The information provided is based on the published date.

Key takeaways

- Proactive tax planning throughout the year can help you avoid penalties, maximize deductions, and put more money back in your pocket.

- Reviewing your 2024 tax return is crucial: it highlights areas where you might have overpaid, missed out on credits, or set yourself up for a hefty tax bill.

- By adjusting withholdings, contributing to tax-advantaged retirement accounts, and staying current with tax law changes, you can build a stronger, more efficient tax plan for 2025.

Many people think tax planning is about finding that one hack or trick that will lower their taxes by thousdands–writing off your new car, setting up an LLC, or buying a rental property. This doesn’t mean those things won’t make sense at some point, but the truth is that tax planning is about understanding your unique situation, knowing what tax moves are available to you (we call them your “levers”), and then applying a series of smart tax moves consistently and year-over-year to creating compounding tax savings.

Understanding What Tax Planning Truly Is

Tax planning isn’t about one big, magical move that saves you tons of money (despite what TikTok will tell you). Yes, there might be moments in life where a very smart tax strategy can save us significant money, but, most of the time, it’s about smart strategies that are consistently applied over time to help you keep more of your money working for you.

It’s a process that looks at your whole financial life—how you earn, save, invest, and spend—so you can make smarter decisions to lower your tax bill today and in the future.

The right tax moves for you will depend on many factors including:

- How you earn income: Do you work for a larger employer, do you receive stock compensation, or are you self-employed?

- What you own (or your assets): Do you own a home, a rental property, or maybe even a small business?

- The retirement plans available to you: Can you contribute to a 401(k), traditional or Roth IRA, or a small business plan?

- How you invest outside of retirement accounts: Do you own stocks or bonds? Are you invested in actively managed investments or are you more diversified and passively invested?

- Your tax rate(s) and deductions: Are you in a high, or low, income tax bracket today? And where do you think you’ll be in the future? What deductions and credits are available to lower your taxable income?

These are just a few of the topics and questions you need to ask to better understand what opportunities are available to you as part of an overall tax strategy.

Key Benefits of Tax Planning

At Facet, our take is that it’s not just how much you make, it’s how much you keep and what you do with it that matters. Here’s how proper tax planning can help you keep more of your money so you can do more with it:

- Identify what’s right for you: There’s no shortage of tax advice out there. However, proper tax planning helps you understand what strategies are available to you so you know exactly what steps to take.

- Reduce Your Tax Burden: By maximizing deductions and credits, you can lower your overall taxable income and potentially increase your refund or reduce the amount you owe.

- Avoid Last-Minute Surprises: Year-round planning helps you steer clear of big tax bills or unexpected penalties come tax season.

- Increase Take-Home Pay: Adjusting your withholdings (using Form W-4) can allow you to keep more money in each paycheck—if you’re strategic about how much you withhold.

- Build Long-Term Wealth: Contributing to tax-advantaged retirement accounts (like 401(k)s or IRAs) can help your savings grow faster, thanks to tax benefits.

Reviewing Your 2024 Tax Return: What Worked & What Didn’t

One of the best ways to plan for 2025 taxes is by looking at your 2024 return to see where you might improve. By reflecting on whether you owed too much, got a hefty refund, or missed out on key deductions, you can make informed adjustments for the year ahead.

Below are some guiding questions to help you learn from last year’s filing:

Did You Owe More Taxes Than Expected?

If you ended up writing the IRS a bigger check than anticipated, you’re not alone. Common reasons include:

- Insufficient Withholdings: Perhaps your Form W-4 (how you tell your employer to take taxes out of your pay) or quarterly estimated taxes weren’t enough to cover your total liability.

- Missing Other Income: If you have taxable investments, retirement account withdrawals, or even rental income, you need to pay taxes throughout the year or you’ll owe come tax time.

- Underestimated Self-Employment Taxes: Freelancers and business owners need to carefully review their income, eligible write-offs, and understand the downstream impact on taxable income.

How to Avoid Future Surprises

- Make a list of all income sources: It might sound simple, but making a list of all income sources and investment accounts can help you identify what kind of income you have to report, how it’s taxed, and how to proactively plan for what you may owe.

- Adjust Your W-4: If you’re employed, consider lowering the number of allowances or adding extra withholding to increase how much is taken out of each paycheck.

- Make Estimated Tax Payments: If you have freelance or side-hustle income, taxable investments, or other non-work related income, quarterly estimated taxes are essential. A quick calculation of your expected income can guide how much to pay each quarter.

Did You Get a Large Refund?

A big refund can feel like free money, but it actually means you overpaid the government throughout the year. Think of it as making an interest free loan to the government, and, with today’s higher interest rates, you’re leaving real money on the table.

How to Keep More in Your Paycheck

- Adjust Withholdings: If you routinely get large refunds, consider filling out a new W-4. By withholding less each paycheck, you can put that money to work in a high-yield savings account or other investments.

- Review Regularly: Most people set withholdings at the beginning of the year and leave them alone. A smarter strategy is to review them periodically (e.g. every six months or after a big income event like a bonus), and to make adjustments along the way

Did You Miss Out on Deductions or Credits?

Let’s start with deductions which are expenses that lower the income you pay taxes on. Here are some of the more regularly used ones:

- Student Loan Interest: If you (or your dependent) are paying off student loans, you might qualify for a deduction on the interest.

- Retirement Contributions: Contributions to a traditional IRA or 401(k) typically reduce your taxable income.

If you itemize your deductions, you can claim the following:

- Charitable Deductions: If you make gifts to charity, keep track of your receipts as you may be able to deduct it from your income.

- State and Local Taxes: There’s a $10,000 cap on this, but, for those with state income taxes, you can deduct all or part of them against your taxable income.

- Mortgage Interest: You can deduct the interest payments on a mortgage balance up to $750,000.

Now, let’s look at tax credits that actually cut your tax bill dollar-for-dollar.

- Child tax credit: If you have a child under 17, you may qualify for a $2,000 tax credit.

- Child and dependent care credit: If you have day care related costs, you may be eligible to claim a credit for some of the costs.

- Education Credits: If you’re paying tuition, you may be eligible for credits like the American Opportunity Credit or Lifetime Learning Credit.

- Clean energy credits: This category includes credits for solar panels, energy efficient home improvements, and buying an electric vehicle.

How to Better Track Income and Deductions for 2025

The best strategy is always to regularly review and track taxable events throughout the year so you aren’t scrambling come tax time. If you are a W-2 employee (meaning you get paid a regular salary from a business), there generally aren’t any big, secretive tax write-offs, but you can keep track of income and accounts that impact your taxes. Some examples include:

- A big bonus, stock option vesting or exercise

- Taxable investment accounts where you sold investments or that paid large taxable distributions

- Retirement account contributions or withdrawals

- Health insurance premiums or health and flexible spending account contributions (HSA or FSA)

- Deductible items like mortgage interest, charitable contributions, and state income taxes

Again, there’s no magic trick if your taxes are straight forward, but being aware of what creates your taxable income and what lowers that taxable income goes a long way in making filing easier and not making any mistakes.

If you own a small business, the task becomes a little more challenging but much more important. Carefully tracking your income, expenses you can write off, and purchases you may be able to either write off or depreciate, is critical to making tax season less stressful and paying less in taxes.

Did You Have to Pay Penalties or Interest?

Penalties often arise from late or underpayment of taxes. The most common issues include:

- Late Payments: Missing an estimated payment can incur penalties and interest.

- Underpayment: If you earn unexpected income and fail to adjust withholdings, you could owe extra.

- Missed Deadlines: Not filing a tax return or extension on time can lead to steep fines.

Avoiding Penalties in 2025

The tax system in the U.S. is a pay-as-you-go system which means you have to pay taxes as you earn the income. This is why you can’t keep all of your money and just make a big payment come April 15th. If you don’t make your payments on time, the IRS may charge you penalties and interest. Here’s how you can avoid them:

- Get Your Withholdings Right: As discussed earlier, regularly reviewing the taxes you pay from your work income throughout the year allows you to make adjustments if/when needed.

- Schedule Estimated Payments: If you have variable income, set reminders for due dates: April, June, September, and January.

- Safe-Harbor Rules: Since we will never get our taxes 100% right, the IRS gives us some flexibility. If you pay 90% of the tax you owe for the current year or 100% of the tax you owed last year, the IRS will let you off the hook. For higher earners (income over $150,000), those numbers are 90% and 110%, respectively.

Key Tax Law Changes for 2025: What to Expect

Tax laws aren’t static. The government adjusts everything from tax brackets to retirement contribution limits to keep pace with inflation or achieve policy goals. Knowing what’s new for 2025 can help you make smarter decisions now.

Inflation Adjustments to Tax Brackets and Deductions

Every year, income tax brackets shift slightly to account for inflation. In 2025, you may see higher cutoffs for each bracket, meaning you could earn a bit more before moving into a higher bracket.

- Standard Deduction Changes: The standard deduction generally increases each year. If you don’t itemize, make sure to check the new standard deduction amount, as it can significantly affect your tax calculation.

Here’s a comparison of 2024 to 2025:

| Filing Status | 2024 Standard Deduction | 2025 Standard Deduction |

| Single: Married filing separately | $14,600 | $15,000 |

| Married filing jointly; surviving spouse | $29,200 | $30,000 |

| Head of Household | $21,900 | $22,500 |

While these aren’t life-changing amounts, knowing how they change over the years can add up.

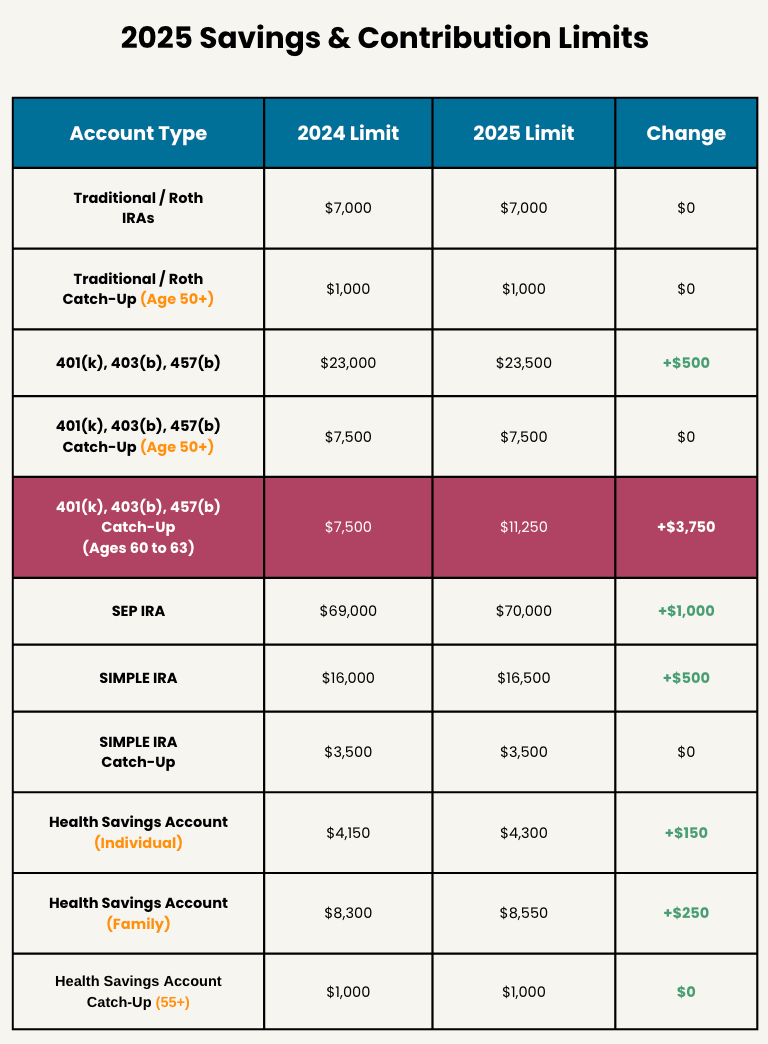

Retirement Contribution Limits and Benefits

Contributing to retirement accounts is a cornerstone of any good tax plan. Contribution limits (i.e. how much you can put into an account in a given year) change incrementally over time:

Important Note: At the time of writing this article, the Tax Cut and Jobs Act of 2017 is set to expire on 12/31/2025 which means income tax rates, estate taxes, and other tax-related items could go up in 2026. It’s critical to keep an eye on future tax legislation to avoid missing big opportunities or paying too much in taxes.

Smart Tax Planning Strategies for 2025

Now that you’ve reviewed your 2024 tax return and have an idea of what’s changing in 2025, it’s time to build a robust plan. Whether you use professional tax planning services or go the DIY route, these strategies can help you stay ahead.

Adjust Your Tax Withholdings Early

- Update Your W-4: If you consistently owe taxes or receive large refunds, adjust your withholding so your paycheck more closely matches your eventual tax liability.

- Calculate Your Withholdings: The IRS provides online tools to help estimate how much you should withhold. By calculating early, you can make smaller changes instead of a drastic adjustment later.

Maximize Retirement Contributions

- 401(k) and IRA Contributions: These reduce taxable income. If your employer matches a portion of your 401(k) contribution, that’s essentially free money—take full advantage.

- Roth vs. Traditional: A Roth IRA won’t lower your current taxes (contributions are made after-tax), but your withdrawals can be tax-free in retirement. A traditional IRA offers a deduction now, but your withdrawals are taxed later. Consider a balance that fits your long-term plan.

Keep Track of Deductible Expenses Year-Round

- Use Apps or Spreadsheets: Tracking expenses as they occur is simpler than scrambling during tax season. Many apps let you scan receipts and categorize expenses in real time.

- What Counts as Deductible: Business expenses (if you own a business), medical costs (beyond a certain threshold), charitable donations, mortgage interest, state income taxes, and more. Make sure to research eligibility or consult a professional.

Consider Tax-Efficient Investing

- Tax-Advantaged Accounts: Health Savings Accounts (HSAs), Roth IRAs, and education savings accounts (529 plans) can all help minimize taxes. For example, growth in an HSA is tax-free if used for qualifying medical expenses.

- Capital Gains Strategies: Investing in the right things in your taxable accounts is critical. Owning low-cost and tax-efficient investments, taking losses during the year to offset gains, and knowing when to rebalance can help lower your taxes.

Common Tax Mistakes to Avoid in 2025

Even the most meticulous filers can stumble. But avoiding common pitfalls could save you time, money, and stress.

Waiting Until the Last Minute to Prepare Taxes

- Why Early Planning Matters: You’ll have more time to find missing documents, correct errors, and capitalize on deductions and credits.

- Stay on Top of Tasks: Use personal finance software or a simple calendar reminder each quarter to review your tax situation.

Not Keeping Proper Documentation

- Why Documentation Is Critical: If the IRS ever questions your return, you’ll need to provide evidence of income and deductions.

- How Long to Keep Records: A good rule of thumb is to keep tax documents for at least three years. However, if you have complex situations (e.g., business or property), you might need to keep them longer.

Ignoring State Tax Changes

- Why State Laws Matter: If you moved states, started a side hustle, or have multiple residences, your state taxes could shift. Some states even have unique credits or deductions you can tap into.

- Check Local Regulations: State websites or a local CPA can provide the most accurate, up-to-date information.

Tax Planning in 2025: FAQs

Q: What are the benefits of filing taxes early?

A: Filing early not only helps you get your refund sooner, but it also reduces the chance of late-filing penalties and identity theft. The IRS often processes early returns more quickly, which means a faster refund if you’re owed money.

Q: What tax credits should I look out for in 2025?

A: Keep an eye on the Child Tax Credit, education credits (like the American Opportunity and Lifetime Learning credits), and any energy-related incentives for home improvements. Also watch for changes in retirement contribution credits, which can offset a portion of what you contribute.

Q: What is the best way to reduce my taxable income in 2025?

A: Maximizing contributions to tax-advantaged accounts—like 401(k)s, IRAs, and HSAs—is one of the most reliable methods. If you invest in a taxable account, knowing how to create a more tax-efficient strategy can save you thousands over time. If you have a side hustle, small business, or rental property your tax planning opportunities expand quite a bit.

Plan Ahead & Save More with Tax Planning from Facet

The best time to start your 2025 tax plan is right now. Waiting until December to take action or mistaking tax filing for tax planning could mean you miss out on important tax strategies and pay more in taxes. Proactive tax planning is always your best course of action to pay less in taxes and keep more of your money working hard for you.

At Facet, our tax planning services can help you identify the strategies that make sense for you, make sure you don’t make any mistakes or miss opportunities, and put your tax strategy into action and put more money in your pocket.

Get in touch with Facet today to start planning for 2025. By reviewing the lessons of 2024 and staying ahead of key changes, you’ll be better positioned to save money, reduce stress, and secure a stronger financial future.