see the general concept if you look at the tables below under portfolio positioning.

In other words, our thesis papers are about ideas like “underweight emerging markets” or “overweight quality factor.” We then buy a set of ETFs that reflect these ideas.

Whatever you do, try to actually write down your reasoning behind each holding, and review those notes with some regularity. This way you’ll remember your thinking at the time, and not revise your reasoning based on new events. The more you can objectively analyze whether your thesis is coming to fruition or not, the better investor you will be.

Facet portfolio positioning

Facet’s current ETF models

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser. This is intended as educational information and is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. This is not a solicitation for the sale or purchase of any specific securities, investments, investment strategies, or products. Past performance is not a guarantee of future performance and all investments come with risks. Individuals should consider their personal risk tolerance, time horizon and goals when make a decision about investing. There are no guarantees on returns; implied or otherwise; investment results may vary.

Tom Graff, Chief Investment Officer

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser headquartered in Baltimore, Maryland. This is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. Past performance is not a guarantee of future performance.