The information provided is based on the published date.

Key takeaways

- The Morningstar Core Bond index has declined by 3.98% annualized over the past three years, with a -12.99% return in 2022

- The poor performance of bonds has led many to question their usefulness in a portfolio

- 2022 was an unusual year with historic interest rate hikes and inflation

- Long-term bond returns are dominated by income generation rather than price fluctuations

- Bonds are less volatile than stocks but produce less return; allocation decisions should be based on individual return needs and risk tolerance

The bond market has had a rough go of it lately. For the three years ending June 30, 2023, the Morningstar Core Bond index has declined by 3.98% annualized, having been particularly dragged down by a -12.99% return in 2022.

Given this poor performance, many are asking whether bonds still make sense as a major part of their portfolio.

In our opinion, the opportunity has rarely been better. Here’s why.

2022 was extremely unusual

The first thing to recognize is just how unusual 2022 was. The Fed hiked interest rates by 4.25% during the year, the largest move since it started publishing its interest rate target in 1994. The second largest year for rate hikes was just 2.5%.

If we want more history, we could look at the yield on the 10-year Treasury, which rose by 2.3% in 2022. That is also the most significant increase in the 10-year rate since first issued in 1962. In the sixty years between 1962 and 2022, the 10-year only rose by 2% or more two times before 2022.

When bond yields rise, the price declines. This is why these historically large moves higher in interest rates led to historically large declines in bond prices.

It is also illuminating to consider what it took to spark such historic moves in interest rates. Inflation was far higher than anyone expected, with the Consumer Price Index reaching as high as 9.1% during the year. This was the highest rate in over 40 years.

Of course, anything could happen. It would be possible to see another year similar to 2022 happen again.

But we should at least acknowledge that for that to happen, inflation would probably have to spike again, the Fed would have to resume hiking at an all-time rapid pace, and the 10-year Treasury would probably have to suffer another record increase in yields.

To have all that happen once is one thing. It would be all the more unusual for it to happen twice in short succession.

Income generation dominates long-term bond returns

There are two sources of return for bonds (and, by extension, bond funds).

- Price return: As we said above, as yields go up, prices go down, and vice versa.

- Income generation: The periodic interest payments your bonds pay you.

Yield is a very close approximation for the income generation of a bond portfolio. It is essentially a measure of how much return you would expect from a portfolio over a one-year horizon if interest rates remained unchanged.

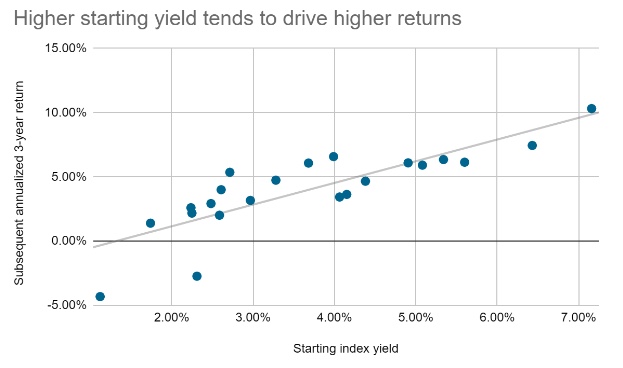

Note that we said above that when yields rise, bond prices fall. However, because yield is an estimation for the forward income return of a bond fund, it stands to reason that higher yields today could mean higher returns in the future. We can see this pattern historically.

The chart below shows the rolling 3-year return for the Morningstar U.S. Core Bond index on the vertical axis and the starting yield for that period on the horizontal axis. It measures how much today’s yield influences bond returns during the subsequent three years, from 1999 to today.

Source: Morningstar

Here, we see that as the starting yield goes up, so does the future return. The gray line shows the overall trend.

Remember that today’s yield on the Morningstar index is 4.79%, meaning today’s starting yield is on the high side of recent history.

This chart makes sense when you realize that long-term bond returns are dominated by income generation. While price movements in bonds can be major in the short term, they tend to even out over the long term.

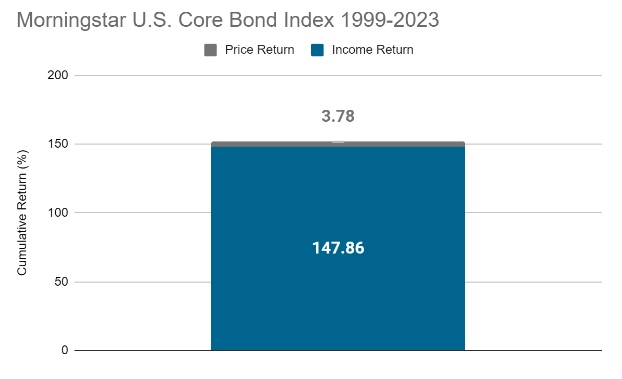

The chart below shows the sources of return for the Morningstar index from 1999 to today.

Source: Morningstar

Over this period, the Morningstar index has returned about 151.6% cumulatively, but just 3.8% of this return came from price fluctuations. The rest came from interest payments.

If all you do is watch the price of your bond fund go up and down daily, it can be easy to conclude that you need to hope interest rates fall to make money in bonds.

However, the above analysis shows this isn’t true. As a matter of fact, because interest payments make up the bulk of your long-term returns, bond investors actually want bond yields to rise and stay high.

The right bond allocation comes down to you

When we are often asked whether now is a good time to own bonds, the question is about whether we think bond prices will go up or down.

We think that’s the wrong question. Instead, we believe this allocation decision has much more to do with your situation than any market forecast.

Going forward, we expect bonds to be less volatile than stocks but produce less return. If your goals are long-term, we think you should base your bond allocation on your return needs and risk tolerance.

If your goals are short-term, you should be aware that even if 2022 turns out to be an outlier year, general bond funds will likely post negative returns occasionally. For our members with short-term goals, we usually recommend something like our Short-Term Strategy or something else with low volatility.

All of this is to say that if a bond allocation is right for you, then now is a perfectly good time to own bonds.

Tom Graff, Chief Investment Officer

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser headquartered in Baltimore, Maryland. This is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. Past performance is not a guarantee of future performance.