The information provided is based on the published date.

Key takeaways

- Finding the right asset allocation is perhaps the most important decision you can make with your investments.

- In your 20’s and 30’s, your biggest advantage is time. Don’t accidentally squander this by using one-size fits all approaches like target date funds.

- In your 40’s, you may have a longer time horizon than you may realize.

- As retirement gets closer, you need a strategy for dealing with “sequence risk.”

Getting your asset allocation right, that is the right mix of stocks and bonds, is one of the most important things any investor can do. A famous study of pension funds showed that asset allocation explained 95% of their investment returns. However, for individual investors, the “right” asset allocation evolves over time. A 30-year old’s portfolio should look very different from someone about to retire.

Unfortunately a lot of people neglect to update their allocation as they age, or they use overly simplistic rules of thumb in making age-based adjustments to portfolios. While the specific allocation that’s best for you depends on a lot more than just your age, here are some of the things you should consider when choosing your asset allocation.

In your 20’s and 30’s

By far the biggest advantage individual investors have is time. Stock prices are ultimately a function of company profits. As long as company profits are generally growing, stock prices should generally go up too. And as long as the economy is generally growing then company profits should rise. The more time you have, the more likely all of these statements will be true.

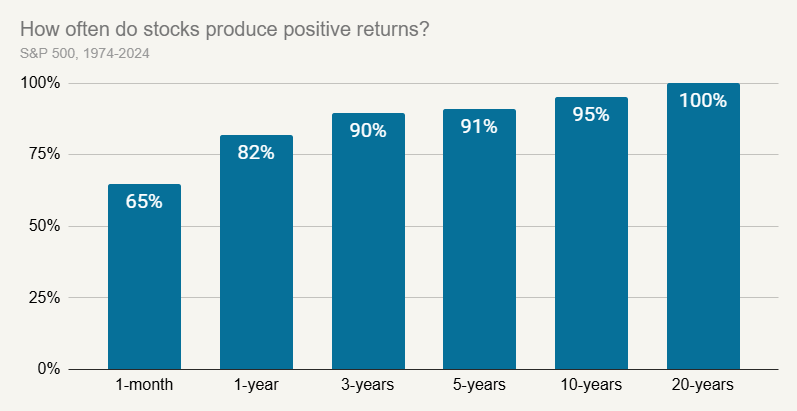

Source: Dow Jones S&P Indices

We can see this by looking at how often stocks produce positive returns over various time horizons. The chart above shows that over the last 50 years, stocks have only been up about 65% of months. But widen that to 5 years, not even that long of a time frame, your chances go to about 9 in 10. At a 20 year horizon, stocks have never had a negative return.

If you are in your 20’s or 30’s, you have this huge benefit of time. You could take full advantage of that by putting as much money into stocks as you can, doing things like not holding on to excess cash, putting as much as possible into your 401k, etc..

Speaking of your 401k, watch out for things like target date funds or asset allocation funds. Even if the target date is far off or the allocation says “growth”, it might still own some conservative investments. At your age, that’s not necessary. You can control your own asset allocation by holding a diversified set of stock funds.

In your 40’s

In your 40’s, the idea really isn’t that different. Even if you are thinking about retiring in 10 or 15 years, that’s still a pretty long time horizon.

There was really only one period in US history where stocks produced negative 10 year returns. That was the 10 years ending around 2009-2010.

That was a period that started with the bursting of the internet bubble and ended with the Great Financial Crisis. In other words, it took not one, but two major crises for stocks to wind up losing money over a ten year horizon.

Could there be another period with multiple crisis like this? Sure, nothing is impossible. Just bear in mind, it takes pretty extreme circumstances to result in stocks losing money over longer horizons

Perhaps more importantly when you are in your 40’s, you might need this portfolio to last you another 40 years or more. You need enough growth potential in your portfolio to not only cover what your spending needs in retirement, but also inflation. Now your exact allocation should depend on the details of your circumstances, but for most people, you should still own a pretty stock heavy portfolio.

In your 50’s and beyond

In your 50’s, retirement is probably getting closer for you, and now we’ve got to worry about something called “sequence risk.” This is the risk that stocks drop significantly just after you decide to retire. There are a few strategies to mitigate sequence risk that Facet employs. However, the easiest thing is to have your portfolio grow enough while you are still working. This allows you to better withstand a down market.

For most people, while you are still in the workforce, it is relatively easy to keep working another year or two. But once you retire, coming back into the workforce is much more difficult.

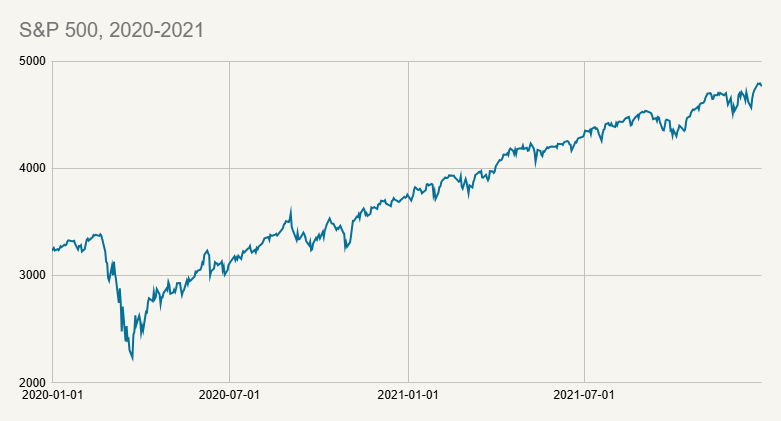

For example, say one had been planning to retire in 2020, but then COVID hit and stocks took a big dive.

Source: Dow Jones S&P Indices

As we can see from the graph above, stocks wound up recovering all their losses and then some by the end of 2021. Anyone who went ahead and retired in 2020 permanently impaired their spending power in retirement. But had one waited just one more year to retire, that problem would have gone away.

Think of it like having a Plan A and a Plan B as you get to retirement. Plan A is to have a portfolio that grows enough to mitigate the impact of a bear market right as you retire. Plan B is work another year or two if a bear market comes just before you retire. This doesn’t eliminate sequence risk, but having just a little flexibility can make a big difference.

Your best asset allocation depends on more than just your age

No matter what your age, there’s no one-size fits all answer to how you should allocate your portfolio. A lot depends on things like your current income, access to a pension, tax circumstances, potential inheritance, and even just other goals besides retirement. But regardless, remember to think about investment risk in terms of the time horizon you have.