Key takeaways

- You have the power to give your money meaning

- It’s time to get proactive with your tax planning

- How to pay yourself first to reach your savings goals

- Investing strategies outside of your retirement plan

- Investing in you to level up your career

You’ve built a solid financial foundation — a healthy emergency fund, a plan to pay down debt and build good credit, proper insurance coverage, and a good start to your investments.

You’re ready to move to the next level as your career advances and your income rises.

This is about moving from building security and freedom from worry to the next step: leveling up your plan to give you the power of choice and put you in control of the life you want.

Here are the five things you need to consider.

#1: From goals to defining what money means to you

After mastering the art of setting SMART-ER goals, it’s time to start thinking about what you value and what meaning you want to give to money in your life.

As you level up your income, the number of choices you have will expand. Defining the life you want, and how money can support it, will put you in control of the decisions that can help you live well.

#2: Get more proactive with your tax planning

Higher income leads to higher taxes.

What you are looking for is a change to your marginal tax rate. If your income pushes you into a higher tax bracket, the planning decisions you make may change.

And don’t overlook your withholdings. Understanding your taxes will put you in control of creating a plan to reduce taxes today and in the future.

#3: Avoid lifestyle creep – be intentional with your money

Wanting to spend your hard earned money on a few things for yourself is OK — it’s part of why you work so hard. But "lifestyle creep," also called expense creep, is real.

Your best course of action is to be proactive in creating a spending plan that puts you in control of your cash flow.

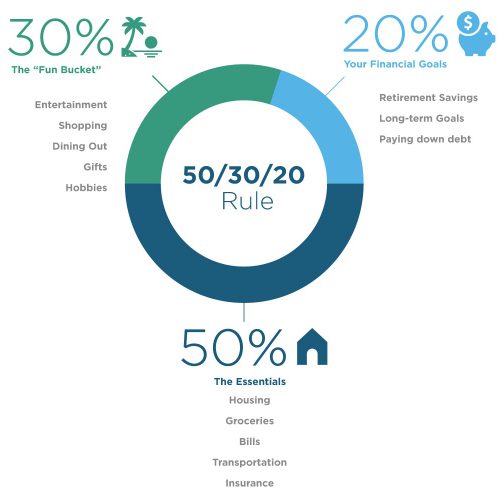

Nail the 20 in the 50/30/20 framework – This is your chance to reach your 20% savings goal [the target for good financial health].

The trick? Paying yourself first — save first and then spend what is left. Commit to putting 20% towards your longer-term goals before spending the rest on the other categories.

#4: Next-level investing — beyond your employer-sponsored plan

Here are four ways to level up your investment strategy:

- 401(k) – Max your plan contributions for the tax break and added retirement savings. Make sure you consider plan fees, investment options, and liquidity needs before doing so.

- Backdoor Roth IRA – For high earners, direct Roth contributions aren’t an option. Enter the backdoor Roth IRA — contribute to an IRA, do not deduct it on your tax return, and convert the account to a Roth IRA. Make sure you understand what other IRA assets mean for your taxes and that you don’t run into the pro-rata rule.

- Taxable brokerage account – A taxable account is funded with after-tax dollars and is subject to taxes each year. There are good strategies to minimize your taxes, but you need to consider dividends, capital gains, how to manage losses (and avoid wash sales), and how to use tax-efficient investments (such as exchange traded funds).

- Health savings account (HSA) – Most HSAs give you the ability to invest your cash. This doesn’t mean you should invest every dollar. Have a plan for how much cash you need and what you can invest for growth.

#5: The most important investment — you

You’re just getting started. You want to level up your career, your knowledge when it comes to money, and your personal life (getting married, having kids, traveling).

Here are a few tips to get you to the next level:

Invest in your future

Invest in your personal and professional growth. Put some money to work on you — hire a life or professional coach, learn new skills, take new classes, pursue a new professional designation, or make time for travel and experiences. Money is a tool to put you in control of the life you want.

Give back

This isn’t about getting your name on a building (maybe one day). This is about finding a cause you believe in and giving back to your community through your time (volunteering), treasury (money), and/or talent (expertise). You will make great connections and will find that giving is a great way to bring meaning to your money.

Final word

You have a lot of choices — relationships, travel, career, how to save and invest, defining what the next few years look like.

The point?

Your plan for your money needs to look at all facets of your life, not just your money.

Smart decisions to save and invest for your future are important, and your plan should put you in control of those decisions and the life you want — spending time with friends and family, building a meaningful career, and experiencing all that life has to offer.