With uncertainty in the stock market and inflation, let's get your finances prepared today!

Make overwhelming financial decisions easy:

- Smart budgeting and planning that works for your life.

- What should you do with your investments? Go long? Sell?

- Keep your job, ask for a raise, or find something new?

- Get the most out of your retirement accounts.

Schedule your free consultation

1-888-321-5909 1-888-823-9469 1-888-824-0752 1-888-825-8163 1-888-826-4185 1-888-950-0651 1-888-950-2057

See our Disclosures for Endorsements, Testimonials and Social Media.

*See Terms and Conditions and active promotions. Not available for Foundations members.

OUR APPROACH TO INVESTING

01

We use Nobel-prize winning research with a modern twist*

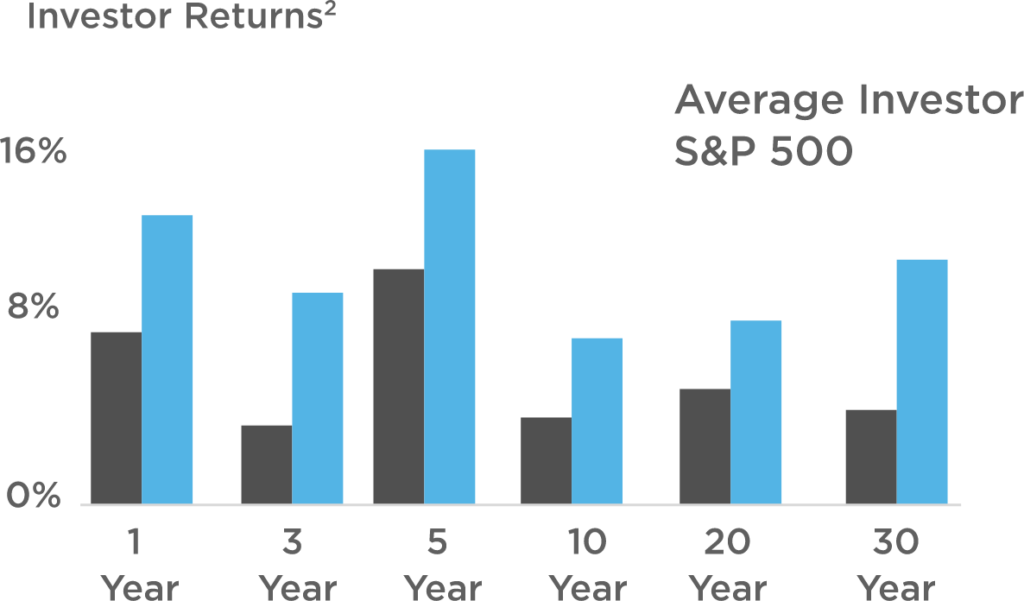

Long-term investment success is all about the right mix of diversified investments, taking smart risks, and staying invested over time.

TIMING THE MARKET CAN MEAN MISSING OUT ON RETURNS1

02

A tailored portfolio that helps you live your today and plan for tomorrow

With your plan as your foundation, and low cost, tax-efficient ETFs at the core of your portfolio, you’ll be positioned to participate in market returns and avoid the mistakes that most investors make.

03

A dedicated CFP® Professional who offers purely objective investing advice

We remove conflicts of interest with one clear, flat fee. This means we can focus on what’s best for you - no hidden fees, no commissions, no sales tactics. Strictly unbiased advice designed to help you achieve success.

04

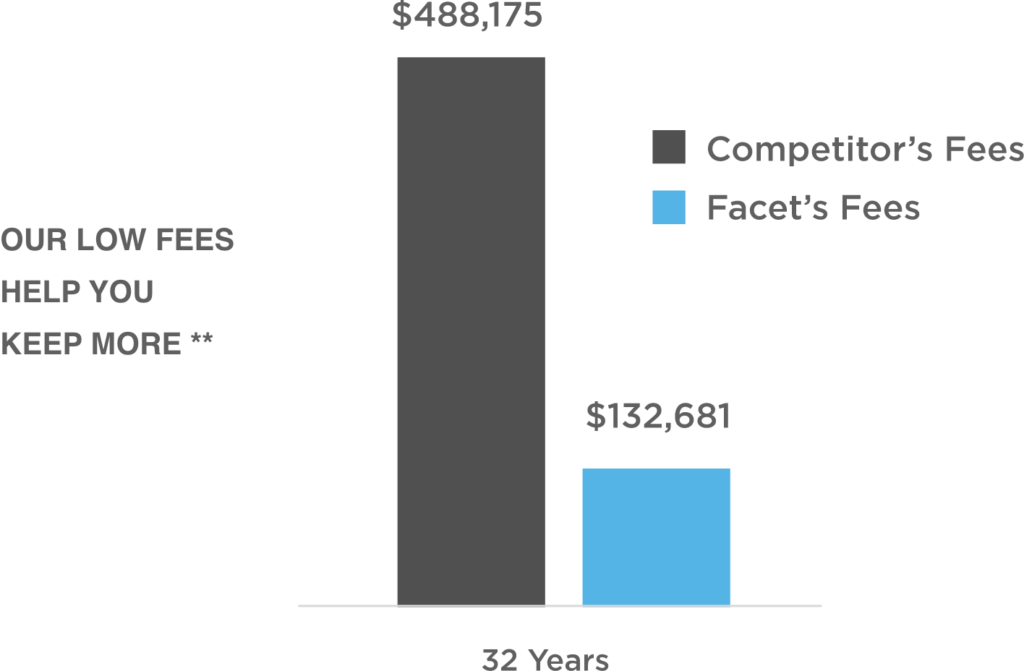

All this, plus some of the lowest fees in the industry, with tax-efficient planning included

In addition to low-cost investments like ETFs, we’ll recommend accounts to minimize taxes today and create tax-efficient income for tomorrow. All for one low flat fee - which makes a big difference over time.

1 Sources: Ibbotson, Fidelity Mgmt & Research Company, Morningstar

2 Capital Spector.com | Source: Dalbar

3 https://www.kitces.com/blog/financial-advisor-average-fee-2020-aum-hourly-comprehensive-financial-plan-cost

* Our investment approach includes research from Nobel prize winners Harry Markowitz, Eugene Fama and Richard Thaler.

** Based on a traditional advisor charging 1% of your total account vs. a Facet annual flat fee of $2,400 plus .08% fund fees. Assumes a starting account balance of $100,000 adjusted for annual contributions and investment growth.

18 More Ways We Reduce Your Stress About Money

Your financial life is impacted by much more than the market. Unplanned and planned changes are a part of life, so your CFPⓇ Professional at Facet Wealth will work with you to answer difficult questions and make smart decisions with your money.

Life Milestones

- Getting married or having children

- Separation or divorce

- Healthcare or medical expenses

- Inheritance or a death in the family

- Buying or renting a home

- Elder care planning

Career Changes

- A new job, raise or career change

- Employee stock plan questions

- Starting a business

- Benefit selection

Investments & Taxes

- Investment management and optimization

- Retirement account management

- Market and tax law changes

- Tax planning questions

Retirement Planning

- Distribution strategies

- Generational transfers and charitable giving

- Navigating Social Security

- Healthcare planning

What Facet Clients Are Saying

These testimonials were provided by current clients of Facet Wealth, Inc. The clients were not compensated, nor are there material conflicts of interest that would affect the given testimonials. These testimonials may not be representative of the experiences of other clients, and do not provide a guarantee of future performance success or similar services.