The information provided is based on the published date.

Key takeaways

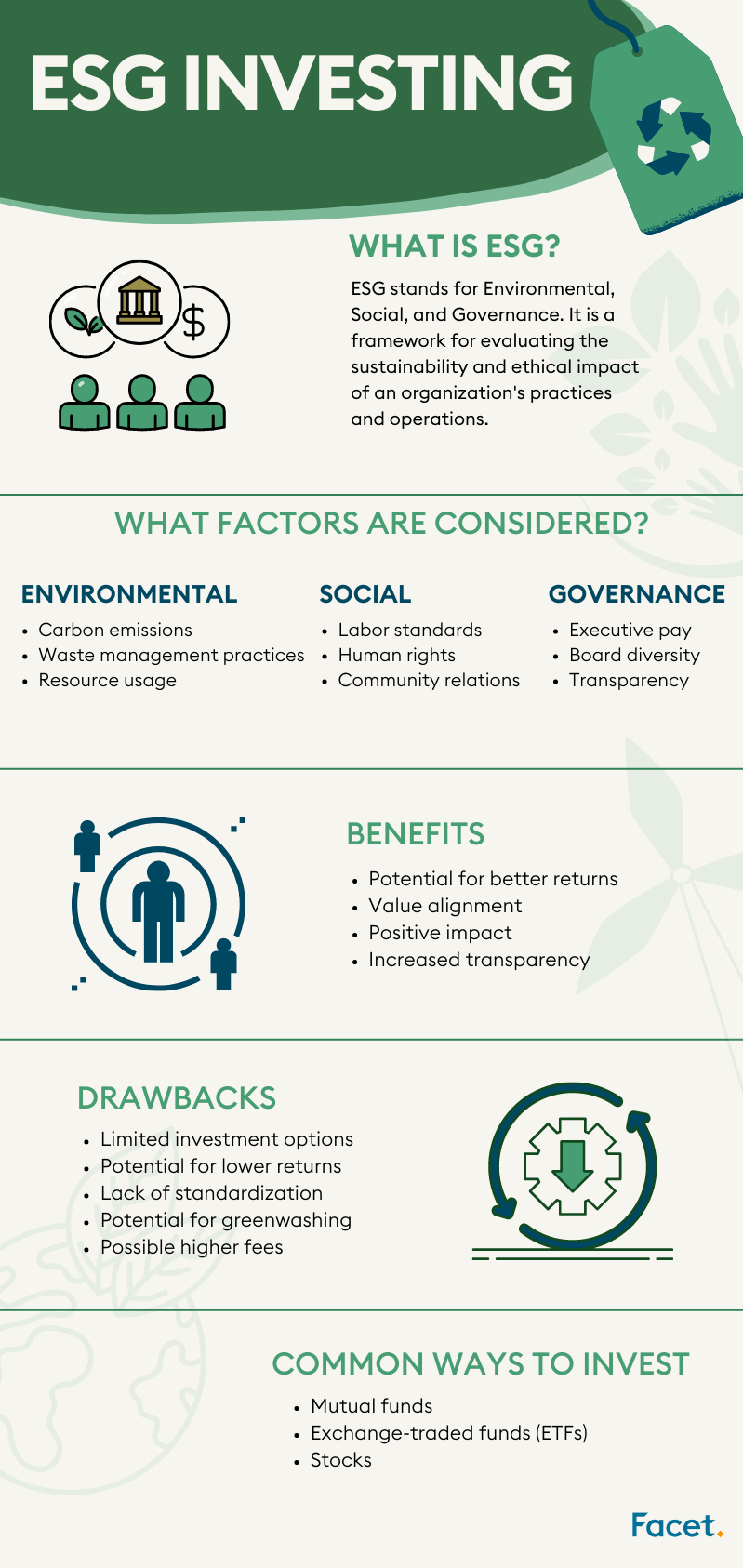

- ESG stands for Environmental, Social and Governance - it is a way to evaluate how well a company is performing in all three of these areas

- ESG investing has grown in popularity as investors look to incorporate sustainability and ethical considerations into their portfolios

- Common ways to invest in ESG include mutual funds, exchange-traded funds (ETFs), and individual stocks

- Potential benefits of ESG investing include potential for better returns, alignment with values, positive impact, increased transparency

- Potential drawbacks include limited investment options, potential for lower returns, lack of standardization, potential for greenwashing and higher fees

What is ESG?

ESG stands for Environmental, Social, and Governance. It’s a way of evaluating how well a company is doing in these three areas.

- Environmental factors: how much energy the company uses or if they’re using sustainable materials.

- Social factors: how the company treats its employees and whether they’re making an effort to be inclusive and diverse.

- Corporate governance: focuses on transparency and accountability, ensuring the company is run ethically and responsibly.

ESG has become increasingly important to investors that seek to align their dollars with their values. It allows anyone to put their money where their heart is.

Many companies now provide ESG reports or disclose ESG information as part of their financial reporting to demonstrate their commitment to sustainable and ethical practices.

What is ESG investing?

ESG investing is a sustainable investment strategy considering environmental, social, and governance (ESG) factors.

It’s designed to align investors’ values and financial objectives by selecting companies demonstrating strong ESG performance or investing in industries supporting various ethical practices and causes.

ESG investing has grown in popularity recently as investors seek to incorporate sustainability and ethical considerations into their investment portfolios. Morningstar reported that by the end of 2022, global assets in ESG funds had risen to approximately $2.5 trillion, compared to $2.24 trillion at the end of the third quarter.

Many investment companies now offer ESG-focused investment products like ESG mutual funds or exchange-traded funds (ETFs).

ESG scores

Most ESG scores are calculated using publicly available data sets from sources like Bloomberg or MSCI. This includes both quantitative indicators, such as greenhouse gas emissions or employee diversity, and qualitative surveys of stakeholders. The scores are then compared to an industry benchmark or peer group to assess the company’s performance in each area.

Investors can use ESG ratings to better understand a company's potential long-term risks, identify opportunities for investments with an environmental and social impact, or make more informed decisions about which companies to invest in. Additionally, they can use the information to inform corporate engagement activities, such as voting on shareholder resolutions or engaging directly with companies to address environmental or social risks.

ESG scores and ratings are becoming increasingly important for investors as more companies commit to sustainable practices and regulations related to climate change become increasingly stringent. As ESG data becomes more widely available, investors have an unprecedented ability to assess the potential long-term risks associated with companies and make more informed decisions about their investments.

Clearing the confusion between ESG and socially responsible investing

Socially responsible investing (SRI) sounds a lot like ESG investing, but there are some differences. Here are the main points.

In the past, the construction of sustainable investing portfolios differed—some adopting an inclusionary approach and others choosing an exclusionary method. For example, SRI implemented an exclusionary approach to weed out “sinful” investments like gambling or alcohol stocks. While ESG avoided these companies as well, they also included companies that generated a positive impact.

Inclusionary vs. Exclusionary

- Inclusionary strategies seek out companies that meet specific ESG criteria, such as strong environmental practices, diverse leadership teams, or ethical business practices, and integrate them into the portfolio. The goal of this approach is to encourage positive change.

- Exclusionary strategies screen out companies not meeting specific ESG criteria, such as those involved in controversial industries like tobacco or weapons manufacturing. This approach avoids investing in companies with negative social or environmental impacts.

As sustainable investing has ballooned in popularity, the more these terms have bled together. However, as you can see, the two have distinct differences.

Most common ways to invest in ESG

The most common ESG investment vehicles are mutual funds, exchange-traded funds (ETFs), and individual stocks. Let’s explore how they work.

- ESG-focused mutual funds: These funds (baskets of stocks) may screen out companies that engage in practices deemed harmful to the environment or society or have poor labor or governance practices.

- Exchange-traded funds (ETFs): Similar to mutual funds, but trade like stocks on a stock exchange (can be bought or sold throughout the trading day).

- Stocks: This is the riskiest option because investing in just one or a few individual companies will lack diversification. However, if you truly believe in a particular business, don’t skip over researching the company’s fundamentals to make sure it’s a sound investment.

Read more: What do I need to know before I start investing?

Reasons to invest in ESG

There are several potential benefits to ESG investing, including:

- Potential for better returns: Some research suggests that companies with strong ESG performance may be more resilient and financially successful in the long term, which could lead to better returns for investors.

- Alignment with values: ESG investing allows investors to align their investment portfolios with their social and environmental values, which can provide a sense of personal satisfaction and fulfillment.

- Positive impact: ESG investing can contribute to positive social and environmental outcomes, such as promoting sustainable practices, reducing carbon emissions, or advancing social justice causes (impact investing).

- Increased transparency: By encouraging companies to report on their ESG performance, ESG investing can increase transparency and accountability in corporate practices, which can benefit investors, stakeholders, and society as a whole.

Reasons not to invest in ESG

While ESG investing has become increasingly popular in recent years, there are some potential drawbacks and reasons why investors may choose not to invest in ESG. Here are a few:

- Limited investment options: While the number of ESG investment products has grown, there may still be a limited selection of options compared to traditional investment products, which could make it difficult to achieve diversification or meet specific investment objectives.

- Potential for lower returns: While some studies suggest that companies with strong ESG performance may outperform in the long term, there is also evidence that ESG investing may result in lower returns, especially in the short term.

- Lack of standardization: There is currently no standard definition or set of criteria for ESG factors, which can make it challenging to compare companies or investment products and can lead to inconsistencies in ESG analysis and reporting.

- Potential for greenwashing: Greenwashing refers to the practice of companies or investment products making false or misleading claims about their environmental or social performance, which can mislead investors who are looking for sustainable investments.

- Higher fees: Some ESG investment products may charge higher fees than traditional ones, which could eat into returns and make it harder for investors to achieve their financial plans.

Make sure you weigh the potential benefits and drawbacks of ESG investing and determine whether it aligns with your values and investment objectives.

Final word

In today’s ever-changing world, ESG investing is becoming an increasingly favored way for investors to align their portfolios with their value systems. However, it is critical to thoroughly research and understand the potential risks and benefits before jumping in.

While ESG investing can create positive outcomes such as better returns, alignment with values, and a positive impact, some drawbacks must be considered, such as limited investment options, potentially lower returns, and higher fees. By weighing the pros and cons of ESG investing, individuals can make informed decisions about whether this strategy suits their financial objectives.

Check out Facet's approach to ESG investing

Facet

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser headquartered in Baltimore, Maryland. This is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. Past performance is not a guarantee of future performance.