Key takeaways

- A “bear market” is when stocks decline by at least 20%. These are pretty rare, and often the market rebounds relatively quickly.

- There are two specific risks that could cause a bear market in 2025. One is a recession, perhaps caused by some kind of policy change such as tariffs.

- The other is some disruption, especially related to AI, that causes tech stocks to decline.

- We don’t think selling stocks outright is a good strategy, but there are ways Facet is allocation portfolios to add some defense against these risks.

The fear of every investor is that a big market downturn is just around the corner. Right now there are some obvious candidates for how a so-called “bear market” could occur. Maybe it is something about tariffs or other new policies coming out of the White House. Or perhaps a bursting bubble in AI stocks? It is true that there are risks in the market today, but there are always risks in the market. Rather than try the very difficult task of timing the market, we prefer to build protection into portfolios. Here are some examples of what we mean.

Bear markets are rare

In finance jargon, a bear market technically means a decline in stocks of at least 20%. I.e., we’re not talking about the normal fluctuations that routinely occur. True bear markets are pretty rare.

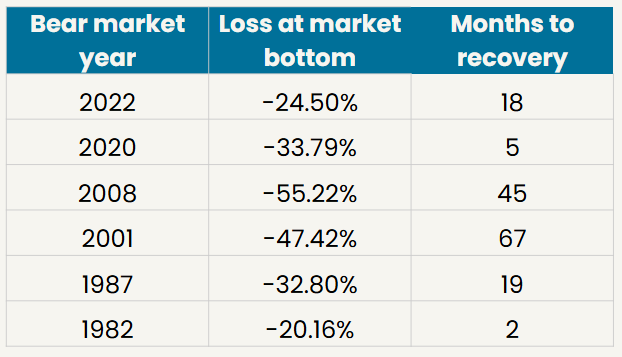

Source: Dow Jones S&P Indices

In the last 50 years, the S&P 500 has only had six of them, listed in the table above. The “recovery” column shows how many months after the bear market did the market erase all losses. Notice that two of these bear markets only lasted a few months before rebounding and erasing the loss. Two more lasted just about a year and a half.

However you slice it, bear markets are rare. This is why we believe trying to time such a downturn is so difficult. While there are always risks in the market, these risks only turn into bear markets occasionally.

Bear markets tend to occur around recessions

Most of these bear markets have happened around recessions. So if we’re searching for how a bear market could hit in 2025, one place to start is by ascertaining what might cause a recession.

Now while it is true that recessions can come on suddenly, there’s no data pointing to a slowdown right now. Consumer spending is strong, job growth is solid, business confidence is rising, and bank lending is expanding. Normally all those factors are going the other direction in a recession.

One clear and present risk is tariffs, something Facet has covered a few times in other articles. That is definitely a policy that could harm the economy. Now as of the time we are publishing this, Trump hasn’t actually implemented any new tariffs. This has a lot of Wall Street analysts hopeful that Trump intends on using tariffs as a negotiating tool, and if so, the tariffs that do get enacted will be more targeted.

If tariffs are targeted or short-lived, it is very unlikely to cause a recession in out view. That being said, tariffs of any sort will probably have some negative effects, and therefore it is worth considering these effects in your portfolio. More on this below.

AI disruption

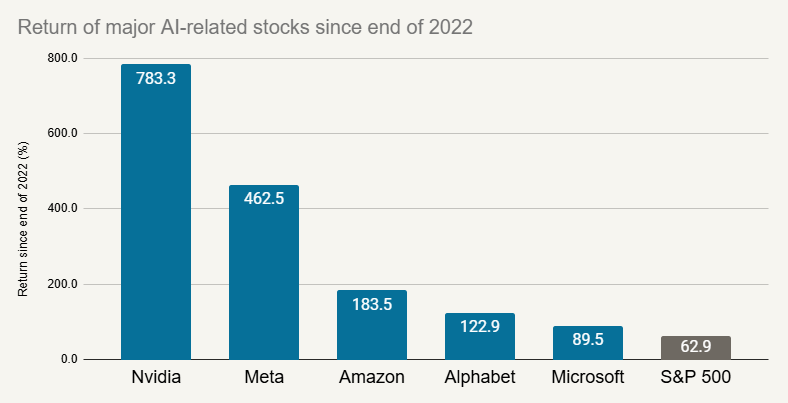

The other big risk in 2025 is around big tech stocks. Enthusiasm around artificial intelligence has driven huge gains in a pretty narrow set of stocks. What if something happens that either cools the excitement around AI or threatens the dominance of these companies?

Source: Bloomberg

That’s certainly possible. Technology is always changing, and so some kind of disruption can happen at any time. Recently a Chinese company called DeepSeek announced a breakthrough on an AI model that uses cheaper, less sophisticated semiconductors. This touched off a severe sell-off in semiconductor stocks on January 28, with Nvidia stock dropping nearly 17% in a single day.

Now there are many questions surrounding DeepSeek, including whether it improperly leveraged existing AI models to boost their results. Regardless, this episode shows that there are risks to this AI stock frenzy. It is possible that AI itself lives up to the hype, but that these mega tech companies aren’t the ones that capture those gains.

Remember that as the internet was being built out in the 1990’s, companies like Cisco Systems, Intel and Yahoo were among the big winners. Yahoo is no longer an independent company, and neither Cisco nor Intel stock has surpassed its 2000 high. The internet changed the world, but these companies weren’t the winners.

This risk is made especially acute because of how large these companies have become. The five stocks in the graph above make up about 24% of the S&P 500. Given this large weight, it would be possible for just a few companies to perform poorly and drag down the whole index, even if the rest of the economy was still performing reasonably well.

Playing defense the right way

So what can you do about all this? One thing we definitely don’t recommend is exiting the market entirely. As we said above, bear markets are rare, and most of the indicators we see right now are pretty positive. Remember too that there’s always reasons why the stock market could drop. If you are constantly running in fear of a down market, you’ll wind up missing out on too many positive years.

However it is possible to lean away from some of these risks. There are several things Facet is doing that we believe could provide some protection in the event of a bear market.

In terms of tariffs, good chance that if the tariffs are targeted, they’ll be targeted at emerging markets countries. This includes China but also includes other Asian exporter countries, also countries like Mexico and the rest of Latin America. It may be that the impact of tariffs is small in the U.S., but large in those countries. Hence we are underweight stocks in emerging markets.

Note that if you just sell emerging markets and buy the S&P 500, you actually are increasing your exposure to the other big risk we outlined: big tech companies.

Rather we’re currently underweight big cap tech slightly and overweight mid-cap stocks. By our analysis this is the cheapest part of the US market, and could benefit from a broadening of earnings growth while also providing some protection if tech stocks were to take a stumble.

We have also built in some other protections in the event that a surprise recession were to occur. These include owning more companies with lower debt burdens, and higher profit margins. These companies tend to have more financial flexibility, potentially making them more resilient to an economic slowdown.

We also have a healthy weight to non-U.S. companies. If the U.S. hits a recession, good chance that the Federal Reserve winds up cutting interest rates. That would tend to cause the U.S. dollar to weaken, which tends to boost the return of non-U.S. stocks.

These are some examples of how it is possible to play a little defense without being out of the market entirely. By staying in the market, you will likely capture gains should the market keep rising. But by leaning away from some of these risks, you might be able to avoid some of the suffering should the market turn weaker.