The information provided is based on the published date.

Key takeaways

- Financial advisor fee models vary widely. Choosing the wrong advisor and fee model can leave you paying a lot of money for very little (and often) the wrong advice

- There are three primary advisor fee models – a fee based on how much you invest, hourly and per-plan fees, and fixed, flat fees

- Not all fees are created equal. Some fee structures could create a conflict of interest for advisers making them prioritize profit over your financial well being

- Fees are only one aspect of what to consider. The experience, ethical standards, and breadth of services the advisor offers are equally as important

- Being informed about fee models and making the right decision can turn financial advice from a cost into an essential investment that is priceless

When it comes to selecting the right person to manage your money, there’s a lot to consider. But the first question most people ask is, "how much does a financial advisor cost?

Understanding financial advisor fees can be confusing because different advisors charge different fees for different services. Being educated on how advisors charge and understanding what you get for what you pay will put you in control of making the right decision.

Understanding financial advisor fee structures

When it comes to figuring out how much a financial advisor costs, it's important to understand that fee models can vary from advisor to advisor and from firm to firm. Four common models you’ll find in your search for a financial planner are:

- Investment-based fees (also called an assets under management (AUM) model or wealth management fee)

- Hourly or per-plan fees

- Flat, fixed fees (also called retainer or subscription fees)

- Commission-based fees (financial advisor commission rates vary by product(s) sold)

The type of fee you pay for financial advice matters, but it’s only one aspect of the relationship. Just as there are varying types of fees, there are varying levels of advice. In fact, financial advisors have different levels of education, experience, and even credentials.

How much an advisor charges tells you nothing about the quality of their advice.

It’s important to note that if you invest money with an advisor, you’ll often have an additional layer of fees from the investments that they select or recommend for you. Investment products – like mutual funds or exchange-traded funds (ETFs) – carry fees that you will pay in addition to the financial advisor fees.

Here’s what you need to know about different advisor fee models, how much you can expect to pay, and what you can expect to receive in terms of financial advice.

What are fee-only financial advisors?

Some financial advisors today will refer to themselves as “fee-only” advisors, but this can be confusing because fee-only encompasses the assets under management, hourly, per-plan, and flat fee models.

The one thing that many fee-only advisors have in common is that they don’t make money from commissions. When you hear that an advisor is fee-only you still need to do your research on which fee model they use.

What are investment management or AUM fees?

Investment portfolio fees are based on the amount of money that you invest with an advisor.

How they work

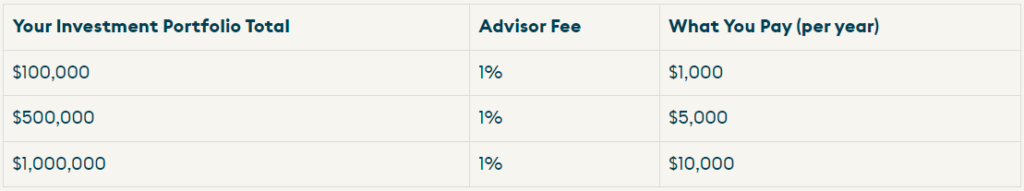

The fee is quoted as a percentage of assets (e.g. 1%) that are managed, which is why it’s called assets under management or AUM.

As your money grows, so do your fees because it’s always a percentage of your account balance.

Some advisors even have account minimums and may not work with you until you have a specific amount of money that you’re willing to invest with them, often $250,000 or greater.

How much you’ll pay

The true financial advisor cost depends on how much you invest and the percentage they charge for managing it. Most advisors charge around 1% of your account balances, but this can vary. Financial thought leader Michael Kitces has a great breakdown of this fee structure on his website.

Here’s what your fee would look like at various levels of investment.

As you invest more and your money grows, your fees continue to grow as well. If you sign up with a robo-advisor – an online and tech-centric investment platform – your fees will be lower at around 0.25% or 0.50%. You will save some money, but it’s an online service with no, or very little, human guidance.

What you get for the fee

Advice and service can vary greatly. A 1% fee does not guarantee a specific level of advice or even a consistent meeting cadence.

Many advisors focus on investment advice because they are incentivized by their fee structure to manage more of your money.

Some advisors offer planning advice as part of the fee. Regardless of the advice, you will have an ongoing relationship with your advisor, but you will continue to pay more in fees as your money grows even if you don’t get additional advice or services.

What are hourly or per-plan advisor fees?

Hourly and per-plan fees are generally for advice that is limited to a specific financial planning topic like a retirement plan review, or a one-time, comprehensive plan.

How they work

In the hourly model, you pay an advisor based on the time it takes to complete the work. The greater the services, or the complexity of your situation, the greater the fee. In a per-plan fee arrangement, you are still paying for an advisor's time and work, but you agree to a fee upfront.

Usually, you’ll consult with an advisor, they’ll review your situation, you will both agree to a fee, and then the advisor will create a plan for you to follow. They often won’t update this plan when your life changes, unless you’re willing to pay for an entirely new one

How much you’ll pay

Hourly fees can range from $100 to more than $400 per hour depending on the experience of the advisor.

Your overall cost frequently depends on the time the advisor spends building your plan. A per-plan fee can range from as low as $1,500 to more than $5000.

The cost is higher up front because the advisor estimates all of the costs to build a full plan from the start.

What you get for the fee

An hourly fee usually allows you to schedule a few meetings with an advisor to check in on specific topics such as budgeting, debt, investments, college, or retirement.

They can also work with you on an end-to-end financial plan. It’s your choice, but you will continue to pay as the advisor does more work.

In a per-plan arrangement, you are typically getting a comprehensive plan and a review of your investment portfolio.

The main drawback to hourly and per-plan models is that you don't get ongoing advice (unless you pay more) and you typically have to execute the advice on your own.

What are flat, fixed, or subscription fees?

A flat, fixed fee is a simple, clear fee that you pay for a financial plan that looks at all aspects of your financial situation, or focuses on specific topics you’d like to cover more in depth.

How they work

The fee can be tailored to your personal circumstances and the complexity of your finances. You’ll review your situation with an advisor, determine the advice that is right for you, and then agree to a flat fee. The fee can change over time, but it’s adjusted based on your needs and not the size of your investment accounts.

How much you’ll pay

Fees can vary, but they typically start in the $1,500 to $2,000 range and can go up to $5,000 to $6,000 or more a year. The complexity of your personal, professional, and financial situation usually dictates how high the costs are. The good news is that the fee is fixed and tied to the financial planning and investment services you receive.

What you get for the fee

This model supports advisors that provide advice that looks at all aspects of your life – everyday finances, navigating life milestones, making major purchases – and includes investment management at no added cost.

It also means you will get ongoing advice, help with executing your plan, and regular check-ins to evolve your strategy over time.

What are commission-based fees?

A commission is a large fee paid upfront to the advisor for the purchase of an investment product like a mutual fund or annuity.

Upfront, a commission based adviser doesn’t cost you anything directly. They will however be selling investment products that typically earn them between 3% to 6% in commission from the sale.

In short, the commission is what you pay and how the advisor gets paid. Commissionable models are frequently full of conflicts, transactional in nature, and can put the advisor’s compensation ahead of the advice you might receive.

If an advisor makes money on commissions, it’s a sign to look elsewhere for your financial planning needs.

What is the right solution for you?

Financial planning, when done right, is a proactive, ongoing, and constantly evolving process that looks at all aspects of your life – personally, professionally, and financially.

The fee model that an advisor uses to provide this advice should support an unbiased approach that is free of conflicts, creates transparency in what you pay, and is directly tied to the advice you receive (not how much you invest).

While fees matter, they are only one aspect of your relationship with a financial advisor.

You need to consider the quality and breadth of the advice, the education and experience of the advisor, and the nature of the relationship. Educate yourself on the fee models that exist, ask the right questions of advisors, and put yourself in control of a critical decision.

A CFP® Professional (Certified Financial Planner) at Facet can help you develop a personalized financial plan for a flat fee that’s tailored to your situation and fully transparent.

Frequently Asked Questions

What's the difference between a financial advisor and a financial planner?

A financial advisor is a professional who provides guidance and advice on various financial matters, such as investments, insurance, taxes, and retirement planning. A financial planner is a type of financial advisor who specializes in creating a comprehensive financial plan for clients. While all financial planners are advisors, not all advisors are necessarily financial planners.

How do fee-based advisors differ from commission-based advisors?

Fee-based advisors charge flat fees (or hourly) for their services, regardless of the products or investments they recommend to clients. Commission-based advisors, on the other hand, earn a commission from selling financial products and may have incentives to recommend certain products over others. This can create conflicts of interest and may not always result in the best financial advice for the client. It's important to understand the fee structure of your advisor before entering into a working relationship with them.

What are some red flags to watch out for when choosing a financial advisor?

Some red flags to watch out for include high fees and costs, lack of transparency in their fee structure, limited areas of expertise, and conflicts of interest. It's important to do thorough research on potential advisors and ask them questions about their experience, qualifications, and fees before deciding to work with them. Additionally, look for advisors who are fiduciaries, meaning they are legally required to act in your best interest at all times.

What is a Certified Financial Planner™ (CFP)?

The Certified Financial Planner™ certification is issued by the Certified Financial Planner Board. CFP® Professionals must meet comprehensive prerequisites and always act in the clients' best interests first (fiduciary standard). CFP® Professionals must meet educational requirements in eight principal knowledge areas, including taxes, investments, insurance, and estate planning. They must also be able to apply their financial planning expertise to life events such as getting married, having a child, saving for college and retirement, starting a business, and everything in between.

The board recently added an educational requirement that CFP® Professionals understand the psychology of financial planning and how our individual beliefs, values, and attitudes around money influence our financial decisions and lives.

Facet

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser headquartered in Baltimore, Maryland. This is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. Past performance is not a guarantee of future performance.