Key takeaways

- Stock prices fell due to higher inflation concerns and geopolitical tensions. The Federal Reserve may not raise rates as aggressively as previously expected.

- The market reacted positively to the Producer Price Index (PPI) data which suggests that the Fed's preferred inflation measure (PCE) might be lower than the Consumer Price Index (CPI).

- A large derivatives trade betting on a Fed rate cut backfired reinforces that a position in any investment should be big enough to matter for your portfolio's performance but not so big it dominates it.

- Earnings season has begun, and we believe it will be a bigger driver of stock prices than the Fed in 2024

Welcome to another edition of the Facet Investor Newsletter. I’m your Chief Investment Officer Tom Graff. This week, the market did a big rethink on inflation, which weighed on both stocks and bonds. I’ll go over how I’m thinking about this as well as what the chatter is among professional investors. Plus a record-breaking derivatives trade blows up, and we’ll use that story to talk about how large you should make each of your portfolio line items. As always, we’ll also include Facet’s current portfolio positioning and the thinking behind it.

We want your feedback! Thoughts on the newsletter so far? Ideas for future topics? Questions about anything you’ve read here? Please send it to [email protected]. Help us make this newsletter more valuable to you!

Market recap

Stocks finished the week lower, highlighted by a higher-than-expected Consumer Price Index (CPI) on Wednesday. We wrote about it in more detail on the Discover section of the Facet website, so check that out. Stocks took another leg lower on Friday as worries grew about escalation in the middle east. The S&P 500 ended the week down 1.5%, with small caps performing materially worse, down around 2.5%. Interest rates rose to fresh 2024 highs, with the 10-year Treasury hitting 4.59% before retreating to 4.52% Friday afternoon.

This week's chatter

Wednesday’s CPI report was the dominant storyline this week, but traders were debating exactly how much it matters to the Fed. Remember that the Fed’s official inflation target is based on Core Personal Consumption Expenditures (PCE) inflation. I won’t get into the technical differences between CPI and PCE, except to say that PCE includes some items that aren’t in CPI.

This is why traders were just as focused on the Producer Price Index (PPI) report on Thursday. The most important items in the PCE that aren’t in the CPI ARE in the PPI. I know, that’s a lot of acronyms! Just focus on the fact that if you know CPI and PPI, you can pretty much guess PCE, and PCE is more important for the Fed.

Anyway, those extra PPI items came in lower than expected. That probably means that PCE inflation isn’t going to look as bad as the CPI. That’s why there was a big stock rally on Thursday. My take is that Fed rate cuts are still very likely, but it is going to be hard for the Fed to cut in June or July unless the data improves quickly. That may mean we’re looking at 1-2 cuts in 2024, not the 3 that were expected coming into this week.

However, all of this is far less important than earnings. On Friday earnings season kicked off with some of the big banks. There wasn’t much to take away from the first few banks to report. Additionally, I’m not overly focused on bank earnings this quarter, especially the bigger banks with limited real estate exposure. As earnings season progresses however, we’ll cover some of the bigger ones in this newsletter. Overall though, it is our belief that stock returns are going to be primarily driven by the strength of earnings in 2024, with the Fed being an important but secondary factor.

Pro's corner

Tuesday morning, a gigantic trade passed through the derivatives market, creating a lot of buzz among professional traders. The trade was 75,000 contracts of a short-term interest rate futures contract expiring in December 2024. Since the contract made money if interest rates fell, the bet was that the Fed would cut rates more aggressively. Since the trade was placed the day before the CPI report, it was clearly a bet that CPI would come in lower than expected. Note that each one of these contracts has a nominal value of about $237,000, so the total trade was a shocking $17.8 billion. That’s the largest trade of this kind of derivatives contract in history.

Of course, we now know that CPI came in higher than expected, sending interest rates much higher. Assuming this trader held onto the position through Wednesday afternoon, they’ve lost about $50 million. Yikes!

There’s a few lessons to take away here. One is that even the pros don’t know what is going to happen. Another is that anytime you hear rumors that some economic release was “leaked” based on large trade activity, be skeptical. Those rumors were definitely swirling Tuesday afternoon.

But the biggest lesson is about sizing your positions. Now I have no idea who this trader was, what firm they worked for, if they are still employed, etc. But what I do know is that deciding how large you should make any one position in your portfolio is a tough decision, even for professionals.

At Facet, our guideline is that the sizing should be large enough to matter, but not so large that it dominates our portfolio performance.

You don’t want to own such a small position that it doesn’t matter for your performance. If you are going to bother to do all the work researching a fund or a stock, it should be worth your while. Estimate what the upside potential is for your position (ideally relative to your benchmark as we discussed last week), and calibrate to what size would produce a meaningful benefit to your overall portfolio.

You also don’t want a position so large that nothing else in your portfolio matters. This basically becomes a question of volatility. One simple way you can test this would be to take the last 12 monthly performance results from your current portfolio and test what adding this new position would have done vs. your benchmark. If adding this one position dominates whether you outperform or underperform, you should probably make it a pretty small size.

If your position is an individual stock, you need to also think about the potential for large drawdowns. Even large cap stocks suffer big drawdowns with some regularity. Over the last three years, just over half of the S&P 500 has suffered a 40% decline from its peak at some point. That includes a lot of “boring” companies like Disney, J.P. Morgan, and Nike. These things happen, so be prepared. If taking a 40-50% hit is intolerable, then either size it smaller or don’t buy it in the first place.

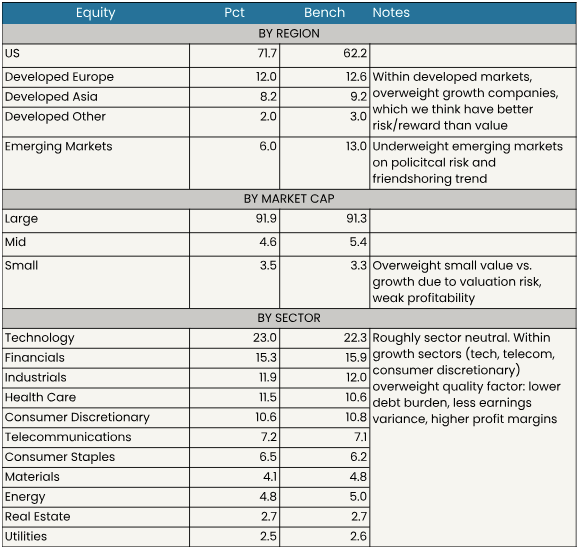

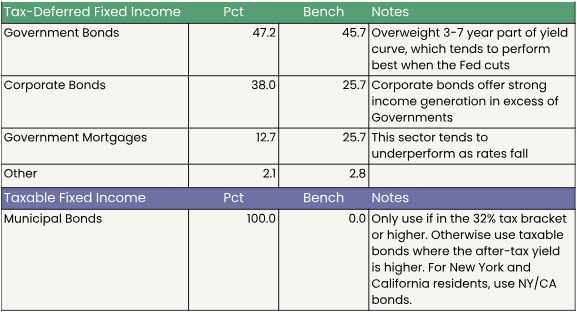

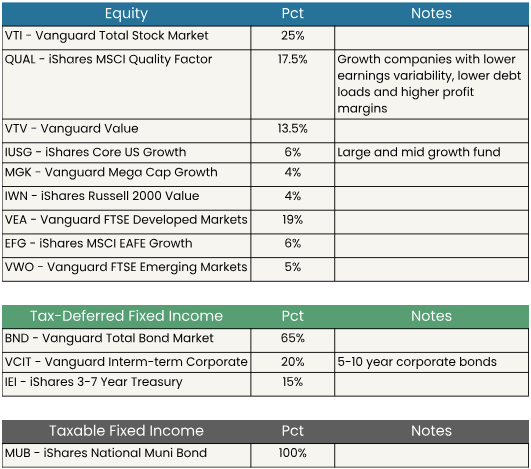

Facet portfolio positioning

Facet's current ETF models

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser. This is intended as educational information and is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. This is not a solicitation for the sale or purchase of any specific securities, investments, investment strategies, or products. Past performance is not a guarantee of future performance and all investments come with risks. Individuals should consider their personal risk tolerance, time horizon and goals when make a decision about investing. There are no guarantees on returns; implied or otherwise; investment results may vary.