Unlock opportunities to speed up retirement contributions

Retirement contributions can be complex. Unsure about your options? Most common questions are answered below. For more guidance, schedule a call with a Facet expert to get help boosting your retirement savings and making smarter financial choices.

Increase your 401k, IRA, and HSA contributions after 50.

Unlock $30.5K and $1K catch-up limits*

Secure Your Future Beyond 50

If you’re 50 or older, it’s prime time to accelerate your retirement savings. Catch-up contributions allow you to add an extra $7,500* annually to your employer-sponsored retirement plans like 401k, 403b, and 457 plans. This means instead of the standard limit, you can significantly boost your savings, paving the way for a more comfortable and secure retirement.*

Why Consider Catch-Up Contributions?

- Enhance Your Retirement Nest Egg: Take advantage of the opportunity to increase your retirement savings, ensuring you have the funds you need to enjoy your golden years to the fullest.

- Tax Benefits: Catch-up contributions can also offer tax advantages, potentially lowering your taxable income.

Turning 50 opens the door to an additional $1,000 you can contribute to your Individual Retirement Account (IRA) annually. It’s a simple yet effective way to ensure your retirement savings are on solid ground.*

HSA Contributions After 55

Healthcare costs are a significant consideration for retirees. If you’re 55 or older, boosting your Health Savings Account (HSA) by an extra $1,000 each year can help cover these expenses, giving you additional peace of mind.**

How A Certified Financial Planner Professional Can Help

Maximizing your retirement contributions is just part of the journey. We believe integrating this into a personalized plan designed to help you with every important financial decision is the best next step.

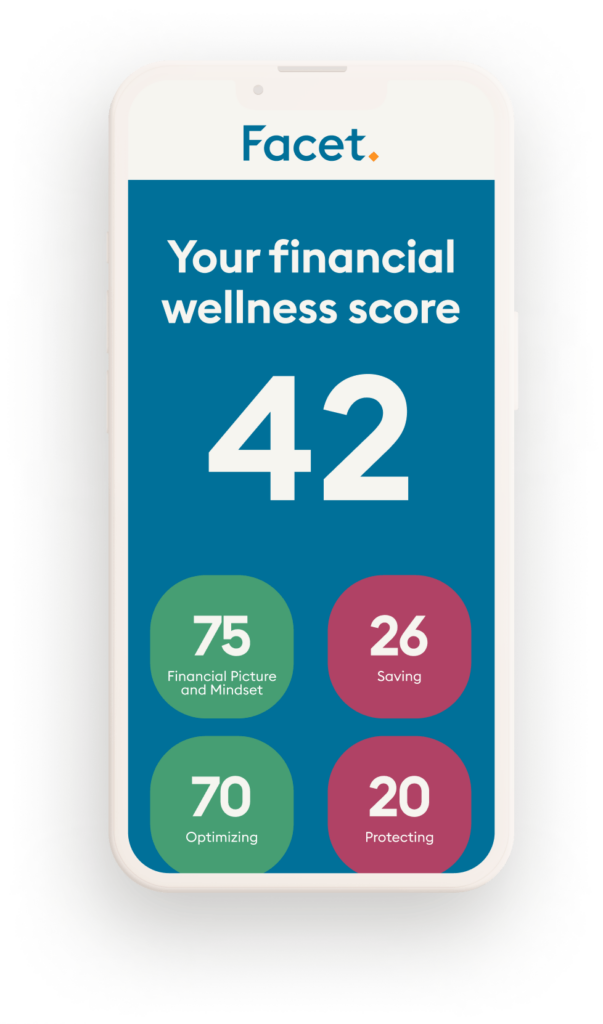

Honestly, how are you doing with your money?

You can find out in under 4 minutes. Your Financial Wellness Score will unlock insights into what you’re doing right and what could still be better.

** Nerdwallet review conducted in October of 2023 based on the time frame of August – October 2023. Nerdwallet’s independent assessment includes data collection, interviews and testing which results in star ratings from poor (one star) to excellent (five stars). Nerdwallet was not paid for this review however does receive compensation based on referrals.

How we’re different.

What Facet members are saying.

Testimonials were provided by current members of Facet ("Facet Wealth, Inc."). Members have not been paid for their testimonial and there are no material conflicts of interest that would affect the given testimonials. These testimonials may not be representative of the experiences of other members, and do not provide a guarantee of future performance success or similar services.