The information provided is based on the published date.

Key takeaways

- Interest costs have yet to increase due to short loan terms, but they likely will in the next few years

- Apartment construction is booming, which could further decrease rent prices and profitability of owning apartment buildings

- Office vacancy rates are currently at all-time highs with no end in sight, making investing in office spaces risky

- Real estate companies depend heavily on banks for financing, which may be curtailed post Silicon Valley Bank collapse

We are often asked if Facet invests in real estate companies, commonly called REITs. The answer is that we do, but the weighting is small.

In our view, there are four major challenges in the real estate sector that make it difficult for us to have a larger weighting in the space. Here are these four major reasons.

1. Higher interest costs haven’t been felt yet

Real estate companies use a lot of debt to finance their business. According to Bloomberg, the average REIT has debts equal to 6.3 times its profits. This compares to just 1.6 times for publicly traded companies in general. Because of all this debt, interest rates are extremely important to the profitability of real estate investing.

We’ve talked a lot about the jump in interest rates during 2022. However, companies generally don’t suffer higher interest costs until it comes time to take out new debts. For example, the mortgage on a commercial property is similar to your home mortgage. The rate doesn’t change until the end of the term. The main difference is that commercial real estate debt is usually a much shorter term than home mortgages: the rate either resets or the loan must be paid off between 3 and 10 years.

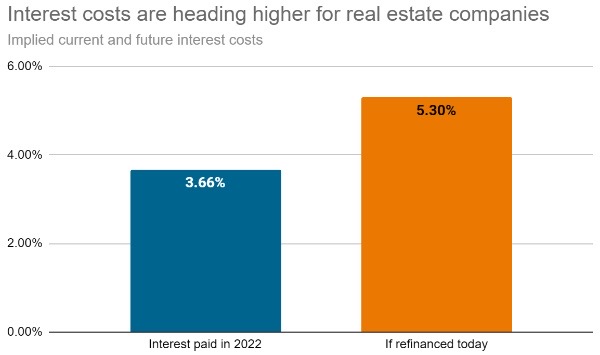

As a result, there hasn’t been much increase in interest costs at publicly traded REITs. Using Bloomberg data, Facet estimates that actual interest costs for 2022 at public REITs were 3.66%. Bloomberg estimates that if all these companies had to take out new loans at today’s rates, the cost would jump to 5.30%.

Source: Bloomberg and Facet calculations

This won’t happen all at once, but unless interest rates drop substantially, this suggests that REITs will face continually higher interest costs over the next few years, which will be a drag on their profits and, therefore, their ability to pay dividends.

2. Apartment rental rates are trending down while construction booms

In the immediate aftermath of COVID, the lease rates on apartments soared, but that trend has reversed in recent months. According to Rent.com, the median apartment rent peaked at $2,053 in August 2022 but has since fallen to $1,937. If lease prices keep falling, owning apartment buildings will be less profitable.

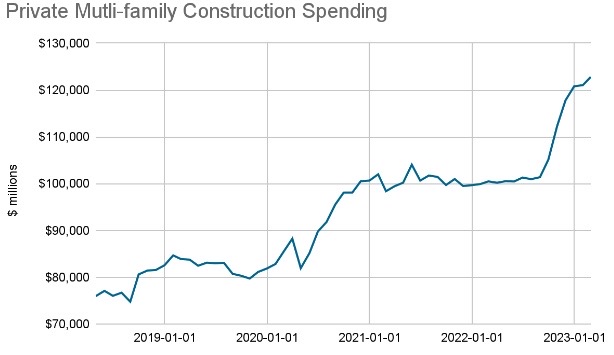

There is good reason to expect this lower price trend to continue. Currently, apartment construction is booming, with private spending on apartments at an all-time high.

Source: U.S. Census Bureau

It may seem odd that real estate companies are building more apartment units amid declining rent rates. Usually, more supply of rental units would only put more downward pressure on lease prices. However, it is likely that many of these construction projects started several months ago when lease rates were still rising. Once a project begins, apartment owners almost always finish the project, even if conditions change during construction.

What this means for investors is that multi-family projects are likely to suffer through a period of weak rental prices and/or higher vacancy rates. This might be good news if you are a renter but bad news if you are an investor.

3. Office vacancy at all-time highs with no end in sight

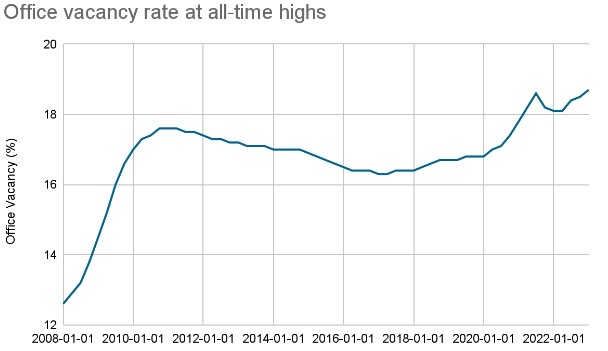

A lot has been written about the trend of increased working from home and the impact that’s having on the economy and society as a whole. One obvious impact has been on office vacancies, which are currently at all-time highs.

Source: Moody’s

This chart suggests that many companies don’t need as much office space as they did pre-COVID, likely because many employees work from home at least some of the time.

However, these elevated vacancies might not even tell the whole story. Office leases are usually three to five years long, meaning many haven’t even come up for renewal in the post-COVID period.

The upward trend in vacancies in the chart above could easily continue. And for those companies that decide to renew their lease, they will likely be able to negotiate more favorable terms.

One solution to the office vacancy problem could be to convert some of them into apartments. However, as we already discussed, apartment rental rates are falling too. So if anything, the oversupply of office space could exacerbate downward pressure on multi-family rent rates.

4. Real estate is especially dependent on the banking sector

As mentioned, real estate investing usually involves a lot of debt. Some of that debt comes from the bond market, but a large percentage comes from banks. According to the Federal Reserve, 39% of all commercial real estate loans are at banks. Of those loans, 67% come from small and mid-sized banks.

There is good reason to expect banks to curtail lending activity in the wake of Silicon Valley Bank’s recent collapse. Both regulators and investors will likely push bank managers to get more conservative. If that happens, it will only increase the interest costs real estate investors face, putting all the more pressure on profits.

Could this all be “priced in”?

All of the factors discussed above are well-known by the investors, which raises the possibility that all of this bad news is already reflected in the price of REIT stocks. For example, in 2022, the S&P 500 REIT index was down 26.2%. In addition, through April 24, REITs are up 1% in 2023, but that trails the broader S&P, which is up over 8%.

In other words, REIT prices might be cheap enough now that they are actually good investments. In our view, this is a good reason to own some REITs but not a good reason to be overweight. As of the time of publication, the equity segment of Facet member portfolios has about 3% in REITs, which is equal to the Morningstar Global benchmark we use for comparison.

When Facet considers overweighting a particular part of the market, we are looking for an imbalance of risks in our favor. This means we want to overweight assets that we believe can perform at least reasonably well in various scenarios. We don’t want to have to guess at any given economic outcome for member portfolios in order to produce strong performance.

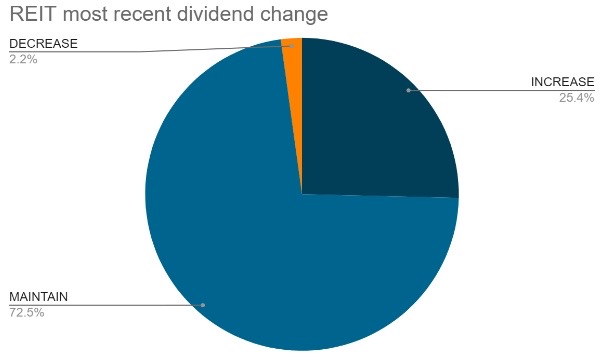

There are just too many risks surrounding REITs to have confidence that their prices will rebound more than other kinds of stocks. For example, all of the factors we described above threaten to curtail profits at REITs, which should put pressure on their ability to keep paying dividends at the same rate. However, virtually no REITs have actually cut dividends yet. According to Bloomberg data, only 2% of publicly traded REITs decreased their dividend payout in the most recent quarter.

Source: Bloomberg

Traditionally, REIT prices struggle when dividends get cut. Therefore, one risk is that the profit pressures described above eventually catch up with the REIT market, causing further underperformance for the sector.

Another risk is that some property owners could become forced sellers, causing the price of similar properties to decline. This could come from bank sales of defaulted properties. For example, real estate giant Brookfield recently defaulted on two sets of properties---one in Washington D.C. and the other in Los Angeles. If more of these defaults occur, more properties will go up for sale in an already soft real estate market.

Sales could also come from real estate funds dealing with redemptions. For example, BREIT, a private real estate fund run by Blackstone, has reported elevated withdrawal requests since November. At that time, the firm took the unusual step of “gating” redemptions. The fund’s structure allows the firm to restrict withdrawals if redemption requests trip certain thresholds.

This provision is common in private real estate funds. The thresholds generally range from 2% to 5% of fund assets, depending on how many prior redemption requests have occurred. Since November, BREIT has had to use this gating option every month. Other funds have since been forced to make the same decision.

Part of the reason private funds have this option is to prevent forced sales of properties. But eventually, the redemptions pile up, and the fund will have to sell properties to pay out exiting investors. Note, too, that because private funds don’t revalue their properties more often than annually, there is a chance BREIT would have to sell properties at a price lower than the current value in the fund. There’s a risk that could exacerbate losses and cause even more investors to look to redeem.

Real estate is just one of many areas where Facet is doing continual due diligence. If real estate becomes especially attractive, we could certainly add a dedicated allocation to member portfolios. But, for now, REITs will remain a small allocation in our strategy.

Tom Graff, Chief Investment Officer

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser headquartered in Baltimore, Maryland. This is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. Past performance is not a guarantee of future performance.