Key takeaways

- The Federal Reserve increased the short-term interest rate target by 0.25% to 5.50% at its July 26 meeting after pausing rate hikes six weeks prior

- Fed Chair Jerome Powell warned about potential future rate hikes due to inflation remaining above the Fed’s 2% target

- The Fed's future decisions will be "data dependent" and based on how quickly inflation improves

- Powell emphasized the Fed's commitment to fighting inflation during the press conference, but also acknowledged recent improvements in inflation data

- It is uncertain if this will be the last hike of 2023 as it depends on inflation data and the Fed's mandate

- The Fed is fading as a driver of stock market volatility, with investors more focused on predictability of rates and improving profit outlooks

Well, that didn’t last long.

Just six weeks ago, the Federal Reserve paused rate hikes, but at their July 26 meeting they were back at it, increasing the short-term interest rate target by 0.25% to 5.50%, a 22-year high.

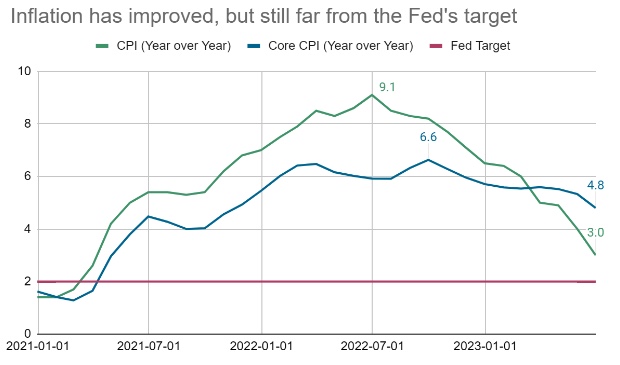

Moreover, Fed Chair Jerome Powell warned there may be more hikes on the horizon. While inflation has moderated recently, it remains well above the Fed’s 2% target.

Here are our thoughts on what this Fed meeting tells us about what comes next.

What happened at this meeting?

By the time the meeting came around, markets had widely expected a 0.25% rate hike. Over the last few weeks, several Fed officials communicated a preference to hike at this meeting.

When that happens, it is often a sign of a coordinated communications effort to make sure the market understands the Fed’s intentions. They don’t like surprising the market, so they will use these public speeches to guide market expectations.

Powell emphasized the Fed’s continued commitment to fighting inflation during his press conference.

He repeated an often-used line: An economy without price stability "doesn’t work for anyone."

He did acknowledge the recent improvement in inflation data, saying it was “welcomed,” but also made clear that the Fed isn’t satisfied with Core inflation at 4.8% over the last year, far above their 2% target.

He said there was “a long way to go” to achieve price stability and that the Fed is “strongly committed” to getting inflation back to 2%.

Source: Bureau of Labor Statistics

He further warned that additional rate hikes could still be necessary, saying the Fed would do “whatever it takes” to normalize inflation.

In Powell’s press conference after the June meeting, he noted that most committee members favored two more rate hikes over the course of 2023.

Today, he backed away from that view slightly. He was asked a few times during the press conference about the SEP, and while Powell said they were “prepared” to raise rates more, he stopped short of endorsing a second rate hike in 2023.

The idea that the Fed could be done after this hike wasn’t surprising. Traders were already doubting that the Fed would actually wind up hiking a second time in 2023, even before this meeting.

Based on futures market pricing, the odds of another rate hike in either September or November Fed meetings were only about 30% leading up to this meeting. However, it did surprise the market that Powell was willing to openly discuss the possibility that they are done quite as clearly as he did.

That being said, Powell made clear that the Fed’s future decisions were not set in stone. He said the Fed would be “data dependent,” meaning that if inflation accelerates they could hike several more times, but if inflation improved quickly, they could be done.

Why hike now but not June?

While the Fed did not hike rates in June, Powell strongly implied at the time that a rate hike in July was likely. A lot of commentators found this curious: Why would the Fed pause in June if they were so sure of a hike in July?

Powell was asked explicitly about this during the press conference, and frankly, his response was somewhat meandering and unclear. We think the reason for the pause and then hike is fairly simple: the Fed wanted to slow the pace of rate hikes but not stop entirely.

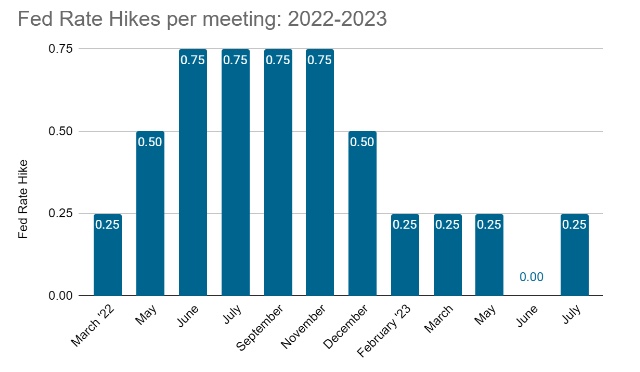

Source: Federal Reserve

The chart above shows the pace of rate hikes over the last 18 months, with each point being the date of a Fed meeting and the bars representing how much the Fed hiked at that meeting.

What we see is that the Fed quickly ramped up rate hikes in the middle part of 2022, then decelerated in December and into 2023. The pause-then-hike over the last two months is just a continuation of the decelerating pace of hikes. Instead of hiking every meeting by 0.25%, they went to an every-other-meeting pace.

Note that this isn’t odd at all, given the Fed’s history. In each of the last two Fed rate hiking cycles (2015-2018 and 2004-2006), the Fed didn’t hike every meeting, and yet it was well known that additional hikes were likely.

Is this the last hike of 2023?

That begs the question, will this every-other-meeting pace continue? Or could the Fed be done hiking for this cycle?

As we said above, it all depends on the data. Certainly, if inflation were to accelerate, the Fed would resume hiking. Powell has made clear that the Fed’s price stability mandate is even more important than its employment mandate in the short term, and it will do whatever it takes to bring inflation back under control.

However, at least to us, what seems more likely is that inflation will continue to subside. The question is how quickly that will happen. More to the point, how quickly does the Fed need to see inflation improve in order to stop hiking?

It appears this question is not settled even among Fed officials. Economists almost universally agree that high inflation is a problem that the Fed needs to address, even if that requires damaging the economy. However, now that inflation is improving, there is yet to be a consensus about how patient the Fed should be.

Should they risk causing a deeper economic slowdown just to bring inflation down more rapidly? Or should they be patient and risk inflation getting stuck at a higher pace?

We are starting to hear this debate playing out in speeches from Fed officials. Over the last few weeks, we’ve heard Atlanta Fed President Raphael Bostic favor more patience. At the same time, Fed Governor Christopher Waller suggested that a second rate hike should come “sooner rather than later.”

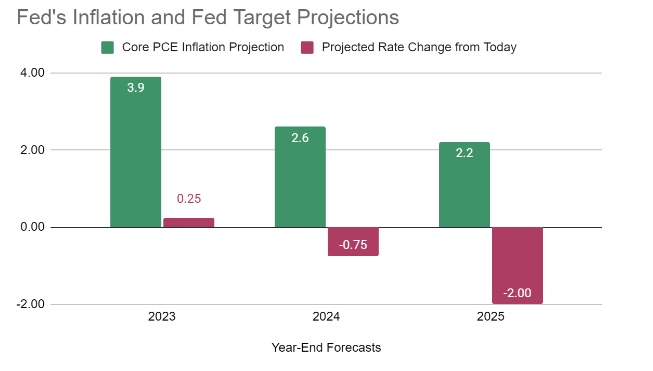

Here’s what we know. If we again look at the Fed’s quarterly Summary of Economic Projections (SEP), that includes the median core inflation projection from each Fed committee member.

It also includes how many rate hikes (or cuts) the median member favors. From these two projections, we can make a good guess as to how much inflation improvement the Fed requires before stopping hikes.

Source: Federal Reserve

The SEP shows the median Fed committee member thinks that if inflation ended in 2023 at 3.9%, then one more rate hike of 0.25% would have been appropriate.

But if inflation fell to 2.6% in 2024, then a handful of rate cuts would be in order. And even if inflation stays slightly above 2% into 2025, most Fed officials would favor several rate cuts.

This tells us a couple of important things about how the Fed thinks about inflation.

- First, they realize it will take a while before inflation actually returns to their 2% target.

- Second, there is a threshold where the Fed would be willing to end hikes and eventually even cut, even if inflation is still above target.

To be clear, 2024 and 2025 are a long way off, and a lot could change between now and then. However, this exercise gives us some important clues about how the Fed thinks about policy decisions as inflation continues to decline.

What does this mean for my portfolio?

It is clear that the Fed is fading as a driver of stock market volatility. Not so much in the short-term: as is common, there was a good bit of volatility during Powell’s press conference. However in 2022, the Fed and inflation seemed to be all that mattered, which led some to assume that unless the Fed backed off rate hikes (or even cut rates), stocks would struggle in 2023. What has happened is that stocks have had a strong year despite the Fed continuing to hike.

We believe there are two big reasons stocks have shaken off rising rates. The first is that stock investors care more about the predictability of rates than they do about the absolute levels.

In 2022, there was tremendous uncertainty about how high the Fed might hike and what would be required to get inflation to turn around.

Now, things are much more defined. We don’t know whether the Fed is done hiking or will hike 1-3 more times. However, we can be pretty confident the end game is near.

The second big lesson is that now there isn’t much uncertainty around the Fed’s path. Markets are focused on basic fundamentals. In general, the stocks that have outperformed so far this year have been the ones with improving profit outlooks - a sign of a healthy market.