Key takeaways

- The US economy added 236,000 jobs in March, which is consistent with a normal pace of job growth during a non-recessionary period

- Wage growth declined slightly in March and is closing in on pre-COVID levels

- The deceleration of job growth and wage growth may indicate a “soft landing” for inflation, meaning that it will return to normal without causing a recession

- As banks become more conservative with their lending, the Fed may pause rate hikes at its upcoming May 3 meeting

Job growth in the US remained solid in March, but the pace of hiring cooled to its slowest in more than two years.

While it is clear the US is not in a recession right now, what does the deceleration in job growth tell us about where the economy is headed? And what does it mean for your investments?

Here are our thoughts on what to expect going forward.

Job gains back to “normal”

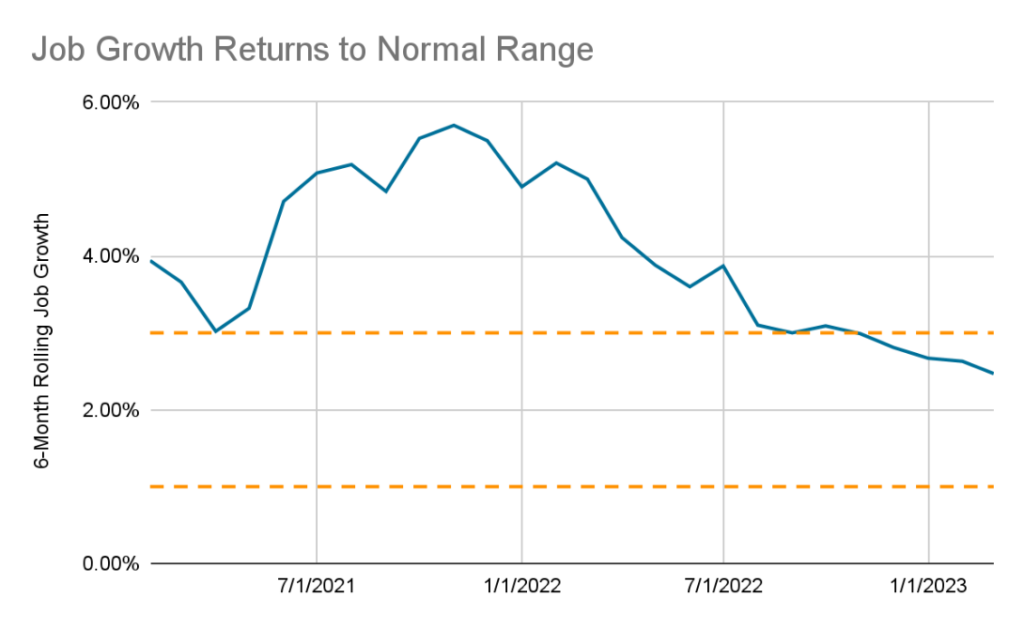

According to the Bureau of Labor Statistics, the economy added 236,000 jobs in March. This is consistent with a normal pace of job growth during a non-recessionary period. Over the last 40 years, jobs have typically grown at a 1-3% annual pace during these periods. Throughout most of 2021 and 2022, job growth ran around 4-5%. But after this March report, jobs have since increased at a 2.5% pace over the last six months, right in the usual range.

A couple of months ago, markets were worried that job growth was accelerating. Such a thing would have risked pushing inflation higher again, bringing on additional rate hikes from the Federal Reserve. Now it appears the spike in January job growth was either a one-off or a statistical aberration.

Wage growth also slows

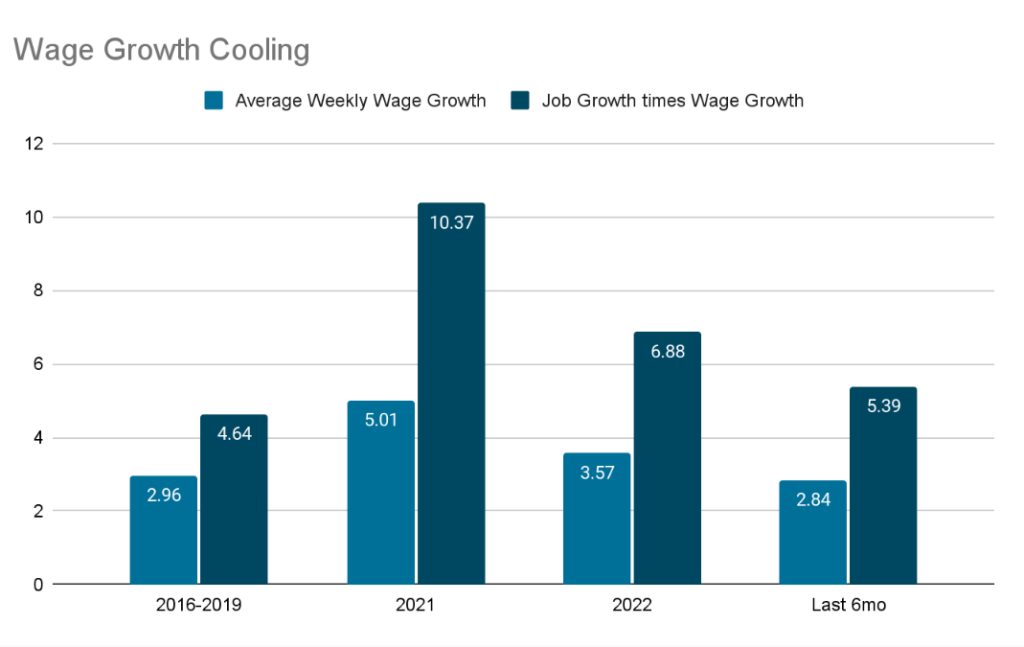

Average weekly wages declined slightly in March, the second month in a row of slight declines. Wage growth is a critical indicator of inflation. Inflation is a product of consumer spending outpacing the ability of the economy to produce goods and services. Consumer spending is driven by income growth, with wages being the dominant source of income for most households. So, if wage growth returns to a more normal pace, it is likely that inflation will also follow.

The chart below shows that wage growth in the most recent six months is closing in on the pre-COVID levels. Here we used average weekly wages (lighter blue) and the change in weekly wages multiplied by the change in jobs (darker blue). This second measure roughly estimates households’ total wages available to spend. Each bar is the annual pace of growth for the period indicated.

For a while, Fed Chair Jerome Powell said the labor market was “out of balance.” However, this slower wage growth suggests that the balance is improving. So what has changed? In 2021 and early 2022, virtually every firm was hiring, with many firms blaming a labor shortage for their inability to produce more goods. Now several firms are still hiring, but others are laying people off. Moreover, we’ve seen posted job openings decline recently: down 12% in the last two months and 17% below the 2022 peak.

These signs indicate softer labor demand: slower hiring, fewer job openings, and smaller wage gains. So far, this has been achieved without a major increase in unemployment. That leaves the possibility of a so-called “soft landing” where inflation returns to normal without needing a recession.

Fed could pause in May

The Labor Department’s payroll survey happened on the week of March 13, the week after Silicon Valley Bank collapsed. Therefore, we didn’t see any impact from the recent banking stress in this report.

That said, we see plenty of evidence that this banking stress’s “crisis” phase is passing. Bank borrowing of emergency funds from the Fed has stabilized. Another source of backup bank liquidity, the Federal Home Loan Banks, only issued $37 billion in new debt the last week of March, down from $304 billion the week Silicon Valley bank failed. This suggests banks are also borrowing less from this source.

Our view has remained that the Fed and other government agencies had the tools to prevent widespread bank failures. The real impact of this period of stress will be banks getting more conservative with their lending. When banks lend less, businesses have less money to buy equipment, expand operations, and carry out other critical activities. Ultimately that will lead to less hiring, spending, and overall economic growth.

The Fed is watching this closely, but it may take some time to tell exactly how much banks pull back on lending and how much that will impact the economy. For this reason, the Fed may pause rate hikes at their upcoming May 3 meeting. This jobs report tells us that the labor market was already slowing, even before any impact from slower bank lending. That gives the Fed even more reason to consider a pause in hikes in the near term.

Tom Graff, Chief Investment Officer

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser headquartered in Baltimore, Maryland. This is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. Past performance is not a guarantee of future performance.