Unlock opportunities to speed up retirement contributions

Retirement contributions can be complex. Unsure about your options? Most common questions are answered below. For more guidance, schedule a call with a Facet expert to get help boosting your retirement savings and making smarter financial choices.

Increase your 401k, IRA, and HSA contributions after 50.

Unlock $30.5K and $1K catch-up limits*

Secure Your Future Beyond 50

If you’re 50 or older, it’s prime time to accelerate your retirement savings. Catch-up contributions allow you to add an extra $7,500* annually to your employer-sponsored retirement plans like 401k, 403b, and 457 plans. This means instead of the standard limit, you can significantly boost your savings, paving the way for a more comfortable and secure retirement.*

Why Consider Catch-Up Contributions?

- Enhance Your Retirement Nest Egg: Take advantage of the opportunity to increase your retirement savings, ensuring you have the funds you need to enjoy your golden years to the fullest.

- Tax Benefits: Catch-up contributions can also offer tax advantages, potentially lowering your taxable income.

Turning 50 opens the door to an additional $1,000 you can contribute to your Individual Retirement Account (IRA) annually. It’s a simple yet effective way to ensure your retirement savings are on solid ground.*

HSA Contributions After 55

Healthcare costs are a significant consideration for retirees. If you’re 55 or older, boosting your Health Savings Account (HSA) by an extra $1,000 each year can help cover these expenses, giving you additional peace of mind.**

How A Certified Financial Planner Professional Can Help

Maximizing your retirement contributions is just part of the journey. We believe integrating this into a personalized plan designed to help you with every important financial decision is the best next step.

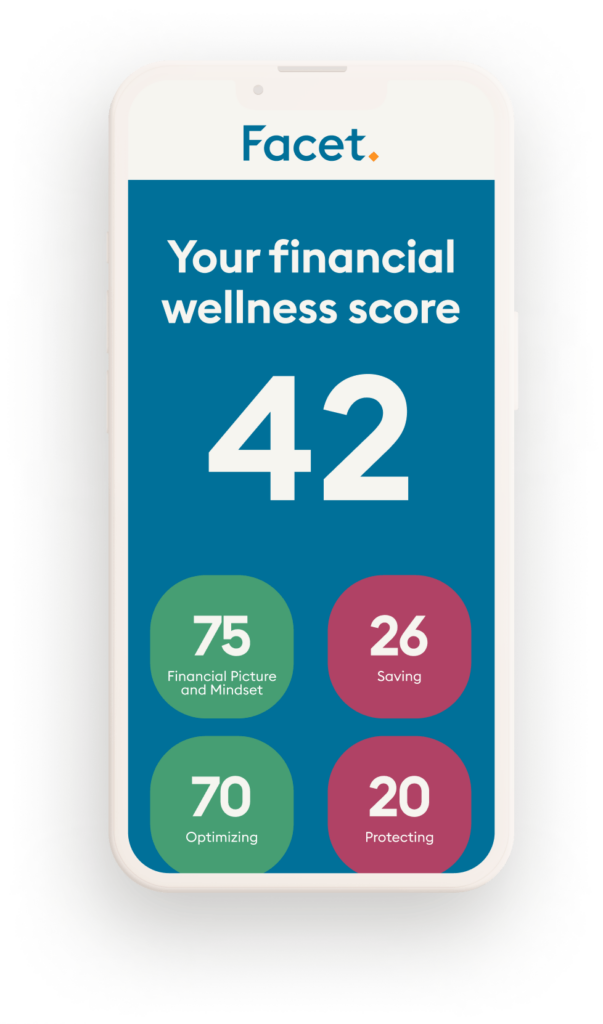

Honestly, how are you doing with your money?

You can find out in under 4 minutes. Your Financial Wellness Score will unlock insights into what you’re doing right and what could still be better.

How we’re different.

What Facet members are saying.

Colby is a current Facet member and received a free membership for providing this testimonial. Zach, Maggie, and Alyssa are current Facet members and did not receive compensation for providing this endorsement. All opinions are their own and not a guarantee of a similar outcome. Facet is an SEC RIA. Facet’s specific investment management services vary depending upon the chosen service level. This is not an offer to sell securities.