The information provided is based on the published date.

Key takeaways

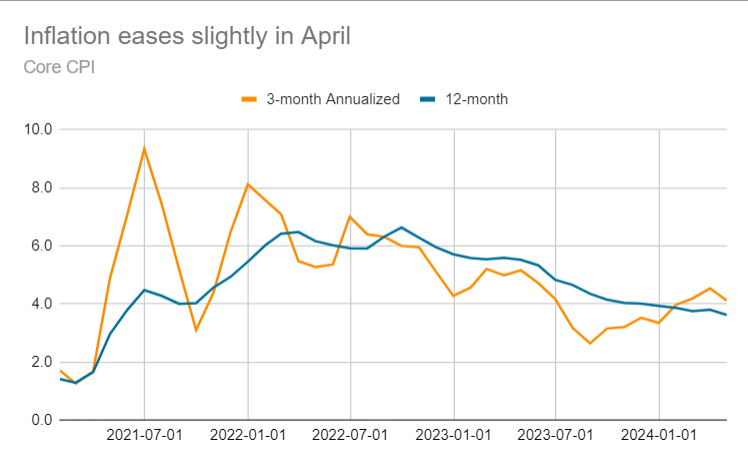

- After rising the first three months of 2024, inflation subsided in April. Core inflation advanced at the slowest pace in three years.

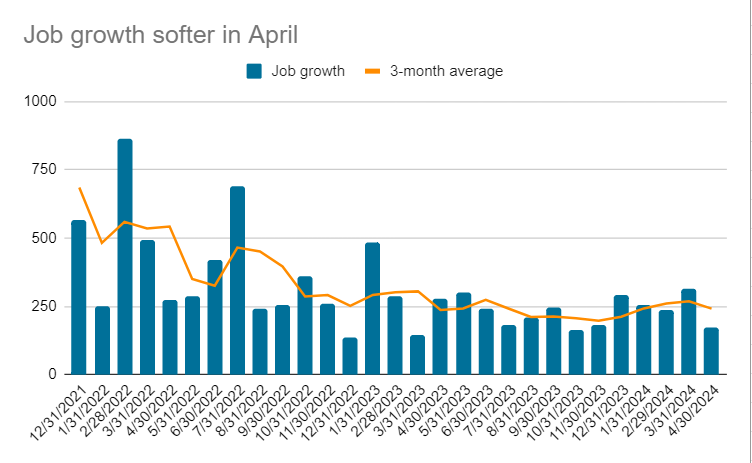

- Hiring also slowed in April, with the economy adding 175,000 jobs, down from +315,000 last month.

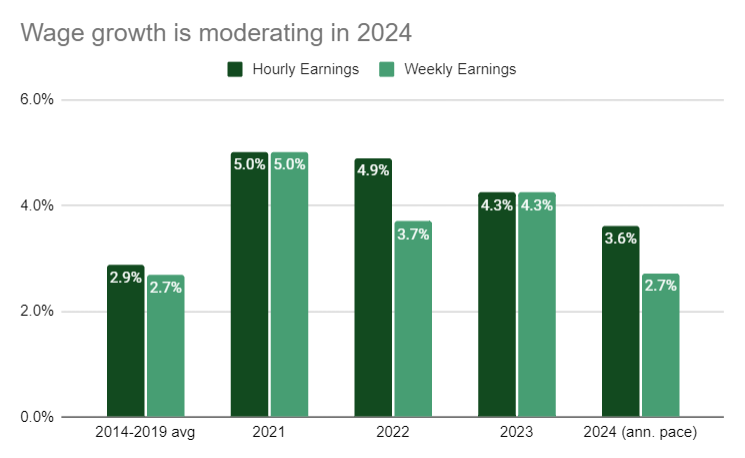

- The relative slow pace of wage growth gives us some confidence that inflation should keep subsiding, although progress could be slow.

- If inflation keeps declining, even slightly, over the course of 2024, the Federal Reserve is likely to cut rates 1-2 times.

Investors are breathing a sigh of relief after this month’s employment and inflation data. For the first few months of 2024, job growth and inflation appeared to be accelerating, which had markets worried about another spike in interest rates. At least for one month however, the data is back to supporting the so-called “soft landing” that helped propel stocks higher in 2023.

Here are our thoughts on this month’s data and what it means for your portfolio.

Inflation eases, still too high

The Consumer Price Index (CPI) rose 0.3% in April excluding volatile food and energy prices.. That is the lowest monthly figure since December. On a year-over-year basis, CPI rose 3.6% excluding food and energy, which is the slowest pace of inflation in three years.

Source: Bureau of Labor Statistics

For both investors and the Federal Reserve, this is something of a relief. After falling consistently throughout most of 2023, inflation data accelerated in the first three months of 2024. This led to rising bond yields in the first quarter and added significant uncertainty about the Fed’s next move.

Even though 3.6% Core CPI is still far too high for the Fed’s liking, the fact that inflation is back to moving in the right direction is hugely important. Fed Chair Jerome Powell said after the Fed’s May meeting that the Fed could be “patient” in allowing inflation to come down. Even if it is declining very slowly, the Fed will be satisfied enough to at least no hike rates and could even eventually cut.

Job growth slows

The economy added 175,000 new jobs in April, which was slightly lower than the 240,000 expectations according to Bloomberg’s economist survey. It was also down significantly from the 315,000 new jobs figure from March.

Source: Bureau of Labor Statistics

Ideally, stock investors want to see solidly positive job gains, but not so high that it causes interest rates to spike and/or encourages more Fed rate hikes. This had started to be a worry after three straight strong jobs reports during the first quarter of 2024. Hence why seeing some moderation was cheered by the stock market. The day of this jobs report, the S&P 500 rose by 1.3%.

Hard to have inflation without rapid wage growth

Investors were also keying on the wage growth figure from this same employment report. Wage growth is so important because it is the direct tie between employment and inflation. Ultimately inflation is about the pace of consumer spending outstripping the economy’s ability to produce. Consumers can’t spend more money unless their income rises. For the vast majority of households, wages are the primary source of income. Hence why wages and inflation are so intertwined.

For April, average hourly earnings rose by 0.2%, which was also slightly lower than expected. For context, that is lower than any month during 2023. I also like to look at average weekly earnings, since that is a closer proxy for take home pay for consumers.

We can see that both wage figures have moderated quite a bit so far in 2024. Weekly wage growth is now running equal to the pre-COVID norm.

Source: Bureau of Labor Statistics

After the May Fed meeting, Chair Jerome Powell expressed confidence that inflation would continue to moderate despite the most recent inflation data being higher than expected. I think it is data like these wage figures that give him that confidence. It is hard to get persistently higher inflation without accelerating wage growth. Right now wages are slowing, and that would suggest that inflation will slow too.

Will the Fed cut rates in 2024?

This is still unclear. Remember that Powell said in May that the Fed needed “greater confidence” that inflation was heading toward 2% before considering rate cuts. That doesn’t mean inflation needs to be all the way to 2%, but it probably does mean that there needs to be a string of inflation reports like this one. The question is really whether that can happen in time for the Fed to cut in 2024 or whether it gets pushed off into 2025.

For bond investors, or for people hoping for lower mortgage rates, Fed rate cuts are going to be key. But for stock investors, stability is at least as important as actual rate cuts. Long-term interest rates rose rapidly in 2022 and the stock market suffered. Rates have risen again in 2024, but this time in a more gentle manner, and stocks have gone up.

Stocks can handle higher rates as long as company profits continue to grow and there is a reasonable amount of stability. This is why we have been saying that profit growth is going to be more important in 2024 than the Fed. As long as rates can stay stable, interest rates are going to be a secondary factor at best.

Tom Graff, Chief Investment Officer

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser headquartered in Baltimore, Maryland. This is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. Past performance is not a guarantee of future performance.