The information provided is based on the published date.

Key takeaways

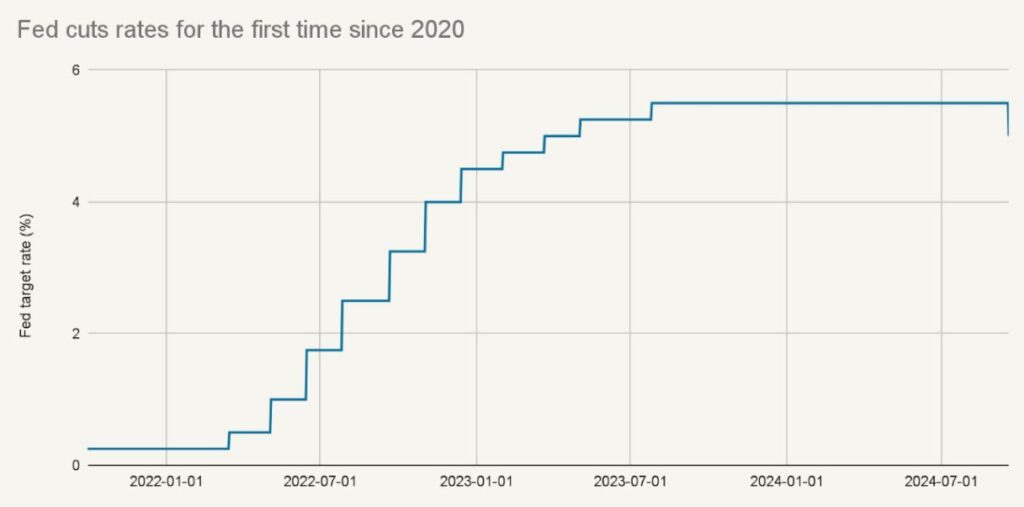

- The Federal Reserve cut their target interest rate by 0.50%, a larger cut than the more typical 0.25%. They also signaled that additional rate cuts were likely in 2024.

- This shows the Fed sees risks in the jobs market and thinks lower rates may help mitigate those risks.

- This may not mean that mortgage rates continue to fall, but does mean that rates on cash accounts will decline.

- For stock investors, the much more important question is whether the Fed cuts rates enough to ensure the economy keeps growing.

The Federal Reserve cut its target interest rates by 0.5% on Wednesday, and signaled that additional rate cuts are likely in the coming months. Why did they decide to cut by 0.5% vs. the more typical 0.25%? Is the Fed more worried about the economy than we realized? And what does this mean for mortgage rates, savings accounts, and the broader financial markets? Here’s our view on all that plus what comes next for the Fed.

Why did the Fed go big with a 0.5% cut?

Coming into this meeting, it seems Fed officials were undecided. We heard public comments from various Fed committee members who seemed open to either a 0.5% or a 0.25% cut. Good chance that inside the meeting there was some division.

I think this ultimately came down to risk management. Job growth has been disappointing the last two months, and this clearly has the Fed concerned. When the Fed hikes interest rates, it does so to combat inflation. However this works because high interest rates also constrain economic growth, and by extension, slows the pace of hiring.

Inflation is now almost to the Fed’s official 2% target. If the labor market continues to soften from here, it could be a sign that the Fed held rates too high for too long, and is in fact doing more damage to the economy than necessary.

So part of what Powell needed to communicate by cutting 0.5% now is that the Fed is on the case. In other words, the Fed is paying close attention to softness in labor, and will act aggressively if necessary. Not only is the Fed acting aggressively now, it is prepared to do even more.

Powell means this to guide market expectations for future cuts. These expectations can have a major impact on the real economy. More on this later.

Source: Federal Reserve

Is the Fed panicking?

One narrative that will come out of this meeting is that a 0.5% cut could signal that the Fed is panicking. I’ve heard this a lot in my many years following the Fed: the Fed can’t make large cuts because the market will assume the Fed knows something we don’t!

Now to be clear, the Fed definitely cares about managing appearances. However they are more concerned with executing good policy.

There’s no way around the fact that a 0.5% cut suggests the Fed is worried about downside risks in the economy. But consider the alternative. Markets are already well aware that the labor market has softened substantially. If the Fed signaled that they had no worries at all, what message would that send? That they are ignoring the data? That they are aloof to the risks?

As I said above, the Fed wants the public to know that they are on the case. They aren’t panicked, but they have concerns, and those concerns warrant aggressive action.

How many rate cuts will we get in 2024 and beyond?

By cutting 0.5% now, and hinting that more is coming, the Fed is front-loading rate cuts. As we said above, right now rates are high enough that they are restricting economic growth. The Fed probably wants to get rates to a more neutral stance, i.e., where rates are neither restrictive nor stimulative. Because of how far inflation has fallen, the Fed can afford to move rates toward neutral relatively quickly.

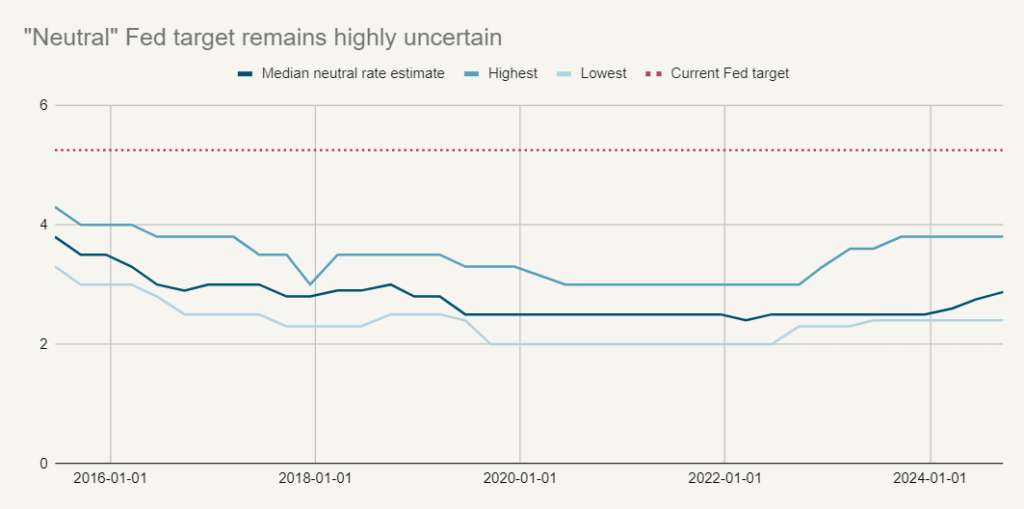

The problem is, no one actually knows what the neutral rate is. Fed officials do make an estimate of neutral as part of the so-called “dot plot.” A new estimate was released today, showing that the median Fed committee member thinks neutral is 2.875%.

Source: Federal Reserve

If 2.875% is indeed the neutral rate, the Fed could cut rates by more than 2% without reigniting inflation. Moreover, it almost certainly changes over time. The only way the Fed will know when it hits neutral is by how the economy performs.

That being said, it is probably safe for the Fed to start out with some larger cuts. The chart above shows the range of Fed estimates of the neutral rate. We see that even the highest estimate is a bit below 4%. So I would say that the Fed feels comfortable cutting to about 4% relatively quickly. That probably means another 0.5-0.75% worth of cuts in 2024, with another 0.25-0.5% coming in early 2025.

From there, it depends on what is going on with the economy. If the jobs market is still slowing, the Fed will keep cutting aggressively. If job gains stabilize, the Fed might keep cutting, but go slower.

Mortgage rates have fallen, but may not fall more

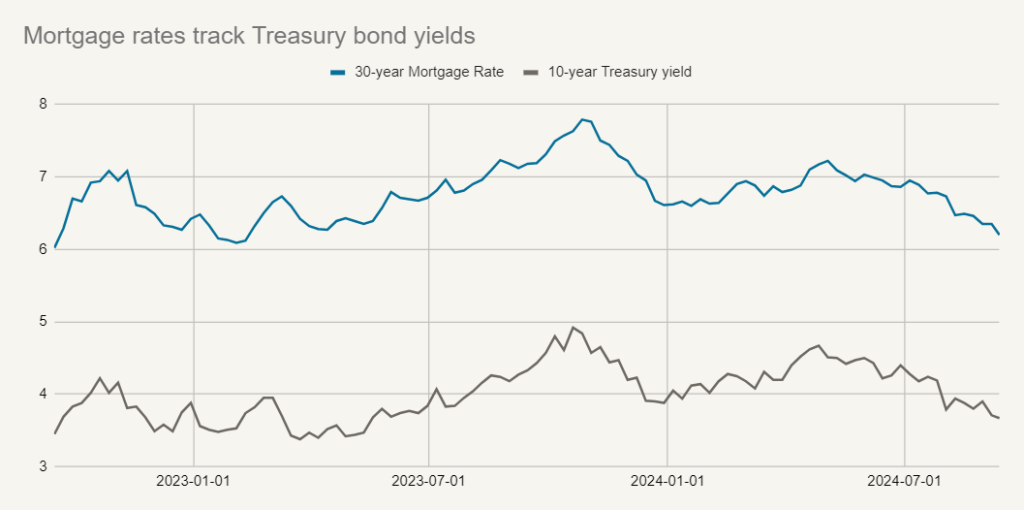

The average 30-year mortgage rate fell to 6.2% on September 12, which was the lowest rate since early 2023. However don’t assume that just because the Fed is cutting its target rate that mortgage rates will keep falling.

Source: Freddie Mac, Bloomberg

As you can see from the chart above, mortgage rates are primarily influenced by longer-term Treasury yields. When the 10-year Treasury yield rises, so do mortgage rates and vice versa.

Notice that both rates have been falling steadily since April of this year? Long before the Fed started cutting rates? This is the anticipation effect I mentioned above. Longer-term bond yields are mostly a function of anticipated future Fed policy rates. This means that longer-term yields tend to move lower before the Fed starts cutting, just as the graph above shows.

Roughly speaking, the market is anticipating that the Fed will keep cutting until it gets to about 3% sometime in 2025. That means for mortgage rates to drop substantially more than they already have, the Fed probably needs to cut rates below 3%. That could very well happen, but it is hardly guaranteed.

Rates on cash accounts to fall immediately

While the Fed only indirectly influences long-term rates, they directly influence very short-term yields. This includes the yield you get on money market funds, high-yield accounts, and any other cash-like vehicle. You will probably notice the yield available on these kinds of accounts has already dropped. We wrote a full article on how this might play out, which you can read here.

Does the stock market still need Fed cuts?

Stocks bounced around quite a bit after the Fed’s 0.5% cut on Wednesday, ending the day about unchanged. However don’t let one day’s volatility distract you from the bigger picture. What really matters is whether the economy can keep growing, and therefore companies keep producing solid profit growth. There’s no particular level of interest rates that determines this. What markets want to see is that the Fed is ready to respond if the economy sours. I think Chair Powell got this across today.

Tom Graff, Chief Investment Officer

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser headquartered in Baltimore, Maryland. This is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. Past performance is not a guarantee of future performance.