Key takeaways

- The only investment return that really matters is how much money you make after fees, taxes, and inflation

- High fees that are tied to how much money you invest will erode your returns year after year and cost you a lot of money

- Without an ongoing tax strategy to minimize taxes today and in the future, the taxes you pay could take a big bite out of your returns

- Not understanding how inflation erodes your returns and your purchasing power over time could leave you coming up short on retirement savings

- Without an ongoing and evolving financial plan to guide you, you will make costly mistakes, chase returns, and lose your direction

When it comes to your investments, the return you get on your money is a critical factor in determining whether or not you achieve your desired outcome. How much you save, the assets - like stocks and bonds - you invest in, and the level of risk you take matter as well. But there are other forces that most people overlook, and they can substantially reduce your returns.

When it comes to investment returns, it’s important to understand that it’s not just how much you make, it’s how much you keep that matters. Here’s why fees, taxes, and inflation may mean your returns are lower than you think.

1. Fees slowly erode your returns and cost you a lot of money

Fees are the silent killers of any investment strategy. Small differences, even 1%, don’t appear to have a big impact on your money in any given year. Over time, however, they gradually erode your returns, keep your money from working for you, and leave you with less money in the end. Those fees come in two forms: financial advisors that charge based on how much you invest and high fee investments.

Working with a financial planner is one of the best decisions you can make, but you need to be aware of how they charge. There are fair and transparent fees, like a flat, fixed fee, and there are fees that are advisor-centric and that will be very costly to you over time.

Financial advisors that charge a fee based on how much you invest – also called an assets under management (AUM) fee – typically charge around 1% if not more. So for every $100,000 you invest, you pay an extra $1,000. And as you work hard and invest more money, your fees continue to grow even if the advice you receive doesn’t.

Second, professional money managers – like mutual fund managers for example – charge a variety of fees to invest money on your behalf. These fees are another form of an AUM fee and can range from as low as 0.03% (a very low fee) to north of 1% (a very high fee).

The justification for AUM-based fees is that the advisor or the professional money manager is meant to outperform the broader stock or bond markets. But studies have shown that 80% to 90% or more of professional money managers don’t beat their benchmark. This means you pay more, don’t get better returns, and that combination can cost you a lot of money.

Here’s an example of what high fees could mean for your returns and your money:

Let’s start with an initial investment of $250,000 and assume you achieve an 8% return (before fees). To keep the math simple, we will assume no additional contributions. Here is what you would have after you account for fees:

| Investment Assets | Flat Fee: $2,400 | 1.00% Asset Fee | 1.50% Asset Fee |

| After 10 Years | $620,000 | $597,000 | $559,000 |

| After 20 Years | $1,030,000 | $953,000 | $861,000 |

| After 30 Years | $2,180,000 | $1,861,000 | $1,599,000 |

| Difference From $2,400 Flat Fee | N/A | ($319,000) | ($581,000) |

Source: Facet Wealth investment fee calculator. All figures are rounded to the nearest $1,000.

For the flat fee, we added a 0.06% investment fee to simulate a low-cost exchange-traded fund (ETF)

2. Taxes can take a big chunk out of your retirement income

The biggest mistake most people make when planning for taxes is that they focus solely on minimizing taxes today. It’s easy to fall into this trap. Who doesn’t want to pay less today? The problem arises when you make tax decisions in a vacuum and fail to consider your future tax situation.

And while taxes may not, at least on the surface, feel like something that will affect your returns, the most important return on your money is how much you take home after taxes because that’s how much you can spend.

Here is a simple example of what different tax rates can do to how much money you have available to you in the future based upon the account type and how the account is taxed. This example is meant to show the impact you experience when you withdraw money from different types of accounts:

| Account Type | IRA | Taxable Investment | Roth IRA |

| Starting Amount | $100,000 | $100,000 | $100,000 |

| Tax Rate | 24%* | 15%** | 0%*** |

| How Much You Pay in Taxes | ($24,000) | ($15,000) | ($0) |

| What You have Available After Taxes | $76,000 | $85,000 | $100,000 |

*Assumes 24% federal tax bracket and no state income taxes

**Assumes standard 15% capital gains rate and no state capital gains tax

***Assumes all Roth IRA withdrawal requirements are met

This isn’t to say one account is better than the other. Which one is appropriate will change over time. Often, investing in a variety of accounts is your best bet. Either way, you need a strategy to help you decide how to balance your savings across different account types based upon your income and changes to the tax code.

Investing only with an eye on taxes today could cost you a lot of money in the future and limit your flexibility to plan for taxes. You need a dynamic and evolving strategy to ensure you minimize taxes today, minimize taxes as your money grows, and create tax-efficient income in the future.

3. Don't forget about inflation - what your money is really worth

Inflation is simply when things cost more in the future. It reduces how much your money can buy – also called your purchasing power. One reason we invest is to achieve a rate of return that is greater than the rate of inflation so our money and purchasing power grow. The wrong investment choices could substantially reduce what your money can do for you.

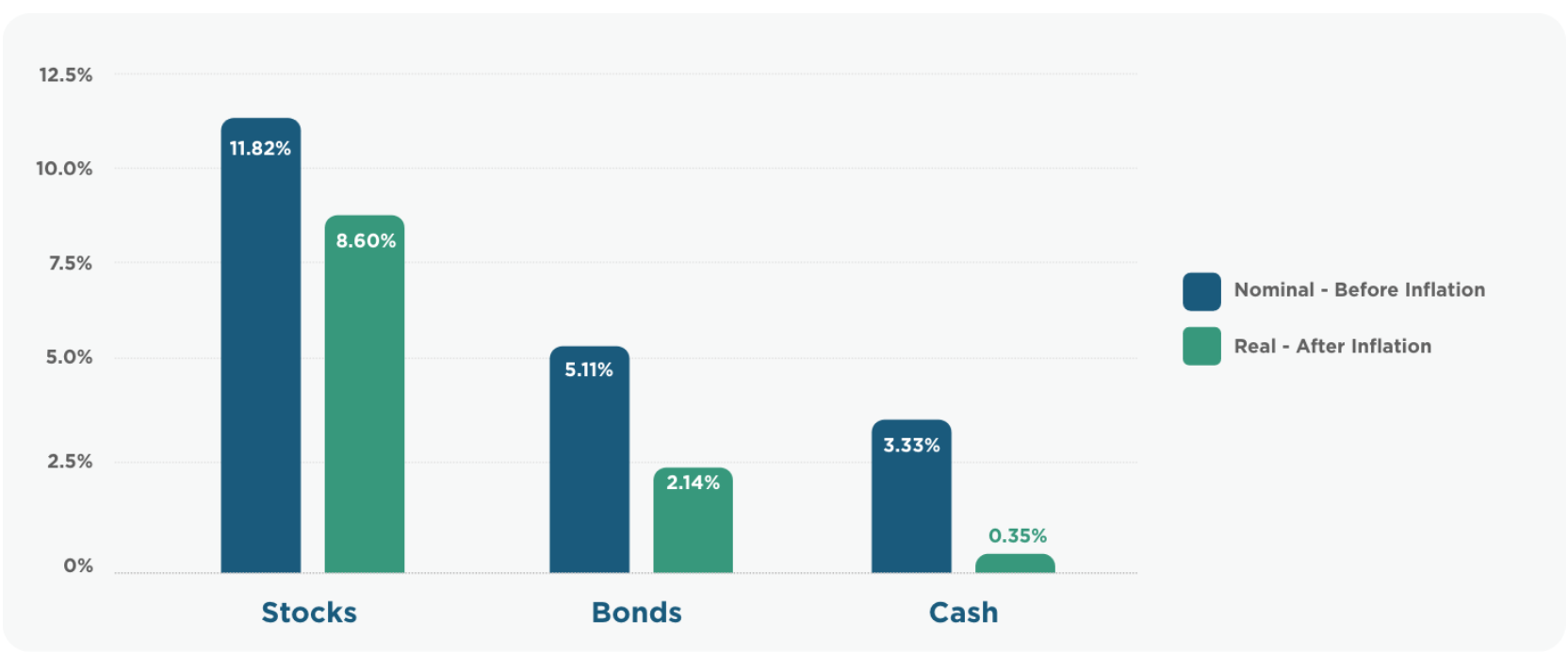

Investment returns can be looked at in two ways – before inflation or after they are adjusted for inflation. These are called nominal and real returns, respectively.

Here are the nominal and real returns for major asset classes since 1928.

Average Annual Returns (1928-2021)

Source: Historical Returns on Stocks, Bonds and Bills: 1928-2021, Aswath Damodaran, NYU

As you can see, the after-inflation returns are substantially lower. The good news is that stocks have been a great inflation hedge over the long term and can help you grow your wealth and your purchasing power. While bonds have a lower real return, it’s important not to forget their role in your overall portfolio – to manage risk and act as a shock absorber during market downturns.

Getting returns that don’t outpace inflation means you aren’t making as much progress towards creating financial independence as you thought. Having enough money to retire and having enough money to last through retirement is a big deal.

Final word

Investment returns are critical to growing your money and achieving financial independence. While investments are just one aspect of your overall plan, your returns can make all the difference for your financial security and the retirement you want. If you look at your investment returns and subtract fees, taxes, and inflation, how do they add up?

It’s not just how much you make, it’s how much you keep. A dynamically evolving financial plan and investment strategy can help you navigate fees, taxes, and inflation every step of the way and put you in control of your investment outcomes.

1Source: S&P Dow Jones Indices - Index vs Passive Research