The information provided is based on the published date.

Key takeaways

- The way you feel about money has a huge affect on how you manage it

- Your money attitudes are shaped by your family, friends, and culture

- Smart financial planning includes working on your money attitudes

- A great financial planner understands your habits and beliefs about money

Have you ever struggled with the inner turmoil of splurging on something luxurious, even though you know it’s not the best financial decision? Or have you found yourself in a state of indecision regarding important money matters out of fear of making the wrong choice? If so, you’re not alone. We’ve all been there.

But here’s the good news. Firstly, it’s normal to feel this way. Secondly, these are challenges that you can overcome.

We all have a set of beliefs about money that we’ve acquired over the years, often formed during our childhood. Unfortunately, these beliefs can sometimes prevent us from attaining financial stability.

However, you can achieve a much healthier financial situation by changing your perspective on money and working with a trusted professional.

Where our beliefs come from

Many of the attitudes we’ve internalized come from our childhood. Even when we don’t realize it, what our parents said and what we saw them do shaped our attitudes about life in general and our financial lives in particular.

That process has been described like this: Until puberty, we’re little tape recorders, absorbing everything around us. Then, about the time we hit puberty, we stop recording and hit the play button.

Culture and religion play a role, too, teaching us additional lessons about earning, spending, saving, and giving. Everything from “the stock market is a gamble” to “donate a percentage of your income to those less fortunate” are lessons we absorbed. As adults, we may not even realize where those beliefs came from.

If those beliefs help us make the best financial decisions for us, great. But all too often, they get in the way.

For example, suppose your parents didn’t understand investing and told you that the stock market is dangerous and uncertain. If that happened, you might choose “safe” investments that leave you far short of your financial goals. But, on the other hand, if you absorbed the lesson that you should live for today and not worry about tomorrow, you might one day find yourself with a mountain of credit card debt and no savings.

A good financial planner is one way to correct some of those early messages and begin internalizing new ones.

Taking the first financial step

Getting started isn’t always easy for everyone. For example, some people are uneasy about opening the books on their financial life to a complete stranger. They worry about being judged and compared to others who appear to be doing better financially.

The reality is that it doesn’t matter how well others are doing. What matters is how you are doing and what progress you’re making toward your priorities.

And when it comes to feeling ashamed or anxious, financial planners have heard it all before. A good financial planner won’t judge you for where you are; they’ll help you get where you need to be.

Working with a financial planner

Think of a financial planner as someone who can help you navigate your financial beliefs and needs to achieve financial wellness.

Chances are, your path to financial health involves several major questions.

- Should you invest more or pay down your mortgage?

- Should you save more for retirement or your child’s dream college?

- Should you buy or lease a car?

The right answers aren’t about how well a given investment performs. The best solutions for you, and only you, need to include your attitudes toward debt, your feelings about risk, and the value you place on your financial goals.

How important is it to you to be debt-free? To own a home? To pay for your child’s education?

There’s no single right answer, only the one that’s right for you.

What kind of a financial planner to choose

Although there are many types of financial planners, the gold standard is a CERTIFIED FINANCIAL PLANNER™, also known as a CFP® professional. CFP® professionals undergo a rigorous education that includes everything that touches your life financially—from investments and planning to taxes, insurance, and estates.

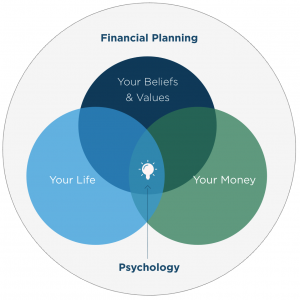

Most importantly, in March 2021, the CFP Board, which manages this designation, announced it was adding a unit on the psychology of financial planning to the exam these professionals must pass to become certified. The board recognizes that your financial planner should understand not only every aspect of finance but also you as a person.

Financial planning is about more than compiling spreadsheets and making investments. A great financial planner should be able to connect with you on a personal level, understand your goals, and make you feel secure as you share your financial history and money beliefs. That’s why every financial planner at Facet is a CFP® professional. We’re here to help you build your best life – judgment-free.

If you’d like to know more or are ready to begin your journey to financial peace of mind, get in touch today.