The information provided is based on the published date.

Key takeaways

- Financial markets are forward-looking. Inflation, rising interest rates, and the risk of a recession have already been priced into the market

- It may be tempting to sell your investments during this period of uncertainty but trying to time the market or selling in a downturn can be damaging and often hurts investor returns over the long-term

- A down market can create opportunities to make targeted investment changes, rebalance your portfolio, take advantage of tax loss harvesting, and ensure you are taking on the right amount of risk for your situation

- Having an emergency fund can help you navigate downturns and unexpected costs without impacting your investment portfolio’s long-term potential

This year has been a rough time in investment markets. Both stocks and bonds are sharply lower for the year, driven by a combination of concern over high inflation and the risk of a potential recession. While these sorts of markets can make even seasoned investors nervous, managing through them well is an important part of investment success. Here are a few ways to handle down markets.

Drawdowns were always part of the plan

Your financial plan was constructed for both up (bull) and down (bear) markets. So, periods like this don’t really change how we think about your asset allocation or your overall plan.

While we never know when exactly a bear market will happen, we always know they will happen at some point. One of the most useful tools for financial success is a good investment strategy that allows you to capture long-term returns. Planning with your time horizon in mind tells us that we will see fluctuations along the way while staying on track.

Part of ensuring that long-term returns are realized in the form of growth is to avoid dipping into your investment portfolio during down periods. It is also one of the main reasons why we generally recommend having an emergency fund of 3 to 6 months worth of expenses. Selling part of your investment portfolio when it is down crystallizes that loss for all of time. Having an emergency fund helps you handle unfortunate surprises without impairing your investment portfolio’s long-term potential.

Markets are forward-looking

Admittedly, it is one thing to talk about down markets being part of your plan, and another to experience one.

Right now you may be reading stories about gas prices, inflation, and other challenges and think, “This doesn’t sound like a great time to own stocks.” That’s an understandable response.

However, remember that financial markets are forward-looking. This means when stock prices are falling, it is because markets are anticipating the economy weakening and/or company profit growth slowing.

For example, say markets start out assuming a company will earn $100 in profits. Then something happens and now the market thinks the company will only earn $90. The company’s stock price will drop immediately once the lower earnings figure is anticipated by investors.

Something like this is happening now. Stocks in general are falling because people think profits won’t be quite as robust as was assumed six months ago.

There’s a silver lining to this story, though. Because markets are forward-looking, when that same company actually announces their earnings, and profits are indeed $90 - the stock likely won’t move up or down, because everyone already anticipated the 10% decline in earnings.

This concept works inversely as well, meaning if profits actually came in at $92, then the stock price would rise. At first blush this might seem strange: how could the stock rise if profits dropped by 8%?

The answer is, because people were expecting profits to drop by 10%! This is what people mean when they say something is “priced in” to the market. In this case, a 10% drop was priced in, so an 8% drop caused the stock to rise.

The point here is that the news you are reading today has already been anticipated by investors. People know inflation is high, interest rates are rising, and that there is a risk of a recession. All of that information is already priced into stocks. This is why historically, most of the decline in stock prices happens before the recession actually starts. There is absolutely zero edge to selling ahead of a recession.

Rebounds tend to be sudden and violent

Another temptation that occurs during these periods of instability is the idea of selling stocks now and buying back in when there’s less uncertainty, but we don’t recommend it.

When stocks are falling, it isn’t just a declining outlook that is causing the drop. The uncertainty about the outlook itself also weighs on stock prices. All that needs to happen for stocks to rebound is for conditions to improve somewhat. Sometimes it isn’t even an improvement in market conditions that cause stocks to rebound, just that the outlook becomes somewhat clearer.

We’ve seen examples of this play out relatively recently.

First, in 2009 when the market bottomed, subprime foreclosure rates kept rising for nine more months and home prices didn’t hit bottom for two more years.

Again, in 2020 when the market bottomed, the discovery of a COVID vaccine was eight months away. In both examples we see that markets bottomed and improved not when the bad news stopped coming, but when there was less uncertainty overall.

This may mean that under today’s conditions, the market will bottom long before inflation gets back to normal or the Fed stops raising interest rates. Trying to time when the shift will happen is extremely difficult, especially given how quickly rebounds tend to happen.

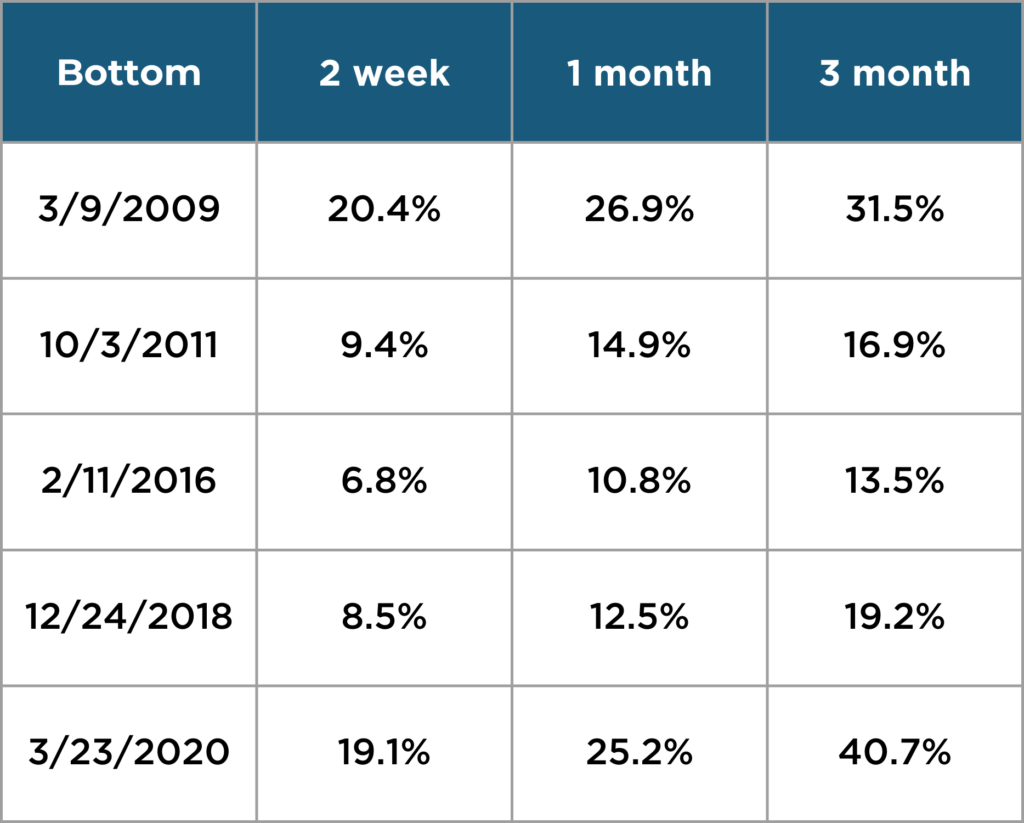

The table below looks at the last five times the S&P 500 has declined at least 15% from its highs and to what extent the market increased in the immediate aftermath of the bottom in the market.

There is usually a big move up in the first three months, and often half or more of a big rally happens within two weeks of the bottom. If you exit the market, you risk missing that big upswing.

Making lemonade

Depending on your specific situation, there may be some ways you can take advantage of downturns.

Is your emergency fund over-funded? Maybe you could put some of the excess cash into the market while stock prices are depressed.

What about your 401(k) or similar employer retirement plans? Can you accelerate contributions to put more money into the market, while receiving a matching contribution from your employer at a beneficial time? Were you dollar-cost averaging (or adding money over time) into the market? If so, why not continue to leg into the market now?

History tells us that putting new money into the market in times like this usually works quite well over the long-term.

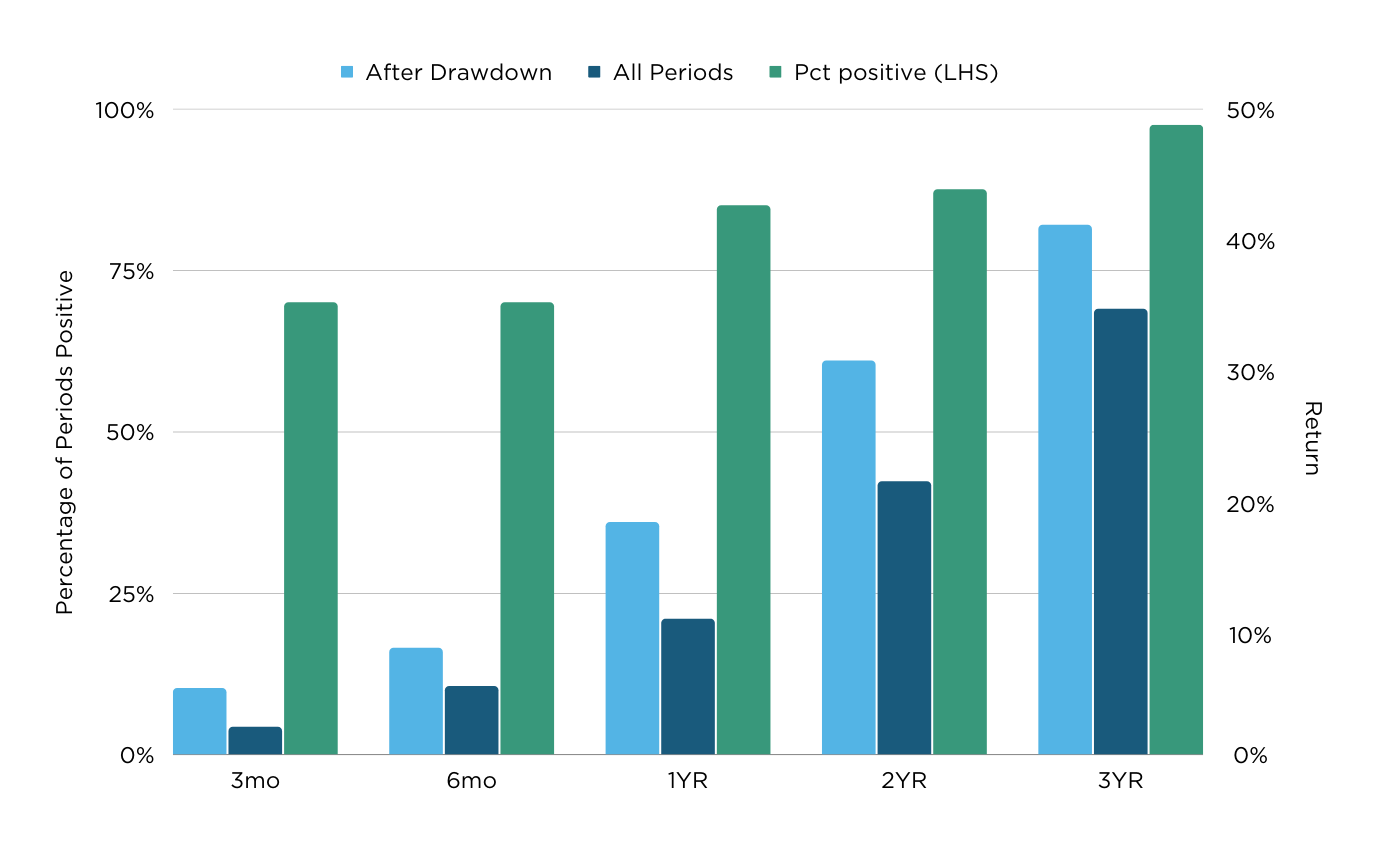

As of June 30, the broad U.S. market was down 22% from its highs. We went back and looked at every period since 1978 where stocks fell at least 20%. Assuming you bought the day the drawdown hit -20%, what would your average return have been from that point forward?

The light blue bars show the average performance post-drawdown, with dark blue being the average for all periods. We see the light blue outperforms for all periods, indicating that periods of sharply negative returns tend to be followed by periods of abnormally good returns! The green bars (left hand axis) show the percent of time stocks were positive post-drawdown at each time period.

Here again, you see the odds are strongly in our favor. Even over three- and six-month periods, we see positive returns about 75% of the time.

Check for opportunities to lower your tax exposure

Now is also a good time to take advantage of the market drop by potentially realizing some tax savings where relevant.

Tax-loss harvesting is where you sell a stock or fund that has declined in value to realize a capital loss. This can be used to offset capital gains on other investments or possibly used to lower your overall taxable income. It can also be an opportune time to talk to your planner about more complex planning strategies like a Roth IRA conversion or simply funding a small brokerage account for the first time.

Make sure your portfolio has the right kinds of risks

The market downturn might also give you an opportunity to make targeted investment changes, rebalance your portfolio, take advantage of tax loss harvesting, and ensure you are taking on the right amount of risk for your situation.

For example, do you have a concentrated position in a single stock or an investment that is producing more volatility than you signed up for? With stock prices having fallen, now might be a good time to diversify. You can probably swap out of more volatile investments and into something more diversified, and either realize a tax loss in the process or at least do so with a lower tax burden than would have been possible a year ago.

You should also always be reassessing your risk tolerance, but be careful. Investors too often allow recent events to color how they feel about their risk tolerance over the long-term. Think about the required returns needed to meet your goals, and talk to your planner about reevaluating your risk tolerance based on what kind of investment mix is most likely to exceed that required return. However, if you have been considering increasing your stock exposure and were waiting for the right time to do it, now may just be that time.

Lastly, with the overall uncertainty surrounding markets, it’s important to focus on what you can control. While you can’t control interest rates, inflation, or the economy overall, taking control of what you can – how much you invest, where you invest it, the level of risk you take, your level of diversification, and how you minimize fees and taxes, will put you in the best position to accomplish your goals in the long run.