The information provided is based on the published date.

Key takeaways

- Stocks set another all-time high despite weakness from many of the mega tech stocks struggling.

- Inflation data for June came in surprisingly low, causing the market to bet more heavily on Fed rate cuts.

- Earnings season is getting started, and how strong company profit growth is vs. market expectations will be a key driver for stock prices in the coming months.

- Bonds have been a tough market the last few years, but there’s a lot of good reasons why that may soon change.

Greetings, I’m Tom Graff, Chief Investment Officer here at Facet. Welcome to another edition of the Facet Investor Newsletter. This week we’ll cover a surprisingly soft inflation report, the start of another earnings season, and answer a member's question about why bother owning bond ETFs at all?

If you have any questions related to anything you read here, or about investing more broadly, please feel free to email our team directly at [email protected]. We’d love to hear from you!

Market recap

Stocks rose slightly last week, with the S&P 500 rising 0.9%. The index set a new all-time high on Wednesday before retreating slightly. Notably though, it was a very broad rally. Of the 500 stocks in the S&P, 423 were up. The index was dragged down by weaker performance by some megacap names like Meta, Netflix, Amazon, Microsoft, and Alphabet, all of which were lower last week. Small caps also did quite well, rising more than 5% as a group.

Interest rates declined materially this week as traders began betting more heavily on multiple rate cuts in 2024. The 10-year Treasury yield fell 0.1% to 4.18%, the lowest level since March.

This week’s chatter

Traders were caught a bit off guard by the Consumer Price Index (CPI) report for June, which came in lower than just about anyone’s expectations. For the month Core CPI was +0.1% vs. 0.2% expected. For the last year, Core CPI was 3.3%, lowest since 2021.

This plus some relatively dovish comments from Federal Reserve Chair Jerome Powell during Congressional testimony this week, had traders adding to rate cut bets. Right now futures markets indicate near 100% odds of a rate cut in September, with either one or two more cuts by December. As I mentioned above, this sent longer-term rates lower as well.

It is interesting to watch the pattern of trading for stocks around these events. The big cap tech names that have been huge winners so far in 2024 struggled last week, while small caps and more cyclical companies were the best performers. Some of this is directly related to interest rates: many of these companies have a lot of debt, and therefore lower interest rates are generally good news. E.g., real estate and utilities were among the best performers for the week. Some of it is also related to recession risk declining. The sooner the Fed can start cutting, the lower the risk of policy staying too tight and causing the economy to slow.

Remember too that while the Fed remains important, earnings matter more at this stage. We are at the start of another earnings season right now, with a few big banks kicking off reporting last week. I expect big tech to be the big focus, and most of those companies don’t report for at least a couple weeks. However if earnings growth can broaden out, we could see a continuation of the small-cap outperformance we saw this week. If you are someone who just owns an S&P 500 ETF, this is something to consider.

Pro corner

Why should you bother owning bonds at all? This is a question we hear a lot, including from one member this week. As you may know, for many years my primary role was managing bond portfolios, so I have been hearing a version of this question basically my whole career.

The answer to the question depends on what you view as the alternative to bonds. The member that sent in the question this week was asking about very short-term bonds, e.g., an ETF where all of the underlying bonds mature in less than two years. The member noticed this ETF had about the same yield as Facet's ETF recommendation, with what looked like way less volatility.

The problem with this has to do with the yield curve inversion. Normally longer-term bonds yield more than shorter-term bonds. Today the opposite is true. For example, the 2-year Treasury yields 4.45% and the 10-year yields 4.18% as of the end of last week. We won't remain in this unusual inversion situation forever. In fact, the curve tends to normalize as the Federal Reserve starts cutting rates. As we said above, that's becoming more and more likely.

Buying longer-term bonds now allows you to lock in today's relatively high yields for some period of time, whereas if you buy ETFs with short-term bonds, your yield will drop quickly if the Fed does start cutting.

Another version of this question we sometimes get is a member looking at the poor performance of bond ETFs over the last couple years and wondering if bonds are just bad investments. Someone who has held Facet's ETF mix for retirement accounts over the last three years has actually lost a slight amount of money, accounting for both interest paid and price changes.

I understand this frustration, but bear in mind that returns are backward looking. The fact that returns are negative in recent years reflects that bond yields have generally been rising while the Fed was hiking rates. Two key things on that: one is that the Fed is almost certainly done hiking rates, so there won't be the impetus for rates to keep rising, at least not for the same reason. Second, now that yields are higher, the forward-looking return potential for bonds is also higher.

So I certainly wouldn't sell your bond just because they have recently fallen in price. Nor would I replace the bond allocation with a short-term bond or even a cash allocation. I think both of these ideas misunderstand bond market dynamics.

If you are going to change your bond allocation, do so because your risk tolerance or something else about your plan has changed. It is true that bonds are very likely to produce less return over the long-run compared to stocks. So you don't want to own too much in bonds. Just don't let either of the two issues above drive your decision.

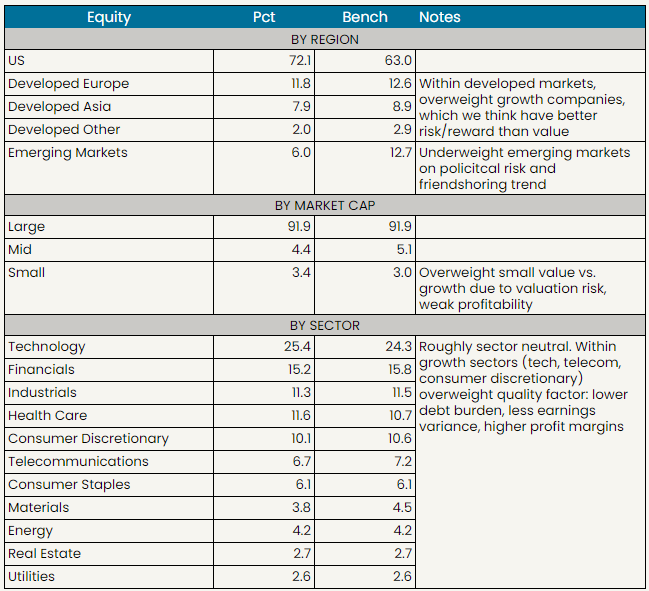

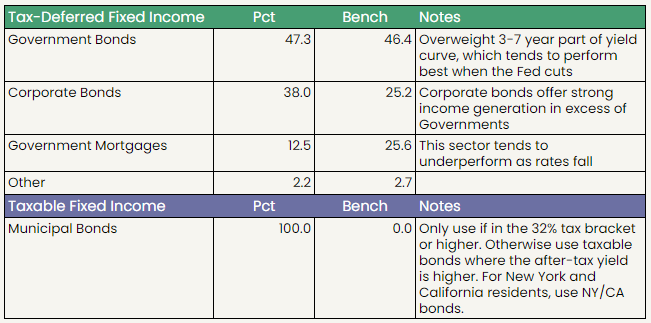

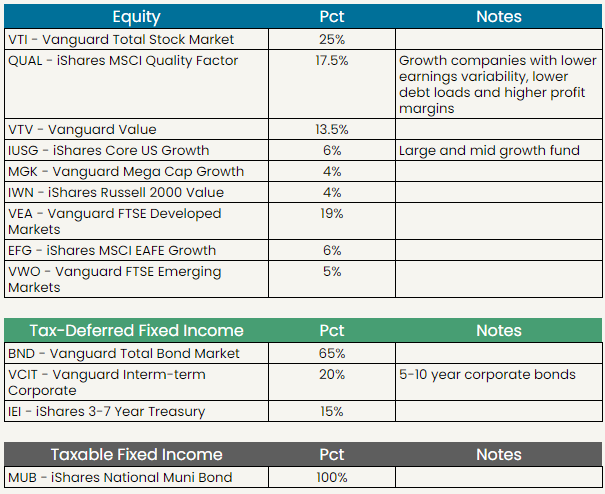

Facet portfolio positioning

Facet’s current ETF models

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser. This is intended as educational information and is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. This is not a solicitation for the sale or purchase of any specific securities, investments, investment strategies, or products. Past performance is not a guarantee of future performance and all investments come with risks. Individuals should consider their personal risk tolerance, time horizon and goals when making a decision about investing. There are no guarantees on returns; implied or otherwise; investment results may vary.

Tom Graff, Chief Investment Officer

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser headquartered in Baltimore, Maryland. This is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. Past performance is not a guarantee of future performance.