The information provided is based on the published date.

Key takeaways

- The average cost of raising a child to age 18 is $272,049, not including college However these costs do not apply to everyone

- There are many factors that will drive the cost of raising your children The hopes and dreams you have for them, for example, are a big factor

- Communicating with your partner is key and you need to be on the same page when figuring out the kind of life you want to give your child

- Every decision you make will have a ripple effect on future decisions. Make sure you think through the impact of each decision and what it may mean for future choices

We all know that raising kids is expensive. But exactly how much will it take?

Here’s what the numbers say.

In 2015, the US Department of Agriculture estimated that the typical middle-income family would spend an average of $233,610 to raise a child to age 17. Factoring in the inflation rate, parents of a child born in 2022 could expect to spend an average much closer to $300,000. That estimate cost doesn’t include college costs.

Chances are that averages won’t apply to your situation and won’t be what you wind up spending. You could very well spend more or less. One of the biggest factors that impact this average include the life you want to give your child.

What kind of life do you want for your children?

Many prospective parents envision the life they want their child to have, which is often based on their own upbringing.

Do they envision a childhood of private schools, horseback riding, and tennis camps?

A home where the parents provide the necessities and children work for the luxuries, or something in-between?

Long before the baby arrives, it’s important for parents-to-be to have in-depth discussions about:

- How each of you were raised

- How you want to raise your children

- Your hopes and dreams for them

- The number of children you want

- The experiences you want them to have

Planning for the cost of having children doesn’t stop when you are decorating the room, buying baby supplies and diapers — it continues throughout every milestone of your children’s lives and requires careful planning and thought. The decisions you make will directly affect the amount you spend.

Your decisions will drive your budget

In some ways asking, “What does it cost to raise a child?” is similar to asking, “How much money do I need to retire?”

Is your retirement going to consist of long, lazy days fishing in a local river, or traveling the world with your partner, enjoying fine restaurants?

Those two alternatives require very different budgets.

Similarly, the cost to raise a child can vary widely.

Many of the decisions you make will have costs attached. For example:

- Will you need a bigger place to live or want to move to an area with better schools?

- Do either or both of you have strong feelings about public school vs. private school?

- Will you pay for childcare expenses or will nearby family members lend a hand? Will you need to buy a family-friendly car?

The best time to make those decisions is before your child is born.

Budgeting for a baby

Before your baby is born, start getting a handle on what their arrival will mean financially. This guide can help you set up your initial financial plans, including expenses you might not have thought of, such as health insurance and estate planning.

When it comes to setting up a plan, it’s important to pay particular attention to the costs of child care, unless one parent is going to be a stay-at-home caregiver. Either way, household income will likely play a major factor in whether you can fulfill your ideal scenario.

Childcare costs

According to the World Population Review, the average cost of providing center-based child care for an infant in the US is $1,230 per month.

While your costs may vary widely from the average on a state-by-state basis, childcare can cost between $5,436 and $20,913 per year.

Next up in your timeline comes your child’s education and making the decision on your preference for a public, private, or combined education approach.

Private elementary school (kindergarten to sixth grade) tuition costs can range from just under $10,000 per year in relatively lower-cost areas to more than $30,000 per year in cities like New York or San Francisco.

This amounts to an easy six-figure spend for seven years of education, and when you consider private middle and high school, this can double the cost. In fact, top-tier private schools can cost just as much as some four-year colleges.

There are no right or wrong answers. Every family is different. The key is to plan for your child and your situation.

The average costs can be a good starting point, as long as you remember that your decisions will determine whether you spend more or less than those averages.

Understanding what your decisions cost

Before getting into the numbers, understanding the trade-offs associated with each decision is key.

Buying a home in a place where public schools are better may cost more, but the savings in not sending your child to a private school may offset that.

Choosing cheaper vacations in the US instead of traveling to other countries may help save money to put toward college tuition (or your own retirement).

Keep in mind that every decision may have a ripple effect on future decisions.

Make sure you think through the consequences of each decision and what it may mean for future choices. Even though your costs may vary depending on many factors, one good starting point for those decisions is an understanding of what families spend.

Where the money usually goes

The US Bureau of Labor Statistics publishes a wealth of data in its Consumer Expenditures Survey.

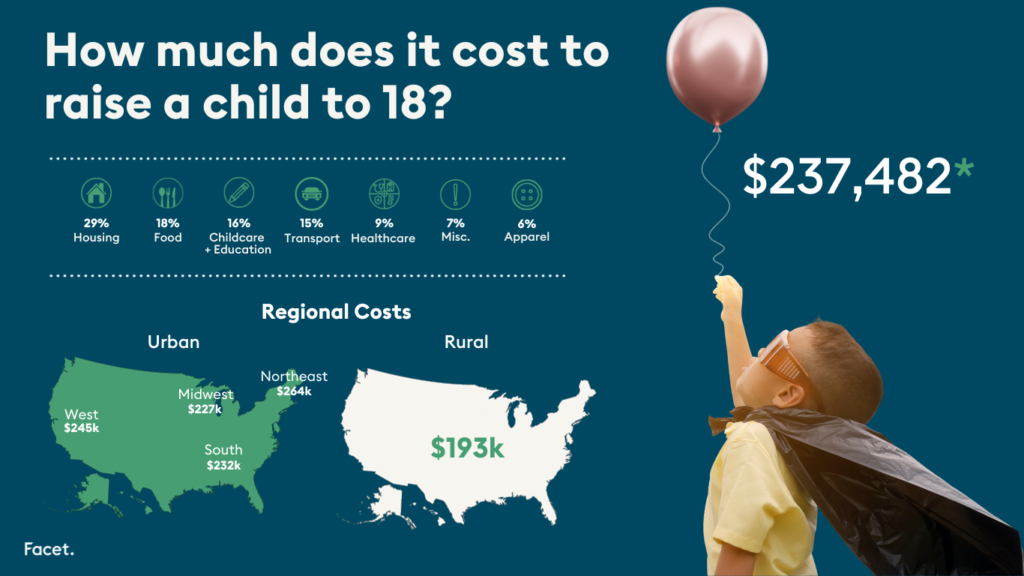

Although many families will spend more or less than the average, surveys show that housing costs are the biggest expenses in raising a child for middle-income families, representing 29% of all child-related spending.

Food is second at 18%, and child care and education is third at 16%.

Also, teenagers tend to cost about three times what babies do per month because they have additional expenses. Add a teenage driver to your auto insurance policy and you’ll understand.

One factor that prospective parents usually don’t realize is that when it comes to children, there are economies of scale when you have more than one.

Families tend to spend less on the second child than they did for the first, and the cost per child decreases when families have even more than two children.

Federal surveys show that for two parent families with one child, expenses averaged 27% more per child than expenses in a two-child family. For families with three or more children, expenses averaged 24% less per child than for a child in a two-child family.

Each additional child costs less because children can share a bedroom; a family can buy food in larger, more economical quantities; clothing and toys can be handed down. Children may not be cheaper by the dozen, as the classic movie claims, but the cost per child drops.

Keep in mind that planning for your children is a lifelong exercise that should be part of your overall financial plan. Working with an expert to help you develop a plan and help you evolve it through the years can make a difficult exercise easier.

The numbers may seem daunting, but there are many ways to reduce the financial worries when it comes to raising a child. Working with a professional can make it easier to balance your wishes for your child with your budget, and help you enjoy every minute of being a parent.

Final word

There’s a lot to think about as a new parent, and you want to make smart decisions that put you in control of the life you want for your children and your entire family.

Facet

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser headquartered in Baltimore, Maryland. This is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. Past performance is not a guarantee of future performance.