Can I Retire? Here's How You Can Make It Happen

Whether you’re aiming for retirement at 40, 50, 55, or even 60, it’s never too early or too late to start planning. The information below is designed to quickly help you understand your options and help you make the right choices for a financially secure future. Schedule a call with Facet to learn more.

How to Retire Comfortably

Retiring comfortably means ensuring that you have enough financial resources to maintain your desired lifestyle. Here are some key steps to take:

- Create a Detailed Retirement Plan: Outline your financial goals, estimated expenses, and potential income sources. Consider healthcare costs, inflation, and lifestyle changes.

- Save and Invest Wisely: Maximize contributions to retirement accounts such as 401(k)s and IRAs. Diversify your investment portfolio to balance risk and growth potential.

- Reduce Debt: Pay off high-interest debt before retiring. This will free up more of your retirement income for living expenses and leisure activities.

How to Start the Retirement Process

Starting the retirement process can seem daunting, but breaking it down into manageable steps can make it easier:

- Assess Your Financial Situation: Calculate your net worth, income sources, and projected retirement expenses. Use tools and calculators to get a clear picture.

- Set a Retirement Date: Choose a realistic retirement date based on your financial readiness and personal goals.

- Plan for Healthcare: Research healthcare options, including Medicare and supplemental insurance, to cover medical expenses in retirement.

What to Do 6 Months Before Retirement

The six months leading up to retirement are crucial for finalizing your plans and ensuring a smooth transition:

- Review Your Retirement Plan: Revisit your financial plan and make any necessary adjustments. Ensure that you have sufficient funds and that your investments are aligned with your retirement goals.

- Update Legal Documents: Update your will, power of attorney, and other legal documents to reflect your current wishes and ensure your loved ones are protected.

- Plan Your Lifestyle: Think about how you’ll spend your time in retirement. Consider hobbies, travel, volunteering, and other activities to keep you engaged and fulfilled.

How to Retire in Your 30s, 40s, 50s, and 60s

Retiring at different ages requires unique strategies:

- 30s and 40s: Focus on aggressive saving and high-growth investments. Keep expenses low and prioritize building a substantial retirement fund.

- 50s: Maximize retirement contributions and catch-up contributions. Pay off debt and consider downsizing your home to reduce expenses.

- 60s: Finalize your retirement plan and ensure a steady income stream. Consider delaying Social Security benefits to increase your monthly payments.

How Much Will I Get If I Retire at Age 62?

Retiring at age 62 means you can start receiving Social Security benefits, but the amount will be reduced compared to waiting until your full retirement age:

- Understand Your Benefits: Learn how your Social Security benefits are calculated and how early retirement affects your monthly payments. You can use the Social Security Administration’s Quick Calculator for a rough estimate of your benefits.

- Consider Additional Income Sources: Factor in other retirement income such as pensions, part-time work, or investments to determine your total income.

- Evaluate the Trade-Offs: Weigh the pros and cons of taking early Social Security benefits versus waiting for a higher monthly amount.

Will I Be Able to Retire? Use a Calculator

Not sure if you’re on track to retire? Consider employing a retirement calculator for a preliminary assessment, or engage the expertise of a financial advisor to craft a comprehensive retirement strategy tailored to your unique circumstances.

- Gather Your Financial Information: Compile key data such as your age, current income, savings, investments, and expected retirement expenses.

- Use a Reliable Online Retirement Calculator: Access a comprehensive retirement planning tool to help estimate your future financial needs. By inputting your current financial information and retirement goals, you can get a clearer picture of your retirement readiness. You can find one trusted calculator here at 360 Degrees of Financial Literacy.

It’s Possible to Retire Now and Facet Can Help!

Facet has helped over 2,100 individuals plan to transition into retirement since 2022. Our personalized flat-fee financial planning service is designed to help you at every stage of your retirement journey. Whether you’re just starting to plan or ready to retire soon, we can provide the guidance you need.

Learn more and schedule a call with Facet. We can work together to help secure your retirement.

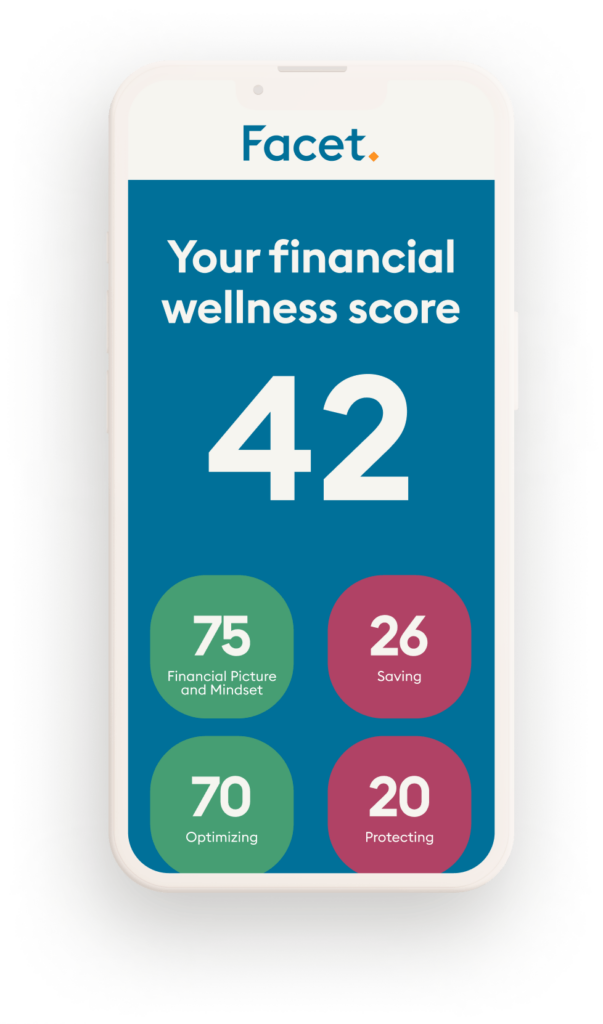

Honestly, how are you doing with your money?

You can find out in under 4 minutes. Your Financial Wellness Score will unlock insights into what you’re doing right and what could still be better.

Schedule a call with a Facet expert

Get help with catch up contributions and every important financial decision with an affordable flat fee membership.

** Nerdwallet review conducted in October of 2023 based on the time frame of August – October 2023. Nerdwallet’s independent assessment includes data collection, interviews and testing which results in star ratings from poor (one star) to excellent (five stars). Nerdwallet was not paid for this review however does receive compensation based on referrals.

How we’re different.

What Facet members are saying.

Testimonials were provided by current members of Facet ("Facet Wealth, Inc."). Members have not been paid for their testimonial and there are no material conflicts of interest that would affect the given testimonials. These testimonials may not be representative of the experiences of other members, and do not provide a guarantee of future performance success or similar services.