The information provided is based on the published date.

Key takeaways

- AI has been present in financial markets for some time

- As a group, AI-powered quant hedge funds have not outperformed the broad stock market over time

- AI is getting better every day, but picking stocks remains difficult due to the complex adaptive nature of the financial market

- AI could have a place in portfolio construction, but for now, it is not seen as a better option than owning a broadly diversified, low-cost set of exchange-traded funds

Over the last few months, the release of ChatGPT has sparked a lot of discussion about artificial intelligence (AI) and its implications.

Naturally, we are excited about the potential for AI to improve various facets of our lives.

But what about investing?

Already some firms are advertising portfolios created entirely by ChatGPT or similar AI tools. Could these funds beat the market? The answer is complicated.

Here are our thoughts on AI and what it means for investors.

AI is nothing new for financial markets

The first thing to note is that AI has been with us for a long time. It’s powered everything from video games to the Netflix movies recommended to you for many years. In this same vein, AI has been prominent in financial markets for some time now.

For example, ten years ago, almost all bond trading occurred over the phone between two humans. Since most bonds don’t trade every day, it was long considered too complicated for them to trade on an exchange like stocks do.

However, over the last decade, Wall Street dealers have developed algorithms to handle these transactions automatically. This has led to a significant reduction in the transaction costs for bond trading, which has benefitted investors.

One might argue that many of the bond ETFs that exist now would not be possible without AI-powered bond trading. These trading algorithms make it much faster for buyers and sellers to match up with each other, which is necessary for continuously-traded ETFs to operate.

Do investors use AI to make trades?

Hedge funds have also been using AI-powered algorithms for trading for many years. There are various strategies employed.

One is called “high-frequency trading,” where a fund builds an algorithm to search for patterns in buy and sell orders, attempting to exploit tiny price movements lasting only a fraction of a second. True to the name “high-frequency,” these funds trade thousands of times a day, generally with little to no human involvement.

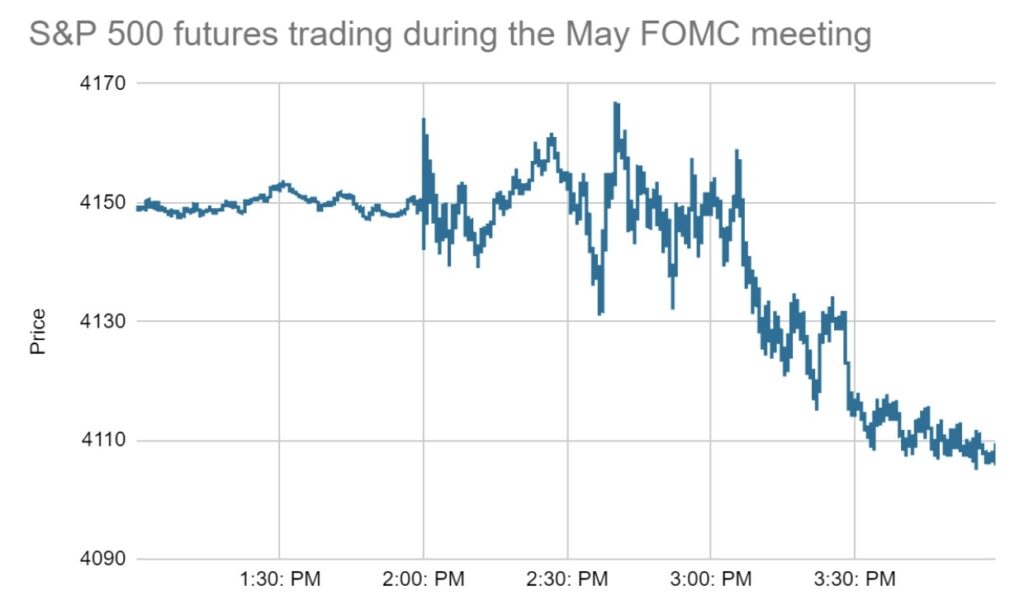

Another strategy involves searching for trends on social media or key phrases in policymaker speeches and then trying to execute on this news before anyone else can. These kinds of computer-generated trades are especially obvious during Federal Reserve meetings. For example, the chart below shows every individual trade in S&P 500 futures contracts on the day of the May Fed meeting.

Source: CME Group

The Fed released its interest rate decision at 2 pm. You can see that in the hour leading up to that release, there wasn’t much movement in the S&P 500. Then, in the moments right after the release, the price starts to swing wildly from gains to losses, all in a matter of seconds. This was probably algorithmic trading, keying off keywords within the press release.

Then Chair Jerome Powell started his press conference at 2:30, lasting until just after 3 pm. Again, we see several large and sudden moves, probably driven by AI-based trading systems jumping on Powell’s phrasing.

So how does this all work? It operates differently for every fund involved in this kind of trading, but the basic idea is the same.

The AI behind these trades has looked at historical patterns and realized that if Powell uses certain phrases, it might indicate he is leaning toward more rate hikes. Perhaps he says something that suggests he’s more worried about inflation than the prior meeting.

AI can be trained to pick up on this kind of sentiment during a speech and execute trades immediately on this supposition. Similar algorithms are built to listen to company earnings calls, read press releases, comb through social media, etc.

These aren’t the only types of AI-based strategies out there. Others look for correlations between assets, such as a currency vs. some stock or interest rates vs. a commodity. AI is extremely good at finding patterns in data that humans might not notice, particularly when these patterns could be fleeting but last just long enough for a trading strategy to exploit.

Do AI investment strategies work?

Yes and no. Hedge funds that use AI and related tools in their trading are generally referred to as “Quantitative” funds or “quant” for short.

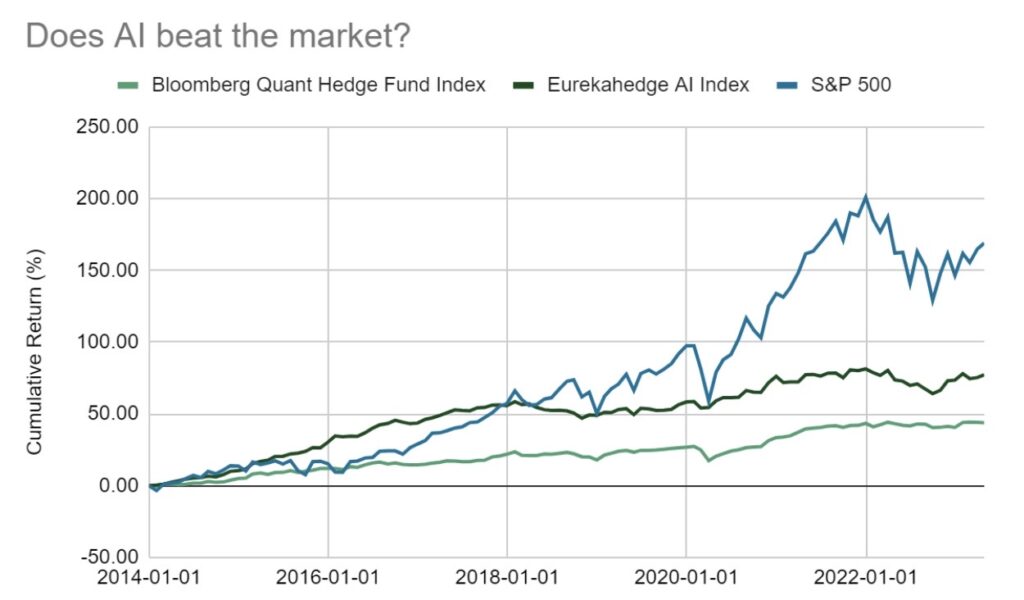

As a group, they have not outperformed the broad stock market over time. Bloomberg has tracked an index of market-neutral quant hedge funds since 2013.

Since then, the quant funds have returned 4.0% annualized vs. 11.1% for the S&P 500. Eurekahedge, a data provider to the hedge fund industry, tracks an index of 12 AI-powered quant funds. That index has returned 6.3% over the same period.

Source: Bloomberg and Eurekahedge

The chart above shows the cumulative return of each since 2013. This shows that $100,000 invested in the S&P 500 would be worth $269,000 today, vs. just $177,000 and $143,000, respectively, for the Eurekahedge and Bloomberg-tracked hedge funds.

To be fair to the hedge funds, many of these funds are marketed to investors as “market-neutral” strategies. This means they are not really trying to beat the stock market. Instead, they are trying to provide a relatively steady but positive return.

We can see from the graph that these funds have mostly been successful in meeting this goal: the returns are much lower than the S&P 500 but are also much steadier. Many big hedge fund investors, such as endowments or pension funds, value this stability and are willing to accept lower returns (and pay very high fees) to get this return.

Could new AI innovations successfully pick stocks?

The traditional AI-based strategies described above have their place in the world, but given the weaker returns than the broad stock market, they aren’t for investors looking to grow their assets over time. Moreover, most hedge funds have huge minimum investment levels (generally over $1 million) and use significant leverage to get their returns. As a result, these aren’t strategies most investors could pursue even if they wanted to.

However, AI is getting better every day. For example, Chat GPT represented a big leap forward in natural language processing—a machine’s ability to process and analyze normal human speech patterns. As this ability continues to develop, could it do a better job analyzing company earnings reports or find patterns in financial reports no human has yet noticed?

The answer is probably yes! But, unfortunately, that probably also means that AI won’t do an especially good job picking stocks.

The problem is that financial markets are a “complex adaptive system.” What this means is that the system itself adapts based on the actions of the players within it. In this case, it doesn’t matter if the players are human or machine.

For example, say that an AI trading bot noticed that stocks with some combination of financial attributes, like profit margin, growth rate, etc., tend to outperform, and it starts buying shares of companies that fit the pattern. That action in and of itself causes the stock prices to rise. That’s a prime example of the system adapting.

Then, soon after, other AI bots discover the same pattern. After all, they are all looking at the same data sets, using similar mathematical models, etc. Pretty soon, the initial pattern stops working, the AI is forced to find a new pattern, and the original bot’s advantage is gone.

This isn’t hypothetical. It’s already happening.

Earlier, we said that most AI-based trading strategies try to profit off stock price movements over extremely short periods, sometimes within mere seconds. This is precisely because the current AI tools traders employ are already squeezing out any profits from these kinds of patterns. The profit potential is gone if you do not execute a trade almost immediately.

It could be that advances in AI allow algorithms to find new patterns not previously discovered. But because markets are an adaptive system, any advantage gained will be fleeting.

This is the same concept that underpins the notion of market efficiency, or the idea that the price of a stock reflects all known information and, therefore, no investor can gain a consistent advantage over other investors. If anything, AI will likely make the market more efficient because it will cause prices to react all the faster to incoming information.

This is not to be dismissive of the impact of AI on the finance industry. AI has already had a huge impact in ways that might not be obvious to those outside the industry. We would also say that AI could have a place in portfolio construction. Facet already uses AI to manage the tax consequences of moving portfolios.

We could imagine AI allowing for other customizations as the technology continues to improve. However, for now, we don’t see AI stock picking as a better option than owning a broadly diversified, low-cost set of exchange-traded funds.

Tom Graff, Chief Investment Officer

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser headquartered in Baltimore, Maryland. This is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. Past performance is not a guarantee of future performance.