Facet’s Alternative Investments

Philosophy, Strategy, and Implementation

Introduction

For most investors, a mix of traditional stocks and bonds are adequate to meet your investing needs. However, for some investors, adding high quality alternative investments can enhance diversification and perhaps even boost returns. These non-traditional investments do come with some risks, including illiquidity, difficulty accessing high quality managers, and high fees. However, if one can navigate these risks, there can be benefits to including alternatives to an investment portfolio.What are “alternative investments?”

What exactly constitutes an “alternative investment”? The definition is broad. Basically any investment strategy that is not traditional stocks and bonds. Common examples include private equity, private credit, hedge funds, real estate, commodities, and even tangible assets like art and collectibles. The definition of “alternative” has evolved over time: at one time strategies like emerging markets or real estate stocks were considered alternatives, but now are thought of as mainstream. Historically, most of these strategies were only offered in complex vehicles that generally required very high minimum investment levels. Furthermore, once you were invested it was difficult if not impossible to withdraw your money. This has started to change, with some alternative investment providers offering certain strategies in mutual fund or ETF vehicles. While the quality of these strategies varies, this has opened up the world of alternative investments to more people.Facet’s Alternative Income Strategy

Within the wider universe of alternative investments, Facet has created a portfolio of income-focused investments we are calling the Facet Alternative Income Strategy. The strategy utilizes funds that primarily invest in private credit and private real estate. The term “private credit” involves loans made to businesses or other entities similar to traditional company bonds. However unlike bonds, these loans do not trade and are generally held by the fund until maturity. Also unlike traditional bonds, these loans are mostly floating-rate. This means that the income generation rises when interest rates rise. This creates some protection during a rising rate and/or higher inflation period. These company loans do carry risk, and for this risk investors are paid a higher rate of income than is typical of more traditional bonds. This risk is somewhat mitigated by the fact that the loans are predominantly “first lien.” This means that in the event of a bankruptcy, our funds usually have first claim on all the company’s assets. Private real estate simply means investing directly in real estate projects. The funds we utilize invest overwhelmingly in “stabilized” real estate. This means projects where the building is already occupied, major construction is complete, and lease income is already being realized. This helps mitigate some, but not all, of the risks of real estate projects, including construction cost overruns, delays in leasing, etc. In both the private real estate and private credit, there is also some return premium for the fact that the asset is illiquid. Investors demand higher yields given that the asset is not easily traded. In finance this is called an “illiquidity premium.”Benefits of alternative investments

Alternatives offer a few benefits when added to a portfolio of stocks and bonds. First is the potential for diversification. Traditional asset classes often exhibit strong correlations, meaning they tend to move in the same direction. During market downturns, both stocks and bonds can decline simultaneously, as happened in 2022. Alternatives, due to their unique characteristics and often lower correlation with public markets, can act as a buffer, mitigating losses and potentially stabilizing portfolio returns. For instance, both stabilized real estate and private credit generate the vast majority of returns from income generation. This income stream contributes to portfolio stability. The table below shows how private credit and private real estate have performed during the last three down years for the S&P 500 as well as during the Covid-related bear market during the first quarter of 2020.| Stocks1 | Bonds2 | Private Credit3 | Private Real Estate4 | |

|---|---|---|---|---|

| 2008 | -37.0% | 5.2% | -6.5% | -6.5% |

| 2018 | -4.4% | 0.0% | 8.1% | 6.7% |

| 1Q 2020 | -19.6% | 3.2% | -4.8% | 0.7% |

| 2022 | -18.1% | -13.0% | 6.3% | 5.5% |

1 Stocks are represented by the S&P 500 Index

2 Bonds are represented by the Bloomberg Aggregate Index

3 Private Credit is represented by the Cliffwater Direct Lending Index

4 Private Real Estate is represented by the NCREIF Index

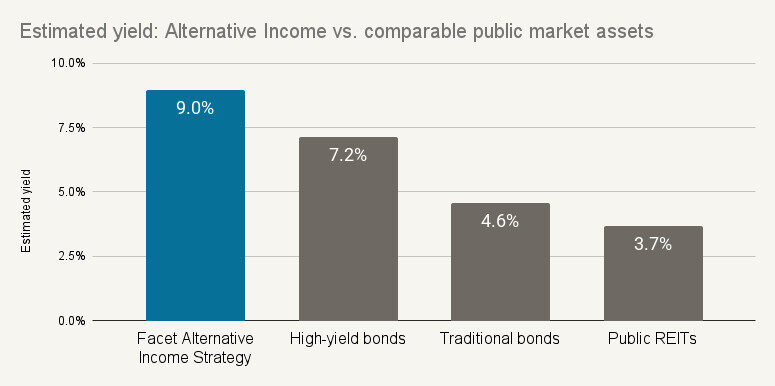

Another compelling argument for alternatives is the potential for enhanced returns. Because of the illiquidity premium mentioned previously, the income generation on these private assets tends to be greater than comparable publicly traded investments. The chart below shows the yield from the funds in the Facet strategy vs. similar public markets assets. In this case, bonds being the public market comparable for private credit and REITs or real estate stocks being the comparable for private real estate.

5 The Facet Alternative Income Strategy was started in 2025. The payout figure quoted was calculated based on the actual performance of the funds selected to be in the strategy although the strategy itself did not exist in 2024. In addition, this figure was quoted net of any fees charged by the underlying fund products and does not include the Facet planning fee. This is intended to be illustrative of how the underlying investments in this strategy have performed. Past performance is not a guarantee of future performance.

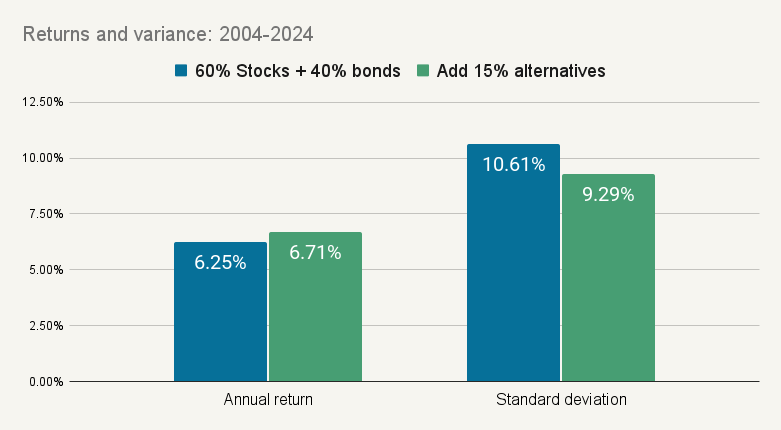

Putting these two benefits together, we can look at how alternatives may enhance a portfolio. The chart below shows a portfolio made up of 60% global stocks and 40% bonds in blue compared to that same account but adding 15% to alternatives. For alternatives, we combined an index of private loans with an index of private real estate in approximately the proportions used in the Facet Alternative Income portfolio. The bars on the left are returns from 2004 to 2024, and the bars on the right are the standard deviation of returns. Standard deviation is a measure of how much the value of a portfolio fluctuates from quarter to quarter.

6 Stocks are represented by the Morningstar Global index. Bonds are represented by the Morningstar Core Bond index.

7 Alternatives are represented by 80% the Cliffwater Direct Lending Index and 20% the the NCREIF Index

We can see from this chart that adding alternatives slightly increased returns over this period, while also slightly decreasing portfolio variability. What this tells us is that at least historically, alternatives would have acted as a valuable diversifier to a portfolio of traditional stocks and bonds. Put another way, the portfolio with alternatives would have earned slightly more return, while also being more stable from quarter to quarter.

Risks of alternative investments

Illiquidity

However, the world of alternative investments is not without its challenges. One of the primary concerns is illiquidity. Unlike publicly traded stocks and bonds, which can be bought and sold easily, many alternative investments are illiquid. Traditionally, most private investments typically have a lock-up period of several years, meaning investors cannot access their capital during that time. The Facet Alternative Income Strategy uses interval funds to access these private investments. These funds do allow for quarterly withdrawals in most circumstances, but this is a clear difference from traditional stocks and bond investments. In addition, these funds are not required to honor all withdrawal requests. Hence investors in the Facet strategy should assume that this is a long-term investment.Fees

Furthermore, alternative investments often come with higher fees compared to traditional investments. Oftentimes private investment funds charge what is called a “2 and 20” fee structure, meaning a 2% annual management fee plus 20% of profits, sometimes called a “performance fee.” The interval funds Facet will utilize work slightly differently. The average management fee of the funds inside the strategy is 0.94%. In addition, some funds do charge a performance fee. In this case, the fee is a percentage of profits above a threshold. This adds approximately 0.25% to total fees in strong years. Lastly, mutual fund rules require that any costs related to investments, such as financing costs or lines of credit, are added to the fund expense ratio. This adds another 1-1.2% to the total expenses of the strategy. This means the total expense ratio for this strategy would be approximately 2.5%. Note that the returns and dividend yield quoted above are calculated net of these fees.Manager selection

The world of alternative investments is characterized by a significant performance dispersion among managers. This means that the difference in return between above-average and below-average managers can be much larger than in traditional stocks and bonds. Hence in order to successfully invest in alternatives, one must be able to identify and get access to high quality managers. In private credit and real estate specifically, a manager’s ability to source deals alone is a key component to performance. In the public markets, anyone who wants to buy a given stock can just do so. Access to the market isn’t relevant. In private markets this is not the case. Not every investment opportunity will be available to every fund. Managers with a long history in the space, good relationships with counterparties, and a reputation for being good partners tend to get access to the best deals. In addition, private investments tend to require a different level of expertise. Access to information in alternative markets is often limited, creating what is called an “information asymmetry.” Skilled managers who can access and interpret information effectively have a distinct advantage. Lastly, there can be significant value added through the structuring of deals. In public markets, the legal provisions of any given stock and bond are roughly the same, and aren’t negotiated by any one party. In private markets, the fund manager usually has substantial leeway to negotiate terms. A private asset manager with the right team and expertise can build significant protections for investors through these negotiations. Facet believes that alternative investments are not worth doing if they cannot be done right. The managers we have selected for the Alternative Income Strategy are the same managers that the world’s largest investors, such as big state pension funds and university endowments, utilize. In this strategy, you will be investing alongside these highly sophisticated investors.Cyclical risk

The underlying assets in the Alternative Income Strategy are primarily private credit and real estate. These assets are not immune to the economic cycle. When the economy weakens, it is likely that some of the loans in the private credit strategies will become distressed. Similarly, economic recessions tend to be a time when real estate lease rates come under some pressure. There are a number of mitigants that help reduce losses during these periods of weakness. Among these protections may include pledges of hard assets, special legal rights negotiated by the manager, and even the fact that private asset managers rarely become forced sellers of assets. Despite this though, we would expect that during recessions this strategy may lose money, at least in the short-term.Conclusion

Despite these challenges, the case for alternative investments remains strong, particularly for sophisticated investors with a long-term investment horizon and a tolerance for illiquidity and complexity. By diversifying beyond traditional asset classes, investors can potentially enhance returns, reduce portfolio volatility, and gain access to unique investment opportunities. Alternative investments are not appropriate for every investor. However for those that it does make sense, we believe Facet’s Alternative Income Strategy can be a beneficial addition to traditional portfolios.1 Stocks are represented by the S&P 500 Index

2 Bonds are represented by the Bloomberg Aggregate Index

3 Private Credit is represented by the Cliffwater Direct Lending Index

4 Private Real Estate is represented by the NCREIF Index

5 For funds and REITs, the yield is calculated as the amount of dividends paid to investors divided by the fund’s price. For bonds, yield measures the income generation of a bond if held to the date it is expected to be retired.