The information provided is based on the published date.

Key takeaways

- The US dollar is the dominant currency in world trade and held as a reserve by many countries

- A continuous debate over whether the dollar could lose its dominance has sprung up once again, especially after China and Brazil’s recent agreement to trade directly in each other’s currencies

- Current signs show that US dollar share of currency transactions has been steady over the last few decades, while US dollar share of global deposits has stayed around 50%

- To replace the dollar would be extremely difficult, as it would require major liberalization of Chinese financial markets and more central control over government spending for Eurozone countries

- Decline of the US dollar in the long run is possible but won't necessarily lead to negative effects on investments

- Over the last 20 years, the S&P 500 returns have been higher when USD declined

The US dollar is the dominant currency in world trade and by far the largest held as a reserve by other countries. This has afforded the US a kind of “exorbitant privilege” by which US interest rates and the cost of trading with other countries is lower than they otherwise would be. This has undoubtedly produced significant benefits for American consumers and businesses.

Could the dollar lose its dominance? This question has been continuously debated since at least the 1960s. Most recently, China and Brazil struck a trade agreement by which the two countries would trade directly in each other’s currencies, cutting out dollars from those transactions. A few days later, Brazil’s President Luiz Inacio Lula da Silva suggested that Brazil, China, and other countries should form their own currency for trade purposes, asking, “Who decided that the dollar was the (trade) currency after the end of gold parity?”

So what is the outlook for the US dollar, and how might that matter for your investments?

Here is a deep dive into what is happening with the US currency and how its role may or may not change in the future.

Dollar is not currently in decline

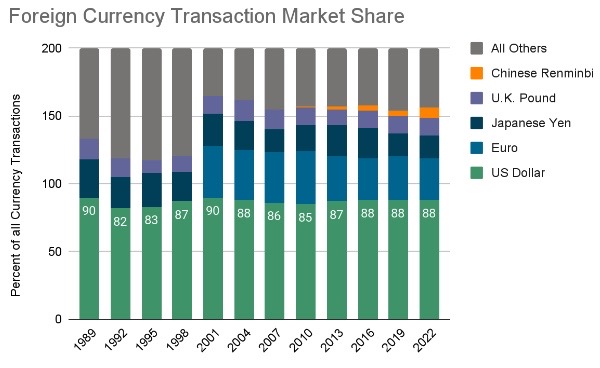

Definitively we can say that there are no signs that the dollar’s dominance in trade has been declining in recent years. The chart below shows the percentage of foreign currency transactions involving various currencies. Note that since there are always two currencies in each transaction, the chart adds to 200%.

Source: Bank of International Settlements

Here we see that the dollar’s share of currency transactions has been remarkably steady over the last few decades. Since the dollar is involved in 88% of currency trades, only 12% are executed without the dollar standing in between.

In other words, if someone wants to exchange Japanese yen for Indonesian rupiah, the overwhelming majority of the time, the yen gets exchanged for dollars, then the dollars are exchanged for rupiah.

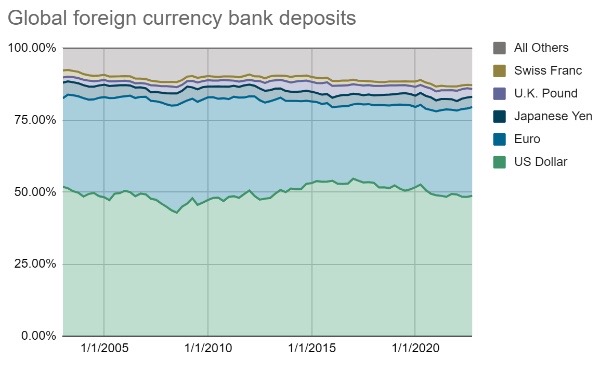

Foreigners are also comfortable using the US dollar for banking purposes. The chart below shows the percentage of all foreign currency deposits in various currencies. This includes things like a British company converting deposits to dollars or an American opening a Swiss bank account.

Source: Bank of International Settlements

Here again, we see that the US dollar’s share of global deposits has also been very steady at around 50% for the last 20 years. These two charts show us that the international community hasn’t significantly changed its use of the dollar in recent years.

Replacing the dollar would be extremely difficult

Let’s return to the question the Brazilian President recently asked about why the dollar is so dominant. It isn’t one thing but many things that make the dollar the best currency for cross-border transactions and investment. We can see this by looking at Brazil and its trade situation.

According to the World Trade Organization, Brazil’s biggest trade partner is China, accounting for 32% of total Brazilian trade. Its main exports are all raw materials and commodities, including soybeans, oil, iron ore, sugar, and beef. Generally speaking, all these goods trade in US dollars globally, so 68% of Brazil’s exports remain tied to the dollar.

However, the ties go deeper than that. Brazil is the world’s largest exporter of soybeans. According to the US Department of Agriculture, Brazil exported 79 million metric tons of soybeans in 2022. Like any other agricultural product, soybeans take a long time to grow and require substantial up-front investment to plant the crop. To hedge the price risk of their soybeans, Brazilian exporters could use soybean futures contracts. Essentially, these contracts lock in the sales price months ahead of the actual harvest.

But could Brazil do that on a Chinese exchange? Probably not. The largest commodity exchange in China, the Dalian Commodities Exchange, only trades about 1.7 million metric tons worth of soybean contracts per day. In comparison, the Chicago Mercantile Exchange trades 36.7 metric tons per day. So China’s exchanges simply aren’t large enough to handle Brazil’s business.

Because most commodities trade in dollars, most hedging also occurs in dollars on American exchanges. To have a functioning market, you need a lot of buyers and sellers of these futures contracts. For this reason, it is beneficial for all involved to have one very large centralized place where these contracts trade. That place is the US.

Brazilian companies also need financing. The US has the deepest capital markets in the world, which is why so many foreign companies use US markets to finance their business activities. Brazil’s largest company is the oil giant Petrobras. According to Bloomberg, Petrobras has $191 billion in debt outstanding, $145 billion of which is in US dollars. The second largest company is Vale, which owns iron, gold, and other metals mines. Vale has $61 billion in debt, $46 billion of which is in US dollars.

Large multinational companies usually need deeper financial markets than they can find at home. This is why they come to the US. As long as companies like Petrobras and Vale use dollars for financing, they will need dollars to make debt payments. The easiest way for them to get dollars is if they sell their products in dollars, at least in part.

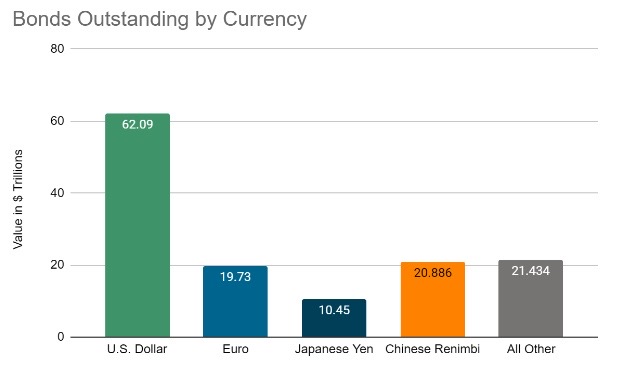

This same idea applies to global investors too. Consider Switzerland’s largest insurer, Zurich Insurance Group. They have $262 billion in investment assets, which like most insurance companies, are largely made up of high-quality bonds. The entire Swiss Franc government bond market is ₣92 billion. The total US dollar bond market is $60 trillion. These large global firms need a big market to invest their funds, and they come to the US to do so.

Source: Bank of International Settlements

Note that this creates a kind of network effect. Large investors come to the US because there are deep markets here. Because so many large investors transact in dollars, big firms come here to get financing. Investors want to invest where there are plentiful assets to buy, and companies want to finance where there are plenty of investors. So it works well for both parties to have one place where buyers and sellers can come together.

To the question as to why the dollar dominates global markets, it isn’t that someone “decided” this should be the case. Instead, it benefits everyone to have a centralized market for things like commodities trading and debt financing. The American capital markets are that centralized market.

Could another currency replace the dollar?

For now, this centralized market idea is one of the biggest reasons why the dollar dominates world trade. Could that change in the future? In the long run, it’s certainly possible. One hundred fifty years ago, the British Pound was the world’s dominant currency. There’s no guarantee that the US dollar will always be the world’s primary reserve currency.

With that in mind, let’s look at the two places that are closest to the US in terms of capital markets depth: China and the Eurozone. What would have to change for either of these two currencies to actually rival the dollar?

For China, there would have to be major liberalization of its financial markets. Today China keeps tight control over capital flows in and out of the country. It is difficult for foreigners to invest directly in Chinese stocks and bonds, and money leaving the country is subject to scrutiny from authorities. Anyone with a Chinese bank account runs the risk of that money getting trapped, either because of a policy shift or some political dispute. This is a concept economists call “rule of law.” It’s the idea that capital flow rules and regulations will be predictable and apply similarly to all firms.

In the fullness of time, this could certainly happen. Ultimately, having a free and fair capital market would be in China’s best interest. However, it is not clear that such a thing is a priority. Liberalizing its capital markets would likely require opening up to foreign financial firms. It would probably also need its government to exert much less control over how (and to whom) banks lend. Today Chinese banks are functionally a tool of the central bank’s policy goals, as the response to the recent property bust illustrates. Hence it seems unlikely that China is about to relinquish that control.

The Eurozone is another potential alternative. Europe generally has strong rule of law, and its capital markets are similarly liberalized as the US. At $14 trillion in GDP, the Eurozone is smaller than the US ($26 trillion) but is large enough to be at least competitive. The problem is that their capital markets are fragmented.

For example, take the government bond market. In the US, the Treasury market is the backbone of the financial system. Therefore, the safety and ease of trading government bonds are crucial for a wide variety of investors. However, the government bond market in Europe is fragmented and not always considered safe. For example, of the four largest issuers, only one (Germany) has a top-rated AAA credit rating, and Germany represents only $1.9 trillion of the $12 trillion in total government debt in the Eurozone.

If the Eurozone were to sell more pan-European government bonds (i.e., ones backed by all Eurozone countries), that market could legitimately compete with US Treasuries. During the COVID pandemic, the European Union issued some mutually-backed debt to fund recovery programs. It used the same program to provide aid to Ukraine after the Russian invasion.

So far, this program has only been used for one-off funding needs, but it is imaginable that someday European governments will agree to use this funding source for routine government spending. However, such a step would likely require more central control over government spending around Europe, and this would be a huge political change from the status quo.

A slow dollar decline shouldn’t figure into investment decisions

So far, we’ve shown that the dollar isn’t currently in decline, nor is any other currency close to being able to replace the key factors that make the dollar so dominant. If either of these conditions is to change, it will take considerable time to do so.

This makes investment decisions challenging based on a slow dollar decline. However, even if it does happen, the effects would probably be minimal in the near term. Even over the longer term, it isn’t clear that a declining dollar would be bad for US companies. Over the last 20 years, the S&P 500 has averaged a 13.5% return in calendar years where the dollar declined in value, vs. just 6.8% in years where the dollar got stronger.

For all of these reasons, we think worrying about the dollar losing its dominance shouldn’t influence your investment decisions. It may not happen at all. If it does, it will take an extremely long time, and even then, it might not affect the performance of your investments. Right now, some other currency replacing the dollar is more of an interesting conversation topic than anything that is about to happen.