The information provided is based on the published date.

Key takeaways

- Inflation is when prices for goods and services increase over time

- There are two primary causes for inflation – the cost to make something goes up, or consumer demand is greater than supply

- The Federal Reserve and the U.S. Government have tools to influence inflation, but it’s more of an art than a science

- A small amount of inflation is healthy for an economy but, if left unchecked, can create challenges

- While inflation matters, your decisions with money will have a far greater impact on your life

The decisions we make with our money are, in many cases, affected by the prices that we pay for things – everything from groceries, to the cars we drive, to the homes we live in. Over time, prices tend to increase and often, quite gradually, to the point where we don’t notice the changes over short periods. For example, we wouldn’t expect a cup of coffee to cost more week to week. The prices we pay for things and their changes over time are tracked through a metric we know as inflation.

Here’s everything you need to know about inflation and what it means for you and your money.

What is inflation?

Here’s a simple definition of inflation that’s free of economic jargon – it’s when things cost more than they used to. The fact that things cost more isn't inherently a good or bad thing, but it does have a very real impact on your money because it means that every dollar you have today buys less tomorrow. You may also hear this referred to as a reduction in your purchasing power. No matter how you look at inflation, what you do with your money – spend it, save it, or invest it – has very real implications for your future.

What causes inflation?

There are many causes of inflation in our economy, but you should know two basic concepts – “cost-push” and “demand-pull”. Here’s a breakdown of each:

Cost-push inflation occurs when it costs a company more to provide a good or service – maybe due to an increase in the cost of raw materials – so they raise their prices to compensate. So higher costs push the price of the things we buy higher.

Think about your iPhone for a second and all of the parts that are required to make it. Now assume that the cost of the battery or the computer chip inside of it increases in price. Eventually, Apple will pass those higher prices on to us.

Demand-pull inflation occurs when our desire to buy things – our demand – is greater than what companies can provide – their supply. Because something is in short supply, people are willing to pay more to get it. In this situation, we pull the price higher.

Let’s look at car prices. New cars increased in price by over 6% from July of 2020 to July of 2021 due to chip shortages and more expensive tech packages. As a result, more car buyers looked at used cars to save money. But due to the pandemic, used car inventory – supply – was down as rental car companies held onto their cars and did not sell them into the used car market. Higher demand and lower supply led to a 41% increase in used car prices over that same period.

Can we control or influence inflation?

The short answer is kind of. Controlling or influencing inflation is more art than science. This is one of the reasons why we have the Federal Reserve (the Fed) – our central bank. The Fed’s job is to promote healthy levels of employment and inflation – also called price stability. The primary tool at the Fed’s disposal to influence inflation is interest rates which is why you may hear the two mentioned together in the news.

As the economy grows and “heats up” and people spend more we typically see an uptick in inflation. As inflation rises, the Fed can raise interest rates to help constrain, or “cool off” the economy, resulting in lower inflation. Conversely, if the economy slows down, the Fed can lower or “cut” interest rates to help stimulate the economy. It’s a little like Goldilocks. The Fed keeps trying different policy measures and then tests the economy to see if it’s too hot, too cold, or just right.

Is inflation a good thing?

A small amount of inflation – around 2% – is generally believed to be “just right” or good for the economy. Why is this the case? First, it’s better than deflation or falling prices. If companies have to lower prices, they make less money and have to lay off workers. Second, rising prices create an incentive to buy more things today. This leads to higher demand which boosts consumer spending and all of this drives economic growth.

You might be asking, “but doesn’t inflation mean my money is worth less?” The short answer is yes. The longer answer is that a healthy level of inflation is generally offset by higher wages and interest rates – which means cash and bonds pay more. It all evens out in the short term in most cases. Over the long term, inflation is a very powerful force – as it reduces how much each dollar is worth – which is why having an appropriate investment strategy to grow your money by more than than the rate of inflation is an essential piece of your overall financial plan.

How is inflation measured and what is and isn’t included?

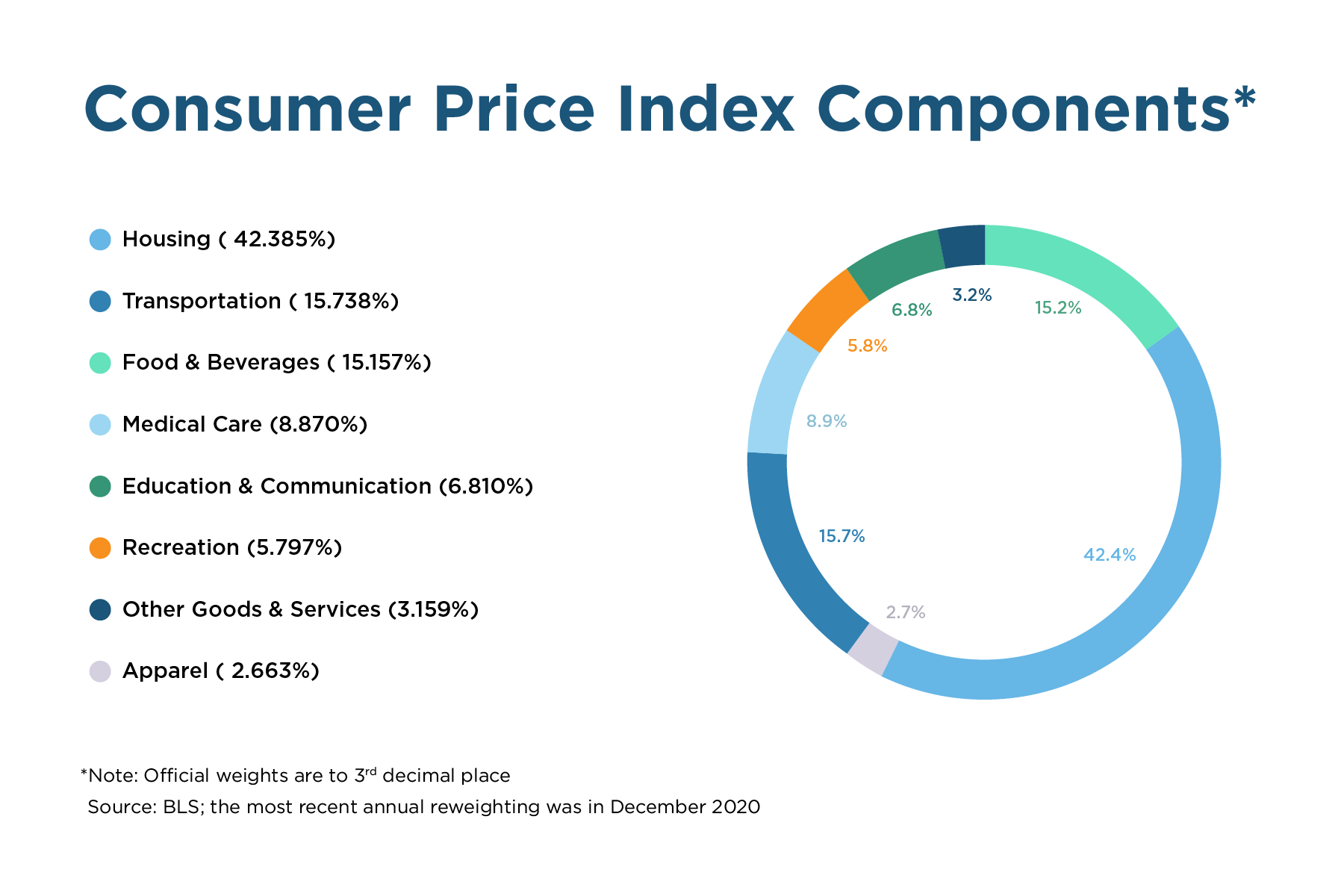

The Bureau of Labor Statistics (BLS) tracks all of the changes in the U.S. economy. To measure inflation regularly, the BLS created a representative group of things we spend money on, which they call a "basket." Think of it as the monthly expenses for an average U.S. household. The basket includes the following categories and their relative “weights” and how much influence they have in the overall basket of goods and services.

The BLS then calculates the price changes in each of the categories every month and reports this information in the Consumer Price Index (CPI). The most widely reported version is headline CPI – which includes all categories – but you will also see core CPI – which is headline CPI minus food and energy prices (the reason is that food and energy prices tend to be very volatile, which can greatly affect the CPI in the short term).

Here’s a quick example:

Let’s say a trip to the grocery store in June of 2020 cost you $100. And this June – one year later – that same “basket” cost $103. This would be reported as a 3% year-over-year price change or 3% inflation.

It’s important to know that inflation only measures the cost of things we buy day-to-day and does not include the price of assets or investments – like real estate or stocks and bonds. Inflation is also a backward-looking number. It tells us very little about the future and nothing about how long a given level of inflation will last.

What does inflation mean to you?

Headlines about rising inflation can get us all thinking about what moves we should be making with our money. Given that the United States hasn’t seen a period of consistently high inflation in 30+ years, it’s not something we are conditioned to think about. But every once in a while inflation rears its head to remind us it’s still there.

The good news is that there is one thing more powerful than inflation, or economic growth, or the Fed’s policies – all things we cannot control. What is it? The decisions we make with our money every day. It’s the things we can control – our spending habits, how much we save, how we invest, how much risk we take on, and how we plan for today and our futures – that will have the greatest impact on our lives. Yes, inflation is a concept we should all be familiar with, but it's just one facet of a much bigger picture when it comes to life and money.

Facet

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser headquartered in Baltimore, Maryland. This is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. Past performance is not a guarantee of future performance.