The information provided is based on the published date.

Key takeaways

- A Roth IRA is an individual retirement account funded with after-tax dollars that grows tax-free

- Withdrawals from a Roth IRA during retirement are not subject to taxation, provided specific rules are followed

- Individuals must have earned income to contribute to a Roth IRA

- Contributions are not deductible from taxable income but if you hold for 5 years and are at least 59 1/2 years old, withdrawals are tax-free

- Tax benefits include no required minimum distributions (RMDs) and tax-free withdrawals in retirement

What is a Roth IRA?

A Roth IRA is an individual retirement account funded with after-tax dollars that grows tax-free. Roth IRAs offer a distinctive advantage: the ability to withdraw funds without incurring an additional tax liability, provided that specific rules are followed.

In contrast to the majority of retirement accounts, distributions from a Roth IRA during retirement are not subject to taxation because they are not considered taxable income.

Contrary to popular belief, a Roth IRA is not an investment, but rather an individual retirement account that can hold various securities.

Depending on your Roth IRA custodian, you will typically have several choices of securities to invest in. These include stocks, bonds, ETFs, mutual funds, and CDs. The performance of your Roth account will depend on how well these underlying investments perform.

Who is eligible to contribute to a Roth IRA?

First and foremost, to be eligible to contribute to a Roth, you must have earned income. Earned income includes the following:

- Salaries

- Bonuses

- Hourly wages

- Tips

- Self-employment income

- Commissions

What isn't considered earned income?

- Unemployment checks

- Social Security benefits

- Investment income

- Retirement distributions

- Alimony

What are the Roth IRA contribution and income limits?

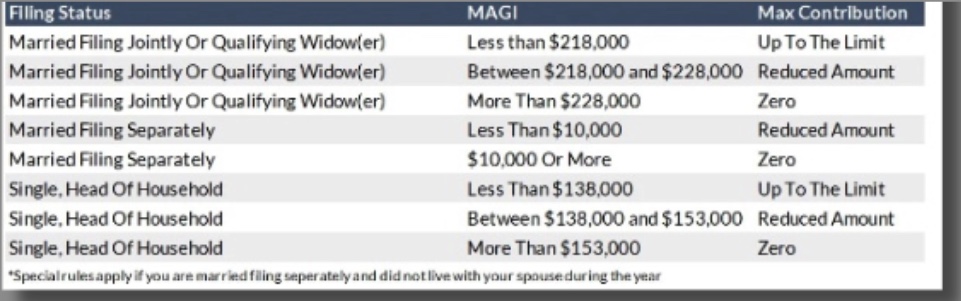

If your income exceeds a specified threshold (determined by your tax filing status and living situation), you cannot contribute to a Roth IRA. If you make too much, you have the option to consider a backdoor Roth IRA strategy.

Backdoor Roth IRA: What it is and how to do it

To find out if you can contribute to a Roth IRA, you must know your modified adjusted gross income (MAGI).

You must know your adjusted gross income (AGI) to determine your MAGI. In most cases, your AGI and MAGI will be nearly identical. According to the IRS website, your MAGI is generally your AGI plus any tax deductions received for student loan interest payments.

The 2023 Roth IRA contribution limit is $6,500 for anyone under 50. You can contribute an additional $1,000 ($7,500) if you are 50 or older. This is known as a "catch-up" contribution.

2023 Roth IRA contribution rules

Tax implications

While you can deduct 401(k) and traditional IRA contributions from your taxable income, the same does not hold true for Roth IRA contributions. However, once you reach the age of 59 1/2 and have maintained your Roth IRA for a minimum of five years, you can withdraw funds from the account entirely tax-free.

Since Roth IRA contributions are made using after-tax dollars, you have the flexibility to withdraw those contributions at any time without incurring taxes or penalties. It’s important to note that this only applies to your contributions, not your earnings.

Roth IRA benefits

Tax benefits

Above all, the best Roth benefit is tax-free retirement income. Depending on your contributions and investment performance, tax-free money from your Roth IRA can save you a lot in tax savings. What’s more, if you make a large purchase after 59 1/2, your tax bracket won’t change since you won’t have to pay taxes on your withdrawals.

No RMDs

Unlike traditional IRAs, you don’t have to take required minimum distributions (RMDs) on Roth IRAs once you reach a certain age. This means you can keep your money in the account for as long as you wish and continue earning tax-free growth.

Flexibility and control

As previously mentioned, you have the option to withdraw your contributions at any time without tax consequences or penalties. Additionally, you can control how much and when you contribute to your Roth IRA.

Differences between traditional and Roth IRAs

The main differences between traditional and Roth IRAs lie in their tax benefits and contribution limits.

- Traditional IRAs offer an immediate tax deduction for contributions, but withdrawals in retirement are taxed as regular income. On the other hand, Roth IRAs do not provide an upfront tax break, but distributions in retirement are entirely tax-free.

- Since Roth IRA earnings are not subject to income tax, they can be a more effective savings tool than traditional IRAs if you expect to be in a higher tax bracket in retirement.

- Traditional IRAs have required minimum distributions (RMDs), while Roth IRAs do not.

Final word

When planning for retirement, it's important to consider your unique financial situation and objectives to determine the best savings vehicle for you. It’s best to consult a financial advisor to determine which account best suits your needs. Regardless of which type of account you choose, saving for retirement is crucial in order to secure a financially stable future.

Consider contributing as early and as much as possible to reap the benefits of compounding interest. Remember, it’s never too early or late to start saving for your retirement. So why wait? Start planning now and take control of your financial future.