The information provided is based on the published date.

Key takeaways

- Stocks surged over 4% last week, with rebounding tech stocks leading the way.

- Interest rates also fell to 2024 lows in the Treasury bond market as well as the mortgage market.

- Traders are looking ahead to a pivotal Fed meeting on Wednesday, with forecasts split on whether the Fed will cut by 0.5% or the more traditional 0.25%.

- There are a lot of problems facing real estate stocks, and a relatively narrow path for these problems to get solved. This is why Facet doesn’t have more invested in real estate for now.

Hello and welcome to the latest Investor Newsletter. I’m Facet Chief Investment Officer Tom Graff. In this edition we’ll look back on a big up week for stocks, a major inflation report, and preview a pivotal Federal Reserve meeting coming up this week. Plus we’ll dive into a common question from members: why Facet doesn’t have an explicit real estate allocation?

Are you enjoying this newsletter? Do you have suggestions to make it more useful? Would a different format be better (like video)? Please let us know your thoughts! Email me at [email protected].

Market recap

Stocks jumped higher last week, with the S&P 500 rising 4%. Tech stocks led the surge, rising over 7%. The buying was pretty relentless. Stocks rose every day this week, even despite a relatively high inflation report. Energy stocks were the big loser, dropping 0.7%. Oil prices fell to YTD lows this week on relatively high supply as well as worries about Chinese demand.

Interest rates also fell last week as traders look ahead to the Fed’s first rate cut of the cycle likely to come on 9/18. Both the 10-year Treasury and the 2-year Treasury fell to year-long lows.

This week’s chatter

Traders remain quite focused on whether the Fed will cut 0.25% or 0.5% at its September 18th meeting. Last week we got perhaps the final bit of economic data the Fed will be considering when making that decision: the August Consumer Price Index (CPI) report. For the month, Core CPI rose 0.3%, slightly higher than the 0.2% expected.

If we assume the Fed committee was on the fence between a 0.25% and 0.5% cut, CPI might nudge them toward 0.25%. However, futures markets remain unsure of the outcome. As of Friday futures pointed to close to 50/50 odds of each Fed outcome.

Fed Chair Jerome Powell is a consensus builder. He’ll want the vast majority of the Fed committee to agree on their action. If the committee is divided, one compromise could be for the Fed to cut 0.25% but for Powell to guide markets to larger rate cuts in the coming months if the labor market remains soft.

For most investors, whether the Fed cuts 0.25% or 0.5% doesn’t matter much other than very short-term price action. What really matters is the pace of cuts over the next several months and whether that pace is enough to stave off any kind of economic slowdown. In other words, if the Fed winds up cutting by 1% over their next three meetings, it doesn’t matter much what the order of those cuts are.

When I’m watching the Fed meeting next week, my focus will be on the Fed’s reaction function. I.e., how much more labor weakness will they tolerate? How worried are they about something like a 0.3% CPI report? Would they stop cutting if job gains rebounded to 200,000 per month but inflation stayed near 2%? These are the kinds of things that will help us understand how much the Fed will be cutting over the course of the next few quarters.

A lot of people wonder if politics will play into the Fed’s decision. Specifically, if they cut by 0.5%, does that open them up to charges of having some political motivation for an outsized rate cut. I don’t know what gets discussed behind closed doors at the Fed, but I will point out this story in Politico describing wide support in Congress for the Fed to start cutting.

Pro corner

While we wait for the Fed, let’s discuss a topic that is very much related to interest rates: real estate investing. We get questions from members regularly about why we don’t have a specific real estate allocation. Here I’m going to talk specifically about investing in real estate stocks (or ETFs), but most of what I’ll say would apply to private markets as well.

Right now nothing is really going well for real estate in terms of fundamentals. The struggles in office buildings have been highly publicized, with office vacancies continuing to rise with no obvious end in sight. Meanwhile apartment construction has been so heavy the last few years that rent rates are now starting to come under pressure too. The boom in warehouse construction has now led to overcapacity and falling property values. Pretty much everywhere you look, real estate is struggling.

You can make money investing in really beat up companies if the stocks are very cheap. In other words, if everyone has incredibly low expectations for a company (or sector in this case) then even the slightest improvement can make for a profitable investment.

However that is not obviously the case with real estate stocks. One simple way to measure this is by looking at the dividend yield on these stocks, since generally the dividends are a major driver of real estate returns. Right now the Dow Jones REIT index, an index of real estate stocks, has a dividend yield of 3.58%. That’s slightly lower than the 10-year Treasury yield. Historically this REIT index has had a higher yield than Treasury yield. If we look from 2011-2021, on average the REIT index had a yield 1.70% higher than Treasury bonds. The lowest gap during that period was 0.73%. Currently the gap is slightly negative.

Based on that metric, real estate stocks are more expensive than anytime during the low interest rate period of 2011-2021. This is key because interest rates are extremely important to real estate. Virtually all real estate is leveraged, so the cost of debt is a key component of the return for the investment.

You’d think that with general conditions for office and apartments weak, plus interest rates much higher than the pre-2022 period, that real estate stocks would be unusually cheap. But based on their dividend payments, the opposite is true. They are expensive.

In poker, there is a term “outs” for the number of cards that can be dealt that makes for a good hand. For real estate, I only see one out: long-term interest rates drop. That could certainly happen. In fact, since the end of April, the 10-year Treasury has dropped from 4.6% to about 3.7%, and real estate stocks are up about 25%.

The problem is, what happens if rates go the other way? Or even just stay steady? For the year up until April, real estate stocks were down 9.1%, as interest rates rose during that period.

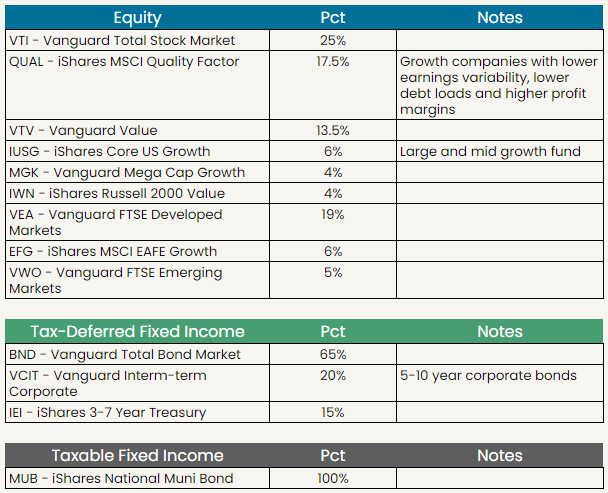

So to me, betting on real estate here is just betting on whether the Fed cuts more than the market is currently anticipating. That’s around 3% right now. Maybe that happens, maybe it doesn’t. We do have a real estate allocation within our ETF mix, but as you see below, it is only about equal to our benchmark. I don’t find this mix of tough fundamental conditions and low dividend yields very exciting.

Facet portfolio positioning

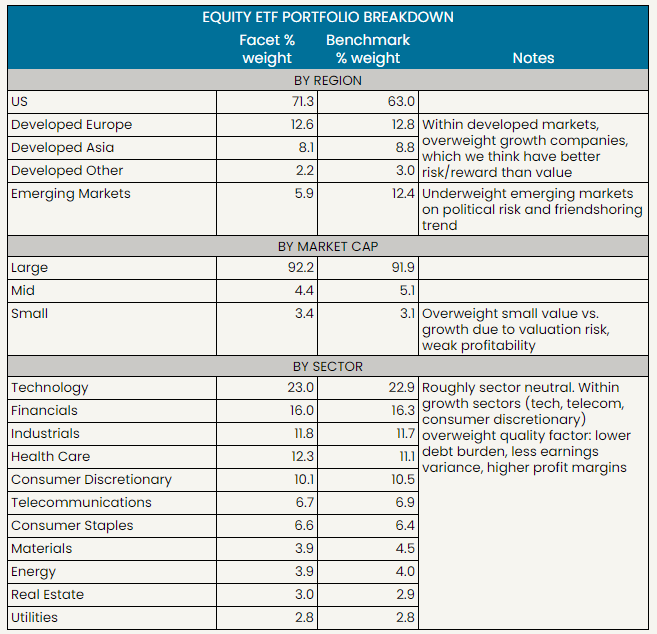

Here is a brief summary of how Facet’s exchange-traded fund portfolio breaks down in terms of regions, sectors and market capitalization. The benchmark is the Morningstar Global Index. This essentially allows for a comparison between Facet’s portfolio and the broad world stock market.

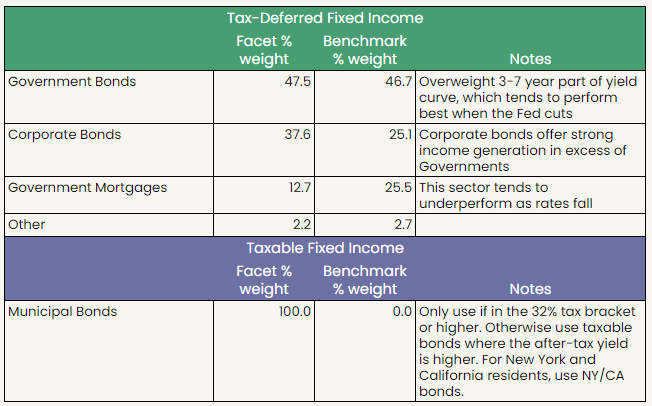

This is the same view but for Facet’s fixed income allocation. The benchmark here is the Morningstar U.S. Core Bond index.

Facet’s current ETF models

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser. This is intended as educational information and is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. This is not a solicitation for the sale or purchase of any specific securities, investments, investment strategies, or products. Past performance is not a guarantee of future performance and all investments come with risks. Individuals should consider their personal risk tolerance, time horizon and goals when making a decision about investing. There are no guarantees on returns; implied or otherwise; investment results may vary.

Tom Graff, Chief Investment Officer

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser headquartered in Baltimore, Maryland. This is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. Past performance is not a guarantee of future performance.