The information provided is based on the published date.

Key takeaways

- Stocks were mixed this week. The overall market finished about unchanged, but many AI-related stocks were materially lower.

- Inflation slowed to the lowest level in over three years, bolstering the case for a Fed rate cut in September.

- Forecasting major market events is very difficult, if not impossible, to do consistently.

- Instead Facet prefers to set our portfolio allocations in an attempt to perform reasonably well across a variety of scenarios.

Greetings, I’m Tom Graff, Chief Investment Officer here at Facet. Welcome to another edition of the Facet Investor Newsletter. This week we’ll cover more good news on inflation, a tough week for semiconductor stocks, and a look at how Facet thinks about forecasting market events.

But first, if you have any questions related to anything you read here, or about investing more broadly, please feel free to email our team directly at [email protected]. We’re happy to help!

Second, a heads up that we will be publishing our quarterly performance review this week on the Learn page of the Facet website. This will be an in depth look at how markets performed this quarter in general but also specifically how Facet’s ETF mix fared vs. the broader market. If you have been following this newsletter closely, you will definitely want to check out that piece as well.

Market recap

Stocks finished the week almost exactly unchanged, with the S&P 500 ending down 0.1%. Stocks briefly hit another all-time high on Friday before retreating in the afternoon. Semiconductor stocks struggled, as memory chip maker Micron reported future earnings guidance that was below expectations. Nvidia continued its slide as well, ending the week down 2.5%.

Core PCE inflation for May came in at 0.08% and 2.57% for the year, with the latter being the lowest since March 2021. Core PCE is the Fed’s official measure for inflation. The Fed’s recent Summary of Economic Projections showed a median forecast of 2.8% inflation for all of 2024, so by that measure the Fed is a bit ahead of schedule. We said this in our last Fed analysis piece, but we think a rate cut in September is quite likely.

Despite the cooler inflation numbers, longer-term interest rates edged higher. For a while some have argued that if the Fed cuts sooner, that reduces recession risk, which in turn might mean that longer-term interest rates can stay higher. I’m not totally convinced of that view, but that’s how it played out this week.

This week’s chatter

There was definitely a lot of conversation among traders about what the decline in semiconductor stocks (and especially Nvidia) means for the wider market. On one hand, we can look at Micron’s earnings report. The company actually reported a very good quarter, with revenue up 81% over last year and profits almost 10x. However expectations were so high that even all of that didn’t satisfy investors and the stock fell 7% after the report.

This shows that expectations can be too high for any company, no matter how strong their business is. In other words, it would be possible for AI to be a big driver for these businesses and yet the stocks still underperform because expectations were just too high.

On the other hand, it is notable that AI-related stocks struggled as much as they did this week and yet the market still wound up about flat. There’s been a trope that because Nvidia got so big, the market couldn’t handle any kind of sell-off in AI stocks. That’s kind of silly. Sure, Nvidia is a big company so any really large sell-off will matter, but the market is always bigger than just one stock.

Next week will be a short one for traders, but a big one for the economy. We’ll get the monthly jobs report on Friday. Economists are expecting job growth to slow to 190,000 in June, down from 272,000 estimated for May. We’ll cover this in next week’s newsletter.

Pro corner

One of my personal core beliefs about investing is that forecasting specific events is very difficult. The macroeconomy has too many variables, each interacting with each other in complex ways. Any specific prediction, from a price target on the S&P 500 to whether there would be a recession, is difficult. Getting such predictions right over and over, often enough to generate profitable investment ideas, is even more difficult.

So my approach has always been different. While it is hard to predict the future, you can usually come up with a discrete set of possible scenarios for markets over the next year or so. In other words, while I might not know which scenario is going to happen, we can usually identify a list of potential outcomes, and feel pretty good that the reality will be one of (or a combination of) those scenarios.

Within each scenario, we can make some reasonable guesses about which kinds of investments will perform better or worse. Maybe we don’t know precisely what the return will be, but we can make a guess about what kinds of things will be outperformers vs. underperformers. In one scenario you might think tech stocks do really well, in another scenario it's real estate and short-term Treasury bonds that are the outperformers, etc.

Once we do that, we can look for patterns. Is there some item that does really well in multiple scenarios, and doesn’t do too badly in any of them? That’s something we want to be overweight in. Is there something that doesn’t manage to outperform big in any scenario, and actually has a couple where it does especially poorly? That’s something to underweight. We call these situations a “risk-reward imbalance.”

What we try to do is create a set of assets that will perform at least reasonably well in all scenarios. Of course, there are no guarantees. But we think if we keep overweighting items with favorable imbalances and underweighting those with unfavorable imbalances, that gives us a good shot at outperforming over time.

We put a lot of work into creating and monitoring our scenarios. Currently we have a list of 10. I realize a lot of individual investors won’t be able to do this level of analysis. But you can still apply the concept. When you are picking a new investment, try to think of all the possible scenarios. Too often investors stop at a single scenario that they view as most likely. I encourage you to think more broadly.

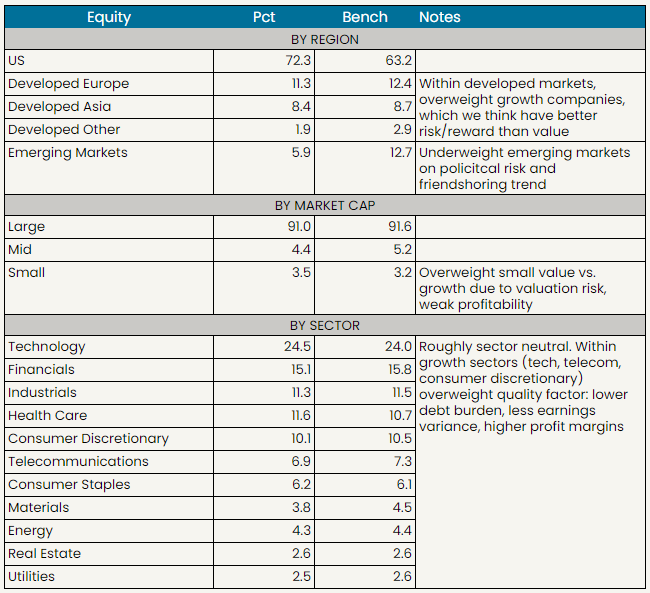

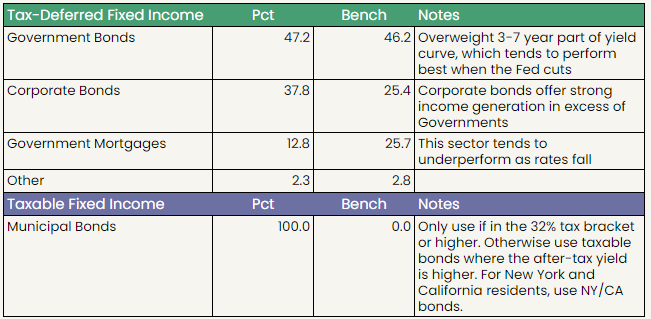

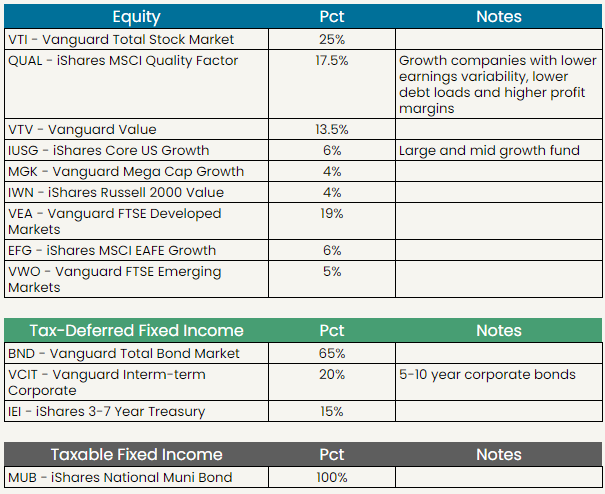

Facet portfolio positioning

Facet’s current ETF models

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser. This is intended as educational information and is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. This is not a solicitation for the sale or purchase of any specific securities, investments, investment strategies, or products. Past performance is not a guarantee of future performance and all investments come with risks. Individuals should consider their personal risk tolerance, time horizon and goals when making a decision about investing. There are no guarantees on returns; implied or otherwise; investment results may vary.

Tom Graff, Chief Investment Officer

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser headquartered in Baltimore, Maryland. This is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. Past performance is not a guarantee of future performance.