The information provided is based on the published date.

Key takeaways

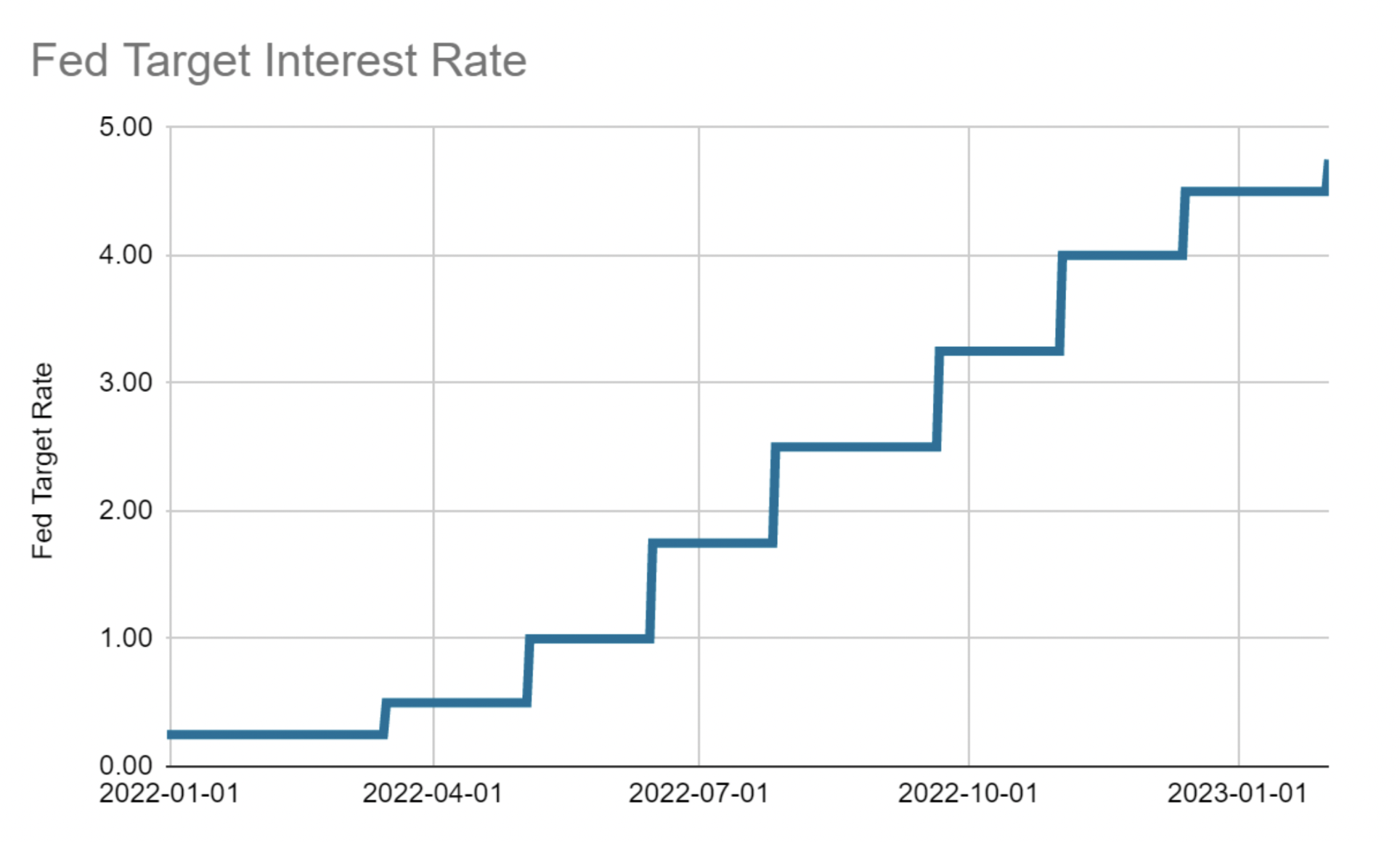

- The Federal Reserve raised its interest rate target by 0.25% at their February 1 meeting

- Fed Chair Powell said the disinflationary process has started

- Powell was careful not to sound overly confident, though. As the Fed moves toward potentially pausing rate hikes in the near future, Powell wants to be sure markets don’t misinterpret the Fed’s thinking

- Looking forward, Powell warned that even once the Fed pauses rate hikes, they are likely to keep interest rates relatively high for “some time” thereafter

As was widely expected, the Federal Reserve raised its interest rate target by 0.25% at their February 1 meeting. The real drama wasn’t the rate hike itself but in Fed Chair Jerome Powell’s post-meeting press conference, where the Chair sounded somewhat optimistic about the path for inflation and the economy for the first time. Here’s what he said and why it matters for your portfolio.

“The disinflation process has started”

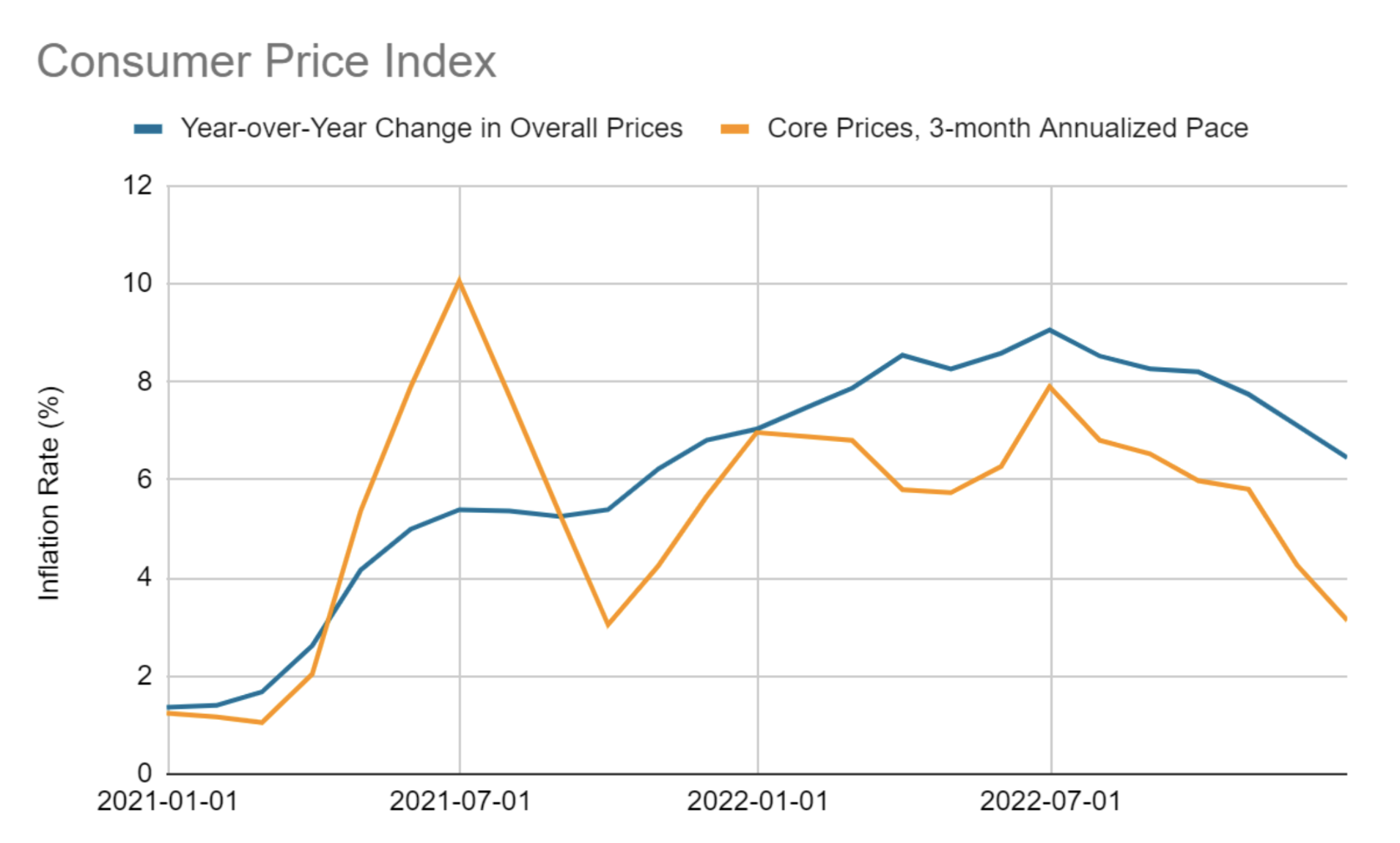

During this press conference, Powell said, “We can now say, for the first time, that the disinflationary process has started.” The fact that Powell used the term “disinflation,” which simply means falling levels of inflation, is notable. While inflation data has been declining for the last three months, Powell has barely acknowledged this improvement. In fact, the word “disinflation” hasn’t left his lips in any of the three prior press conferences.

Source: Bureau of Labor Statistics

Now, by saying the disinflationary process has begun, not only is Powell acknowledging the better inflation data recently, but he is also saying that he expects further improvements. This strikes a very different tone than other recent press conferences. In December, Powell said that he needed “substantially more evidence to give confidence that inflation is on a sustained downward path.”

Given Powell’s statement about the “disinflation process,” we can safely conclude that Powell feels much more confident that inflation is heading in the right direction. Markets took this statement and some others Powell made during the press conference to suggest that the end of rate hikes could be in view.

“We are going to be cautious about declaring victory”

Powell was careful not to sound overly confident, though. After all, inflation has fooled them before. The Fed has acknowledged that they waited too long to respond to rising inflation in 2021, thinking it would turn out to be “transitory.” The Fed also views maintaining price stability as its most important job. Powell repeated a phrase he has used in several public appearances: “Without price stability, the economy does not work for anyone.”

As the Fed moves toward potentially pausing rate hikes in the near future, Powell wants to be sure markets don’t misinterpret the Fed’s thinking. They are likely to stop hiking rates before inflation gets all the way to their 2% goal, but that won’t mean they are satisfied with a higher level of inflation. Instead, they expect the “disinflation process” to continue even without further rate hikes. However, if that turns out to be incorrect, i.e., inflation reignites, the Fed won’t hesitate to restart rate hikes.

“Not very far from that level”

In this way, Powell was trying to walk a careful line. He made various statements suggesting a pause in rate hikes could come relatively soon, but he was careful to say that was highly contingent on continued softer inflation data.

Source: Federal Reserve

So when exactly might the Fed stop hiking rates? We could see them stopping as soon as their next meeting in March. While Powell said that the Fed expects “ongoing rate increases will be appropriate,” he later clarified that no decision had been made about March or any other meeting. Based on a few different questions Powell got during the press conference, we think he currently views two more rate increases of 0.25% each as his base case.

However, between now and the Fed’s next two meetings, we will get three more months’ worth of economic data. Fed Governor Chris Waller recently said he could be convinced to pause rate hikes given six months of subdued inflation data. The Fed’s May meeting could easily achieve that.

We would conclude that one more 0.25% rate hike in March is pretty likely. After that, all bets are off.

“So far, what we see is progress but without any weakening in labor market conditions”

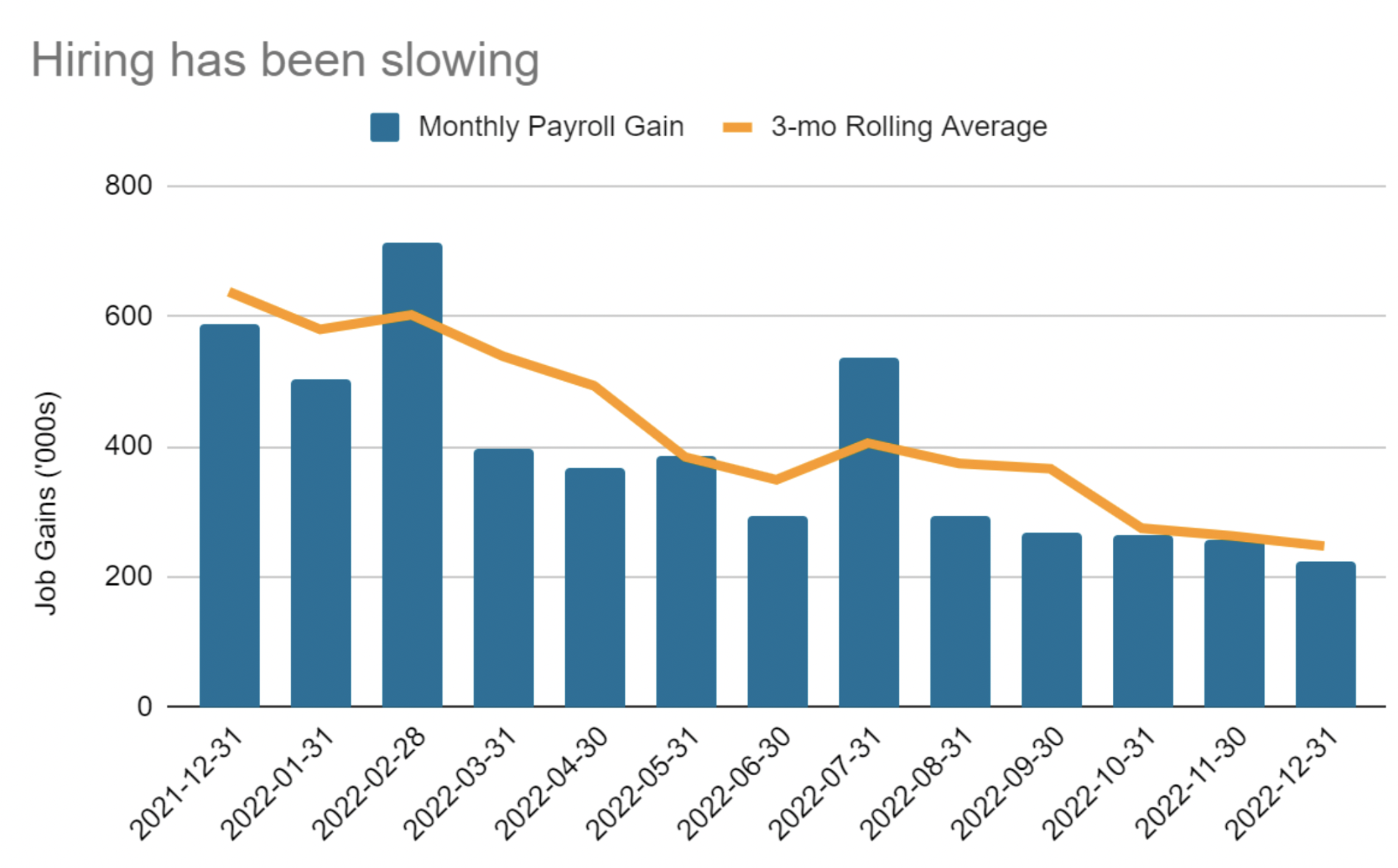

For months Chair Powell has been warning us that the labor market was “out of balance” and that reducing inflation would probably require “some softening of labor market conditions,” by which he means an increase in unemployment.

While Powell repeated these statements during this presser, he acknowledged that so far, inflation has improved without requiring major damage to employment. Right now, it isn’t completely clear how or why this is happening. It may be that inflation was driven more by reverberations from the COVID-era government stimulus. Households built up huge savings balances during this period, and perhaps as those balances were being spent down, it created enough excess demand for goods to fuel inflation.

It is also true that while unemployment hasn’t risen, job growth has slowed materially. For example, job growth averaged 444,000 per month in the first half of 2022 but slowed to just 247,000 in 4Q. Maybe that adjustment from outsized job gains to a more normal pace was enough to restore “balance” to the job market.

Source: Bureau of Labor Statistics

Both of these possibilities have been cited for a while as potential optimistic outcomes, and recent data has indicated that these more positive outcomes could be coming to fruition. For example, during 2022, there was a general consensus that a recession was likely in 2023, which was a major reason why stocks fell last year. However, if inflation can revert to near 2% without major damage to the job market, there is a decent chance the U.S. can avoid a recession. This improving optimism is one reason stocks have risen so far this year, specifically why they rose after this Fed meeting.

“Restrictive for some time”

Looking forward, Powell warned that even once the Fed pauses rate hikes, they are likely to keep interest rates relatively high for “some time” thereafter. Currently, futures markets indicate traders expect the Fed to cut rates toward the end of 2023. Powell doesn’t share this forecast as of now. However, the Fed may not have any reason to cut rates that quickly if the economy is relatively strong. Additionally, as Powell indicated, the Fed wants to be sure it achieves price stability before making any move that could revive inflation. That sentiment probably means the Fed will be more hesitant to cut rates than they might have been in recent years.

That being said, overall, this was a very positive Fed meeting. The Fed acknowledged what we all see: the economy is doing remarkably well, yet inflation seems to be falling. If this trend can keep up, 2023 could turn out to be a much stronger year for the economy and markets than was expected just a few months ago.

Tom Graff, Chief Investment Officer

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser headquartered in Baltimore, Maryland. This is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. Past performance is not a guarantee of future performance.