The information provided is based on the published date.

Key takeaways

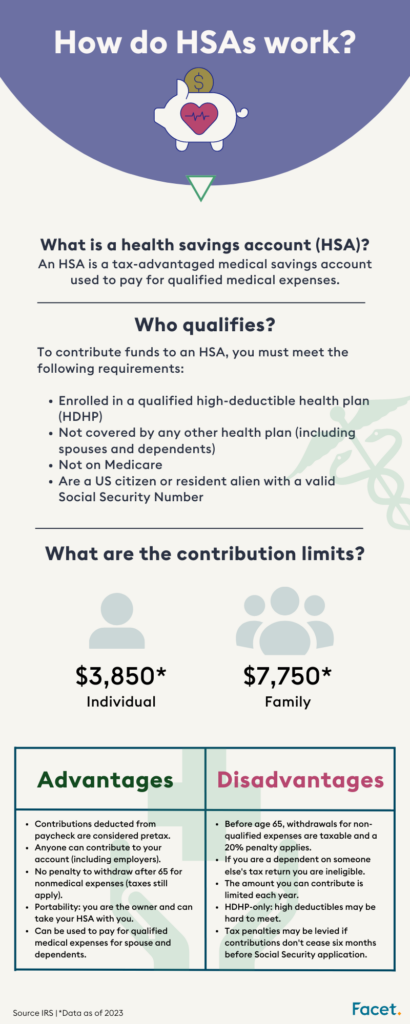

- A health savings account (HSA) is a tax-advantaged medical savings account for US taxpayers with a high-deductible health insurance plan (HDHP)

- Contributions made to an HSA are tax-free and can be used to pay for current and future

- Individuals who have an HDHP and are a US citizen or resident alien with a valid Social Security Number are eligible for an HSA

- HSAs offer three unique tax advantages: contributions are pre-tax or tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are tax-free

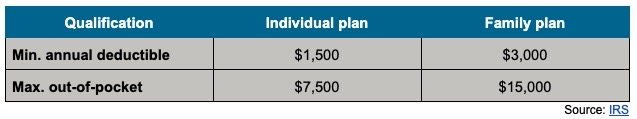

- The minimum annual deductible and maximum out-of-pocket limits for an HDHP to qualify for an HSA in 2023 are $1,500 for an individual plan and $3,000 for a family plan

- The contribution limit for an HSA in 2023 is $3,850 for individuals and $7,750 for those with family coverage

What is a health savings account (HSA)?

A Health Savings Account (HSA) is a tax-advantaged medical savings account available to US taxpayers with a high-deductible health insurance plan (HDHP). HSAs allow individuals to pay for current qualified expenses and save for future medical expenses tax-free.

How do HSAs work?

HSAs are similar to other savings accounts, with the added benefit that any money contributed can be used tax-free for qualified expenses.

The individual who establishes an HSA owns the funds in the account. In addition, any contributions will not be taxed.

If you don’t spend the funds, they will continue to grow each year and can be invested in different options to potentially earn more.

Who’s eligible for an HSA?

To contribute funds to an HSA, you must meet the following requirements:

- Enrolled in a qualified high-deductible health plan (HDHP)

- Not covered by any other health plan (including spouses and dependents)

- Not enrolled in Medicare

- Are a US citizen or resident alien with a valid Social Security Number

What are the potential tax advantages of an HSA?

Unlike other tax-deferred investment accounts, HSAs offer three unique tax advantages:

- Contributions are pre-tax or tax-deductible

- Earnings grow tax-free

- Withdrawals for qualified medical expenses are also tax-free

Additionally, HSAs can provide a savings cushion when transitioning to retirement and assist with long-term healthcare planning.

What are HDHPs, and what deductible limits qualify for an HSA?

High-deductible health plans have lower insurance premiums. The trade-off is that lower premiums mean lesser coverage. Without proper planning and utilizing tools like HSAs, owners of HDHPs can expose themselves to potentially higher out-of-pocket costs than a typical health insurance plan when they have to use it.

That’s because when you submit a claim (e.g., use the insurance), you must pay 100% of the medical expenses upfront, up to a maximum limit. Once you hit the limit, then your insurance provider starts to pay.

For example, say you have an HDHP with an annual deductible of $4,000. If you go to the hospital (or any medical provider) and get a $5,000 bill, you must pay the first $4,000 out of pocket before your insurance kicks in.

Obviously, this type of health plan is great for healthy people because those who don’t make a medical claim don’t incur any medical bills. However, for those that have to use their health insurance, an HSA is a great way to help pay for qualified medical costs.

Your HDHP must have the following minimum annual deductible and maximum out-of-pocket limits to qualify for an HSA in 2023.

What is the contribution limit for an HSA?

The Internal Revenue Service (IRS) establishes contribution limits for Health Savings Accounts (HSAs) annually.

For 2023, the annual HSA contribution limit is $3,850 for individuals with self-only high-deductible health coverage and $7,750 for those with family coverage.

What is the catch-up contribution for HSAs?

For 2023, those ages 55 or older at the end of their tax year can make an additional “catch-up” contribution of up to $1,000. So, if you have self-only coverage, you can contribute a maximum of $4,850 (3,850 + $1,000).

Are there any special rules for HSA contributions?

There are several special rules you should know when making HSA contributions:

- Funds contributed must come from your own resources (not an employer or family member)

- Funds must be deposited in the account by the tax return due date (including extensions)

- You cannot exceed the annual contribution limit, regardless of how many accounts you have

- You must report all contributions and withdrawals to the IRS on Form 8889

- You can only make contributions while you are eligible for HSA coverage

Can I open an HSA if I’m self-employed?

You can open an HSA if you are self-employed and enrolled in a qualified high-deductible health plan.

You can contribute to the account with pre-tax dollars from personal funds or through a payroll deduction. Additionally, any contributions made to the HSA may be tax-deductible on your income tax return.

Need help understanding your new job's insurance benefits?

Advantages of a health savings account

HSAs offer several advantages, including:

- Contributions deducted from paycheck are considered pre tax

- Anyone can contribute to your account (including employers)

- No penalty to withdraw after 65 for nonmedical expenses (taxes still apply)

- Portability: you are the owner and can take your HSA with you

- Can be used to pay for qualified medical expenses for spouse and dependents

Disadvantages of a health savings account

HSAs also have some potential drawbacks, including:

- Before age 65, withdrawals for non-qualified expenses are taxable and a 20% penalty applies

- If you are a dependent on someone else's tax return you are ineligible

- The amount you can contribute is limited each year

- HDHP-only: high deductibles may be hard to meet

- Tax penalties may be levied if contributions don't cease six months before Social Security application

What’s the difference between an FSA and an HSA?

Like HSAs, a flexible spending account (FSA) is a tax-advantaged account used to pay for certain medical expenses. However, there are a few key differences between the two.

Portability

Most FSAs mandate that you must use your available FSA funds every year unless your employer grants a rollover or an extended grace period. In 2023, the IRS allows you to roll over a maximum of $610 of your FSA funds by March 15th of the following year.

On the other hand, HSAs have no time limit. You can carry all of your HSA money over to the following year. HSAs also allow you to roll your funds over to a new provider once every year.

Restrictions

FSAs are only offered through an employer. HSAs are more flexible, allowing you to set one up on your own or go through your employer.

Ownership

FSAs are owned by your employer. You are the owner of an HSA. This is the reason you can bring your funds with you if you leave your job (portability).

What if I don’t need to use my HSA funds?

If you don’t need to use your HSA money for qualified medical expenses, the funds can stay in your account and grow tax-free.

You can also invest the funds in stocks, bonds, mutual funds, or other investments to potentially earn higher returns.

Additionally, any unused funds roll over from year to year and can be used for qualified medical expenses in the future.

When it comes time to retire, you can use HSA funds tax-free to pay for Medicare premiums and other out-of-pocket medical expenses. However, withdrawals not used on qualified medical expenses are subject to ordinary income tax but are no longer subject to the 20% penalty.

Final word

Health savings accounts (HSAs) are a great way to save for healthcare costs, both now and in the future.

Understanding the advantages and disadvantages of HSAs is key to making an informed decision about your healthcare coverage.

Knowing eligibility requirements, contribution limits, withdrawal rules, and how HSAs differ from FSAs can help you decide if an HSA is the right choice for you.

This is just one of the many areas where Facet’s team of experts helps our members. If you need a trusted guide to provide you with critical insights to make your financial life more manageable, click below to set up an intro call.

Facet

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser headquartered in Baltimore, Maryland. This is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. Past performance is not a guarantee of future performance.