The information provided is based on the published date.

Key takeaways

- Lifestyle creep is another name for the increase in expenses as you make more money

- Over-spending comes in many shapes and sizes — you need to know what this means for you

- There are key questions that can help you determine if you are at risk of falling into the trap of overspending and life style creep

- It’s about more than money – the psychology of money plays an important role in your decisions

- A plan is essential to putting you in control of your spending now, protecting you from debt and making sure you have what you need to live the life you really want

As you progress in your career, get promoted, and change jobs, you’ll likely make more money along the way. As you reach new milestones in life — marriage, family, new home, new car, and saving for college and retirement — you’ll have more options on how to spend that money. Without a plan, you may find that your lifestyle expenses inflate to fill the space created by your extra income – which leaves you with nothing left to save. This is called "lifestyle creep."

Here's what the phenomenon is, and how to avoid it.

What is lifestyle creep?

Lifestyle creep is when your expenses, those that support your lifestyle, increase as you make more money. It’s simple: make more money, spend more money. However, lifestyle creep isn’t just about spending more money. It’s spending more money without a plan, which can start eating into your ability to save or put you into serious financial debt. One day you realize you’re making more but you don’t have much to show for it.

Spending more money as you make it isn’t necessarily a bad thing. Lifestyle creep occurs when you overspend to the point where you have nothing left to save for what you want in the future, your retirement, or for a rainy day. The decisions you make now can have a ripple effect and impact you for years to come.

Having a plan as your finances evolve will help you make the right choices as your income changes, and keep you from making risky financial decisions in the future. The fact is that every decision, regardless of its size, is a financial decision that can affect many areas of your life.

Here’s what you need to know about lifestyle creep to keep you on track and to put you in control of your money.

What lifestyle creep looks like

The biggest mistake people make when they earn more money is that they spend it first and then look to save what is left. But those new expenses creep up more than expected, and there is nothing left to save. Let’s explore where things typically go wrong. There are two places to look.

#1 - The big 3 expenses:

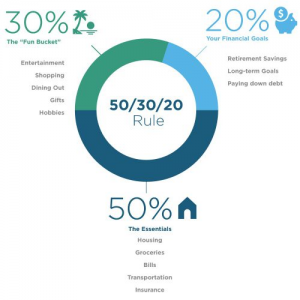

There are three things that make up almost 50% of your ideal spending plan: housing, transportation, and food. Lifestyle creep can hit quickly in these areas since they are so big. As your income increases, you might start thinking about the bigger home, the nicer car, or even eating out more. These items might be affordable, but you need to plan carefully or they will inflate your lifestyle.

#2 - The other stuff:

The smaller expenses that make up 30% of your ideal plan are the ones that sneak up on you — not individually but collectively. If you’ve ever muttered the words “it’s just…” before the price of something, you may know a thing or two about lifestyle creep. “It’s just” $100, what’s the big deal? That nicer car is just another $200 more per month. You can easily go from “it’s just” to “it’s now” a problem.

Now let’s look at the main causes of lifestyle creep.

How to avoid lifestyle creep

Think lifestyle creep won’t happen to you? Ask yourself these questions and you may be surprised..

#1 - Be aware of emotional spending

Have you made an emotional purchase or regretted buying something? Buyer’s remorse can be a sign that lifestyle creep may eventually pop up, especially if it happens more than once.

Have you ever wondered why you think, feel, or act the way you do when it comes to money? It’s the psychology of money, and it drives your decisions. Healthy and unhealthy money habits can either set you up for success or lead you down a frustrating path. Knowing what makes you tick financially can make all the difference in the world.

#2 - Prioritize value over "things"

Have you bought something you always wanted only to find it didn’t really make you happier? Nicer things are OK, but they often aren’t the things that make you happy. Increased happiness comes when you align your money with what you value and the life you want for you and your family.

#3 - Don’t try to ‘keep up with the Joneses’

Have you looked at something a neighbor or friend owned and thought, “I should get one of those, I can afford it.?” Keeping up with the Jones’ is a real phenomenon. If you make decisions to keep pace with those around you, you may end up with a lifestyle you won’t be able to afford.

#4 - Stick to a plan

Have you ever struggled to pay for something you really wanted or needed because you spent too much on something you really didn’t need? Overspending can result in depriving yourself of things that are important, like a nice vacation, planning for your next home, or even contributing to your children’s college fund.

#5 - Understand your debt

Have you ever found yourself spreading payments out on a large purchase because you didn’t have the money? Not all debt is bad debt, but loan payments can add up faster than you think. Keep an eye on your total recurring monthly expenses..

#6 - Have a plan

Have you made a purchase and then realized there are other expenses you didn’t account for ? That bigger house means more furniture, higher utility bills, more maintenance, higher insurance premiums and more taxes. The “extras” can add up and need to be part of your plan before you sign the loan papers.

Have you made purchases, big or small, without thinking about the other areas of your life it could affect? Without a plan, it’s hard to see how new expenses affect the rest of your financial landscape. As expenses add up, they can eat into your ability to save for key life milestones, such as marriage, kids, college, home, and retirement.

Final word

Lifestyle creep isn’t just spending more when you make more. It’s spending more without a plan and without an understanding of how your expenses affect the rest of your life. To avoid it, you need a financial plan, one that looks at all facets of your life, both now and in the future.

A personalized plan will help you weigh all your options, make smarter decisions, and put you in control of the life you want for you and your family. It will allow you to save for a rainy day or that next important purchase, and invest for the future ahead of you.

The best way to avoid lifestyle creep, to live the life you want, and to save for your financial independence is to make ongoing financial planning a priority.